[ad_1]

What tendencies ought to we search for it we need to determine shares that may multiply in worth over the long run? In an ideal world, we would wish to see an organization investing extra capital into its enterprise and ideally the returns earned from that capital are additionally growing. Principally which means an organization has worthwhile initiatives that it could actually proceed to reinvest in, which is a trait of a compounding machine. Talking of which, we seen some nice modifications in Saudi Arabian Mining Firm (Ma’aden)’s (TADAWUL:1211) returns on capital, so let’s take a look.

What’s Return On Capital Employed (ROCE)?

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. The formulation for this calculation on Saudi Arabian Mining Firm (Ma’aden) is:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Belongings – Present Liabilities)

0.11 = ر.س9.8b ÷ (ر.س106b – ر.س14b) (Based mostly on the trailing twelve months to March 2022).

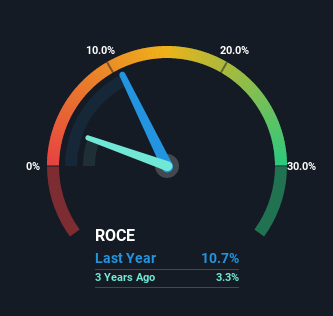

Subsequently, Saudi Arabian Mining Firm (Ma’aden) has an ROCE of 11%. In absolute phrases, that is a fairly regular return, and it is considerably near the Metals and Mining trade common of 13%.

View our newest evaluation for Saudi Arabian Mining Firm (Ma’aden)

Above you’ll be able to see how the present ROCE for Saudi Arabian Mining Firm (Ma’aden) compares to its prior returns on capital, however there’s solely a lot you’ll be able to inform from the previous. If you would like, you’ll be able to try the forecasts from the analysts protecting Saudi Arabian Mining Firm (Ma’aden) right here for free.

The Development Of ROCE

Saudi Arabian Mining Firm (Ma’aden)’s ROCE progress is sort of spectacular. Trying on the knowledge, we will see that although capital employed within the enterprise has remained comparatively flat, the ROCE generated has risen by 474% over the past 5 years. So it is possible that the enterprise is now reaping the complete advantages of its previous investments, because the capital employed hasn’t modified significantly. The corporate is doing properly in that sense, and it is value investigating what the administration crew has deliberate for long run progress prospects.

The Key Takeaway

In abstract, we’re delighted to see that Saudi Arabian Mining Firm (Ma’aden) has been capable of enhance efficiencies and earn larger charges of return on the identical quantity of capital. For the reason that inventory has returned a staggering 174% to shareholders over the past 5 years, it seems to be like traders are recognizing these modifications. Subsequently, we expect it might be value your time to examine if these tendencies are going to proceed.

On a ultimate observe, we discovered 3 warning indicators for Saudi Arabian Mining Firm (Ma’aden) (1 is regarding) try to be conscious of.

For individuals who wish to spend money on strong corporations, try this free listing of corporations with strong stability sheets and excessive returns on fairness.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/KGUZ567SJEVT4EPGQQ4MSC6DVQ.jpg)