[ad_1]

That is a part of a collection of options sponsored by Brokers for Influence (AFI), a German impression investing agency whose merchandise embody the AFI Sustainability Alignment Score (AFISAR©) Software. The AFISAR© ranking is a belief mark – in microfinance and different types of social enterprise – signifying a dedication to optimistic and enduring change for folks and the planet primarily based on the UN Sustainable Growth Aim (SDG) framework.

That is a part of a collection of options sponsored by Brokers for Influence (AFI), a German impression investing agency whose merchandise embody the AFI Sustainability Alignment Score (AFISAR©) Software. The AFISAR© ranking is a belief mark – in microfinance and different types of social enterprise – signifying a dedication to optimistic and enduring change for folks and the planet primarily based on the UN Sustainable Growth Aim (SDG) framework.

AFISAR© helps MFIs leverage the market’s rising deal with sustainability performance to lift capital from internationwide buyers and, particularly, impression buyers. The ranking helps buyers and social companies understand their strengths and weaknesses and devise efficient methods to reduce damaging impression and maximize optimistic impression to the good thing about the group – its workers, purchasers and different stakeholders – in addition to the setting.

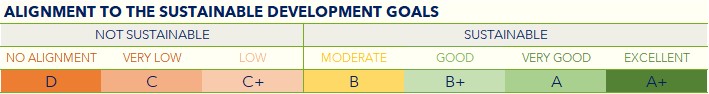

The lively dialogue and engagement embedded within the AFISAR© ranking course of allows the MFI in addition to asset managers to embark on a journey that results in long-term sustainable growth. A ranking above the sustainability threshold on the size (see under) is favorable for the disbursement funds. Thus far, AFI has used the AFISAR© Software to fee 30+ microfinance and SME finance establishments within the Caucasus, Central and South Asia, East Africa and Japanese Europe, serving to the establishments reveal their SDG competency and alignment.

Pratibha Singh (pictured): How did you change into involved in microfinance?

Pratibha Singh (pictured): How did you change into involved in microfinance?

Sergey Kim: My skilled profession began in 1998 within the area of microfinance. I used to be working as a mortgage officer for a UN microcredit venture, which made it attainable for me to have an in depth take a look at the ground-level realities regarding credit score operations. After ending my graduate diploma, I selected FINCA as a result of the job was near folks.

I’ve labored with FINCA since 2006 and have been in Tajikistan for the final 12 years. FINCA Tajikistan has been lively since 2004 and is now amongst the highest 5 MFIs within the nation. We provide many financial services, comparable to loans, financial savings, deposits, cash transfers, microinsurance coverage and foreign money change. FINCA Tajikistan serves 30,000 clients by means of 26 branches. There’s a significant want for microfinance in Tajikistan, as greater than half of the nation’s inhabitants lacks entry to frequent monetary companies.

PS: What makes the FINCA mannequin distinctive?

SK: For FINCA, the social mission is embedded in our values of heat, belief and responsible banking. The phase of folks that we work with has restricted entry to conventional banking companies, and most of our clients are in distant, rural areas. At FINCA, we create belief within the banking system by giving folks the instruments, data and confidence they should construct their monetary well being. We are also increasing digital service supply to drive down prices and attain extra folks.

PS: What’s at stake for an MFI like FINCA Tajikistan in relation to the SDGs, and the way does the MFI contribute to those objectives?

SK: From the very starting of my profession, being out within the area, I understood how microfinance is essential to ending poverty as a result of it offers folks the flexibility to create their very own futures. The pandemic has pushed extra folks again into poverty, particularly girls. In Tajikistan, 39 % of our debtors are girls, and 80 % of those girls are the principle earnings earners of their households.

We’re additionally battling climate-related challenges in Tajikistan comparable to mudslides and excessive climate occasions that impression agricultural production. World wide, folks on the backside of the financial pyramid will really feel the largest impacts of local weather change, and we’ve got to develop methods to help their resiliency and hold them within the monetary system. We combine these dangers into our portfolio and make a degree of communicating straight with our clients about their choices.

PS: FINCA Tajikistan acquired an A ranking on our AFISAR© ranking scale (above), and USD 2 million had been disbursed through Put money into Visions. These are nice outcomes. How did the AFISAR© ranking course of unfold, and why did you determine to take it on?

SK: Present process the AFISAR© ranking was the start of our halfnership with AFI. The framework covers many features of our actions, together with our social and environmental impression, our strategy to employees and gender points, and the safety of buyer rights. The AFISAR© Software has enabled us to raised focus our efforts to enhance our operations and make sure that we’re meeting requirements. We share the outcomes with lenders, employees and clients to develop belief and appeal to extra enterprise.

PS: Please share a narrative of FINCA’s impression. SK: The primary buyer who involves thoughts is called Rustom. He was rising numerous fruits in his backyard and owned a small piece of land for planting wheat and rice. He was lively in agribusiness however doubted whether or not he may increase his enterprise sustainably. He finally selected to use for a mortgage and was profitable in increasing his agricultural professionalduction, including by elevating livestock. The multidimensional impression of his mortgage is seen in his private life, additionally, as he managed to professionalvide schooling for his youngsters and fund his daughter’s wedding.

SK: The primary buyer who involves thoughts is called Rustom. He was rising numerous fruits in his backyard and owned a small piece of land for planting wheat and rice. He was lively in agribusiness however doubted whether or not he may increase his enterprise sustainably. He finally selected to use for a mortgage and was profitable in increasing his agricultural professionalduction, including by elevating livestock. The multidimensional impression of his mortgage is seen in his private life, additionally, as he managed to professionalvide schooling for his youngsters and fund his daughter’s wedding.

PS: How have you ever navigated the challenges of the previous two years, and what are your plans to organize for future uncertainty?

SK: For a few years, we’ve got operated in environments that ceaselessly change and demand a sure resilience. Nonetheless, COVID-19 created a degree of uncertainty that we had by no means witnessed earlier than. We first ensured that we had the assets that might enable us to proceed our opperiodtions whilst enterprise floor to a halt.

We gathered plenty of information to analyse the impression on our clients, employees and portfolio efficiency whereas additionally evaluating the implications of government motion. This helped us reply in a means that professionaltected our clients. We had a transparent lending technique and reevaluated our danger tolerance ranges for some customer segments, leading to the restructuring of some buyer loans. The important thing right here was transmother or father communication to all stakeholders.

We’ll proceed to cope with the penalties for a while. It’s important for microfinance stakeholders to create extra resiliency inside the sector to soak up these sorts of shocks whereas protecting MFIs and their clients financially wholesome.

PS: What’s your recommendation to different MFIs which have but not launched into the maintaincapability pathway?

SK: MFIs’ clients are typically essentially the most susceptible to the impacts of the present international challenges. If we aren’t efficient, inequality will develop, and our mission might be comprofessionalmised. Microfinance impacts people, nevertheless it additionally contributes to nationwide political and economic stability, which is essential for addressing local weather change and lowering poverty. I imagine we have to incorporate continuous evolution into all features of the corporate to adapt and respond to altering threats and alternatives. As we imshow employees and governance capability and improve the customer expertise, we might be a stronger establishment.

Curious in regards to the AFISAR© ranking? Then drop us a line at pratibha.singh@agentsforimpact.com.

Comparable Posts:

[ad_2]

Source link