[ad_1]

A lot has been written concerning the China-Pakistan Financial Hall (CPEC), one of many six limbs of China’s Silk Street Financial Belt. Supporters hail CPEC as equipping Pakistan with the infrastructure to thrive within the twenty first century, whereas critics deem it as a type of colonization that can doom Islamabad into being a vassal of Beijing. As CPEC lately concluded its early harvest interval in 2021, it’s a superb time to guage the influence it has had on China-Pakistan commerce patterns.

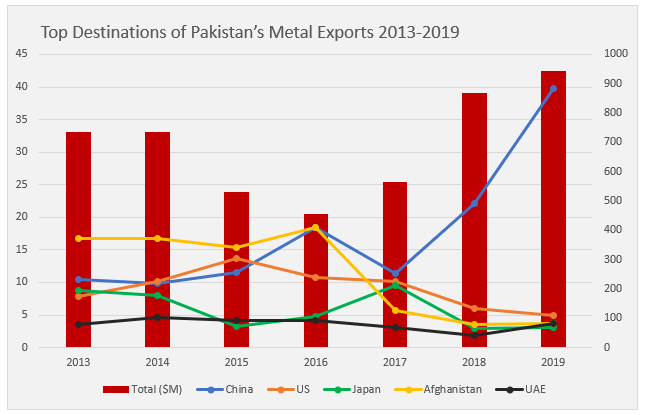

One profound change that might add to the controversy is the unprecedented spike in steel exports from Pakistan to China since 2016, the 12 months CPEC formally started. In line with the Observatory of Financial Complexity, previous to CPEC’s unveiling, the highest shares of Pakistan’s steel exports had been break up amongst Afghanistan, China, Japan, america, and the UAE. Nevertheless, after two consecutive dips in 2015 and 2016, exports have elevated steadily since 2017, with a lot of the features going to Beijing. Because of this, China now receives much more of Pakistan’s steel exports than its beforehand shut opponents.

Supply: Creator’s compilation based mostly on knowledge from the Observatory of Financial Complexity

This spike is attributable to China’s intense funding into Pakistan through CPEC. Certainly, the $64 billion challenge has considerably improved Pakistan’s connectivity and power manufacturing and has reanimated the nation’s mining sector, which had suffered from excessive transport prices, low funding, and insufficient infrastructure.

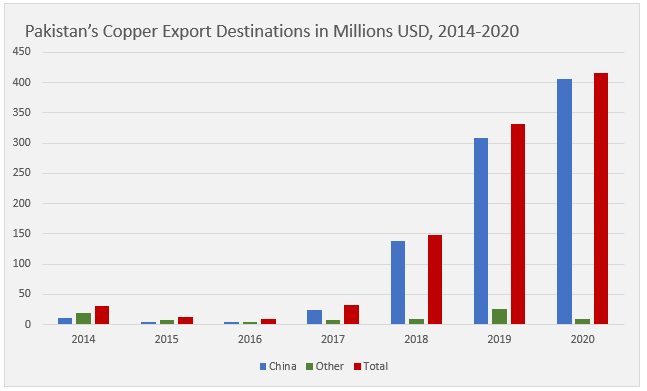

Among the many metals extra intensely pulled in by Beijing’s new magnetism is copper. In 2014 Pakistan exported underneath $50 million in cooper to China; in 2020, that determine topped $410 million.

As well as, this growth has seen Pakistan flip from a web importer of refined copper to a web exporter as of 2018, a feat not completed for the reason that 12 months 2000. For China, this new stream of copper, regardless of constituting underneath 3 % of complete copper imports, addresses inside considerations over the environmental harm brought on by native copper manufacturing. By outsourcing the manufacturing of copper, China can keep the availability required to fulfill rising demand for its inexperienced expertise merchandise similar to photo voltaic panels and electrical vehicles, by which copper is an integral factor.

Creator’s compilation based mostly on knowledge from UN Comtrade.

For CPEC proponents, the export surge joins the checklist of advantages accrued from partnering with Pakistan’s “iron brother” and all-weather pal. Nevertheless, this new income has not been painless. Protests erupted at Saindak Copper and Gold Venture with employees demanding a rise to their wage of 15,000 Pakistani rupees, a sum whose worth additional diminished as rising inflation pulled the worth in U.S. {dollars} down from $106.5 in January 2019 to round $95 in August of that 12 months. The Saindak challenge is a joint Beijing-Islamabad enterprise situated in Pakistan’s restive Balochistan area, the place native opposition to China’s growth has at instances turned violent. Furthermore, mortgage repayments and their accruing curiosity won’t see Islamabad basking within the new wealth CPEC could generate; as an alternative Pakistan will likely be scrambling to repay debt to China, which has change into higher that the cash owed to the IMF.

Geographic proximity is definitely an vital issue diminishing transport prices previous to export. Given China’s shared border with Pakistan, home air pollution drawback regularly lamented in public discourse, and burgeoning inexperienced expertise sector, market physics dictate that cheaper and extra considerable copper in Pakistan would naturally channel eastward. One other issue, nevertheless, is the rising complementarity between Pakistan and China.

This elevated manufacturing and export of Pakistani metals, a uncooked materials, to a extra developed and richer state feeds into discourse on the consequences of China’s Belt and Street Initiative (BRI), notably on what it means for the hegemony of america. Certainly, these cynical concerning the fortitude of U.S. hegemony would see the above copper surge as indicative of China’s hegemonic features. It’s because a classical side of the connection between a hegemon and its subordinate peripheries is (comparatively) low cost uncooked materials and labor shifting from periphery to core, whereas (comparatively) costly merchandise and experience are exported in the other way.

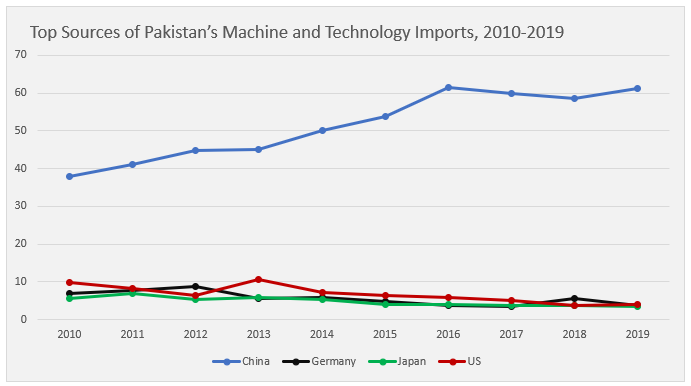

Intriguingly, taking machines and electronics as examples of China’s pricier exports to Pakistan, one sees that whereas China’s provide to Pakistan has lengthy dwarfed exports from america and Japan, this hole elevated within the years previous to CPEC’s begin in 2016, after which China’s share plateaued at roughly 60 % of complete imports.

Supply: Creator’s compilation based mostly on Pakistan Mach and Elec Imports by Nation & Area 2019 | WITS Knowledge, n.d.)

For world-systems analysts observing the completely different manifestations of hegemony since its first incarnation because the United Provinces of British India, these developments resonate with the peripheralization of areas as soon as exterior to the hegemon, whereby its financial outputs change into extra in tune with the hegemon’s orchestration of provide and demand. On this vein, a periphery is molded by the hegemon right into a producer of low cost items and labor that it requires for its dearer merchandise and exports, in so doing engineering the classical asymmetry between hegemon and periphery. This asymmetry is one among income, if nothing else, structured in such a method as to ensure that web income enters the hegemon from the periphery, with a commerce imbalance and the abovementioned curiosity funds inflating China’s features.

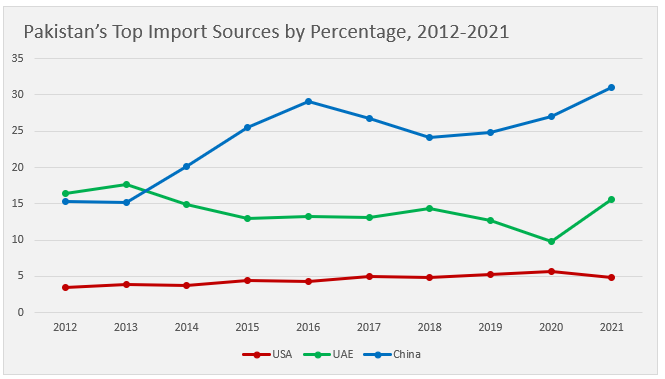

On this regard, a look at Pakistan’s prime import sources reveals China’s share has doubled since 2012 – going from 15 % to over 30 % – whereas rivals such because the UAE and the U.S. remained at roughly their pre-BRI ranges.

Compiled by writer based mostly on knowledge from: Pakistan | Imports and Exports | World | ALL COMMODITIES | Netweight (Kg); Amount and Worth (US$) | 2009 – 2020, 2021.

What does this imply for U.S. hegemony? Some Pakistani students say China has already achieved hegemony in Pakistan, with these newest commerce victories being solely elements of an equipment of management, together with low cost imports corroding native manufacturing and resulting in deindustrialization.

Multipolarity, or a world with two or extra hegemons, has accompanied analyses of comparable features China has made on the expense of america and the worldwide liberal order, particularly as China’s imprints on creating states change into extra obvious. An rising variety of states are becoming a member of China’s worldwide establishments, such because the Asian Infrastructure Funding Financial institution, and extra are adopting the One China place on the authorities and United Nations ranges. China has additionally change into a prime vacation spot for college students from creating international locations, with this instructional migration eastward involving training on Chinese language language and tradition in a way set to groom returning college students right into a Mandarin-speaking counterweight to Western-educated elites at house. In Pakistan, China has even achieved the extent of belief as soon as given to Washington in safety affairs, as Islamabad has rejected a latest request to host a U.S. army base to observe Afghanistan whereas the Individuals’s Liberation Military traverses contested territory in Kashmir.

China’s financial features in Pakistan haven’t been met with a lot alarm, in comparison with the all-out try to cease Vladimir Putin from conquering Ukraine. It is a quiet skirmish, one which performs out in markets and factories, declared with free commerce agreements and fought with environment friendly merchandise. This conflict is extra silent than Russia’s invasion of Ukraine, however simply as able to furthering Beijing’s affect. By complete design and sustained perseverance, China can extract from Pakistan all the advantages of a periphery which might be the stuff of Putin’s fantasies in Ukraine.

Certainly, Putin could also be instructing Xi Jinping a beneficial lesson: Enduring and natural affect over different states have to be pillared by financial promise. In poetic justice, Moscow’s use of pressure in lieu of Western financial attract (and cultural enchantment) has pulled it farther than ever from nice energy standing as sanction after sanction whittle away at an economic system Putin’s apologists would have used to defend his heavy-handedness domestically and in Moscow’s satellites.

[ad_2]

Source link