[ad_1]

ESG investments

Surroundings, Social and Governance (ESG) are non-financial efficiency indicators utilized by buyers in evaluating funding selections. ESG investments are investments that search constructive returns together with long run influence on society and the surroundings. Socially aware buyers use ESG requirements to display potential investments by evaluating the areas proven in determine 1.

Determine 1: ESG issues in funding selections

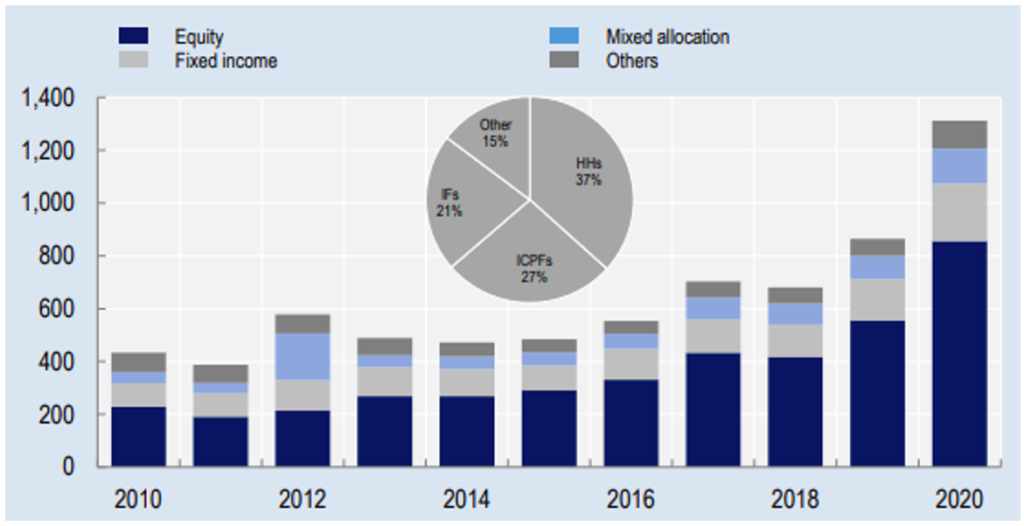

Determine 2: Belongings of ESG funds over time

(Supply: Monetary markets and Local weather Transitions, OECD)

With the specter of local weather change extra imminent than ever, buyers all over the world have began acknowledging that environmental points are one of many largest dangers disrupting our world at present. Attributable to this, an elevated focus has been noticed in investing patterns at corporations that cater to the surroundings, social and governance values of the buyers.

As proven in determine 2, sustainable fund flows globally has been growing since 2010. Funds that used Surroundings, Social and Governance (ESG) rules have acquired USD 51.1 billion of web new cash from buyers in 2020, a major improve from USD 21 billion in 2019.

Funds, which incorporate ESG rules into their investments have outperformed non-ESG based mostly share portfolios. Analysis performed by Constancy on the efficiency of ESG investments all over the world between 1970 and 2014 confirmed that half of them outperformed the market. Throughout 2020, BlackRock reported that greater than 8 out of 10 sustainable funding funds outperformed non-ESG based mostly funds. ESG funds had decrease volatility whereas delivering an excellent return on fairness and an extended lifespan, as 77% of ESG funds that began 10 years in the past endured in comparison with 46% of typical funds.

This quickly rising pattern of ESG investing has inspired companies to combine ESG rules into their operations to draw investments. The worldwide effort in direction of sustainability has created a necessity for organizations to be extra clear relating to their administration of environmental, social, and governance danger. Together with this, there may be additionally an elevated want for companies to be seen as moral in mild of more and more aware shopper teams. The fast want for companies to know and cling to sustainability rules and disclosure necessities has led to the elevated prevalence of greenwashing.

Inexperienced washing

Inexperienced washing might be outlined as when corporations, deliberately or unintentionally, make false or deceptive claims about their sustainability efforts. Inexperienced washing contains unsubstantiated claims of merchandise being environmentally pleasant, poorly outlined claims, merchandise with hidden tradeoffs and so forth.

A extra sensible instance of inexperienced washing is when corporations spend considerably extra assets on promoting themselves as being inexperienced than they do on incorporating environmentally sound practices.

Inexperienced washing provides a misunderstanding of being on monitor by way of local weather change ambitions and targets which hinders the precise ESG and local weather progress. It can lead to lack of investor confidence in ESG investing. Elevated prevalence of greenwashing may additionally discredit the sustainability motion utterly. It additionally misleads customers into believing {that a} product is moral when the other is true. Whereas advertising campaigns designed to spotlight an organization’s, moral insurance policies can improve status and model picture, the rise of unsubstantiated claims and greenwashing tends to have the other impact.

Inexperienced washing will not be a brand new phenomenon. Funds that declare to include ESG rules into their investments have lengthy been accused of holding shares of unsustainable and unethical industries resembling fossil gasoline corporations, weapon producers and mining corporations. Russia’s invasion of Ukraine has additionally introduced into mild USD 8.3 billion price of Russian authorities bonds and shares of Russian corporations held by ESG funds. With the conflict escalating, funds have began to unwind Russian bonds and shares from their portfolios.

Morningstar Inc, an unbiased analysis and score company, lately eliminated ESG tags from over 1200 funds, with a complete of USD 1 trillion in property, which claimed to think about ESG components into their funding course of however didn’t combine them in a definitive manner of their funding choice. A report by InfluenceMap has discovered that 55% of funds marketed as low carbon, fossil gasoline free and inexperienced power had exaggerated their environmental claims, and 70% of funds with ESG objectives didn’t meet their targets.

Ongoing efforts to sort out inexperienced washing

The growing investments in ESG funds have attracted the eye of regulators, who’ve taken actions towards corporations to guard buyers from false or deceptive ESG claims. Additional, customary setting our bodies have taken this elevated curiosity in ESG to standardize ESG rankings and enhance their reliability. The efforts which were undertaken globally to sort out greenwashing are as follows:

- Regulatory actions

DWS Group, a German asset supervisor, was investigated by German and US officers after a whistleblower’s accusations of the corporate exaggerating its inexperienced investments. The German officers reported that ESG components have been solely thought of in minority investments of DWS, which is opposite to the DWS fund’s gross sales prospectus. Additional, the US Securities and Alternate Fee (SEC) fined BNY Mellon Funding Advisor and sued Vale, SA for misstating ESG funding insurance policies and making false ESG disclosures. European regulators have uncovered a number of cases of unsubstantiated ESG claims in France, Britain, Sweden, Netherlands, and Switzerland. The French regulators have additionally compelled managers to drop ESG labels after discovering circumstances of inexperienced washing.

- Regulatory efforts

To be able to forestall deceptive claims by USA based mostly ESG funds, the SEC has proposed adjustments in regulation and improve the requirement of disclosure for such funds. A latest change to the Identify Rule would require funds with ESG of their identify to obviously outline the time period and be sure that 80% of investments of the fund fall inside that definition.

Additional, The Sustainable Finance Disclosure Regulation (SFDR) goals to keep away from greenwashing of economic merchandise within the European Union. It requires complete sustainability disclosure which covers a broad vary of ESG metrics at each entity stage and product stage. ESG funds have been categorized into people who actively promote environmental and or social traits and people who have sustainable funding as their principal goals, each of that are topic to greater disclosure requirement.

Whereas separate efforts have been made throughout the globe, harmonization of local weather change disclosure associated requirements and improvement of recent inexperienced frameworks could possibly be the important thing to avoiding inexperienced washing. A typical disclosure requirement throughout all jurisdictions would assist sort out inexperienced washing constantly whereas easing disclosure burdens on multinational corporations.

- ESG rankings

ESG rankings are broadly utilized by buyers to combine ESG rules into their funding methods. Completely different ESG score suppliers apply ESG metrics utilizing totally different sources and varieties of knowledge, parameters, weightings, and assumptions, hindering their comparability. The Worldwide Organisation of Securities Fee (IOSCO), the worldwide customary setter for securities market regulators, steered enhancements in reliability of uncooked ESG knowledge, transparency in ESG methodologies, and reliability in ESG rankings and knowledge merchandise. The IOSCO has additionally advisable ESG rankings suppliers and entities topic to ESG evaluation to enhance info gathering processes, disclosures and communication between one another. These enhancements will assist make ESG rankings and knowledge extra rigorous and clear.

Non-public sector investments in sustainable and moral enterprise practices are one of many key drivers of a sustainable and greener future that the world has envisioned. With the fast rise in ESG funds, tackling inexperienced washing is essential to make sure that the world makes actual progress on sustainability metrics.

[ad_2]

Source link