[ad_1]

Observe us on Telegram for the newest updates: https://t.me/mothershipsg

You’d in all probability have heard some information about petrol costs going up, even in the event you do not personal a Certificates of Entitlement (COE).

Pump costs are up, and drivers are feeling the pinch, with Seize drivers, taxi drivers amongst these most impacted.

However the remainder of us — who commute by way of “Bus, MRT, Stroll” — will expertise some influence too, within the type of increased costs general (and never only for petrol), much less comfort, and better uncertainty for the longer term.

Sure, it’s due to the warfare in Ukraine, however there are different elements too.

We attempt to clarify why all that is occurring, and what we are able to do about it.

Petrol costs: How unhealthy is it?

Picture by Erik Mclean by way of Pexels

Picture by Erik Mclean by way of Pexels

The “common” 95-octane grade petrol worth at Shell elevated by S$0.21 to cross S$3 per litre on Mar. 7.

Caltex and Esso additionally raised costs for that grade of petrol, providing charges of S$2.98 and S$2.95 respectively.

The worth leap over the weekend signifies that petrol utilization for a household automotive (with a 40-litre gasoline tank) would value S$8.40 greater than earlier than.

To additional put issues in perspective, S$0.21 works out to a 7.4% enhance, in Shell’s case.

And, to make issues worse, petrol costs could not come down that shortly even when international oil costs fall.

Why is all this occurring? As a result of every little thing is related.

Russia’s invasion of Ukraine is partly answerable for the rise in oil costs.

Picture by Andre Robillard by way of Unsplash

Picture by Andre Robillard by way of Unsplash

Russia is the third-largest oil producer on this planet, which signifies that something that impacts Russia’s oil market can have knock-on influence on the remainder of the world.

However what precisely has been the influence of the warfare in Ukraine?

Russia continues to export oil and gasoline, though many nations — together with Singapore — have rolled out sanctions that enormously restrict Russia’s entry to the SWIFT international cost system.

It’s because the sanctions haven’t focused Russian corporations’ capability to obtain energy-related funds.

Not but, at the least.

Sanctions on power exports, one in every of Russia’s most important income sources, may nicely be rolled out if the disaster escalates.

Within the meantime, the U.S., together with corporations like Shell, have already determined that they won’t purchase oil from Russia, which means that demand for various sources may be anticipated to extend, which can create upward stress on costs.

It isn’t troublesome to think about that gamers within the power markets are going through a lot uncertainty.

As it’s, the operator of Nord Stream 2 AG, a pipeline that might provide gasoline from Russia on to Germany, has fired over 100 workers as progress on the venture has been stalled for the reason that pipeline’s completion final yr.

Germany had beforehand withheld closing approval for the pipeline to begin operations, as a way to present its disapproval of Russia’s actions.

Not simply the warfare

But it surely’s not simply the warfare that’s contributing to sky-high oil (and petrol) costs — there have been different elements in movement even earlier than the battle in Ukraine.

This implies they are going to be round even after the battle in Ukraine is ultimately resolved.

Looming power disaster

For one, the power sector has been going through an impending disaster for a while.

Some Singapore households would have felt the very actual influence of this final yr, as their electrical energy suppliers shut down, citing causes comparable to a “risky electrical energy market” and “extraordinarily troublesome” circumstances.

Whereas oil costs dipped dramatically in early 2020, post-lockdown financial restoration throughout the globe drove up demand within the later a part of the yr and in 2021.

On the similar time, the rising emphasis on local weather change led many economies to maneuver away from conventional power sources — notably in Europe.

Local weather-friendly as that is, such nations are actually left with fewer choices to ramp up power manufacturing when confronted with supply-related points comparable to excessive climate (which disrupts hydroelectric- and wind-based energy technology), and even the present warfare in Ukraine.

Which means that they’ve to show again to fossil fuels to make up any shortfalls.

Fossil gasoline trade underdeveloped lately

However the “conventional” power industries are those that might have seen much less analysis and growth, with banks and traders more and more unwilling to become involved for moral or sustainability-related causes.

This has had the impact of constructing them much less in a position to reply to elevated demand.

With extra patrons competing to purchase more and more restricted shares of oil and pure gasoline, costs naturally rise.

How does this translate to increased costs for almost every little thing?

As oil and gasoline closely affect financial provide chains, customers can anticipate the common costs of on a regular basis requirements, comparable to meals, transport and electrical energy, to rise.

Oil costs have pushed up import prices via increased freight charges and delivery expenses, elevating financial prices for customers. The scenario can also be additional compounded by a scarcity of delivery crews because of the warfare, with roughly 14.5 per cent of worldwide delivery workers being Russian or Ukrainian.

Picture by Andy Li by way of Unsplash

Picture by Andy Li by way of Unsplash

This can be a drawback for Singapore as our economic system depends predominantly on imports, which account for 147.63 per cent of our GDP. As well as, the manufacturing sector additionally depends upon imported uncooked supplies to fabricate its merchandise, elevating manufacturing and consumption prices.

For example, in accordance with SingStat’s import indices, costs of imported manufactured items have risen by 14.5 per cent in January 2022, up from a ten.1 per cent enhance in June 2021.

A sustained enhance within the costs of imports could drive up Singapore’s inflationary stress, pushing costs even increased. In January, the annual core inflation price, which measures the costs of important gadgets, rose by 2.4 per cent, the very best price in additional than 9 years.

Evidently, our grocery payments are going up — the common retail worth of a carton of 10 eggs elevated by 20 cents between December 2021 and January 2022, reported the Ministry of Commerce and Trade.

Moreover, oil and gasoline proceed to be a significant power supply in Singapore, with roughly 95 per cent of our electrical energy being generated from imported pure gasoline; leading to increased electrical energy payments for households and companies alike.

As reported by At present, F&B enterprise house owners comparable to hawkers, are additionally lowering their working hours to preserve power in view of the escalating electrical energy costs.

Consequently, companies are prone to endure increased alternative prices and decreased earnings, forcing them to up their product costs to compensate.

Hawkers are additionally elevating their costs, citing an increase in the price of substances and electrical energy payments amid the Russo-Ukraine warfare. International meals costs have additionally reached an all-time excessive in February this yr, primarily brought on by worth surges for vegetable oil and dairy merchandise.

For example, statistics offered by UkrAgroConsult indicated that the worth of sunflower oil from Ukraine has doubled, a worrying statistic contemplating that roughly 53 per cent of the world’s sunflower oil manufacturing comes from Russia and Ukraine.

Palm oil, the world’s most generally used oil, has additionally turn into the costliest among the many 4 most prevalent vegetable oils. Such worth hikes threaten our meals safety, as costs for meals proceed to rise throughout the board.

Public transport commuters are additionally not exempt from the issue, with MRT fares already seeing an as much as four-cent enhance since December 26, final yr.

Picture by way of Ministry of Transport web site

Picture by way of Ministry of Transport web site

A number of bus, taxi and personal rent corporations in Singapore are additionally reporting an increase in working prices, brought on by rising gasoline costs. To assist private-hire drivers and taxi drivers tide over the elevated gasoline expenses, ride-hailing corporations have rolled out new measures within the type of reductions and card rebates at some petrol stations.

Such initiatives, nonetheless, are related to increased firm expenditures. Taxi firm, ComfortDelGro, has introduced a rise in its flag-down fare by twenty cents to assist offset a number of the additional bills.

As well as, the surge in petrol costs has seen a lower within the take-home wages of business drivers, deterring these drivers from working. With fewer drivers on the street, taxi surcharges are set to extend additional.

What you are able to do

Amid the worth hikes, listed below are some wallet-friendly approaches you may discover, to cushion the influence of rising petrol costs.

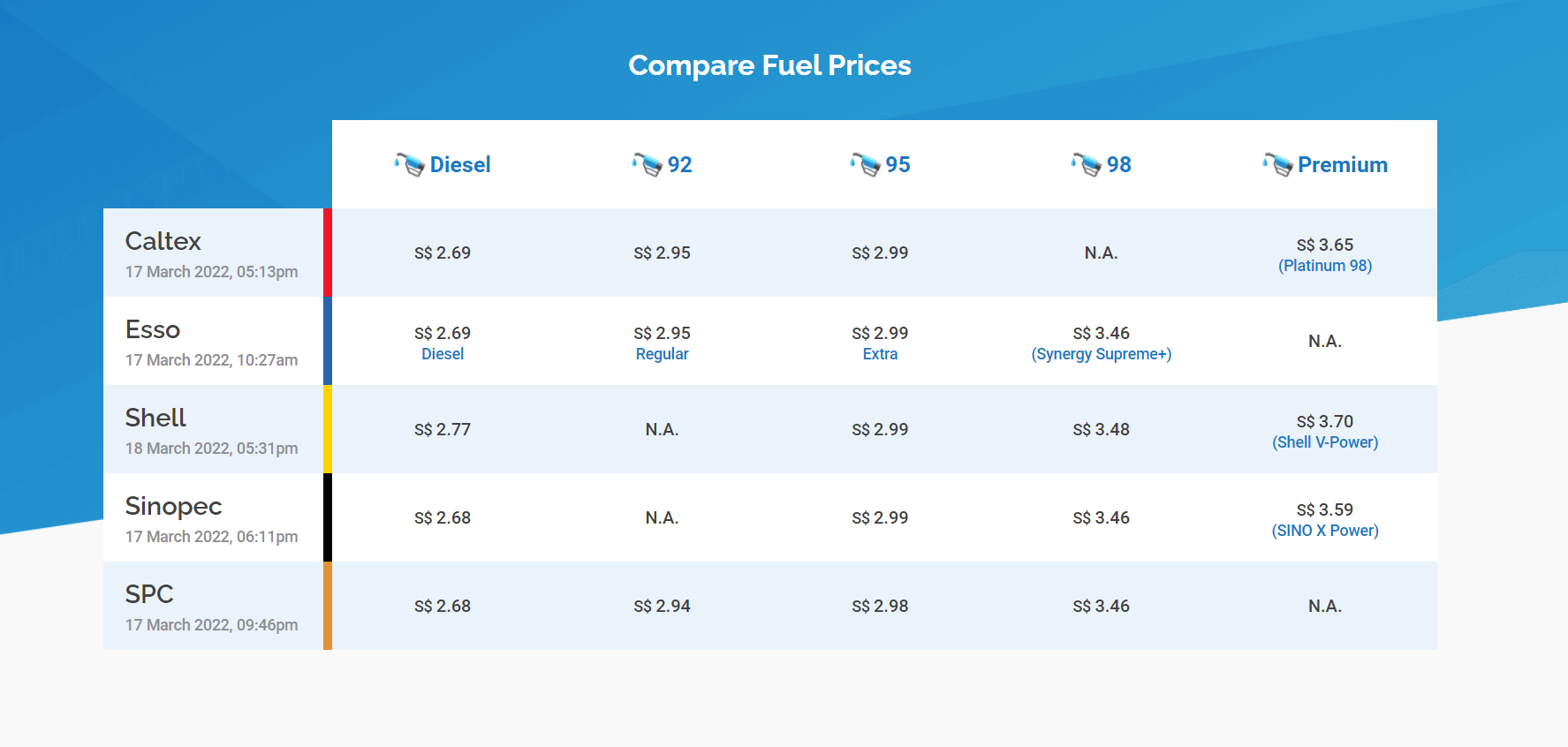

As a driver, you may think about using web sites comparable to Gas Kaki — developed by the Customers Affiliation of Singapore (CASE) — to match the costs of gasoline and examine for promotions throughout varied petrol stations, making certain that you don’t overpay for gasoline.

Picture by way of Gas Kaki

Picture by way of Gas Kaki

Commuters may think about travelling throughout off-peak hours to keep away from worth surges, that are doubtless if extra drivers resolve that petrol has turn into prohibitively costly.

Moreover, taxi reserving charges throughout non-peak durations are additionally cheaper at S$2.30 in comparison with S$3.30 throughout peak hours.

Non-peak commuting is feasible on public transport too — underneath the Morning Pre-peak Fares scheme, commuters can take pleasure in cost-savings of as much as S$0.50 by tapping in earlier than 7.45am at any MRT station islandwide.

Decreasing reliance on typical power sources

House owners of buildings, or companies, might also go for renewable power to cut back their reliance on pure gasoline, as a lot as doable.

Picture by Los Muertos Crew by way of Pexels

Picture by Los Muertos Crew by way of Pexels

As a part of the Carbon Pricing Act, the Ministry of Sustainability and the Setting (MSE) promotes the swap to renewable power via the implementation of a carbon tax, capped at S$5 per tonne of greenhouse gasoline emissions.

By switching to renewable power, companies can save on carbon taxes whereas dodging electrical energy worth will increase and lowering their carbon footprint.

Vitality saving for households

For households, you could need to strive these energy-saving tricks to cut back power consumption.

- Think about using a fan slightly than an air conditioner

- Flip off electrical home equipment on the energy socket

- Wash your laundry on a full load within the washer

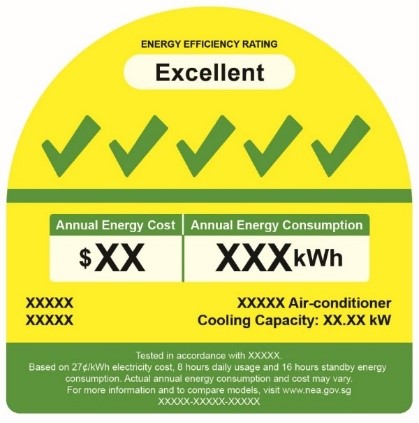

When buying new electrical home equipment, you could think about buying energy-efficient home equipment with power labels containing 4 to 5 ticks. Whereas energy-efficient home equipment are dearer up-front, they provide long run cost-savings.

Picture by way of NEA web site

Picture by way of NEA web site

The power consumption of a 5-tick air conditioner, for instance, quantities to about S$650 a yr, which is 30 per cent lower than a 2-tick unit, resulting in financial savings of as much as S$195 yearly.

Moreover, the federal government has made energy-efficient home equipment extra inexpensive via its Local weather-Pleasant Family programme, which inspires households to buy such home equipment.

This scheme is accessible to those that reside in 1-room, 2-room or 3-room HDB flats and eligible households can redeem e-vouchers to offset the price of their home equipment at taking part retailers.

The world is at present going through, because the Coordinating Minister for Social Insurance policies, Tharman Shanmugaratnam, describes, a “excellent lengthy storm”. However, the actual query is: Will we emerge from this “storm” unscathed?

High Picture by Erik Mclean by way of Pexels.

Associated story

Observe and take heed to our podcast right here

[ad_2]

Source link