[ad_1]

Sunda Gasoline is busy finishing numerous research that would result in the business improvement of the shallow-water Chuditch gasoline discovery offshore East Timor with a possible floating liquefied pure gasoline (LNG) improvement into account.

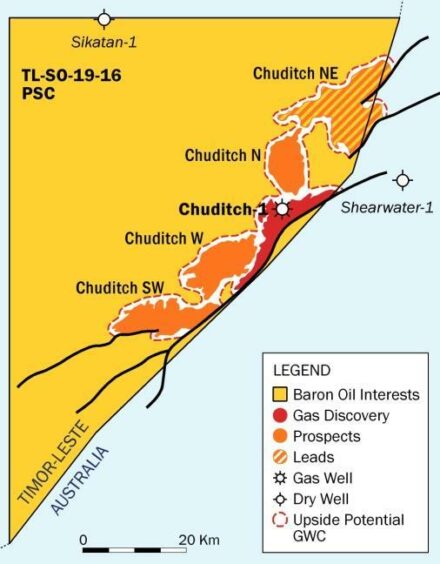

Sunda Gasoline, which is 100% owned by AIM-listed Baron Oil (LON:BOIL), is at the moment reprocessing 1270 sq. kilometres of 3D seismic round Chuditch, which was found by Shell in 1998. The reprocessing work is being performed by TGS within the UK.

Crucially, the seismic work, which is being carried out alongside geological and business research, ought to be full by mid-year, Andy Butler, chief govt of Sunda Gasoline, instructed Vitality Voice.

Butler added that the corporate will make a judgement later this 12 months relating to the viability of the venture, when a “drill or drop choice” will likely be taken.

“Going ahead, if the reprocessed knowledge deserves it, we want to drill an appraisal effectively, which is an obligation on the Chuditch discovery. However we’d additionally wish to drill at the least one extra exploration effectively to ascertain the presence of gasoline assets in adjoining options. We’d successfully be a cluster improvement for all that gasoline,” he stated.

Sunda’s focused reserves will likely be refined significantly as soon as 3D reprocessing is full. “In the meanwhile we’re carrying about 750 billion cubic ft of gasoline for the Chuditch discovery with a imply useful resource for the adjoining options of about 3.4 trillion cubic ft of gasoline, throughout 4 prospects and leads, together with Chuditch. The adjoining prospects are thought-about extraordinarily low danger as a result of reservoir and structural configuration. These numbers would advantage a standalone improvement,” added Butler.

Shell beforehand collected an unlimited quantity of technical knowledge on the discover. This lined the whole lot from coring to working all types of logs that give Sunda a superb foundation of understanding. However Shell didn’t check it. They drilled in 1998, when there was no gasoline infrastructure and nothing just like the gasoline markets immediately. Due to this fact, Shell, which hoped for an oil discovery, let it go. “For us it’s a way more attention-grabbing business alternative immediately,” he stated.

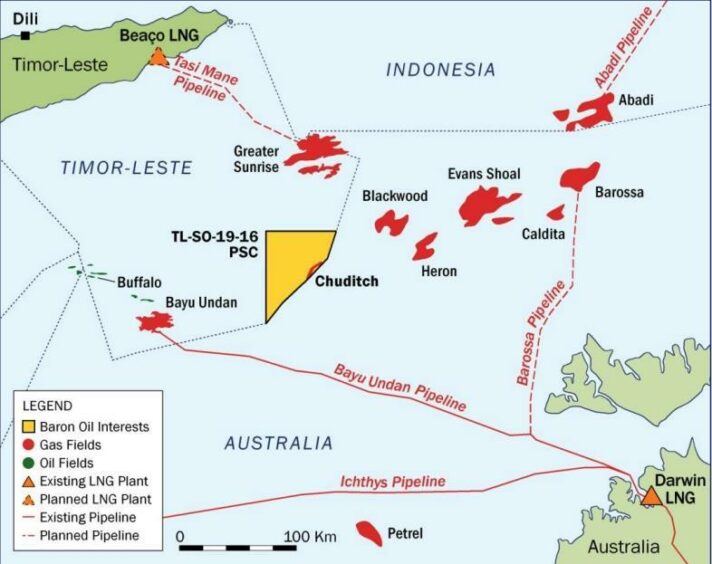

“It’s a superb discovery and it’s the identical plover reservoir system you see in the whole lot from Bayu Undan to Abadi, going by means of Barossa and Dawn. The reservoirs encountered by the Chuditch effectively are excellent. We’re assured of excellent stream charges,” added Butler.

The explorer is to carry new buyers into the venture both through farm-ins or by means of a direct company funding.

If the outcomes of the 3D seismic advantage it, Sunda will likely be drilling an appraisal effectively in 2023 and the corporate want to drill extra exploration wells following that. Every effectively is anticipated to price round $20 million.

East Timor’s nationwide oil firm, which holds a 25% stake within the TL-SO-19-16 PSC, is free carried, which is the norm within the nation, also called Timor Leste.

Any vital upstream discovery would offer a welcome windfall for East Timor, which has been closely reliant on revenues from oil and gasoline. Nevertheless, manufacturing from its sole producing area Bayu Undan is waning and operator Santos expects to close down the sector inside a few years.

Growth Choices

If the potential appraisal and exploration campaigns are profitable there are a number of improvement choices into account for Chuditch and the cluster of options round it.

The Timorese aspire to develop the Better Dawn area, to the north of Chuditch, through a greenfield LNG export facility onshore East Timor. Nevertheless, there are some complexities round that, when it comes to getting the gasoline to the island of Timor as a result of deepwater between the fields and the shoreline. There are additionally challenges growing greenfield LNG initiatives in a distant location. However this represents one pathway for Chuditch.

To the south of Chuditch, there may be the Darwin LNG (DLNG) terminal in northern Australia and Santos’ Barossa area that’s at the moment being developed to backfill DLNG. “We are able to see numerous methods to suit into that image. It has third-party challenges, but it surely’s a extra definable timeline and a definable set of challenges. Though the complexity is cross border preparations,” stated Butler.

Sunda can be standalone developments. “In some methods, these are most likely the most definitely to work out. We’re LNG amenities at Chuditch itself, most likely by means of a floating LNG (FLNG) facility,” he added.

“We’re prospects of mounted platform-based LNG amenities given we’re in shallow waters. That is progressive however easy given the underlying applied sciences. Though it isn’t actually being performed globally but,” stated Butler.

“FLNG might be the best answer. It takes away third-party points, in addition to the necessity for lengthy pipelines. It additionally takes away ready to see what occurs with Dawn or elsewhere,” he continued.

Sunda is contemplating FLNG amenities of comparable scale to these pioneered by Petronas in Malaysia. “A unit able to processing round 1.5 million tonnes per 12 months of LNG is probably going achievable with the sector now we have. If something, we’re a bit bigger than the fields Petronas are working with offshore Sabah and Sarawak,” stated Butler.

Petronas was the world’s first oil and gasoline firm to efficiently deploy two FLNGs, that are designed to faucet stranded gasoline fields economically as an alternative of constructing costly land-based amenities. Petronas is at the moment planning to construct a 3rd FLNG unit.

Beneficial for you

Santos enters FEED for world’s largest CCS venture at Bayu Undan offshore East Timor

[ad_2]

Source link