[ad_1]

(MENAFN- Iraq Enterprise Information)

By Ahmed Tabaqchali, Chief Strategist of AFC Iraq Fund .

Any opinions expressed are these of the creator, and don’t essentially mirror the views of Iraq Enterprise Information .

Market Evaluate: ‘Oil and the Economic system’

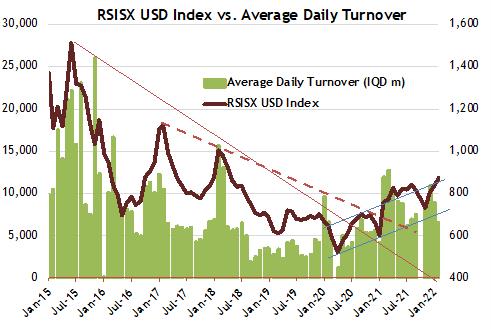

The market, as measured by the Rabee Securities RSISX USD Index, elevated by 4.5%, and eight.8% for the 12 months. Common every day turnover on the Iraq Inventory Trade (ISX) declined for the second month in a row and is presently on the decrease finish of the degrees that prevailed during the last twelve months.

On a constructive word, the Rabee Securities RSISX USD Index has reclaimed the upper-end of the uptrend that it established during the last two years (chart under) – a promising improvement that’s in distinction to that of many markets worldwide.

(Supply: Iraq Inventory Trade, Rabee Securities, AFC Analysis, knowledge as February twenty eighth)

Among the many index’s constituents, lower-priced Gulf Business Financial institution (BGUC) was up 20.0% for the month, far forward of the opposite 9 constituents. The subsequent greatest performing constituent was Financial institution of Baghdad (BBOB) up 4.7%, adopted by Baghdad Gentle Drinks (IBSD) up 4.4%, Asiacell (TASC) up 3.3%, the Nationwide Financial institution of Iraq (BNOI) up 2.6%, and Al-Mansour Financial institution (BMNS) up 2.0%, whereas the Business Financial institution of Iraq (BCOI) was flat. Decliners had been led by Al-Mansour Pharmaceutical Industries (IMAP) which was down 6.5%, adopted by Nationwide Chemical and Plastics Industries (INCP) down 2.0%, and Kharkh Tour Amusement Metropolis (SKTA) which was down 0.3%.

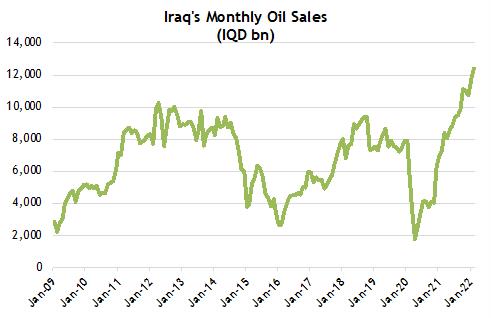

Excluding BGUC, these modest inventory value performances for the month have not but mirrored the elevated bounty introduced by excessive oil costs taking Iraq’s oil gross sales to an all-time excessive for a fifth consecutive month (chart under). The nation’s excessive leverage to grease costs and therefore to grease gross sales could have important positives for each the economic system, and the fairness market down the road – on account of the centrality of the federal government’s oil fuelled spending to the economic system.

(Supply: Ministry of Oil, AFC Analysis, knowledge as of February twenty eighth)

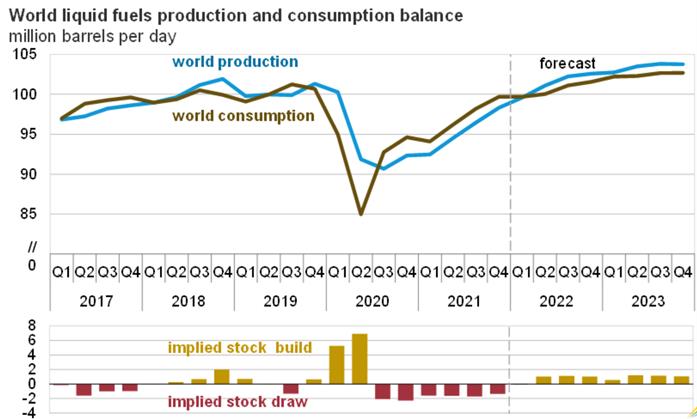

There’s quite a lot of concern constructed into oil’s present costs, and as such they’re unlikely to be sustainable for too lengthy, but the modified geopolitical panorama as a consequence of the invasion of Ukraine could have important penalties for the provision and demand of oil. On the demand facet, the restricted disruptions introduced by the Omicron variant on financial exercise worldwide since its emergence has solidified market expectations that oil demand in 2022 will return to pre-COVID-19 ranges seen in 2019 – there isn’t a purpose, a minimum of for now, to count on significant change to those expectations following the Ukraine invasion.

Nevertheless, the identical market expectations that offer will itself, like demand, return to its pre-COVID-19 ranges will possible be re-examined in gentle of the pressures that the OPEC+ group will likely be beneath within the new modified world order. Previous to the occasions resulting in the present disaster, OPEC+’s plan was to completely unwind by September 2022 the manufacturing cuts agreed to in April 2020. Nevertheless, over the previous few months, the plan was going through difficulties as some members of OPEC+ had been struggling to return to pre-COVID-19 manufacturing ranges.

A state of affairs will possible worsen given the broad scope of sanctions levied upon Russia, which is able to negatively have an effect on its oil manufacturing and the manufacturing of lots of the ‘+’ members of OPEC+ which can be intently aligned to Russia. Consequently, provide will possible be meaningfully tighter than anticipated earlier regardless of many nations releasing oil held inside their strategic reserves, the return of full U.S. shale oil manufacturing, and attainable manufacturing will increase by Saudi Arabia. Furthermore, the modified geopolitical panorama means the return of high-risk premiums to grease costs for a substantial interval into the longer term.

(Supply: U.S. Vitality Data Company, knowledge as of February eighth)

Oil value expectations – a consequence of the modified dynamics of oil’s provide and demand – and what they imply for the Iraqi economic system, are meaningfully greater than these articulated right here within the ‘Outlook for 2022 ‘ which argued on the time that ‘oil costs at these ranges are constructive for the nation’s monetary place in that they’ll present governments, present and upcoming, with the wherewithal to proceed with present expansionary financial insurance policies that may even nonetheless enable for the buildup of finances surpluses. Furthermore, they may even result in multi-year constructive balances within the nation’s present account which in flip will translate into significant will increase in Iraq’s international trade reserves.’

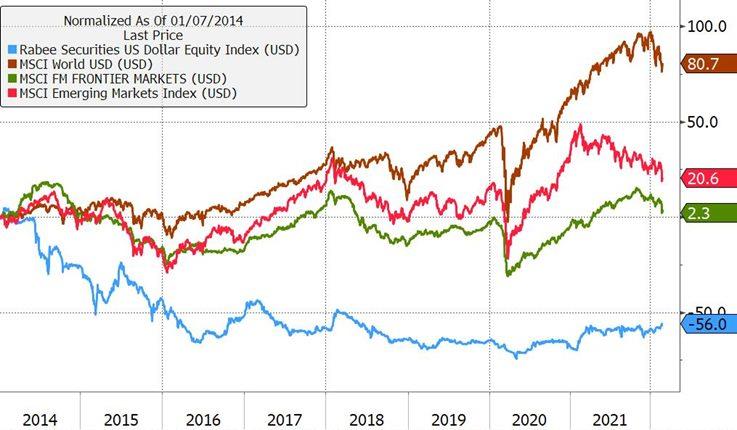

Iraq’s fairness market outlook and engaging risk-reward profile, within the unfolding new world order, is in sharp distinction to that of many markets worldwide. Firstly, the Iraqi fairness market is within the technique of rising from a multi-year bear market that noticed the Rabee Securities RSISX USD Index on the finish of 2020 down by 68% from its 2014 all-time excessive – in contrast to many markets worldwide which have had multi-year bull markets.

Secondly, its 8.8% efficiency year-to-date is in distinction to the sell-offs skilled by different markets in response to the modified world order dynamics.

Lastly, the index’s 8.8% enhance year-to-date approaching the again of a +21.4% return in 2021, is by the tip of the month nonetheless 58% under the 2014 excessive – underscoring the potential catch-up upside for the fairness market and its engaging risk-reward profile versus different international markets (chart under).

Normalised returns for the RSISUSD Index vs MSCI World Index, MSCI Rising Markets Index and MSCI Frontier Markets Index

(Supply: Bloomberg, knowledge as of February twenty eighth)

Please click on right here to obtain Ahmed Tabaqchali’s full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an skilled capital markets skilled with over 25 years’ expertise in US and MENA markets. He’s a Visiting Fellow on the LSE Center East Centre, Senior Fellow on the Institute of Regional and Worldwide Research (IRIS), and a Senior Non-resident Fellow on the Atlantic Council. He’s additionally a board member of Capital Investments, the funding banking arm of Capital Financial institution in Jordan.

His feedback, opinions and analyses are private views and are meant to be for informational functions and normal curiosity solely and shouldn’t be construed as particular person funding recommendation or a suggestion or solicitation to purchase, promote or maintain any fund or safety or to undertake any funding technique. It doesn’t represent authorized or tax or funding recommendation. The data offered on this materials is compiled from sources which can be believed to be dependable, however no assure is made from its correctness, is rendered as at publication date and will change with out discover and it’s not meant as a whole evaluation of each materials truth relating to Iraq, the area, market or funding.

MENAFN06032022000217011061ID1103803554

Authorized Disclaimer: MENAFN gives the data “as is” with out guarantee of any sort. We don’t settle for any accountability or legal responsibility for the accuracy, content material, pictures, movies, licenses, completeness, legality, or reliability of the data contained on this article. When you have any complaints or copyright points associated to this text, kindly contact the supplier above.

[ad_2]

Source link