[ad_1]

Each investor in Saudi Kayan Petrochemical Firm (TADAWUL:2350) ought to concentrate on essentially the most highly effective shareholder teams. Establishments typically personal shares in additional established corporations, whereas it is common to see insiders personal a good bit of smaller corporations. We additionally are inclined to see decrease insider possession in corporations that have been beforehand publicly owned.

Saudi Kayan Petrochemical has a market capitalization of ر.س24b, so it is too huge to fly beneath the radar. We might anticipate to see each establishments and retail traders proudly owning a portion of the corporate. Within the chart beneath, we are able to see that establishments are noticeable on the share registry. Let’s take a better look to see what the various kinds of shareholders can inform us about Saudi Kayan Petrochemical.

View our newest evaluation for Saudi Kayan Petrochemical

What Does The Institutional Possession Inform Us About Saudi Kayan Petrochemical?

Many establishments measure their efficiency towards an index that approximates the native market. So that they often pay extra consideration to corporations which are included in main indices.

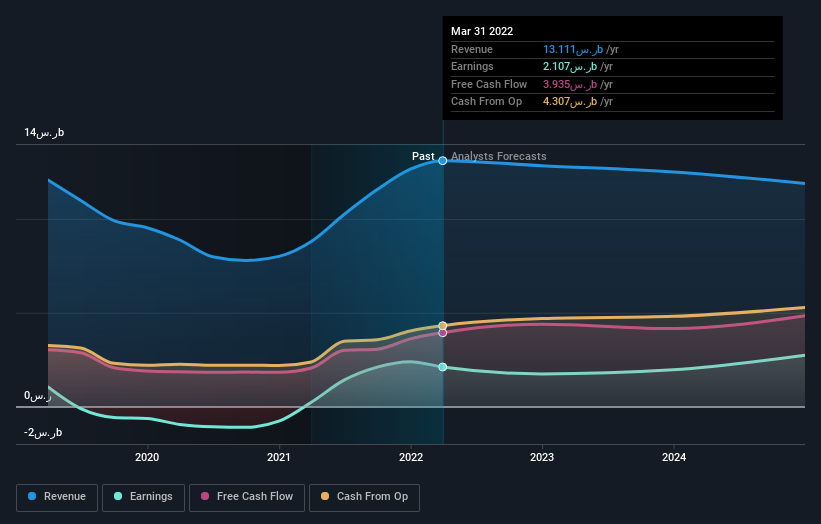

As you’ll be able to see, institutional traders have a good quantity of stake in Saudi Kayan Petrochemical. This means the analysts working for these establishments have appeared on the inventory they usually prefer it. However identical to anybody else, they may very well be unsuitable. If a number of establishments change their view on a inventory on the similar time, you can see the share worth drop quick. It is subsequently price Saudi Kayan Petrochemical’s earnings historical past beneath. In fact, the long run is what actually issues.

Saudi Kayan Petrochemical just isn’t owned by hedge funds. our information, we are able to see that the biggest shareholder is Saudi Arabian Oil Firm with 35% of shares excellent. With 1.9% and 1.2% of the shares excellent respectively, The Vanguard Group, Inc. and BlackRock, Inc. are the second and third largest shareholders.

On learning our possession information, we discovered that 25 of the highest shareholders collectively personal lower than 50% of the share register, implying that no single particular person has a majority curiosity.

Whereas it is sensible to review institutional possession information for a corporation, it additionally is sensible to review analyst sentiments to know which means the wind is blowing. There are an inexpensive variety of analysts overlaying the inventory, so it may be helpful to search out out their mixture view on the long run.

Insider Possession Of Saudi Kayan Petrochemical

The definition of an insider can differ barely between totally different international locations, however members of the board of administrators at all times rely. The corporate administration reply to the board and the latter ought to symbolize the pursuits of shareholders. Notably, typically top-level managers are on the board themselves.

Insider possession is constructive when it indicators management are considering just like the true homeowners of the corporate. Nevertheless, excessive insider possession may give immense energy to a small group throughout the firm. This may be unfavourable in some circumstances.

Our info means that Saudi Kayan Petrochemical Firm insiders personal beneath 1% of the corporate. Take into account that it is a huge firm, and the insiders personal ر.س2.5m price of shares. Absolutely the worth may be extra vital than the proportional share. Arguably, current shopping for and promoting is simply as vital to contemplate. You may click on right here to see if insiders have been shopping for or promoting.

Normal Public Possession

Most of the people, largely comprising of particular person traders, collectively holds 59% of Saudi Kayan Petrochemical shares. This stage of possession offers traders from the broader public some energy to sway key coverage selections reminiscent of board composition, govt compensation, and the dividend payout ratio.

Public Firm Possession

It seems to us that public corporations personal 35% of Saudi Kayan Petrochemical. We won’t make sure however it’s fairly doable it is a strategic stake. The companies could also be related, or work collectively.

Subsequent Steps:

Whereas it’s properly price contemplating the totally different teams that personal an organization, there are different elements which are much more vital. Think about dangers, as an illustration. Each firm has them, and we have noticed 2 warning indicators for Saudi Kayan Petrochemical it’s best to learn about.

In case you would favor uncover what analysts are predicting when it comes to future development, don’t miss this free report on analyst forecasts.

NB: Figures on this article are calculated utilizing information from the final twelve months, which confer with the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be according to full 12 months annual report figures.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to convey you long-term targeted evaluation pushed by elementary information. Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link