[ad_1]

However because the warfare in Ukraine approaches its a centesimal day, that machine remains to be very a lot operational. Russia is being propelled by a flood of money that would common $800 million a day this 12 months — and that is simply what the commodity superpower is raking in from oil and fuel.

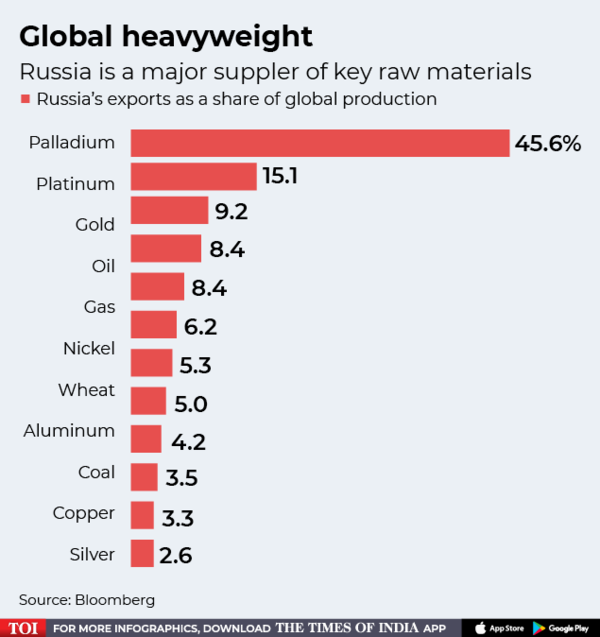

For years, Russia has acted as an enormous commodity grocery store promoting what an insatiable world has wanted: Not simply vitality, however wheat, nickel, aluminum and palladium too. The invasion of Ukraine has pushed the US and the European Union to rethink this relationship. It’s taking time, although the EU took an extra step this week by hammering out a compromise settlement on Russian oil imports.

Russia is much from unscathed by the sanctions, which have made it a pariah throughout the developed world. Company giants have fled, many strolling away from billions of {dollars} of property, and the financial system is heading for a deep recession. However Putin can ignore this harm for now, as a result of his coffers are overflowing with the income from commodities, which have turn out to be extra profitable than ever due to the surge in world costs pushed partly by the warfare in Ukraine.

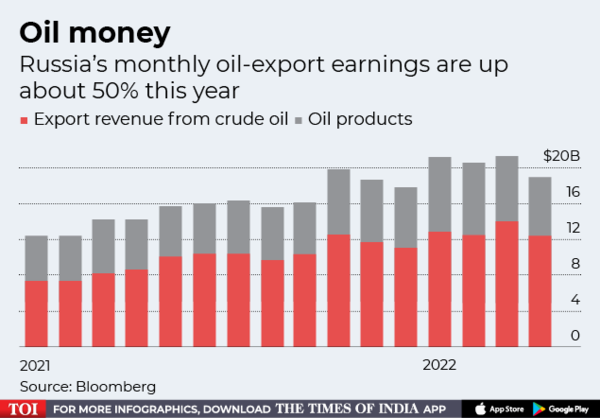

Even with some international locations halting or phasing out vitality purchases, Russia’s oil-and-gas income can be about $285 billion this 12 months, in response to estimates from Bloomberg Economics based mostly on Economic system Ministry projections. That might exceed the 2021 determine by greater than one-fifth. Throw in different commodities, and it greater than makes up for the $300 billion in international reserves frozen as a part of the sanctions.

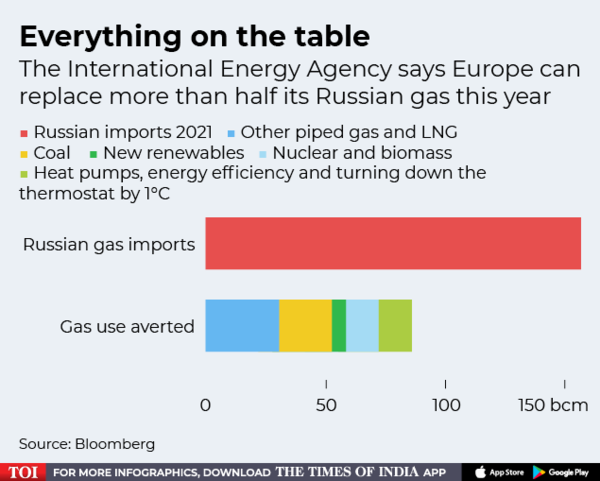

EU leaders know that they need to cease shopping for from Russia and not directly funding a devastating warfare on Europe’s doorstep. However for all that ambition, nationwide governments additionally know there can be repercussions for their very own economies.

They agreed this week to pursue a partial ban on Russian oil, paving the best way for a sixth package deal of sanctions, however solely after weeks of haggling and division.

“There are all the time political constraints on the usage of sanctions,” stated Jeffrey Schott, a senior fellow on the Peterson Institute in Washington. “You wish to maximize the ache in your goal and decrease the ache in your constituency at dwelling, however sadly, that’s simpler stated than finished.”

Lesson #3: solely an vitality embargo actually hurts Russia. Two-thirds of the rise within the c/a surplus this 12 months is from… https://t.co/xwQ02tYbJR

— Robin Brooks (@RobinBrooksIIF) 1653836670000

Within the US, officers are debating methods to ratchet up the monetary stress, probably by serving to to impose a cap on the value of Russian oil or slapping sanctions on international locations and firms nonetheless buying and selling with Russian companies below restrictions. However such secondary sanctions are deeply divisive and danger damaging relations with different international locations.

The US has already banned Russian oil, however Europe is simply slowly weaning itself off this dependency. That’s giving Moscow time to search out different markets — corresponding to commodity guzzling behemoths China and India — to restrict any to wreck to export income, and its monetary warfare chest.

Which means the cash is gushing into Russia’s accounts, and the monetary figures are a continuing reminder to the West that dramatic change is required. Oil-export income alone is up 50% from a 12 months earlier, in response to the Worldwide Power Company. Russia’s prime oil producers made their highest mixed revenue in virtually a decade within the first quarter, Moscow-based SberCIB Funding Analysis estimates. And wheat exports proceed — at greater costs — as sanctions on Russian agriculture aren’t even being mentioned as a result of the world wants its grain.

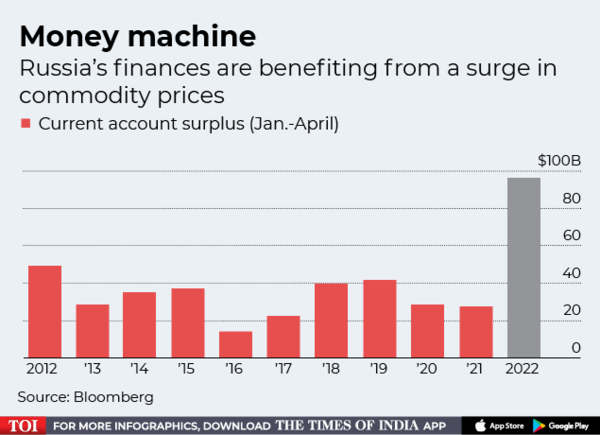

The present account surplus, the broadest measure of commerce in items and providers, greater than tripled within the first 4 months of the 12 months to virtually $96 billion. That determine, the very best since not less than 1994, primarily mirrored a surge in commodity costs, although a plunge in imports below the load of worldwide sanctions was additionally an element.

The ruble has turn out to be one other image utilized by Putin to venture power. As soon as mocked by Biden as “rubble” when it initially collapsed in response to the sanctions, it’s since been propped up by Russia to turn out to be the world’s best-performing foreign money in opposition to the greenback this 12 months.

Putin has additionally tried to leverage Russia’s place as a commodity superpower. Amid concern about meals shortages, he’s stated he’ll permit exports of grain and fertilizer provided that the sanctions on his nation are lifted.

“If the aim of sanctions was to cease the Russian navy, it wasn’t real looking,” stated Janis Kluge, senior affiliate for Japanese Europe and Eurasia on the German Institute for Worldwide and Safety Affairs in Berlin. “It may nonetheless fund the warfare effort, it will possibly nonetheless compensate for a few of the harm sanctions are doing to its inhabitants.”

One of many large holes within the sanctions in opposition to Russia is the willingness of different nations to proceed oil purchases, albeit at a reduction in some instances.

Indian refiners bought greater than 40 million barrels of Russian oil between the beginning of the Ukraine invasion in late February and early Could. That’s 20% greater than Russia-India flows for the entire of 2021, in response to Bloomberg calculations based mostly on commerce ministry information. Refiners are searching for personal offers as a substitute of public tenders to get Russian barrels cheaper than market costs.

China can also be strengthening its vitality hyperlinks with the nation, securing cheaper costs by shopping for oil that’s being shunned elsewhere. It’s boosted imports and can also be in talks to replenish its strategic crude stockpiles with Russian oil.

It’s the same story for steelmakers and coking coal. Imports from Russia rose for a 3rd month in April to greater than double final 12 months’s stage, in response to official customized workplace information. And a few sellers of Russian oil and coal have tried to make issues simpler for Chinese language consumers by permitting transactions in yuan.

“The overwhelming majority of the world isn’t concerned in imposing sanctions,” stated Wouter Jacobs, founder and director of the Erasmus Commodity & Commerce Centre on the Erasmus College in Rotterdam. “The commerce will go on, the necessity for fuels can be there” and consumers in Asia or the Center East will step up, he stated.

With regards to fuel, Russia has fewer choices for diverting provides, however the international locations on the finish of pipelines from Russia — a few of which run by way of Ukraine — are additionally locked right into a mutual dependency.

About 40% of the EU’s fuel wants are met by Russia, and this would be the bloc’s hardest hyperlink to sever. European deliveries even jumped in February and March because the invasion triggered a value spike in European fuel hubs, making purchases from Russia’s Gazprom PJSC cheaper for many clients with long-term contracts.

Volumes have decreased since then, due to hotter climate and file inflows of liquefied pure fuel from the US and different international locations. There’s additionally been disruptions due to navy exercise, and Russia itself halted provides to Poland, Bulgaria and Finland, which refused Putin’s demand to pay in rubles.

Even because the EU reduces its dependency — Germany says it’s right down to 35% from 55% — there are issues at each step. A number of large consumers of Russian fuel have gone out of their technique to preserve shopping for the essential gasoline, and utilities corresponding to Italy’s Eni SpA and Germany’s Uniper SE count on provides to proceed.

Whereas progress is sluggish, the route is simply towards an increasing number of restrictions. Even with the unsure timetable, the stress on the Russian financial system, and Putin’s funds, will ultimately mount.

The nation’s vitality sector can also be dealing with an array of different components past demand, from delivery and insurance coverage restrictions to weak home demand. Oil manufacturing could drop greater than 9% this 12 months, whereas fuel output could decline 5.6%, in response to Russian Economic system Ministry’s base-case outlook.

“Within the Kremlin there’s some optimism and even shock that the Russian financial system did not collapse from the onslaught of sanction,” stated Tatiana Stanovaya, founding father of political guide R.Politik. “However wanting forward two to 3 years, there’s plenty of questions on how the vitality and manufacturing sectors will survive.”

[ad_2]

Source link