[ad_1]

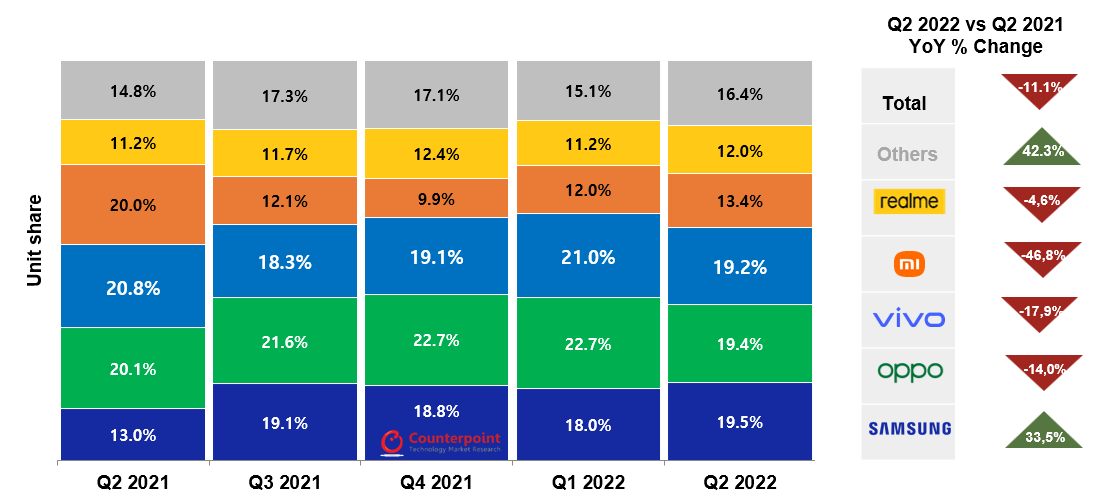

- Indonesia’s Q2 2022 smartphone shipments declined 11% YoY to fall beneath 9.4m models

- The broad choice for finances, sub-$150 gadgets made Indonesia particularly weak to macro weak point and forex fluctuations

- Of the highest OEMs, solely Samsung managed to develop shipments YoY

- Most main Chinese language manufacturers noticed double-digit declines

- On-line channels ticked up, highlighting its continued significance

- We’re ‘not bullish’ on 2H, however system improve cycles a brilliant spot with 5G gadgets greater than 20% cargo share throughout Q2

Jakarta, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – August 16, 2022

Indonesia’s Q2 2022 smartphone shipments fell 11% year-on-year to 9.4m models, in keeping with Counterpoint’s newest Month-to-month Indonesia Smartphone Channel Share Tracker.

The disappointing outcomes mirrored broader regional and world tendencies the place macro headwinds and forex points made for a tricky quarter. Base results had been additionally in play, as extreme lockdown restrictions final yr boosted demand for smartphones as extra individuals spent extra time on-line, magnifying the impression of this yr’s financial woes.

Q2 2022 Indonesia Smartphone Cargo Share by Key OEM

Supply: Counterpoint Month-to-month Indonesia Channel Share Tracker, Q2 2022.

Supply: Counterpoint Month-to-month Indonesia Channel Share Tracker, Q2 2022.

Demand for finances gadgets (<$150), which account for a giant portion of the market, fell essentially the most, with shipments falling after Ramadhan and Eid Al Fitr. The latter half of the quarter was particularly unhealthy; June was off by virtually 1m models in comparison with final yr within the finances class.

Samsung was the one gainer by way of unit shipments, which grew by a large 33% – although a lot of it was as a consequence of base results as the seller struggled final yr from provide points stemming from its Vietnam manufacturing unit shutdown.

However, Samsung flooded the market by launching varied low-to-mid finish gadgets prefer it’s A and M sequence, which did particularly properly in April, accounting for 14% of whole home shipments throughout the festive month. It was sufficient to assist the corporate take pole place by way of market share for the primary time in three years, however not sufficient to match pre-COVID ranges.

Xiaomi noticed the most important slide as chipset provide points continued to plague shipments after its report Q2 2021. The newest quarter noticed shipments fall YoY by an astonishing 47%.

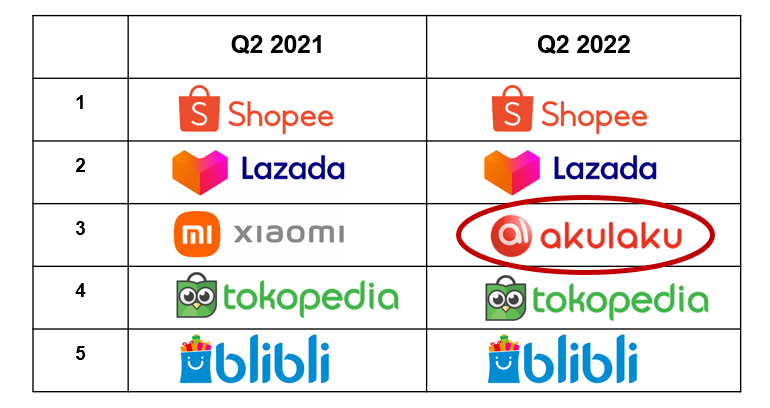

Q2 2021 vs. Q2 2022 Indonesia E-Commerce Rank for Smartphone Shipments

Supply: Counterpoint Month-to-month Indonesia Channel Share Tracker, Q2 2022.

Extra broadly, on-line channels ticked up as OEMs and main e-commerce websites supplied promotions to assist drive gross sales. Virtually one out of each 5 smartphones shipped final quarter had been by way of on-line channels. “What’s attention-grabbing to see is the quick rise of home fintech participant Akulaku, which grabbed third spot final quarter in on-line shipments,” notes Senior Analyst Febriman Abdillah. “One of many methods they grabbed share was by offering patrons with Akulaku instalment plans. This ‘pay later’ pricing technique can be essential in rising the mid-end of the market, particularly contemplating the present macro local weather.”

Wanting ahead to 2H, our expectations for Indonesia stay tempered. Though it’s much less weak to a recession than a few of its regional and world friends, forex fluctuations will probably play a robust function in driving or hampering smartphone demand and our world macro outlook implies elevated inflation threat. Diminished spending energy will hit segments looking for low-to-mid finish gadgets the toughest – making home smartphone demand particularly weak over the second half of 2022. Nevertheless, there’s room for some optimism because the upcoming 3G shutdown and continued digital transformation efforts will lead shoppers to improve their telephones.

“We’re anticipating to see not solely 3G alternative drive the decrease finish of the market, however shoppers upgrading from 4G to 5G, which reached 1.96m models for Q2, to assist enhance higher-value segments as individuals look to reinforce their on-line expertise,” says Senior Analyst Glen Cardoza. “That is excellent news for the mid-end of the market, which at present delivers some unimaginable worth by way of specs.”

“We’re additionally protecting our eye on e-sports and smartphone gaming within the area. We count on specs to help this sort of gaming to grow to be mainstream throughout mid-end gadgets. Therefore, past 5G, we see this as one other improve driver, significantly amongst youthful customers – a large demographic in Indonesia.”

Background:

Counterpoint Know-how Market Analysis is a worldwide analysis agency specializing in merchandise within the TMT (know-how, media and telecom) business. It companies main know-how and monetary corporations with a mixture of month-to-month stories, custom-made tasks and detailed analyses of the cellular and know-how markets. Its key analysts are seasoned consultants within the high-tech business.

Analyst Contacts:

Febriman Abdillah

Glen Cardoza

Comply with Counterpoint Analysis

press(at)counterpointresearch.com

Associated Posts

[ad_2]

Source link