[ad_1]

The trade charge system, also called the present system, establishes the worth of a nation’s forex towards the forex of one other nation. The trade charge system is a vital macroeconomic coverage subject, particularly for small open economies like Nepal. With rising globalization and international commerce, a handy trade charge coverage is required to permit nations to transform their forex to a different forex to conduct clean worldwide commerce.

Nepal is positioned between the 2 nations, India and China. The north outlined with the restrictive Himalayan ranges, whereas the south is surrounded by an open plain terrain stretching throughout east to west inflicting higher Indian affect in comparison with Chinese language affect. The geographical attribute of the nation has resulted in a mutual relationship between Nepal and India, with shared cultural heritage and shut financial relationship that dates to 1000’s of years. Important commerce and funding linkages with India led to the dominance of the Indian Foreign money (IC), particularly within the Terai area, whereas the circulation of Nepali forex was restricted to the Kathmandu valley and the hilly area. In Nepal, each Indian Foreign money and Nepali Foreign money have been authorized tenders sooner or later and underneath the twin forex system the trade charge was fastened on the idea of demand and provide by the non-public cash changer.

Historical past of pegging Nepali Foreign money

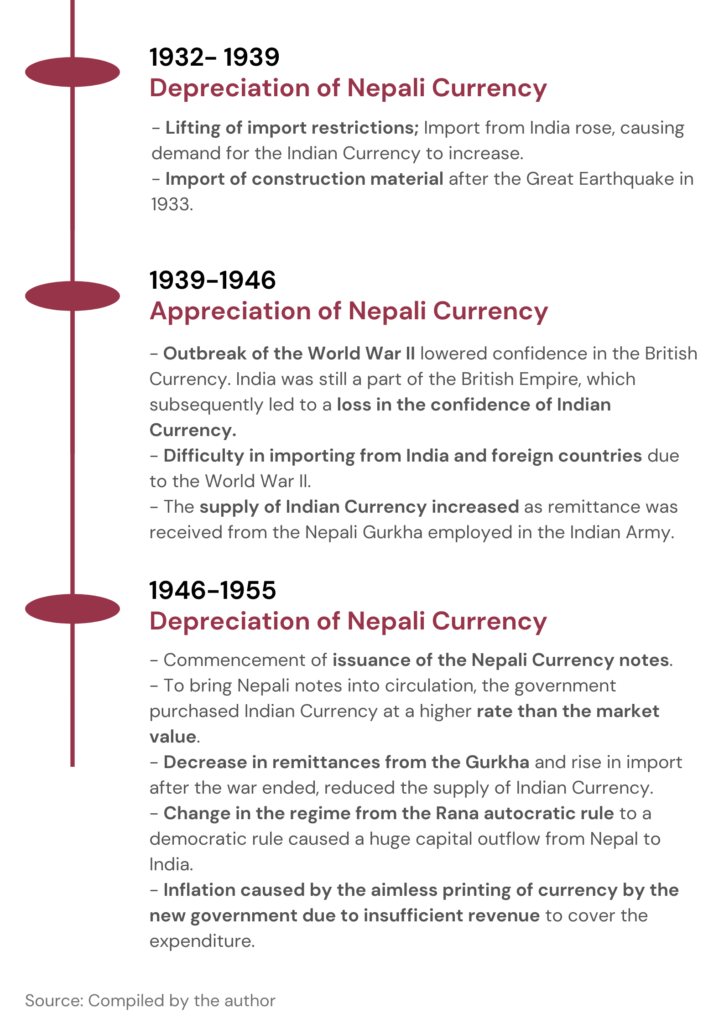

The twin forex trade charge had been in existence for a really lengthy interval in Nepal. Since 1877, the twin trade charge had been steady as the quantity of import from India was restricted to needed items like uncooked cotton, kerosene, textiles, salt, medicines and so on. The interval between 1932-1955 confronted most fluctuations, as illustrated within the graphic under.

The surge within the import, particularly from India throughout 1932-1939 led to an increase within the demand for the Indian Foreign money. For the reason that twin forex system charge was decided based mostly on the demand and provide of every forex, a rise within the worth of Indian Foreign money meant depreciation of the worth of Nepali Foreign money.

Within the interval between 1939-1946, varied occasions led to a rise within the provide of the Indian Foreign money, nonetheless the lower within the demand of INR, depreciated the worth of the forex.

The turmoil inside Nepal throughout 1946-1955 led to an increase within the worth of the Indian Foreign money, which additional introduced volatility within the trade charge between the 2 nations.

Determine 1. Historical past of twin forex in Nepal (from 1932-1955)

The twin forex system led to a partial IC-ization throughout 1932-1960 in Nepal. The Indian Foreign money was largely utilized to pay income to the federal government. This led to the next demand for the Indian Foreign money inside Nepal, ensuing within the appreciation of the Indian Foreign money. On one hand, appreciation of the worth of the Indian Foreign money implied that the federal government obtained increased complete income worth. Whereas however, the appreciation of the Nepali Foreign money’s worth meant a discount within the worth of the full income collected by the federal government in Indian Foreign money. Due to this fact, the federal government was extra centered on stopping overvaluing of the Nepali Foreign money as its worth appreciation meant discount within the worth of income collected by the federal government in INR.

Through the interval between 1955-1960, every day fluctuation of the trade charge was noticed. The interval noticed the enactment of the Nepal Rastra Financial institution Act of 1955 and after its institution, varied makes an attempt stabilizing the trade charge by means of applications and insurance policies have been made. An lively coverage to stabilize the trade charge was launched which emphasised the circulation of Nepali Foreign money and eradicated the usage of Indian Foreign money in Nepal. The twin forex system ended underneath the Nepal Foreign money and Growth Act of 1957.

The federal government declared that Nepali Foreign money shall be absolutely convertible to Indian Foreign money at INR 100 for NPR 160, and the pegged system was launched which has been carried until date.

Present State of affairs

Nepal has maintained the pegged system by means of a managed provide of Indian Foreign money. When the demand for Indian Foreign money will increase, it causes the worth of INR to turn out to be higher than the pegged charge. To make sure that the trade charge is maintained at NPR 160 to INR 100, the provision of the Indian Foreign money wants to extend. The availability of the Indian Foreign money is managed by NRB with the assistance of its international trade reserve. These international trade reserves are maintained by the earnings collected by means of tourism, exports and remittances, which NRB makes use of to buy Indian Foreign money to extend provide inside the Nepali economic system.

Nepal Rastra Financial institution (NRB) launched the pegged system with the intention to stabilize the Nepali Foreign money and keep its worth within the worldwide market by pairing it with a relatively highly effective regional forex i.e. Indian Foreign money. Indian Foreign money is comparatively highly effective and steady on account of its excessive demand and provide within the worldwide market. The steadiness supplied by the forex system additionally builds confidence amongst buyers, which helps deliver Overseas Direct Funding (FDI) into the nation. Moreover, the pegged system has made commerce simpler as stability was introduced by the fastened charge which created a clean cross transaction.

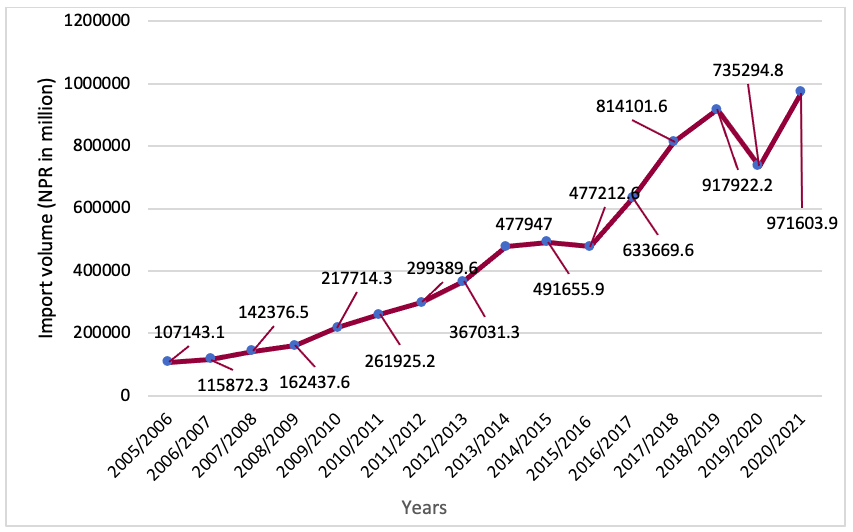

The steadiness introduced by the pegged system has resulted in an elevated reliance on India. The import from India has been rising, which may be seen in Determine 1. From 2006 to 2021 the import from India elevated by a Compound Annual Progress Price (CAGR) of 15.83%.

Determine 2: Import quantity from India to Nepal between 2005-2021

Supply: NRB Annual Report, Present Macroeconomic Updates

As mentioned, the pegged system implies a dependency on the Indian economic system. Any shock in the Indian economic system impacts Nepal equally. As an example, the demonetization of the Indian Foreign money introduced volatility throughout sectors, as Nepal confronted a scarcity of Indian Foreign money. Consequently, the economic system of Nepal was impacted since commerce between the 2 nations grew to become tough.

Nepali Foreign money pegged with the Indian Foreign money subsequently affect the worth of the Nepali Foreign money towards the US greenback. The worth of the US greenback is necessary for any nation as it’s a extensively accepted international forex, and can be utilized for any worldwide commerce. Moreover, 90% of the foreign exchange trades embrace the US greenback. Due to this fact, when the worth of Indian Foreign money weakens towards US greenback due components equivalent to inflation, rise in oil costs, uncertainty introduced by conflict – the worth of Nepali Foreign money additionally depreciates. Not too long ago the Indian Foreign money’s worth towards the US greenback has been depreciating, which has brought on the Nepali Foreign money to depreciate as effectively.

Whereas the pegged forex system enormously advantages the Nepali economic system, it’s accompanied by problem with regard to the administration of the international trade reserve. Overseas trade reserve is essential in a pegged forex system, because it acts as a security internet for the central financial institution in occasions of crises, when nationwide forex devalues. Stability of cost deficit straight influences the international trade reserve, which induces liquidity disaster within the home market.

Future potentialities

Though Nepal’s Gross Home Product (GDP) formation has modified because the introduction of the pegged forex system in 1960, solely seven changes have been made to the Nepal’s trade charge coverage. Regardless of the drawbacks of the pegged system, it has protected Nepal from volatility and inflation. Nepal lacks a notable place within the worldwide commerce, which ends up in a low demand for the Nepali Foreign money. To benefit from the pegged system, Nepal should concentrate on creating an export sector to strengthen the worth of the Nepali Foreign money and keep the international trade reserves.

[ad_2]

Source link