[ad_1]

Owing to coverage efforts and improved availability of vaccines towards COVID-19, the world financial system, which contracted because of the restrictions imposed to manage the pandemic, is starting to get well. In keeping with the Worldwide Financial Fund, the world’s gross home product (GDP) was projected to develop by 5.9% in 2021, up from 3.1% in 2020. Because the impression of the pandemic diminishes, financial exercise in most international locations, together with Nepal has been bettering with rising employment alternatives. The Financial Actions Report 2020/21, a lately revealed report by the Nepal Rastra Financial institution (NRB) on the present conditions of the totally different financial sectors and actions reveals that the first, secondary and tertiary financial sectors of the nation are in a restoration stage. Within the fiscal yr 2020/21, the agriculture, business and repair sectors of Nepal grew by 2.6% and 5% and 4.4% respectively. Equally, the contribution of agriculture, business, and the service sector to the GDP of the nation was 25.8%, 13.1% and 61.1% respectively. This text will current highlights of the important thing sectors mentioned within the Financial Exercise Report 2020/21.

Agriculture Sector

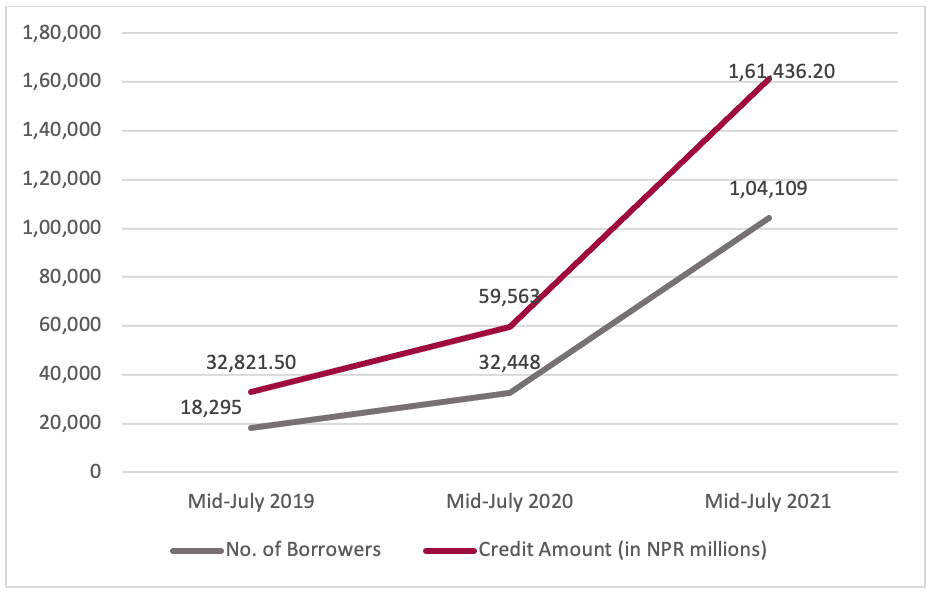

As per NRB’s Financial Exercise Report, the whole manufacturing of main agricultural crops, together with meals and money crops, greens, fruits, and spices elevated by 1.9% throughout FY 2020/21 after experiencing a decline of 1.3% in FY 2019/20. Out of the whole agricultural crop manufacturing, paddy constituted the best manufacturing i.e., 23.6%. Equally, manufacturing of milk, meat, eggs, and fish additionally noticed a rise in FY 2020/21. On the finish of FY 2020/21, credit score was prolonged to the agriculture sector by the nation’s banks and monetary establishments (BFIs) that amounted to NPR 276.35 billion, a 42% enhance in comparison with the quantity in mid-July 2019/20. Equally, as of mid-July 2020/21, a complete of NPR 161.43 billion had been disbursed to the agriculture sector as concessional loans. Determine 1 illustrates the rise within the quantity and quantity concessional loans distributed within the agriculture sector over the previous three years.

Determine 1 Concessional loans disbursed to the agriculture sector

Supply: NRB, 2021

Whereas manufacturing and credit score improved within the sector, the sector continues to face the identical obstacles by which embody lack of ability to make sure market and minimal costs of agricultural produce, handle agricultural inputs like fertilizers, broaden dependable and sustainable irrigation amenities all year long, problem in correct association and administration of chilly storage, and prevention of agricultural land fragmentation. Modernization, mechanization, and diversification of the agricultural sector together with analysis continues to be a problem. Moreover, the nation’s agriculture sector additionally faces extreme threats from local weather change.

Business Sector

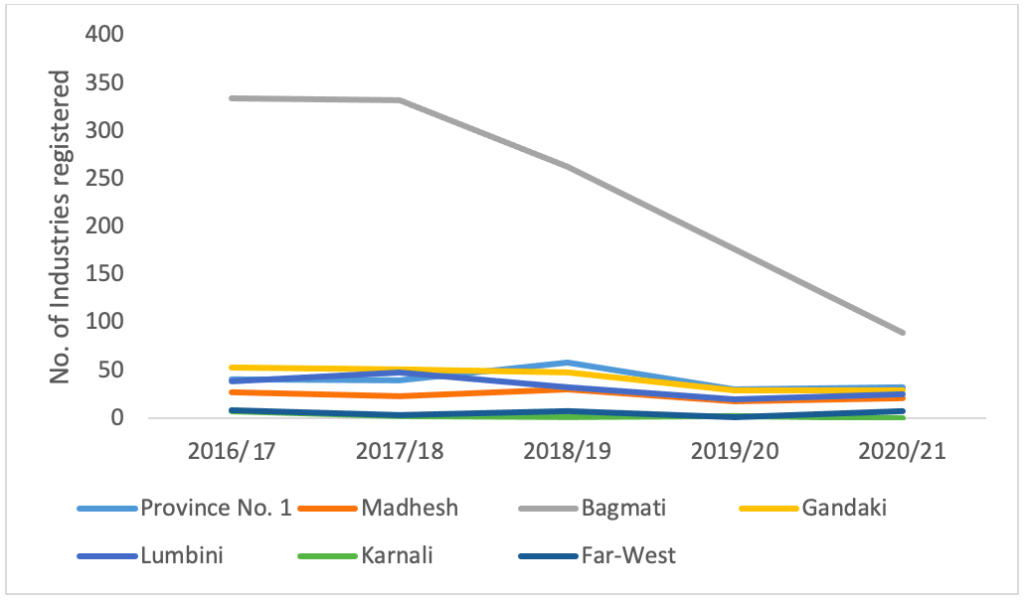

In keeping with the information from the Division of Business, 203 industries had been added within the nation in FY 2020/21. A complete of 8,453 industries with home and overseas funding was registered within the nation as of mid-July 2021 (check with Determine 2.). Out of those, 1,214 had been giant, 1,908 had been medium and 5,331 had been small scale industries. These industries had generated employment for 628,712 people by the top of FY 2020/21. Equally, 46,340 Micro, Small and Medium Enterprises have been registered on the district stage. Furthermore, a complete of 183 International Direct Funding (FDI) proposals with a complete funding of NPR 32.20 billion was accredited in FY 2020/21.

Determine 2. New industries registered in every province

Supply: Division of Industries, 2021

With regard to the capability utilization of industries that dwindled previously two years because of the COVID-19 pandemic, the common capability utilization of the industries throughout FY 2020/21 jumped a mere 3.8 share factors to 52.2%, from 48.4% in FY 2019/20. Among the many industries coated within the report, the concrete business is the one business working at full capability. Equally, credit score prolonged by Banks and Monetary Establishments (BFIs) to the commercial sector elevated by 20.9% to NPR 1367.75 billion in mid-July 2021 in comparison with mid-July 2020. Out of the whole credit score disbursed by BFIs, 32.8% has been disbursed to the commercial sector.

Nevertheless, the commercial sector encounters main challenges resulting from fluctuations and instability within the political, financial, and pure atmosphere. Making certain the provision of expert manpower by retaining semi-skilled and expert manpower within the nation itself, facilitating the institution of industries and lowering the price of institution is sort of a problem. Equally, growth and growth of commercial infrastructure, rising manufacturing of indigenous industrial uncooked supplies, making industrial provide chain effectiveness, attracting FDIs and creating an funding pleasant atmosphere stay unaddressed. Furthermore, minimizing the potential disruption to the availability and demand with the third wave of the COVID-19 underway would additionally pose as a problem.

Service Sector

The service sector has been hit the toughest by the COVID-19 pandemic. The tourism and public transport sectors have been most affected whereas the true property, monetary providers and different sectors have been much less affected. Though the service sector includes of quite a few sub-sectors, this text opinions the tourism, actual property, and monetary providers.

Tourism: Throughout FY 2020/21, the variety of vacationer arrivals decreased by 91.5% in comparison with FY 2019/20 with solely 68,726 vacationers arriving. Nevertheless, by mid-July 2021, the variety of motels and lodges had elevated by 9.4% with the variety of beds rising by 4.5% in comparison with the earlier yr. Nonetheless, the common occupancy of motels stood at 32%.

Actual Property: In the course of the overview yr, the variety of actual property registrations elevated by 8.5% to 539,872 in comparison with 497,713 in FY 2029/20. Equally, income from actual property registrations elevated by a whopping 74.6% to NPR 47.89 billion in FY 2020/21. Such income had declined by 11.0% in FY 2019/20. Likewise, as the development sector regularly returned to regular after a decline through the COVID-19 lockdowns, home/constructing, and land map passes, which decreased by 37.1% within the earlier yr, elevated by 11.5% in FY 2020/21.

Monetary Providers: As of mid-July 2021, a complete of 10,684 BFI branches had been in operation. Complete deposits collected by the BFIs elevated by 20.5% to NPR 47.39 billion by mid-July 2021 in comparison with a 24.3% enhance within the earlier yr. Loans prolonged by the BFIs elevated by 28.1% to NPR 41.69 billion by mid-July 2021. Moreover, the Credit score to Deposit ratio stood at 88.0% as of mid-July 2021, up from 82.8% in mid-July 2020.

With looming impacts of the COVID-19, reviving the service sector can be one of many largest challenges in Nepal with the outbreak of the brand new COVID-19 variants igniting a 3rd wave.

Manner Ahead

Growing revenue ranges has propelled the inner demand to surge as properly, which might be taken as an enormous alternative for all of the sectors of the financial system. Improved energy era and provide, growth of transportation, infrastructure and data know-how, and applications encouraging youth participation in agriculture together with the easing of economic entry would convey large alternatives for the agriculture sector. Equally, insurance policies to facilitate and encourage the institution of industries is a should to offset the excessive imports. Improvement of infrastructure and growth of economic entry whereas making certain balanced distribution of economic assets would assist the service sector to revive. Moreover, channeling monetary assets to areas which are comparatively extra productive and create employment can be required to beat the various challenges within the varied sectors of Nepal’s financial system. Whereas the financial system is on the highway to restoration, the brand new variants of the coronavirus might deter the tempo. The longer term course of the nation’s financial system would closely be decided by the insurance policies and applications adopted by the present authorities and the effectiveness of vaccinations.

[ad_2]

Source link