[ad_1]

Sri Lanka is presently dealing with its worst financial disaster because the nation gained independence in 1948. Despite fixed assurances by the governor of the Central Financial institution of Sri Lanka (CBSL), worldwide ranking companies in addition to economists have sounded the alarm about Sri Lanka’s potential to make its overseas debt repayments in 2022. Plenty of analyses point out that Sri Lanka is on the verge of a sovereign debt default because the nation’s usable overseas forex reserves plunged beneath $1 billion.

Daily, warning indicators about potential default are including up. At the beginning of March, Sri Lanka’s Ministry of Energy introduced seven-and-a-half hours of day by day energy cuts because the nation didn’t buy the oil required for electrical energy technology because of the overseas forex scarcity. Throughout the identical week, lengthy queues had been seen at gas stations because of gas shortages. Bus proprietor associations even raised considerations about persevering with transport providers because of the gas provide crunch.

All these occasions are outcomes of a extreme Stability of Fee (BOP) disaster Sri Lanka has been battling since early 2020. With COVID-19 hitting the globe, Sri Lanka misplaced roughly $4 billion of annual overseas forex inflows earned from tourism. However, the opposed financial impression of COVID-19, reckless financial coverage modifications similar to tax cuts supplied in late December 2019, and the cussed stance of the federal government to not search the assist of the Worldwide Financial Fund (IMF) resulted in constant downgrading of the nation’s credit score rankings. With these developments, Sri Lanka was unable to borrow from worldwide capital markets by way of issuing Worldwide Sovereign Bonds (ISBs). The nation has not issued a single ISB since April 2019.

Resulting from these developments, Sri Lanka’s overseas forex inflows diminished drastically. In 2020, the federal government imposed extreme import restrictions, together with suspending car imports, to curtail overseas forex outflow. Though the foreign exchange outflow to imports was diminished, overseas debt compensation commitments stay unchanged. This implies Sri Lanka’s exterior financing hole (the scarcity of overseas forex inflows to satisfy overseas forex outflows) was additional expanded with no choice to problem ISBs. As there have been no enough overseas forex inflows, the federal government continued to dry up foreign exchange reserves to pay present loans. On account of this overseas forex reserves declined from $7.5 billion in February 2020 to $1 billion on the finish of November 2021.

The standard response to a extreme BOP disaster of this nature is to hunt the assist of the IMF. The truth is, the very motive for the institution of the IMF was to help international locations to sort out BOP crises. But, the Sri Lankan authorities continued its cussed refusal to hunt help from the IMF or restructure debt.

China and India As an alternative of the IMF?

For the reason that authorities is adamant about not searching for IMF help, they checked out different avenues to cope with the financial disaster. Given the magnitude of the disaster, limiting imports was not enough to bridge the exterior financing hole. The island nation wanted to search out methods to extend overseas forex inflows.

Towards this backdrop, the Sri Lankan authorities began to hunt assist from two world competing rivals: India and China. Sri Lanka has had sturdy financial ties with each these international locations over the a long time; financial relations with China particularly have gotten stronger over the last 20 years, with China rising as the largest bilateral lender and FDI supplier to Sri Lanka. President Gotabaya Rajapaksa and plenty of different high political leaders of the nation requested financial assist from each China and India to sort out the unprecedented financial disaster.

The doubtless motive for the Sri Lankan authorities opting to hunt monetary help from China and India is their unwillingness to hold out the financial reforms which might be a part of an IMF program. Rajapaksa’s authorities, instantly after its election victory, diminished tax charges and abolished a number of taxes. The federal government determined to not go forward with the legislation proposed to make sure the independence of the Central Financial institution, a coverage that’s strongly advocated by the IMF. Additional, the Central Financial institution of Sri Lanka (CBSL) has been controlling the trade charge, the precise reverse of what the IMF recommends. Thus, searching for IMF help would imply revising a lot of the financial insurance policies of the Rajapaksa authorities and finishing up financial reforms. Though most of those coverage modifications and financial reforms are the necessity of the hour, a few of these reforms typically have a excessive political price. Such a coverage revision would additionally imply an acknowledgement from the federal government to say: “We made an enormous blunder. We must always not have diminished taxes.”

Sri Lanka may get hold of monetary help from China and India with out such situations. In fact, there are underlying situations and offers in acquiring this monetary help. However such situations are completely different from those advocated by the IMF, because the pursuits of China and India are primarily geopolitical versus the financial pursuits of the IMF.

Sri Lanka’s BOP Disaster Is Past Chinese language Debt

Within the latest previous, Sri Lanka has been relying closely on China to keep away from BOP troubles. In 2018, Sri Lanka obtained a International Foreign money Time period Financing Facility (FCTFF) of $1 billion from China Growth Financial institution (CDB). In 2017 and 2018, overseas forex inflows generated by way of leasing the Hambantota port to China Service provider Port Firm helped Sri Lanka to spice up overseas forex reserves and bridge the fiscal deficit.

After the pandemic hit the globe and Sri Lanka was unable to borrow from the worldwide capital market, CDB prolonged one other FCTFF of $500 million to Sri Lanka in April 2020. This was not precisely a typical export credit score; this mortgage was straight used to strengthen Sri Lanka’s foreign exchange reserve place. Based on the Finance Ministry, this was an upsizing of the earlier FCTFF of $1 billion that Sri Lanka obtained from CDB in 2018.

The rate of interest for the mortgage obtained in 2018 was the LIBOR six-month USD charge, with a 2.56 p.c margin. It had a grace interval of three years and a payback interval of eight years. After the upsizing of the mortgage, for the $500 million obtained in April 2020, the rate of interest was once more LIBOR six-month USD and a 2.51 p.c margin. It had a grace interval of three years and a payback interval of 10 years. So Sri Lanka was given an additional two years to pay again the $500 million mortgage supplied in 2020 in comparison with the phrases of the 2018 mortgage.

In 2021 additionally CDB supplied two extra FCTFFs to Sri Lanka, upsizing the present loans. The primary one was one other $500 million mortgage supplied in April 2021 for a similar rate of interest because the 2020 FCTFF, with the identical grace interval and payback interval. One other 2 billion Chinese language renminbi was supplied in August 2021 with the identical grace interval and payback interval.

Nevertheless, given the magnitude of the financial disaster Sri Lanka had encountered, these loans weren’t enough to get out of significant BOP troubles and clear up the extreme scarcity of overseas trade reserves. Through the latest go to of Chinese language International Minister Wang Yi to Sri Lanka, Rajapaksa inquired concerning the potentialities of restructuring the debt, contemplating the continuing financial disaster. Regardless of this request, the CBSL governor continues to emphasize that they’ll meet all repayments attributable to worldwide collectors.

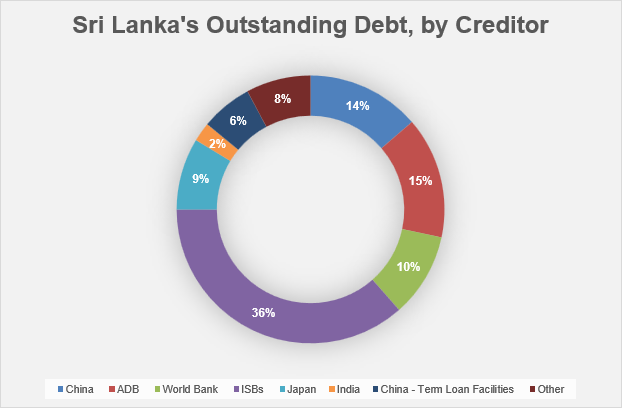

Whereas restructuring Chinese language debt would supply respiration area to Sri Lanka, it’s not at all a approach out of this unprecedented disaster. Opposite to the sensationalism of Sri Lanka being a sufferer of a Chinese language “debt entice,” Sri Lanka’s debt troubles go far past China. The nation’s financial disaster is attributable to deep-rooted financial points which have remained unaddressed for many years. As an alternative of addressing these points, Sri Lanka continued to borrow from the worldwide capital market by way of issuing ISBs. By the top of 2021, out of Sri Lanka’s excellent overseas debt inventory 36 p.c was ISBs and solely about 14 p.c of the full public debt was owed to China.

Knowledge as of the top of 2021. Knowledge from the Exterior Useful resource Division, Sri Lanka.

The easy actuality is that China can’t save Sri Lanka from a sovereign debt default by restructuring Chinese language debt obtained by Sri Lanka. Sri Lanka’s debt repayments to China, together with repayments of FCTFFs over the following three years, quantity to roughly to twenty p.c of complete exterior debt repayments whereas ISB repayments quantity to almost 50 p.c of the exterior debt repayments. Moreover, ISB repayments embody huge one-off repayments of $1 billion or extra yearly, posing severe threats to the nation’s BOP place. Because it stands now, Sri Lanka doesn’t have enough overseas forex reserves to make these huge principal funds of ISBs, together with a $1 billion ISB maturing in July this 12 months, except U.S. {dollars} magically seem out of skinny air in Sri Lanka.

It’s also evident that whereas China desires to maintain sturdy financial ties with Sri Lanka, they’re cautious to not take pointless dangers. Earlier forex swap preparations attest to this.

In 2020, Sri Lanka entered right into a bilateral forex swap settlement with the Individuals’s Financial institution of China (PBoC). This, nevertheless, was a stand-by association of 10 billion RMB ($1.5 billion) for use for bilateral commerce and different functions over three years. Thus, it was counted as part of the overseas forex reserves. In December, PBoC allowed Colombo to attract this 10 billion RMB to Sri Lanka’s reserves, permitting the island-nation to nearly double its overseas forex reserves from $1.6 billion to three.1 billion. Based on the Chinese language envoy to Sri Lanka, this swap was a novel association supplied by China.

Nevertheless, provided that the swap is in RMB, it can’t be used to make mortgage repayments in U.S. {dollars}. This swap doesn’t assist Sri Lanka to settle ISBs, which is the largest concern pertaining to overseas mortgage repayments. Subsequently, this forex swap is completely different to forex swaps supplied by India up to now, which supplied U.S. {dollars} to Sri Lanka to deal with points pertaining to greenback liquidity. The forex swap with PBoC doesn’t present that liquidity. This implies China has taken a comparatively low-risk choice to handle its financial ties with Sri Lanka, as an alternative of offering a U.S. greenback mortgage to Sri Lanka to handle overseas forex shortages.

Reemerging Financial Ties With India

On this unprecedented financial disaster, China was not the one ally Sri Lanka sought assist from. During the last two years, Sri Lanka additional strengthened financial relations with India and sought assist quite a few instances. India too has leveraged this chance to increase its financial presence in Sri Lanka in mild of an rising Chinese language financial presence in India’s shut neighbor.

In February, because the overseas forex scarcity turned extreme, Sri Lanka signed a $500 million credit score facility with India to import gas. This was part of the monetary package deal India agreed to supply to Sri Lanka to come across the financial disaster. Over the last week of February, the Sri Lankan finance minister was scheduled to go to India for the remaining a part of the monetary package deal pledged by India. Below this, Sri Lanka anticipated to obtain a $1 billion credit score facility to import important objects from India. Nevertheless, the go to was postponed indefinitely attributable to “final minute scheduling points.”

With these credit score amenities, Sri Lanka will have the ability to barely handle some important objects within the quick time period. Nevertheless, these credit score amenities is not going to assist Sri Lanka to get out of the unprecedented financial disaster. It simply delays the inevitable default.

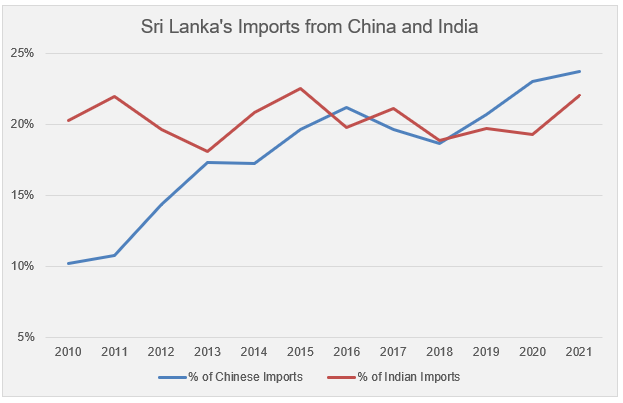

These credit score amenities will doubtless lead to India changing into the highest supply of imports for Sri Lanka, overtaking China. In 2018, China turned the key exporter to Sri Lanka, surpassing India, which had been the highest supply of Sri Lanka’s imports for almost 20 years.

Knowledge from Export Growth Board, Sri Lanka.

This financial disaster had additionally allowed India to satisfy its personal geopolitical pursuits by rising their presence in strategically essential locations in Sri Lanka. A subsidiary of the Indian authorities oil firm, the Lanka Indian Oil Firm (LIOC), signed a deal to develop Trincomalee oil farms as a three way partnership along with Sri Lanka. Accordingly, 51 p.c of the three way partnership is owned by the Ceylon Petroleum Company whereas LIOC owns the remaining 49 p.c. This deal had been stalled for years because of the controversial nature of the venture, however the disaster offered a possibility to India to seal the deal.

What Does the Future Maintain?

As repeatedly famous on this article, Sri Lanka is on the verge of a sovereign default. Deep-rooted financial weaknesses of the nation have been aggravated because the begin of the pandemic. As Sri Lanka is encountering an unprecedented financial disaster, the nation’s relations with China and India have additionally taken an fascinating flip. Thus far, Sri Lanka has been attempting to stability each international locations and reap advantages from the geopolitical pursuits of China and India, as each international locations have strategic pursuits in Sri Lanka. This was Sri Lanka’s technique to keep away from searching for IMF help and perform financial reforms. Nevertheless, this can be a harmful sport to play for a rustic that’s dealing with a extreme financial disaster. In conditions like these, susceptible international locations, Sri Lanka on this case, would not have a lot bargaining energy; they threat compromising nationwide pursuits by changing into part of world rivalry.

However, regardless of the selections made by the federal government – and no matter Sri Lanka restructuring debt, defaulting on debt, and even efficiently persevering with to pay down its debt – Sri Lanka goes to come across many hardships within the years to come back. In such a circumstance, having the assist of China and India could be very essential for Sri Lanka. But, Sri Lanka must be cautious about defending its nationwide curiosity when getting into financial offers. The nation must facilitate funding and commerce to repair unaddressed financial points as an alternative of trying to profit from geopolitical rivalries.

[ad_2]

Source link

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DJG7FO5JVFLSTJLQHPYPSSCUIA.jpg)