[ad_1]

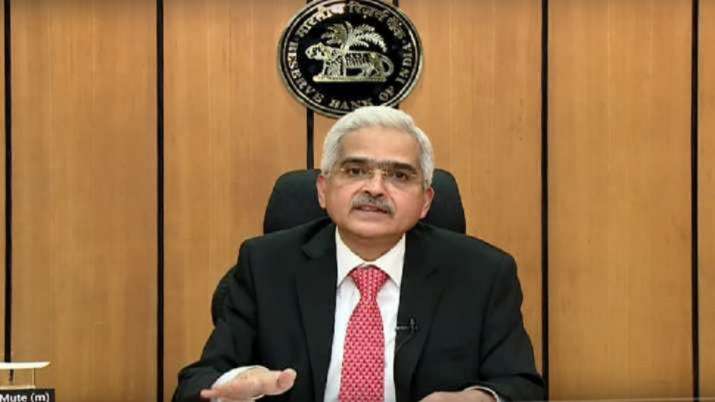

RBI Governor Shatikanta Das

Highlights

- Whereas inflation continues to be a significant concern, revival of financial exercise stays regular

- The speed hike, he mentioned, will reinforce RBI’s dedication to cost stability

- Six members had voted to extend the coverage repo fee by 50 foundation factors (bps) to 4.9 per cent

RBI Governor Shaktikanta Das has cautioned that continued excessive inflation is a significant concern for the economic system, whilst financial actions are gaining traction whereas voting for a 50 foundation factors hike in key rate of interest to verify value rise earlier this month, as per minutes of the assembly launched by the central financial institution on Wednesday.

The six-member Financial Coverage Committee (MPC), headed by Das, had introduced its resolution on June 8. It was the second consecutive hike in repo fee. As per the minutes of the three-day assembly, the Governor mentioned whereas excessive inflation continues to be a significant concern, the revival of financial exercise stays regular and is gaining traction.

“The time is acceptable to go for an extra enhance within the coverage fee to successfully cope with inflation and inflation expectations.

“Accordingly, I vote for a 50 bps enhance within the repo fee which might be in step with the evolving inflation-growth dynamics and can assist in mitigating the second-round results of antagonistic provide shocks,” he mentioned.

The speed hike, he mentioned, will reinforce RBI’s dedication to cost stability — its major mandate and a pre-requisite for sustainable development over the medium time period. All of the six members had voted to extend the coverage repo fee by 50 foundation factors (bps) to 4.9 per cent.

Additionally Learn: Combined response to RBI article warning indicators of stress as a consequence of excessive debt in a number of states

Newest Enterprise Information

[ad_2]

Source link