[ad_1]

Who would know the enjoyment and ache of an strange Singaporean higher than ourselves?

Our bank cards, maybe.

It’s the one and solely merchandise that’s at all times there with you, whether or not on the counter whenever you take a look at your requirements, or when you ring up your loot from retail remedy.

However some playing cards are higher at decreasing the pinch you are feeling in your pocket each time you hear the “beep” sound made throughout transactions, by providing you with additional perks.

As a self-proclaimed tech-savvy millennial “aunty”, the perk that sparks probably the most pleasure in me is getting rebates from the cash I spend.

With the rise in the price of residing, what’s even higher than rebates? Extra rebates.

My mind has run out of RAM house to maintain observe of miles and reward factors.

Reality is, I’ve by no means mastered such bookkeeping expertise, which make me envious of my colleague who even retains observe of the assorted books she reads in a 12 months.

Should you’re like me and don’t have a prodigious reminiscence, simply face the information and get a card that fits us higher – the POSB On a regular basis Card.

Take pleasure in rebates from on a regular basis spending

A few of us have turn into extra accustomed to on-line procuring and cashless procuring, because of the pandemic, which makes the POSB On a regular basis Card good for our wants.

From meals deliveries to on-line procuring, this card has acquired your again.

Listed here are some rebates that the cardboard gives:

As much as 10 per cent money rebates for meals

With the POSB On a regular basis Card, you get 10 per cent money rebates whenever you order from foodpanda, Deliveroo or WhyQ.

Consuming out with pals and family members? You can even clock three per cent money rebates at most eating places or eateries, besides quick meals retailers.

As much as 8 per cent money rebates for procuring

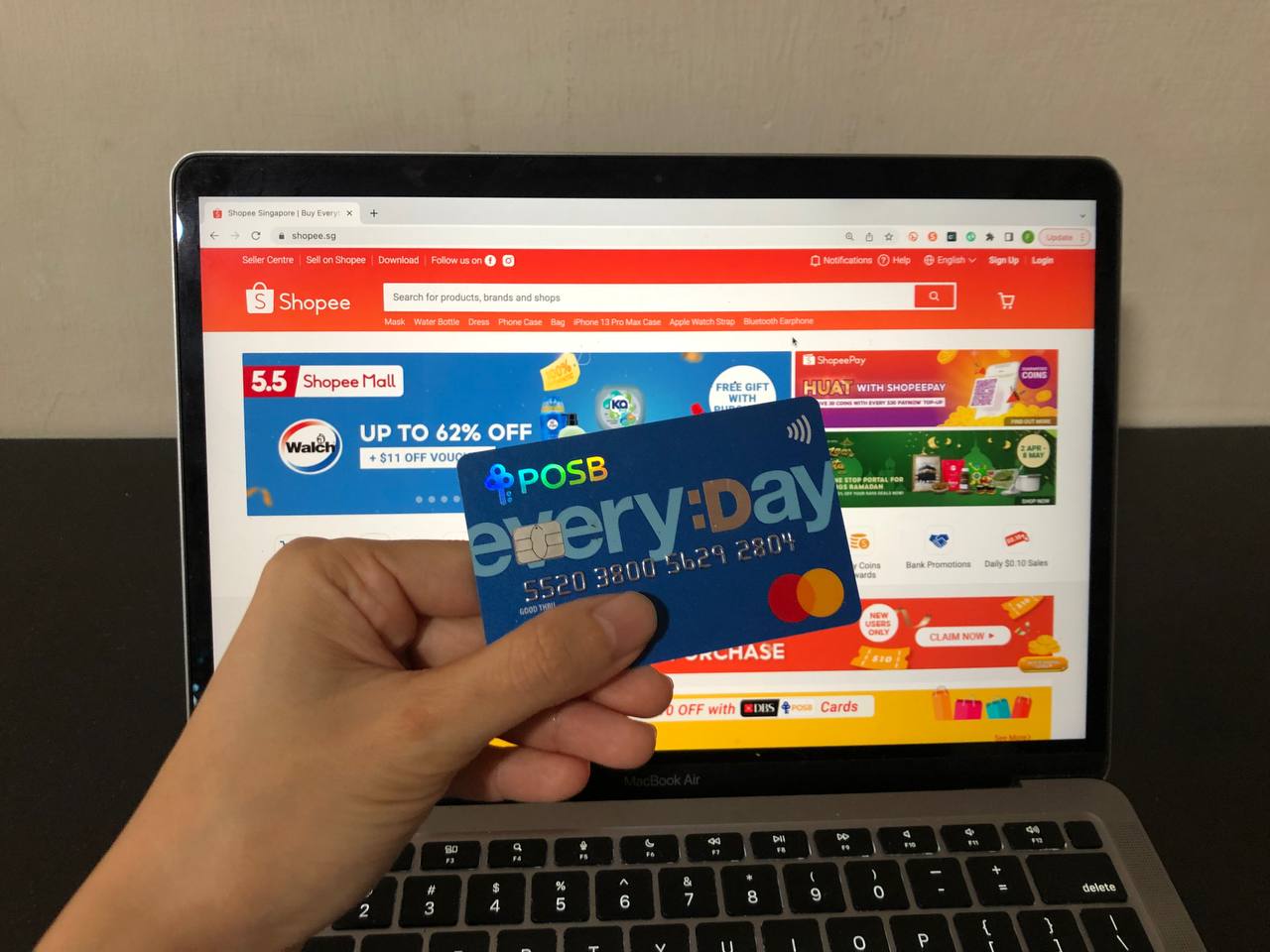

Scrolling by way of e-commerce platforms equivalent to Amazon.sg, Lazada, Qoo10, Shopee, RedMart, iHerb, and Taobao every single day?

You will get 5 per cent money rebates whenever you spend on these well-liked on-line marketplaces with the POSB On a regular basis Card.

Picture by Mothership.

Picture by Mothership.

POSB On a regular basis Cardmembers can even take pleasure in as much as three per cent money rebates whenever you make purchases at Watson, each in-store or by way of on-line.

For Sheng Siong customers, get 5 per cent money rebates with the POSB On a regular basis Card, with a restrict of as much as S$30 money rebate per thirty days.

Can’t get bai bei (The reward value 100 instances of your receipt worth)? A minimum of you may safe these rebates.

When making purchases at Widespread shops, POSB On a regular basis Cardmembers can get eight per cent money rebates.

As much as three per cent money rebates for payments and gasoline

To prime it off, there are as much as three per cent money rebates for POSB On a regular basis Cardmembers after they arrange recurring funds for his or her utilities and telecommunication payments.

This fashion, you’ll by no means miss out on the fee deadline too.

Should you drive, a POSB On a regular basis Cardmember can stand up to “20.1 per cent + two per cent” gasoline financial savings at SPC.

From now until June 30, you could stand an opportunity to win S$1,000 value of SPC voucher for each S$50 nett spend in a single receipt at SPC.

20 per cent off for Sentosa Enjoyable Go™

Those that should not planning to make an abroad journey any time quickly because of the pandemic could discover themselves heading to Sentosa extra usually than that they had anticipated as of late.

Whether or not you’re searching for an escapade or simply some chill time together with your family members, Sentosa has one thing for everybody.

To get probably the most bang for the buck, why not purchase a enjoyable go so you will get cheaper rides and even reserve a spot prematurely on your desired sights?

Lower your expenses, save time, why not?

POSB On a regular basis Cardmembers can get an extra 20 per cent low cost for buy of the Sentosa Enjoyable Go™ with the promo code

Don’t say bo jio.

Apply now to get S$300 cashback

The POSB On a regular basis Card lives as much as its identify by overlaying varied elements of our on a regular basis spending.

Each small saving accumulates to a major quantity for those who do some fast math.

Should you want additional convincing, right here’s it.

For brand spanking new DBS/POSB bank card candidates, you will get S$300 cashback whenever you apply for the POSB On a regular basis Card from Might 17 to Might 30, 2022.

To get the cashback, you’ll have to apply for a card on-line and spend a minimal of S$500 throughout the first 30 days from card approval date.

Do observe that some rebates would require a minimal spending of S$800 in the identical calendar month which is unlikely an issue if you’re settling all of your payments on this all-in-one card.

Discover out about all of the perks of being a POSB On a regular basis Cardmember right here.

The author of this sponsored article is getting extra smart at spending, hopefully.

High picture by Mothership.

[ad_2]

Source link