[ad_1]

Whereas Saudi Industrial Growth Co. (TADAWUL:2130) shareholders are in all probability usually pleased, the inventory hasn’t had notably good run lately, with the share value falling 13% within the final quarter. However over three years, the returns would have left most traders smiling In truth, the corporate’s share value bested the return of its market index in that point, posting a acquire of 82%.

Though Saudi Industrial Growth has shed ر.س70m from its market cap this week, let’s check out its long run basic developments and see in the event that they’ve pushed returns.

Take a look at our newest evaluation for Saudi Industrial Growth

Saudi Industrial Growth is not at the moment worthwhile, so most analysts would look to income progress to get an thought of how briskly the underlying enterprise is rising. When an organization would not make earnings, we would usually anticipate to see good income progress. That is as a result of it is exhausting to be assured an organization will likely be sustainable if income progress is negligible, and it by no means makes a revenue.

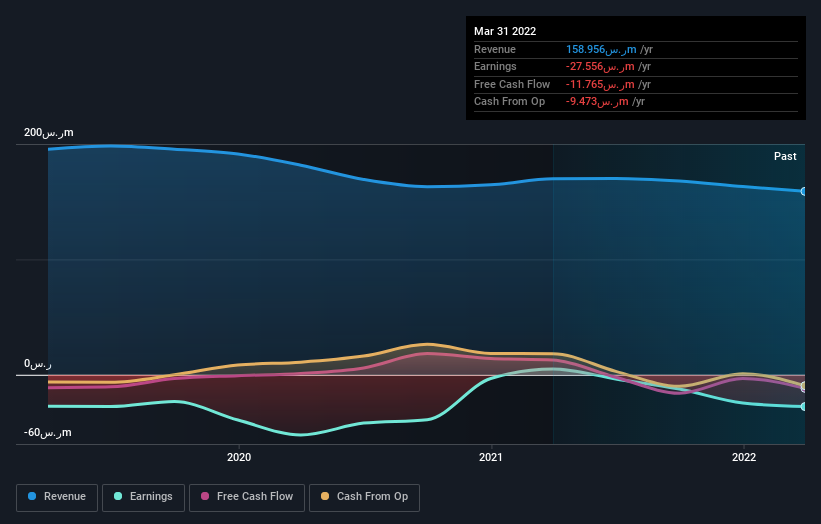

Within the final 3 years Saudi Industrial Growth noticed its income shrink by 7.5% per 12 months. The income progress could be missing however the share value has gained 22% every year in that point. If the corporate is slicing prices profitability may very well be on the horizon, however the income decline is a prima facie concern.

You’ll be able to see beneath how earnings and income have modified over time (uncover the precise values by clicking on the picture).

Take a extra thorough take a look at Saudi Industrial Growth’s monetary well being with this free report on its stability sheet.

A Completely different Perspective

Traders in Saudi Industrial Growth had a troublesome 12 months, with a complete lack of 39%, in opposition to a market acquire of about 19%. Even the share costs of fine shares drop generally, however we wish to see enhancements within the basic metrics of a enterprise, earlier than getting too . Long term traders would not be so upset, since they might have made 6%, every year, over 5 years. If the basic knowledge continues to point long run sustainable progress, the present sell-off may very well be a chance price contemplating. I discover it very fascinating to take a look at share value over the long run as a proxy for enterprise efficiency. However to really acquire perception, we have to think about different info, too. To that finish, you need to be conscious of the 2 warning indicators we have noticed with Saudi Industrial Growth .

In fact, you may discover a unbelievable funding by trying elsewhere. So take a peek at this free listing of corporations we anticipate will develop earnings.

Please word, the market returns quoted on this article mirror the market weighted common returns of shares that at the moment commerce on SA exchanges.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by basic knowledge. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link