[ad_1]

Bangkok ride-hailers can seize a brand new possibility subsequent month. AirAsia’s mother or father holding firm Capital A plans to launch its ride-hailing platform within the Thai capital in April, because it continues an aggressive foray into non-aviation companies after the Malaysian airline suffered vital pandemic-era losses.

The brand new service, dubbed AirAsia Experience, will start with some 5,000 taxis in Bangkok, earlier than increasing to non-public drivers and different key cities, in accordance with the corporate’s regional CEO Lim Chiew Shan.

AirAsia Experience first launched within the Malaysian capital of Kuala Lumpur final August. It at present covers all of Malaysia’s main cities, with month-to-month bookings within the six digits for its 30,000 registered drivers, all of whom are fully-vaccinated for Covid.

The platform’s complete rides elevated on common greater than 60% every month since launch in 2021, recording greater than 700,000 rides to this point. Notably, drivers take 85% of the web fares, excluding toll charges, which the corporate claims is greater than every other “e-hailing” platform available on the market.

‘Seize’-ing maintain of the market

In a post-pandemic world, the corporate plans to beat the highway as a lot because the skies. In Southeast Asia, meaning snatching floor from the market’s largest participant — Seize.

Since Uber’s exit from Malaysian in 2018, Seize has been the nation’s dominant e-hailing participant. In response to the Singaporean firm’s preliminary public providing paperwork, it managed greater than 70% of the native market in 2021.

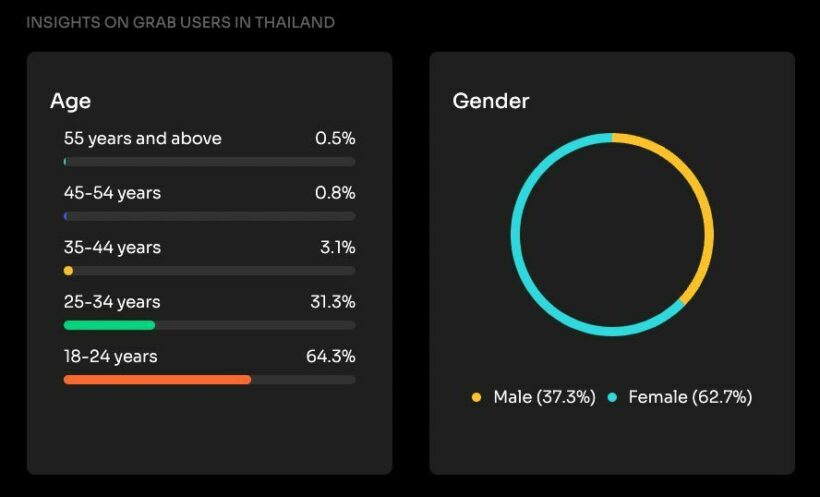

It’s an analogous image right here in Thailand, the place Seize controls the lion’s share of the e-hailing market and can also be a foremost platform for meals supply. Seize has some 1,339,154 customers in Thailand, with greater than 60 p.c of consumers being girls between the ages of 18 and 34, in accordance with Begin.io.

In a bid to draw extra feminine drivers, AirAsia Experience launched its LadiesONLY group earlier this month, giving feminine passengers in Malaysia the choice of reserving cabs for ladies solely. It might be an indication of how the brand new e-hailing platform hopes to shake up the market in Thailand.

When the brand new e-hailing platform launched in Malaysia final August, Amanda Woo, CEO of airasia Tremendous App, emphasised price range mindedness and increasing northward into Thailand…

“Airasia Experience inherits the DNA of operating a low value mannequin which permits financial savings to be handed on to company and strives to supply the bottom fares on the highway, introducing nice worth to the extremely aggressive e-hailing ecosystem. That is a part of our steady digital transformation journey to turn into Asean’s prime tremendous app via our regional enlargement into Thailand and doubtlessly Indonesia very quickly.”

GRAPHIC: Demographic insights of Seize customers in Thailand. Credit score: Begin.io

Determined instances, diversified measures

In July final 12 months, AirAsia introduced that AirAsia Digital had acquired the Thailand operations of Indonesian tech firm Gojek. The all-share deal value US$50 million gave Gojek a mere 5% stake in AirAsia Digital, and laid the groundwork for logistical platforms like AirAsia Experience to ultimately develop into the Thai market this 12 months.

On the time, the digital enterprise division of AirAsia was valued at US$1 billion, incomes it the coveted enterprise standing of “unicorn.” But it surely wasn’t sufficient to make up for the airline’s billions of {dollars} in losses throughout two consecutive years of pandemic.

As the corporate seemed to digital companies for extra income, it turned way more than simply an airline. And it wanted a reputation change to mirror its new identification. Tony Fernandes, founding father of price range provider AirAsia, rebranded the airline’s mother or father holding firm as Capital A in January this 12 months, saying…

“Over the previous two years we’ve got spent the downturn in flying constructing a strong basis for a viable and profitable future, which isn’t solely reliant on airfares alone. Capital A indicators an thrilling new period for our airways and all of our different portfolio companies throughout the Group as we embark on a big new progress part.”

Fernandes started increasing full-throttle into non-airline companies two years in the past, when the pandemic began stymying air journey in spring 2020. AirAsia Experience is simply one of many ensuing non-aviation subsidiaries beneath the corporate’s vast umbrella…

“Whereas the airline will at all times underpin the AirAsia model, it has lengthy been my agency intention, properly earlier than Covid hit, to leverage the robust information we’ve got constructed up over 20 years and incorporate industry-leading new applied sciences to supply a broad vary of services and products, over and above promoting simply airfares. The pandemic has allowed us to speed up that technique. “

Fernandes initially branched out into on-line journey company and cargo logistics companies, earlier than constructing an diversified digital enterprise empire encompassing meals, groceries, eating places, parcel supply, insurance coverage, micro-lending and, in fact, e-hailing companies. A complete of 16 such companies can be found although the airasia Tremendous App…

“We’re already one of many prime three on-line journey brokers (OTAs) in Asean and our tremendous app is on monitor to turn into the main way of life app within the area very quickly. All of our portfolio companies are properly on the way in which to changing into {industry} leaders of their respective fields throughout Southeast Asia, together with BigPay, our plane engineering division Asia Digital Engineering (ADE) and logistics enterprise Teleport.”

Weathering the storm

But it surely hasn’t been a easy transition for the aviation tycoon. Fallout from the COVID-19 pandemic and the ensuing journey restrictions noticed the corporate’s income lower from 11.9 billion ringgit in 2019 to three.1 billion ringgit in 2020.

Worst of all, the corporate has wracked up staggering web losses of 5.1 billion ringgit and three.1 billion ringgit in 2020 and 2021, respectively.

In January, Capital A was placed on watch by the Bursa Malaysia inventory alternate, which ordered the rebranded firm to bear a monetary restructuring inside one 12 months or be mechanically delisted, in accordance with a report by Nikkei Asia.

In the meantime, AirAsia (the airline) plans to reopen flights between Malaysia and Thailand within the coming months, as the 2 nations ease Covid-19 journey restrictions and reopen their shared border.

Time will inform if Fernandes’ pandemic-era restructuring will maintain his firm afloat in a post-pandemic Southeast Asia. Flight bookings — and experience hailing — might be part of the equation.

The corporate goals for it digital companies to supply half of its complete income within the medium time period — if it could get there. Fernandes is optimistic…

“Importantly, the most effective is but to come back. We now have pivoted, we’ve got reworked and we’ve got a 5 12 months plan in place which is able to see non airline revenues contributing round 50 p.c of total Group income by 2026. As soon as the airways return to pre-Covid ranges within the close to future all of our different strains of enterprise will profit considerably and can all soar to new heights in tandem with each other.”

Thailand Information At present | Extra competitors for thai taxis!

SOURCES: Nikkei Asia | Bangkok Publish | AirAsia | Begin.io

[ad_2]

Source link