[ad_1]

Lebanon, Yemen particularly weak to larger vitality costs produced by sanctions, specialists say

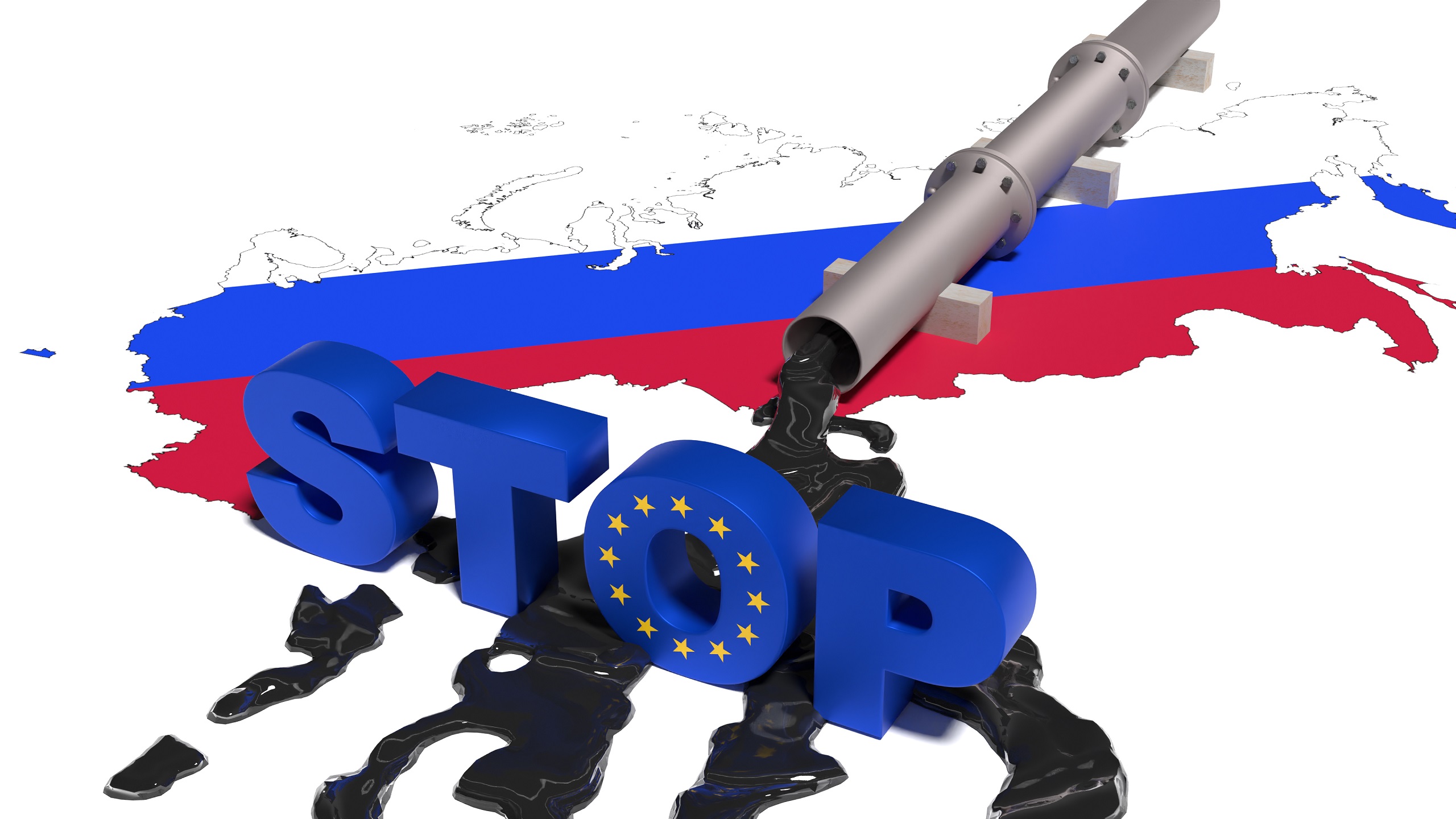

European Union leaders in Brussels agreed on Monday evening to ban the seaborne import of Russian oil – about two-thirds of the full − by the top of 2022. And whereas landlocked Hungary, Slovakia, and the Czech Republic will proceed to obtain Russian oil through the Druzhba pipeline, Germany and Poland have pledged to voluntarily forgo it, bringing the full minimize in imports to about 90%.

That is the sixth spherical of sanctions imposed by Europe on the Russian Federation for the reason that battle in Ukraine started.

Talks on an oil boycott had been happening for the reason that starting of Might. Nonetheless, they have been stalled as a result of Hungary needed to proceed to purchase Russian oil.

The sanctions are anticipated to trigger international oil costs to rise.

Within the Center East, some international locations might undergo collateral injury; others will profit.

Nader Itayim, Dubai-based Mideast Gulf editor at Argus Media, advised The Media Line the international locations that can most profit are the area’s oil exporters.

“Saudi Arabia, the UAE, Kuwait, Iraq, Oman, and even Iran regardless of the sanctions will all be benefiting from $100+/barrel oil,” he stated.

Itayim defined that larger costs translate into larger state revenues, which first will assist these international locations to alleviate any short-to-medium-term budgetary points that they might be going through, presumably due to COVID-19, and second finance their plans to diversify their economies away from hydrocarbons.

The area’s oil importers will undergo. He cited Lebanon, Jordan, and even Israel.

For them, he stated, “larger oil costs translate into larger import prices for the state, which put stress on state funds and overseas change reserves.”

Robin Mills, CEO of Qamar Power and creator of The Delusion of the Oil Disaster, defined to The Media Line that whereas the rise in oil costs advantages exporters and hurts importers, there are different elements which are necessary to think about.

Whereas oil-importing international locations corresponding to Egypt, Jordan, and Lebanon undergo from larger costs, they might to some extent get better from larger remittances from their residents working in oil-exporting states and from help from oil-exporting governments, he stated.

However, he continued, “the non-oil sector in oil-exporter [countries] can be negatively affected by larger costs, particularly in international locations the place oil worth rises are handed on to home gas costs, such because the United Arab Emirates.”

The damaging results are mirrored in gas shortages, larger gas costs, and common inflation, Mills defined. “This may be elevated when governments have to chop again on gas subsidies,” he famous.

To date, he continued, “we now have not seen a lot of that within the area, but it surely occurred in earlier conditions of rising meals and gas costs.”

For now, it has principally affected Lebanon, however Egyptians and Iranians might additionally undergo if they’ve to scale back subsidies, Mills stated.

Mohammed al-Qadhi, a Yemeni political adviser on the Geneva-based Centre for Humanitarian Dialogue, advised The Media Line that Yemen is likely one of the international locations most damage by rising oil costs.

His nation is already harshly affected by the Ukraine battle because of the lack of wheat exports.

Regarding the excessive oil costs, Qadhi added, Yemen will likely be badly damage as a result of it imports crude oil for the native market and for energy stations.

Yemen is often an oil producer, he defined. Nonetheless, due to the civil battle that started in 2014, it halted manufacturing.

Now with the truce, Qadhi continued, “only some firms resumed their manufacturing of oil, however it’s not that a lot and … it is going to be shipped to promote it outdoors of Yemen.”

Yemenis are struggling an awesome deal due to the value of gas, which is already very excessive, he stated.

This, he defined, has resulted in a black market everywhere in the nation, particularly within the areas beneath the management of the Houthis. “This black market is producing tens of millions in response to worldwide organizations,” Qadhi stated.

Already now, earlier than the newest bounce in oil costs is felt, folks and autos wait in lengthy strains to get gasoline, he stated. That is taking place each within the Houthi-controlled areas and in Aden, the headquarters of the internationally acknowledged interim authorities.

“Yemen is already going through a variety of issues, and if oil costs rise extra, it’s going to face extra issues,” Qadhi stated.

Mills stated governments might implement insurance policies to scale back folks’s affected by will increase in the price of vitality.

“They will section in subsidy reductions, supply different help to lower-income residents, and enhance non-oil choices,” he stated.

Qadhi, nevertheless, just isn’t optimistic concerning the Yemeni authorities’s skill to behave.

He described the Yemeni authorities as “toothless” with regards to assuaging the results of upper oil costs.

“It’s not able to doing something,” he stated. “They’re relying on the Saudis for gas within the gasoline stations, and we don’t know the way for much longer they’re going to help Yemen,” Qadhi stated.

Itayim stated the reply is for governments to plan and suppose forward.

“In a phrase: planning,” he stated. Prior to now, he defined, “significantly in some GCC [Gulf Cooperation Council] international locations, you’d see clear shifts in coverage between instances of increase [high oil prices] and bust [lower prices].”

In increase instances, Itayim added, “you’d see governments recurrently implement public sector wage hikes and provides beneficiant handouts to the folks, as a substitute of diversifying and reinvesting within the financial system, whereas in instances of bust, public spending would actually be scaled again.

“I believe these days are behind us now,” he famous.

Itayim believes that governments in vitality exporter international locations will proceed to give attention to strengthening their economies and stability sheets, to ensure they’re higher ready for any future worth falls.

[ad_2]

Source link