[ad_1]

As such, DB’s Jim Reid mentioned that July 22, the day gasoline is meant to come back again on-line, could possibly be an important day of the 12 months: “whereas all of us spend most of our market time eager about the Fed and a recession, I believe what occurs to Russian gasoline in H2 is doubtlessly a good greater story. In fact by July twenty second components could have be discovered and the availability may begin to normalize. Anybody who tells you they know what will occur right here is guessing however as minimal it needs to be an enormous focus for everybody in markets.”

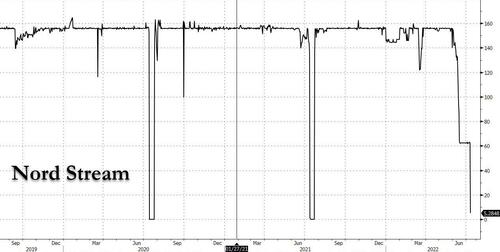

Quick ahead to immediately when, someday after the beginning of the scheduled 10-day shutdown interval which has already despatched flows by way of to NS 1 pipeline to mainly zero…

[url=https://www.zerohedge.com/s3/files/inline-images/NS 1.jpg?itok=DLK-k8Q-]

[/url]

[/url]… and the market is now specializing in the worst case situation: what occurs if Russia cuts off all gasoline on July 22, the day even Bloomberg has now dubbed Europe’s “doomsday situation.”

Here’s a pattern of what Wall Road expects to occur then: European shares plunging 20%. Junk credit score spreads widening previous 2020 disaster ranges. The euro sinking to simply 90 cents, earlier than a full-blown recession slams the world’s 2nd largest economic system.

And all this energy within the palm of Putin’s hand, virtually as if he knew exactly how a lot leverage he had again in February whereas Europe was – as all the time – fully clueless.

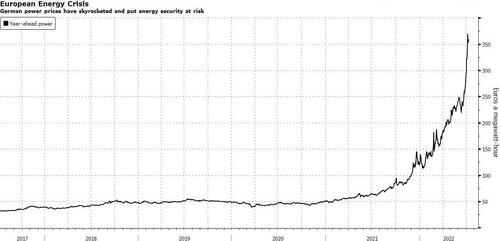

So to assist Europe’s braindead bureaucrats, the place power insurance policies have been dictated by a petulant Scandianvian teenager and a bunch of German “greens”, strategists throughout Wall Road have tried to place numbers on a situation that will be unthinkable in regular occasions. The caveat in fact is that there are such a lot of variables, such because the size of any shutdown, the extent of provide cuts, and the way far nations would go to ration power, that anybody’s prediction is a guess at greatest. Even so, the eventualities are catastrophic.

[url=https://www.zerohedge.com/s3/files/inline-images/power prices year ahead.jpg?itok=D1Huh-w5]

[/url]

[/url]“The large unknown is how the shock that begins in Germany, Poland and different central European nations will reverberate all through the remainder of Europe and the world,” mentioned Joachim Klement, head of technique at Liberum Capital. “There merely isn’t any substitute obtainable for Russian gasoline.”

In an evaluation this week (obtainable to professional subscribers), UBS economists laid out an in depth imaginative and prescient of what they see occurring if Russia halts gasoline deliveries to Europe: It could scale back company earnings by greater than 15%. The market selloff would exceed 20% within the Stoxx 600 and the euro would drop to 90 cents. The push for secure property would drive benchmark German bund yields to 0%, they wrote.

“We stress that these projections needs to be seen as tough approximations and in no way as a worse-case situation,” wrote Arend Kapteyn, chief economist at UBS. “We may simply conceive financial disruptions that result in extra damaging development outcomes.”

To make sure, markets are already pricing in among the injury beginning with the euro which immediately traded at a contemporary two-decade low and briefly touched parity with the greenback, one thing it hasn’t executed since 2002.

[url=https://www.zerohedge.com/s3/files/inline-images/eurusd parity.jpg?itok=ICG-nKTm]

[/url]

[/url]In the meantime, German shares have misplaced 11% since June. German gasoline large Uniper SE is the most important company casualty, with the inventory plunging 80% this 12 months because it seeks a authorities bailout.

To make sure, although French and German leaders are warning populations to “put together for complete cut-off of Russian gasoline”, many buyers nonetheless consider there’s purpose to consider Russia will flip gasoline provide again on when upkeep on the Nord Stream 1 pipeline ends on July 21. However, as UBS factors out, if European nations begin voluntary gasoline rationing to refill on storage, the hit to financial development shall be extreme.

“Europe is presently being caught in a vicious circle,” mentioned Charles-Henry Monchau, chief funding officer at Banque Syz. Larger power costs are hurting Europe’s economic system, driving the euro decrease. In flip, the weaker euro makes power imports much more costly, he mentioned.

The opposite fear is that the ECB shall be unable to do a lot to assist the economic system – which is about to slip right into a recession – with inflation already working at decade-highs, mentioned Prashant Agarwal, a portfolio supervisor at Pictet Asset Administration.

“I’m not certain central financial institution instruments work on this situation,” he mentioned. “Prior to now, that they had leeway to deal with the state of affairs as a result of inflation was low.”

Courtesy of Bloomberg, right here’s a round-up of different strategist views:

BNP Paribas SA

A full-blown gasoline disruption would drive the Euro Stoxx 50 to 2,800, a few 20% plunge from present ranges, wrote strategists together with Sam Lynton-Brown and Camille de Courcel.

They advocate hedges, corresponding to high-quality firms and shopping for choices skew on the European inventory index. Auto, industrial and chemical industries shall be beneath stress, they wrote.

Nomura Worldwide Plc

Foreign money strategist Jordan Rochester has been urging purchasers to brief the widespread forex since April. If Nord Stream 1 doesn’t resume operations, the euro could drop to 90 cents over the winter, he wrote.

“We consider Europe could fail to construct up adequate gasoline storage for the winter and this will result in power rationing,” he mentioned. “If that’s not an financial disaster, what’s?”

JPMorgan Chase & Co.

The strikes in European company bond spreads could be greater than the primary wave of the Covid pandemic in 2020 if Russia shuts off gasoline provides, based on strategists led by Matthew Bailey.

Spreads on high-grade debt could surge to 325 foundation factors, they wrote. For junk-rated bonds, the unfold may widen to as a lot as 1,000 foundation factors.

Goldman Sachs Group Inc.

The euro is already reflecting a variety of the negativity, however the forex may fall one other 5% if markets worth in a full shutdown of Nord Stream 1, mentioned strategists together with Christian Mueller-Glissmann. They advocate a defensive allocation, with overweights on money and commodities.

Financial institution of America Corp.

Former copper bull Financial institution of America additionally slashed its forecasts final week, warning that in a worst-case situation the place Europe experiences widespread gasoline shortages, costs may plunge to as little as $4,500 a ton. Copper sank 2% to $7,429 on Tuesday.

kenlej- GURU HUNTER

- Posts : 1434

Be a part of date : 2013-12-23

Age : 68

Related subjects

Related subjectsPermissions on this discussion board:

You can’t reply to subjects on this discussion board

[ad_2]

Source link