[ad_1]

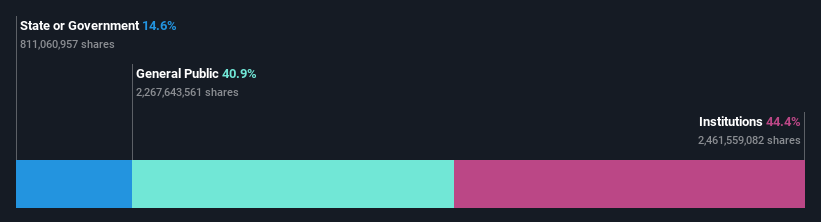

To get a way of who is really in command of Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC) (DSM:QGTS), you will need to perceive the possession construction of the enterprise. With 44% stake, establishments possess the utmost shares within the firm. That’s, the group stands to learn probably the most if the inventory rises (or lose probably the most if there’s a downturn).

Since institutional have entry to large quantities of capital, their market strikes are inclined to obtain loads of scrutiny by retail or particular person traders. Therefore, having a substantial quantity of institutional cash invested in an organization is usually thought to be a fascinating trait.

Let’s delve deeper into every sort of proprietor of Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC), starting with the chart under.

View our newest evaluation for Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC)

What Does The Institutional Possession Inform Us About Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC)?

Institutional traders generally evaluate their very own returns to the returns of a generally adopted index. So they often do think about shopping for bigger corporations which are included within the related benchmark index.

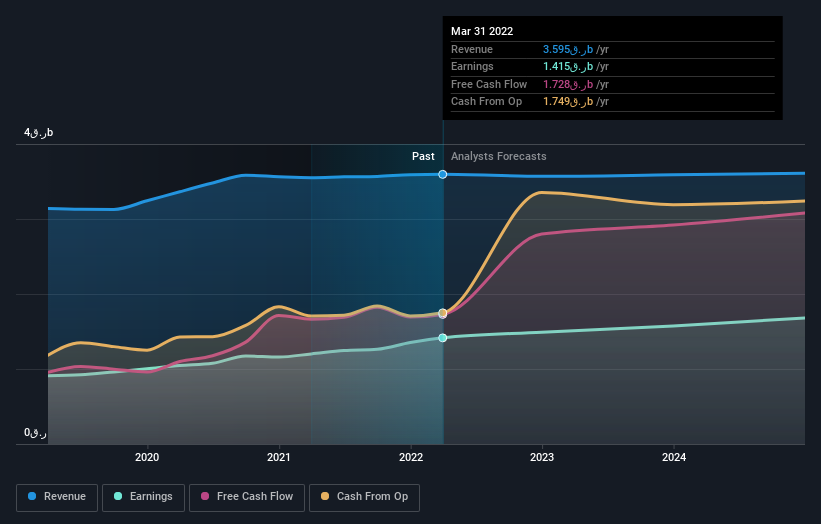

Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC) already has establishments on the share registry. Certainly, they personal a decent stake within the firm. This will point out that the corporate has a sure diploma of credibility within the funding group. Nonetheless, it’s best to be cautious of counting on the supposed validation that comes with institutional traders. They too, get it fallacious typically. If a number of establishments change their view on a inventory on the similar time, you can see the share value drop quick. It is subsequently value taking a look at Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC)’s earnings historical past under. In fact, the longer term is what actually issues.

Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC) isn’t owned by hedge funds. The corporate’s largest shareholder is Milaha Capital, with possession of 36%. Compared, the second and third largest shareholders maintain about 15% and a pair of.0% of the inventory.

To make our research extra fascinating, we discovered that the highest 2 shareholders have a majority possession within the firm, that means that they’re highly effective sufficient to affect the selections of the corporate.

Whereas it is smart to review institutional possession information for a corporation, it additionally is smart to review analyst sentiments to know which manner the wind is blowing. There are an inexpensive variety of analysts overlaying the inventory, so it could be helpful to search out out their mixture view on the longer term.

Insider Possession Of Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC)

The definition of an insider can differ barely between completely different international locations, however members of the board of administrators at all times depend. Administration in the end solutions to the board. Nonetheless, it isn’t unusual for managers to be govt board members, particularly if they’re a founder or the CEO.

I usually think about insider possession to be an excellent factor. Nonetheless, on some events it makes it tougher for different shareholders to carry the board accountable for selections.

We observe our information doesn’t present any board members holding shares, personally. It’s uncommon to not have no less than some private holdings by board members, so our information could be flawed. A superb subsequent step could be to test how a lot the CEO is paid.

Basic Public Possession

With a 41% possession, most of the people, largely comprising of particular person traders, have some extent of sway over Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC). Whereas this dimension of possession might not be sufficient to sway a coverage choice of their favour, they’ll nonetheless make a collective impression on firm insurance policies.

Subsequent Steps:

Whereas it’s effectively value contemplating the completely different teams that personal an organization, there are different elements which are much more necessary. Working example: We have noticed 1 warning signal for Qatar Gasoline Transport Firm Restricted (Nakilat) (QPSC) you ought to be conscious of.

However in the end it’s the future, not the previous, that may decide how effectively the house owners of this enterprise will do. Subsequently we expect it advisable to check out this free report displaying whether or not analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing information from the final twelve months, which confer with the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be in line with full 12 months annual report figures.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to deliver you long-term centered evaluation pushed by elementary information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link