[ad_1]

jetcityimage

Expensive readers,

Hyundai (OTCPK:HYMTF) is a not-uninteresting automotive enterprise. Whereas I personally am much more aware of European and particularly German/French manufacturers, it nonetheless comes with upsides which can be value contemplating – particularly for the long run. Each time an organization turns into low cost that could be regarded as a market chief in a number of markets, it is at the very least well worth the query if the corporate has one thing it could give you.

In Hyundai’s case, I do consider there’s worth right here, however administrative and sensible challenges make this a tough one even for me.

Nonetheless, let’s examine what we received right here.

Hyundai

Hyundai Motor Firm is a South Korean automotive producer headquartered within the lovely metropolis of Seoul. Since its founding in 1967 by releasing the Hyundai Cortina in cooperation with Ford (F). The corporate started creating its personal autos within the mid-70s with a British managing director who in flip employed among the high automotive engineers within the trade, and the Hyundai Pony was launched in -75.

The corporate has been within the European market since -82 and in NA since -84. It has been by way of a few tough turns, together with the shake-up within the Asian Monetary Disaster of 1998, brought on for Hyundai by overambitious growth. That was additionally when Hyundai acquired the vast majority of its closest rival, Kia Motors (OTCPK:KIMTF). On the time, Hyundai owned greater than 50% of the corporate. Kia continues to be a part of the company construction often called the Hyundai Motor Group, which additionally contains Genesis and Ioniq, however its possession stake is down to simply north of 33% at the moment. It is a frequent false impression that Kia and Hyundai are the identical producers due to this – however they’re fully completely different automotive companies, slightly below the identical dad or mum.

Hyundai has an annual manufacturing output of over 3.5M-4.5M items per 12 months and 2021 gross sales of three.9M autos, and revenues of 117T Received, or simply south of $90B, making them one of many largest producers round. On that 117T, they make round 6.7T value of working earnings, and 5.7T value of internet earnings.

Hyundai Motors is BBB+ rated, and as such is without doubt one of the best-rated automotives on the market.

The possession construction is fairly simple. There are authorities pursuits within the type of the biggest public pension fund within the nation, with 21.4% owned by Hyundai Mobis, the components enterprise, and some % owned by people identified by the previous CEO and the present “inheritor obvious” to the enterprise, collectively about 7-8% value of possession.

Hyundai Motor Group is the second-largest chaebol in South Korea and manages 54 subsidiaries together with companies similar to Hyundai Metal. These subsidiaries embody what you get publicity to once you put money into Hyundai. A chaebol is basically a Korean-specific conglomerate run by one particular person or a particular household. Such organizations are much less frequent within the west, however they’re nonetheless very a lot round in South Korea and different areas, and so they play a significant function in each nationwide politics and native traits.

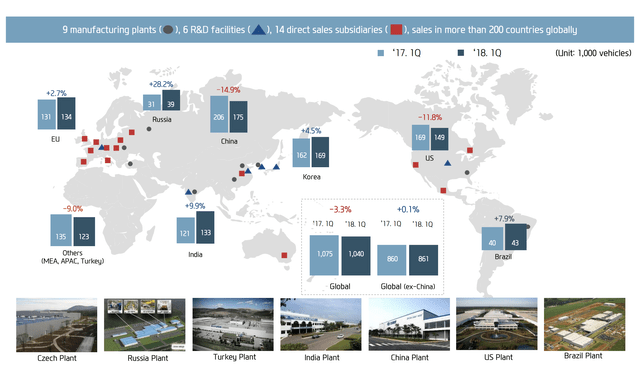

Again to Hyundai as a core. The automotive enterprise has worldwide illustration with analysis, manufacturing, and gross sales subsidiaries throughout your complete world.

Hyundai IR (Hyundai IR)

The corporate has additionally, aside from the pandemic, seen profitable development in high quality, automobile dependability, and model worth development for the reason that fruits of the monetary disaster. Since that point, the corporate ranks among the many higher non-premium manufacturers, at #third place in automobile dependability.

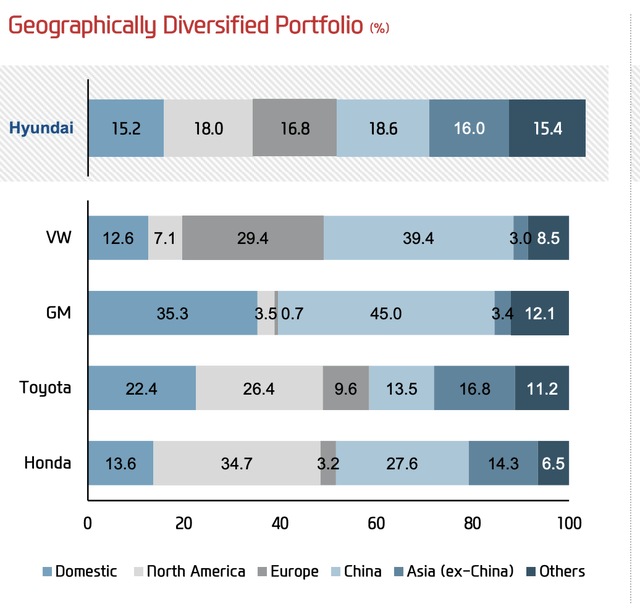

The corporate additionally has one of many best-diversified gross sales portfolios within the automotive world. Check out the combo right here in comparison with its friends.

Hyundai IR (Hyundai IR)

Since its shift in dependability, the corporate has seen quite a few awards and accolades come its means, and I consider it truthful to say that the frequent notion of Hyundai, and Kia for that matter, is that they’re high quality merchandise backed by lengthy years of guarantee normally unequaled by different producers.

Like most companies within the trade, Hyundai is on a path of streamlining and capturing efficiencies. EV will really be part of this, on account of brand-wide platform integration, which is able to scale back future, if not present improvement prices and ship a higher diploma of scale economics. These integrations have the results of not solely lowering improvement time for brand new fashions and mannequin updates however enhance firm margins.

Like most automotive companies, the corporate focuses on clear, linked, and free mobility. Its EV’s, Hybrids, and different new applied sciences are all in the marketplace, and whereas I’m not a Hyundai driver, I’ve tried their merchandise and take into account them to be qualitative for the customers that need such a automotive. By 2025, the corporate needs to have greater than 35 “inexperienced” fashions in the marketplace.

The corporate has oft been criticized for its shareholder remuneration coverage, which like most South Korean corporations and chaebols has been centered on rewarding majority house owners and the household/people versus shareholders. Hyundai seeks to alter this by allocating 30-50% of the corporate’s annual FCF to shareholder returns with combos of buybacks and dividends.

Its said goal is to extend its payout ratio to be aggressive on a global foundation, and as a global investor, that is in fact information that I welcome.

Margins for the enterprise are on par with different producers and development between 3-7% on internet, however all of those traits are considerably unstable with the pandemic. On a GM foundation, the corporate goes between 15-20% gross margins, which once more is according to most main producers – nevertheless it traits up and down.

2Q22 is the most recent report now we have. Gross sales noticed a sequential improve of near 19% and a YoY improve of 18.7%, with vital, recovering working revenue numbers, each sequentially and YoY, of 50-58%. The identical is true for internet revenue. Nonetheless, the corporate went very conservative with its dividend in 2021, dropping to a 26.3% payout ratio, nicely under its goal and 2020 degree. The dividend for 2021 was 5,000 KRW, and a present native share value of 196,000 KRW per share, which implies a yield of lower than 3%

Nonetheless, pushing apart dividend lag, the corporate has appreciable upside and power. The impression of upper product pricing and low spend/value management outweighed the worldwide problems with commodity pricing and labor value will increase. We must be very cautious of the impression of those shifts, particularly in an organization like this, however the firm posted significantly better outcomes than general anticipated on account of spectacular pricing energy.

When digging down into the numbers for the quarter, we discover that the corporate noticed a detrimental EPS impression from uncooked supplies and pressures from between 7-8%. Nonetheless, this hasn’t completed something to fully offset your complete upside that the corporate sees from pricing. EPS visibility is, as I see it, excessive, and the corporate is forecasted to proceed to develop its earnings.

EVs have additionally been comparatively profitable. The corporate, together with KIA, has reached practically 1 / 4 million autos per 12 months on the present run fee, and that is excluding the Genesis model from the combo. This ramp-up of EV gross sales has principally gone from zero-to-hundred in lower than a couple of seconds. The discharge of its proprietary platform has enhanced gross sales right here.

So how precisely does this stream to valuation for the corporate?

Let’s have a look.

Hyundai’s valuation

Much like most automotive companies, particularly at this time (excepting premium manufacturers like Ferrari (RACE) and comparable), Hyundai tends to commerce at low earnings multiples. Over a 10-year interval, the corporate’s common isn’t any increased than 7X, with a most of 12X and a low of 4X. The corporate’s present normalized P/E is round 6.5X for the native share listed on the Seoul Index.

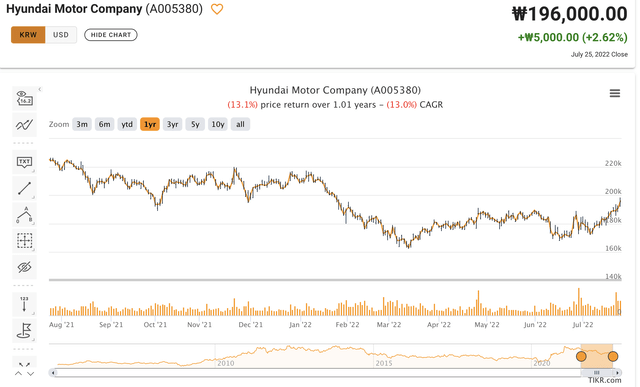

Revenue multiples similar to P/E, EBITDA, EBIT and comparable metrics to income and market cap present us that Hyundai, following a value decline of 13% in a 1-year interval, trades at an undervaluation – however that it’s beginning to get better.

Hyundai Value/Returns (Tikr.com)

Equally, trailing multiples for the corporate present us comparable undervaluations, with a lot of the typical metrics off round 10-30% to their 10-year historic averages. Contemplating the scenario the corporate is at the moment by way of gross sales, portfolio, and blend, it isn’t an unfair evaluation to make that Hyundai ought to commerce considerably increased even than a few of its rivals.

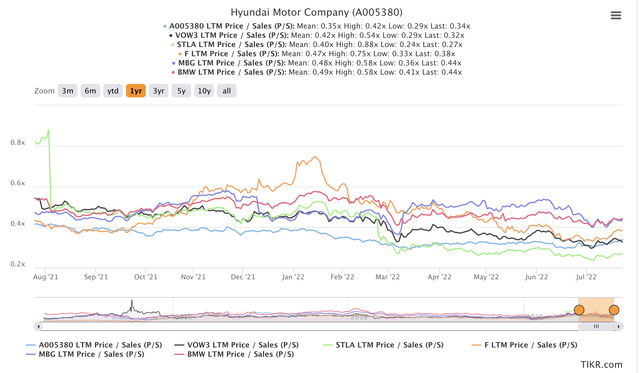

Hyundai is at the moment being “awarded” a 0.34X Gross sales a number of, for example, and evaluate this to each main peer and there are definitely discrepancies there.

Hyundai peer valuations (TIKR.com)

These traits are pretty seen throughout the board of metrics – Hyundai is being discounted fairly closely even to most of their closest friends. Some may name it a stretch to check Hyundai to say, BMW (OTCPK:BMWYY). I say comparability to Porsche (OTCPK:POAHY) can be too far, however BMW is legitimate.

Forecasts for the corporate are equally optimistic. The bullish thesis right here hinges on a continued capability to cost premium costs for good merchandise – and I see the corporate with the ability to do that, particularly with Genesis within the combine.

General, I, due to this fact, view Hyundai as undervalued – and I am not the one one to take action. 27 analysts comply with the corporate’s native ticker on the South Korean market, and 24 of them are at both a “BUY” or “Outperform” score for this firm. With a mean value goal of 257,000 KRW, the upside for the native ticker for this enterprise is 31.5%. That is above the typical for automotive undervaluation. The yield is in fact, decrease, however the security for this firm given its BBB+ credit standing is excessive.

Nonetheless, shopping for Hyundai is a comparatively complicated enterprise if you need the native. Even I’ve solely restricted entry to the South Korean market, which leaves me with ADRs and comparable avenues.

Hyundai’s ADR is HYMTF, and it is comparatively illiquid right here on the US market. I discovered an avenue with phone brokers to put money into the corporate natively, nevertheless it requires a steep minimal funding quantity that I’m at the moment unwilling to place down.

So whereas I at the moment do see the corporate as a “BUY” with a 15-20% upside, I additionally won’t be investing within the firm at this particular time.

Thesis

My thesis for Hyundai is as follows:

- Hyundai is maybe one of many higher automotive investments obtainable on account of its conservative nature and its home-field publicity to Asia, with a particularly well-diversified gross sales portfolio of enticing automobiles in each section from semi-luxury to frequent.

- The corporate has a not-insignificant upside of 15-30%, and only a few analysts at the moment following the corporate take into account this something besides a “BUY” right here.

- The relative complexity of constructing a “BUY” right here implies that I will not make investments an organization till I see a sector-beating and completely huge upside with a fantastic dividend. That point, for me, isn’t now.

Bear in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital good points and dividends within the meantime.

- If the corporate goes nicely past normalization and goes into overvaluation, I harvest good points and rotate my place into different undervalued shares, repeating #1.

- If the corporate does not go into overvaluation however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (bolded).

- This firm is general qualitative.

- This firm is essentially secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at the moment low cost.

- This firm has lifelike upside primarily based on earnings development or a number of growth/reversion.

[ad_2]

Source link