[ad_1]

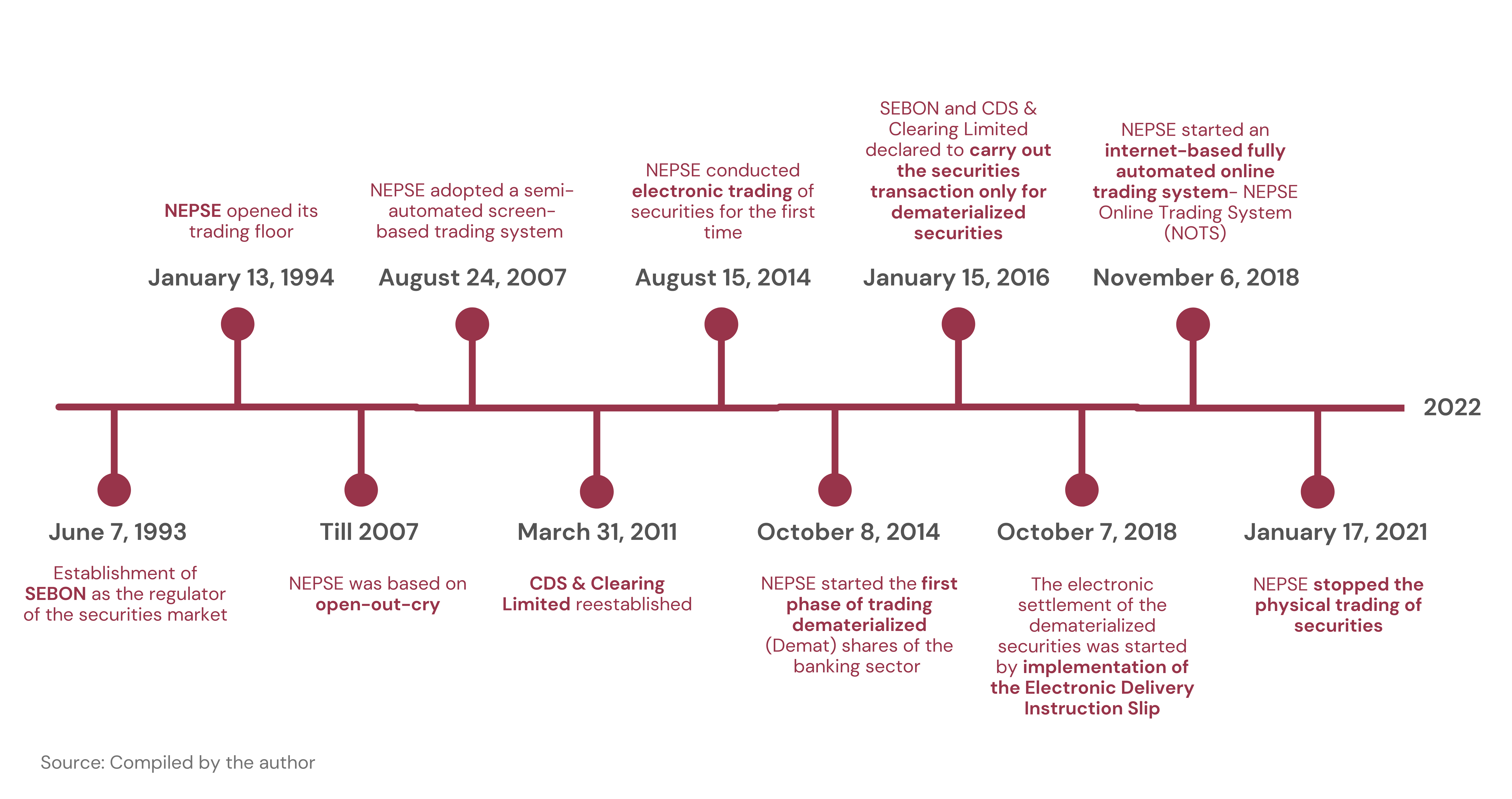

Nepal Inventory Alternate Ltd. (NEPSE) is the one inventory trade of Nepal for the secondary market that gives a platform for buyers to purchase and promote shares of publicly traded corporations in numerous sectors in Nepal. It was established beneath the Corporations Act-2006 and operates beneath Securities Act-2007. The inventory market has since gone by a paradigmatic shift (discuss with Determine 1).

Determine 1. Temporary historical past of Inventory Market in Nepal

Inventory Market Progress Indicators

Among the indicators that may be checked out to guage the inventory market progress are liquidity, market dimension, and index efficiency.

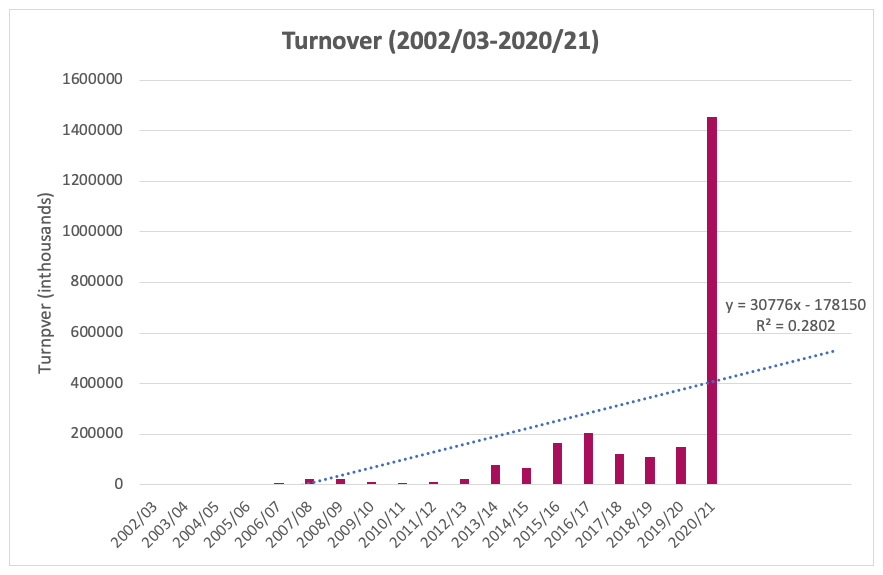

Liquidity: Share market liquidity may be interpreted from the full turnover. Whole turnover is calculated by dividing the worth of whole shares traded by market capitalization. Increased turnover usually signifies larger liquidity within the share market (Bepari and Mollik, 2008), which means it’s simpler to promote inventory within the share market. In 2019/20, whole share turnover elevated by 36% from NPR 110.07 million to NPR 150.04 million. It additional elevated by a whopping 869% in 2020/21, when it reached NPR 1454.44 million. The share market noticed one other important enhance within the whole turnover in 2006/07 and 2007/08, when turnover elevated by 142% and 173%, respectively. Equally, the turnover elevated by 54% in 2011/12, adopted by 114% in 2012/13 and 251% in 2013/14. This enhance in turnover exhibits a rise within the whole commerce relative to the market dimension and a rise in liquidity within the Nepali inventory market over time. The development line in Determine 2 forecasts a gradual enhance in turnover over the following 4 years.

Determine 2: Share turnover in Nepal Inventory Market, 2003-2021 (with 4 years forecast)

Supply: Nepal Inventory Alternate Annual Experiences

Market Dimension: An indicator that measures market dimension is the variety of listed corporations. In 2020/21, the variety of corporations listed in NEPSE elevated from 212 to 219 corporations. It additionally elevated by 19% in 2010/11, when it reached 209 corporations. The full listed corporations reached an all-time excessive of 233 in 2013/14.

The variety of transactions in 2020/21 elevated considerably from 1.85 million to fifteen.42, a 734% enhance. One other important enhance was noticed in 2003/04 when it reached 85.6 thousand – a 272% enhance in comparison with 2002/02. Equally, the variety of transactions elevated considerably from 2013/14, when it elevated by 94%, and in 2015/16 when it elevated by 75%.

It’s attention-grabbing to notice that the full market capitalization of Nepal has been growing through the years. Market capitalization elevated by 124% in 2020/21, when it elevated from NPR 1.79 trillion in 2019/20 to 4.01 trillion in 2020/21. Market capitalization additionally elevated considerably in 2006/07 and 2007/08, respectively, by 92% and 97%. One other important enhance was seen in 2015/16, when the market capitalization elevated to NPR 1.06 trillion, in comparison with NPR 0.99 trillion in 2014/15, a rise of 91%.

Trying on the market capitalization-to-GDP ratio, along with the inventory market dimension, it may be decided if the given inventory market is valued precisely in accordance to a historic common by evaluating the worth of all of the listed shares to the worth of the nation’s whole output. The ratio is calculated by dividing the inventory market capitalization of an economic system divided by the economic system’s GDP. Normally, a ratio larger than 100% exhibits that the market is overvalued, and a ratio between 90% and 115% are thought-about modestly overvalued. The market capitalization to GDP ratio of Nepal is 93.4%.

Efficiency: NEPSE index factors are an indicator that can be utilized to investigate the efficiency of the Nepali inventory market. A rise within the NEPSE index refers back to the bullish inventory market. NEPSE index elevated from 1362.4 factors in 2020/21 to 2883.41 factors in 2021/22, a 1521.01-point enhance. Equally, one other important change was seen in 2013/14, when the index elevated by 517.77 factors. In 2006/07 and 2007/08, different important adjustments had been seen when the index elevated by 297 and 279.41 factors, respectively.

Developments and Progress Components

A development may be noticed in Nepal’s inventory market efficiency based mostly on the indications talked about above. The indications have grown considerably in 2007, 2008, 2011, 2014, 2016, and 2021. The expansion in 2007 and 2008 may be linked to NEPSE’s adoption of a semi-automated screen-based buying and selling system, which changed the open outcry system. Equally, the expansion in 2011 may be attributed to the institution of CDS & Clearing Restricted (CDS). CDS supplied a centralized depository, clearing and settlement companies in Nepal and began dematerializing the share market, which had a long-term influence available on the market. An identical enhance was seen in 2013-2014, when NEPSE performed digital buying and selling of securities for the primary time and initiated dematerialization. The expansion in 2021 is the results of the institution of NEPSE On-line Buying and selling System (NOTS). These transformational adjustments all have a typical theme – digitalization.

Digitalization allowed buyers to put their orders on-line and perform buying and selling, clearing, and settlement electronically, making transactions extra clear and handy for buyers. Earlier than the introduction of NOTS, buyers needed to place their orders to purchase or promote a inventory by way of telephone calls to their brokers. Nonetheless, for the reason that introduction of NOTS, buyers can now purchase and promote shares by a platform referred to as Commerce Administration System – an account supplied by their dealer. Despite the fact that brokers are nonetheless concerned within the course of, their involvement has been minimized, saving buyers a variety of time. This has decreased the method of buying and selling shares from a minimum of every week to 3 days.

Along with digitalization, COVID-19 inspired investments within the inventory market and made a big influence available on the market efficiency. COVID-19 led to a halt in financial actions, as companies in lots of sectors shut down or halted operations. Put up-COVID-19, many individuals began utilizing the capital market as a passive supply of revenue, which created a extra energetic inventory market.

Moreover, the extent of economic literacy in Nepal has elevated through the years, with many academic establishments now educating college students on the inventory market and people sharing insights and basic data by social media platforms such because the Clubhouse. Quick access to information and data regarding the capital market by platforms comparable to sharesansar and nepalipaisa has contributed to buyers’ confidence.

These elements mixed have led to a rise in each buying and selling actions within the capital market, and the variety of Nepalis coming into the share market. In 2020/21, the variety of Demat accounts elevated by over 1.5 million items. As per the CDC, Demat account has reached 4,895,021, and the variety of dematerialized shares has reached 8,012,542,328. The variety of Demat accounts elevated from 1.48 million in FY 2018/19 to three.79 million on the finish of FY 2020/21.

Means Ahead

The inventory market developments and the expansion within the essential share market indicators goes to point out the significance of digitalization within the Nepali inventory market. With growing monetary literacy and the estimated enhance in remittance influx within the nation, the variety of energetic merchants within the Nepali inventory market has a possible to additional develop. The variety of corporations making use of and getting accepted for an preliminary public providing (IPO) has additionally elevated, indicating that a variety of corporations are coming into the secondary market. Making the net platform (TMS) simpler to maneuver, growing monetary literacy, and offering incentives for international migrants to enter the Nepali inventory market might enhance the variety of buyers out there. Whereas the preliminary enhancements within the platform have had a huge impact on attracting Nepali individuals in direction of the capital market, Nepal has potential for improvement when it comes to growing the comfort for buyers.

[ad_2]

Source link