[ad_1]

JAKARTA, Indonesia, Might 13, 2022 /PRNewswire/ — NFT has grow to be a scorching subject of dialogue broadly, particularly after many NFTs had been offered at incredible costs, similar to Beeple’s work entitled “Everydays: The First 5000 Days” which offered for $69,346,250, equal to Rp 9 Trillions. Impressed by Beeple, the NFT made by an Indonesian, Ghozali, additionally managed to achieve reputation and offered tens of tens of millions of rupiah. At present, increasingly artwork performers and connoisseurs in Indonesia are beginning to grow to be conscious and perceive the NFT, that is indicated by the emergence of many NFT communities in Indonesia whose members have reached hundreds and even tens of hundreds when considered from the social media accounts of the neighborhood. Asosiasi Blockchain Indonesia’s Chairwoman, Asih Karnengsih conveyed “the necessity for literacy associated to the implementation and advantages of blockchain expertise that may contribute to financial improvement in Indonesia, for instance NFT which can assist artists in Indonesia get recognition and rewards or their potential to contribute to the digital economic system.”

Nonetheless, seeing this phenomenon, questions and considerations come up, primarily about whether or not this NFT is only a pattern or will it grow to be a bubble, a situation by which an asset that has excessive worth will shortly decline and disappear from the market.

It’s fully potential that NFT will grow to be a ‘bubble’ if the next issues proceed to occur and are usually not instantly addressed. What are the issues that may make NFT a bubble?

NFT Market Retains Down

The NFT market has really began to look settled in latest instances. In response to Bloomberg, the common buying and selling worth of NFTs has fallen drastically in latest instances, dropping from a report $6,900 at first of the yr to below $2,000 from knowledge tracker NFT NonFungible.

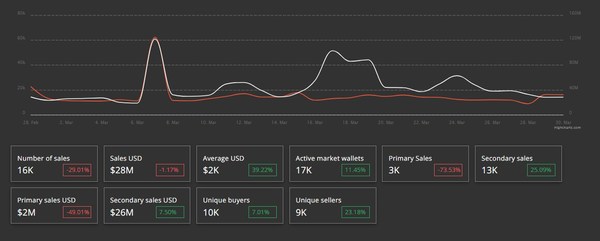

NFT gross sales knowledge in a single month. Supply: NFT Tracker.

The principle NFT gross sales additionally fell considerably prior to now month, in keeping with knowledge recorded, NFT gross sales fell 29% and 1.17% gross sales in USD. In the meantime, the principle gross sales, that are gross sales that came about on the NFT mission web site, fell 73%, and decreased 49% in USD .

In response to Monetary Instances knowledge, each day transaction quantity for NFT on OpenSea fell 80% to $50 million in March, in comparison with $284 million in February.

OpenSea Quantity Lower. Supply: Monetary Instances.

On OpenSea, the NFT tracker DappRadar additionally reveals a lower within the variety of merchants and general quantity. Total buying and selling quantity has fallen practically 67 % within the 30 days of March. to $2.6 billion, with merchants down 23 % to 489,796 customers.

What’s much more exceptional is that, even in the course of the “nice NFT sale” tens of millions of {dollars} and cryptocurrencies nonetheless have sturdy circulation on OpenSea day-after-day. Persons are nonetheless spending a median of hundreds and tons of of hundreds of {dollars} on NFT, however analysis reveals that it has declined.

The decline is also attributed to elevated scrutiny from US regulators. In response to a Bloomberg article, the Securities and Alternate Fee (SEC) said this week that it’s investigating whether or not NFTs are securities and must be regulated.

Turning into a Ponzi Scheme

Along with the declining worth, NFT additionally nonetheless has detrimental sentiments, for instance for cash laundering. With NFT cash laundering will be simply carried out as a result of consumers and sellers can’t be absolutely tracked in the event that they use an nameless id.

NFT can be known as a ponzi scheme, quoted from The Dialog. That is based mostly on a number of similarities, for instance the primary purchaser will get a better revenue than the final purchaser who has lagged the pattern of the NFT he purchased, and when that occurs the final purchaser won’t get any revenue, as a result of the NFT he purchased has no followers anymore.

Has No Elementary Worth

It should be admitted that there are nonetheless many NFTs that would not have a transparent elementary worth and usefulness. It is only a random picture {that a} consumer purchased due to FOMO. If the NFT continues like this, it is rather doubtless {that a} bubble will happen, and NFT’s work that has a transparent operate will even be dragged into this detrimental sentiment. In the long run it would destroy the NFT market.

The impression of the NFT bubble if it happens won’t solely affect NFT, however can unfold to crypto belongings generally, as a result of shopping for NFT requires different crypto as a transaction software.

The larger the bubble, the extra widespread it would unfold when it bursts.

“That is maybe the apotheosis, the top of the all-bubble paradigm. This worries me so much even when I absolutely perceive the dynamics that drive younger individuals specifically to purchase NFTs,” mentioned Michael Each, Rabobank’s head of monetary markets analysis for Asia-Pacific.

To scale back considerations concerning the NFT bubble, Evan Cohen, the founding father of Vincent, additionally gave a suggestion.

“Do not buy it as a result of it is NFT, purchase it since you just like the artwork or purchase it since you assume the gathering or the neighborhood is cool. You wish to take part within the belongings, not the underlying expertise that helps this,” he mentioned.

Till now, NFT continues to be filled with hypothesis, these three issues present that this business shouldn’t be secure and is surrounded by detrimental sentiments that may injury the ecosystem and switch NFT right into a bubble if the NFT business activists do not instantly deal with it.

This text was beforehand revealed on Coinvestasi.

PR Newswire Asia is the official information launch distribution associate of Indonesia Blockchain Affiliation.

[ad_2]

Source link