[ad_1]

Comply with us on Telegram for the newest updates: https://t.me/mothershipsg

Some Ang Mo Kio HDB flat homeowners whose properties fall beneath the Selective En bloc Redevelopment Scheme (SERS) challenge are going through a dilemma: They’re reluctant to place up their flat on the market on the resale market and they don’t need to take up the provide of shopping for the substitute flat both.

A complete of 606 flats positioned in blocks 562 to 565 Ang Mo Kio Avenue 3 are affected, and homeowners have been invited to buy new flats at Ang Mo Kio Drive — that are attributable to be accomplished within the third quarter of 2027 — at subsidised costs.

Out-of-pocket bills required for substitute flats

CNA spoke to 2 teams of house homeowners who’re going through this conundrum.

One couple, Teo Boon Jia and Lim Hoi Sim, fear about how they are going to be capable to afford the additional prices concerned.

Lim stated, “We won’t have a one-for-one change, which makes it powerful for us. My husband is outdated so how can he nonetheless be working after 5 years? How would we pay for the home?”

Screenshot through CNA.

Screenshot through CNA.

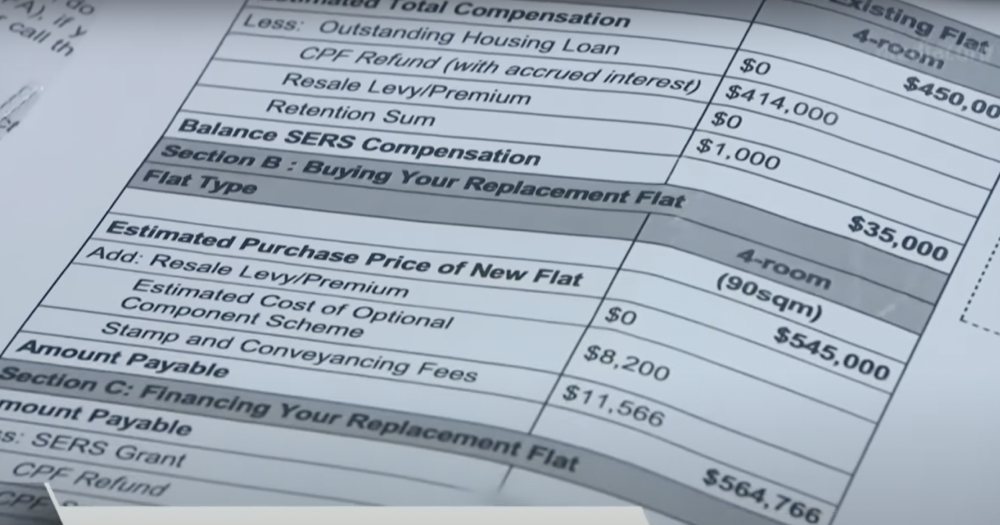

Based on a monetary information that the couple obtained, the estimated whole compensation for his or her four-room flat is S$450,000.

A substitute four-room flat is estimated to value S$564,766 after factoring within the estimated buy worth, value of elective element scheme, together with stamp and conveyancing charges.

Teo mused:

“It is okay if we handle to promote our flat (on the resale market) for the next worth (as a result of) I can nonetheless purchase one other home to dwell in. If I promote it at too low a worth, I will not be capable to afford an analogous four-room flat. I am caught between a rock and a tough place (as) I am unable to afford HDB’s substitute flat both. I do not know what to do.”

One other home-owner’s daughter, recognized solely by her surname Tee, stated the household met with a property agent, who instructed them that her father doesn’t have “sufficient in his retirement account, so after returning this (flat) to the federal government, he may need to prime up about S$70,000 (or so).”

Consultants weigh in

Lee Sze Teck, who’s a senior director of analysis at Huttons Asia instructed CNA that residents within the affected blocks might presumably be retired and would subsequently discover it tough to qualify for a mortgage.

This could possibly be a motive why they would favor an change the place they won’t must borrow extra funds or dig into their financial savings.

Property agent Jay Tan identified that owners must downsize to a smaller flat with a purpose to “not carry any debt”.

CNA reported that HDB will share the precise compensation affords within the fourth quarter.

Owners who’re affected by the SERS challenge produce other choices if they don’t want to take up the substitute flat or put their present flat up on the market: making use of for a Construct-To-Order (BTO) flat elsewhere, or participate in a Sale of Stability Flats (SBF) train.

They are going to be given a precedence beneath each workout routines.

High screenshot through CNA.

[ad_2]

Source link