[ad_1]

The Instances of India – June 28, 2022

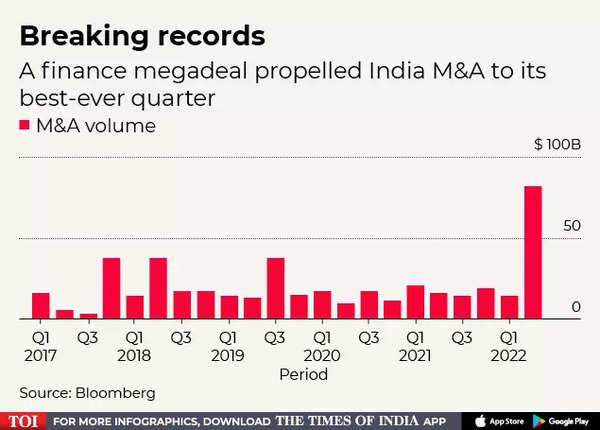

Bankers in India recorded their best-ever quarter for mergers and whereas dealmaking elsewhere slows to a crawl.

India noticed $82.3 billion pending and accomplished M&A offers within the second quarter, the very best quantity on file, based on knowledge compiled by Bloomberg. That’s greater than twice as a lot than the earlier file of $38.1 billion within the third quarter of 2019. Globally, M&A quantity within the quarter reached $827.6 billion, down 8.7% from the identical interval in 2021.

The surge in India was dominated by HDFC Financial institution Ltd.’s $60 billion all-stock buy of Housing Improvement Finance Corp. in April, combining India’s most precious financial institution and largest mortgage lender within the nation’s largest ever M&A transaction. The transfer illustrated how India’s flagship firms, dealing with disruptive tendencies such because the rise of fintech and local weather change, are turning to dealmaking as a tactic to dramatically reshape themselves.

“Whereas conglomerates will consolidate to develop into stronger and acquire market share of their core sectors, there will likely be renewed or new initiatives round two massive themes: ESG and digital,” based on Sonjoy Chatterjee, chairman and chief govt officer for Goldman Sachs Group Inc. in India. The second particularly is a spotlight for all firms, regardless of the sector, he added.

“There received’t be a technique going ahead that doesn’t present a transparent path to ship this,” Chatterjee stated.

The mix of Mindtree Ltd. and Larsen & Toubro Infotech Ltd., two software program corporations managed by engineering conglomerate Larsen & Toubro Ltd., in a $3.3 billion all-stock deal introduced in Could additional illustrated how India’s largest corporations are positioning themselves for a modified panorama in know-how, aided by volatility within the markets.

Even with out the HDFC megadeal, India’s second quarter would nonetheless rank as its fifth-best quarter on file, because of transactions resembling billionaire Gautam Adani’s $10.5 billion deal to purchase Ambuja Cements Ltd., giving his conglomerate a large presence within the business.

Learn Extra…

[ad_2]

Source link

/cdn.vox-cdn.com/uploads/chorus_asset/file/23668847/Police_Tape_1__29_.jpg)