[ad_1]

Hong Kong has signed a number of double tax avoidance and bilateral funding treaties with nations within the Center East, serving to to facilitate commerce and funding and enhance cooperation between the 2 areas. We offer an summary of the present HK funding treaties in place with nations within the Center East and talk about how they assist defend investments and facilitate enterprise change.

Hong Kong is deepening commerce and funding cooperation with nations within the Center East, opening new alternatives for firms and buyers within the area to achieve a foothold within the vibrant metropolis.

This cooperation is underpinned by a sequence of bilateral funding, commerce, and tax treaties with nations within the area that assure truthful taxation and safety of investments. As well as, a number of nations within the Center East are members of the WTO, and commerce and funding between the 2 areas are in some situations coated by multilateral treaties.

Under we offer an summary of the energetic bilateral and multilateral agreements between Hong Kong and Center Japanese nations.

Hong Kong DTAs with Center Japanese nations

Hong Kong has energetic double taxation agreements (DTAs) with 4 nations within the Center East, specifically, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates (UAE). It is usually within the technique of negotiating DTAs with Bahrain and Israel.

| DTAs with International locations within the Center East | ||

| Nation | Standing | Efficient Date |

| Kuwait | In drive | July 2013 |

| Qatar | In drive | December 2013 |

| Saudi Arabia | In drive | September 2018 |

| United Arab Emirates | In drive | December 2015 |

| Bahrain | Below negotiation | – |

| Israel | Below negotiation | – |

In all 4 of the DTAs, the taxes coated in Hong Kong are:

- Income tax

- Salaries tax

- Property tax

Hong Kong implements a two-tiered income tax system:

- For the primary HK$2 million (US$254,833), the tax charge is 8.25 p.c for firms and seven.5 p.c for unincorporated companies

- For over HK$2 million, the tax charge is 16.5 p.c for firms and 15 p.c for unincorporated companies

Nevertheless, for 2 or extra linked entities, just one could elect the two-tiered income tax charges. The remainder of the entities shall nonetheless be taxed at 16.5 p.c for firms and 15 p.c for included companies. Enterprises that already profit from preferential tax regimes, corresponding to the company treasury heart regime, plane leasing regime, and others, are additionally excluded from the two-tiered income tax regime.

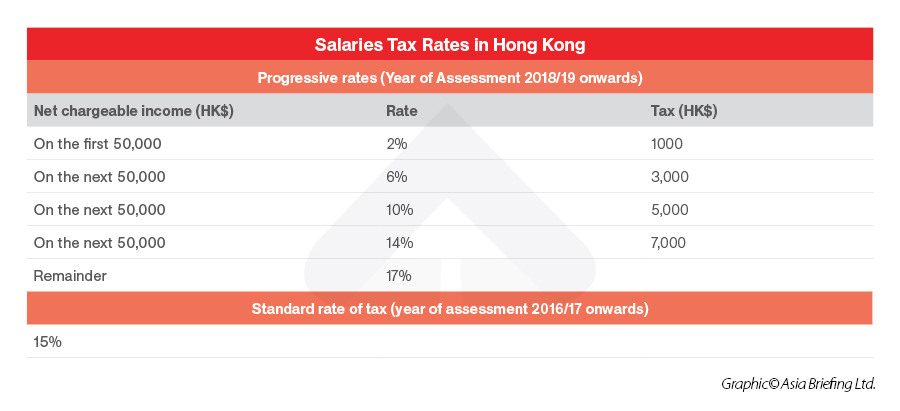

Hong Kong implements a progressive salaries tax charge on “web chargeable revenue” or a normal salaries tax charge on “web revenue”.

Web chargeable revenue = whole revenue – deductions – allowances

Web revenue = whole revenue – deductions

Hong Kong’s property tax charge is 15 p.c of the web assessable worth of revenue arising from the letting of immovable property in Hong Kong.

| Taxes Coated by Hong Kong’s DTAs | |

| Hong Kong |

|

| Kuwait |

|

| Qatar |

|

| Saudi Arabia |

|

| United Arab Emirates |

|

Residency is outlined barely in a different way within the numerous DTAs. Within the Kuwait, Qatar, and UAE DTAs, a Hong Kong resident is outlined as:

- Any particular person who ordinarily resides in Hong Kong

- Any particular person who stays in Hong Kong for greater than 180 days throughout a 12 months of evaluation or for greater than 300 days in two consecutive years of evaluation, one in all which is the related 12 months of evaluation

- An organization included in Hong Kong or, if included exterior of Hong Kong, that’s usually managed or managed in Hong Kong

- Every other individual constituted beneath the legal guidelines of Hong Kong or, if constituted exterior Hong Kong, that’s usually managed or managed in Hong Kong

- The Authorities of Hong Kong

Within the Saudi DTA, the time period “resident of a Contracting Celebration” is outlined extra broadly as “any one that, beneath the legal guidelines of that Contracting Celebration, is liable to tax therein by purpose of his domicile, residence, place of incorporation, place of administration or every other criterion of the same nature”.

The definitions of “resident” within the 4 Center Japanese nations are as beneath.

| Definitions of “Resident” in Hong Kong’s DTAs | |

| Kuwait |

|

| Qatar | Any particular person who has a everlasting house, his heart of important pursuits, or recurring abode in Qatar, and an organization included or has its place of efficient administration in Qatar. The time period additionally contains the State of Qatar and any political subdivision, native authority, or statutory physique thereof. |

| Saudi Arabia | Any one that, beneath the legal guidelines of that Contracting Celebration, is liable to tax therein by purpose of his domicile, residence, place of incorporation, place of administration, or every other criterion of the same nature. |

| United Arab Emirates |

|

Hong Kong’s BITs with Center Japanese nations

Hong Kong has at present signed bilateral funding treaties (BITs) with two nations within the Center East: UAE and Kuwait.

Each BITs assure remedy to buyers from the opposite social gathering that is the same as that afforded to buyers in their very own nation or area.

This remedy contains compensation for losses because of:

- Struggle or different armed battle, revolution, a state of nationwide emergency, revolt, revolt, or riot within the space of a given social gathering’s jurisdiction

- Requisitioning of an investor’s property or destruction of an investor’s property by a contracting social gathering’s forces or authorities that was not induced in fight motion or was not required by the need of the state of affairs

Below the BITs, buyers are additionally assured unrestricted rights to switch their investments and returns overseas. These belongings embrace:

- Funds from compensation for losses and expropriation

- Funds by one contracting social gathering to an investor beneath an indemnity

- Funds arising out of the settlement of disputes

The scope of investments which can be assured the appropriate to switch overseas is broader within the UAE BIT, with the specific addition of:

- Preliminary capital and extra quantities to keep up or enhance an funding

- Returns

- Funds made beneath a contract, together with repayments pursuant to a mortgage settlement

- Proceeds from the sale or liquidation of all or any a part of an funding

- Earnings and different remuneration of personnel engaged from overseas in reference to an funding

- Income and returns of airways

All funds are additionally freely convertible beneath the BITs.

The BITs additionally define dispute decision mechanisms, which embrace submission of the dispute to a impartial worldwide arbitration tribunal.

For extra data on how buyers can profit from China’s BITs, see our article right here.

WTO agreements

Along with the bilateral agreements mentioned above, a number of Center Japanese nations are members of the WTO. This, by extension, implies that Hong Kong and these nations are social gathering to a number of multilateral commerce and funding agreements, which give extra safety for commerce and funding between the areas.

Center Japanese nations which can be WTO members embrace:

- Bahrain

- Egypt

- Israel

- Jordan

- Kuwait

- Oman

- Qatar

- Saudi Arabia

- UAE

- Yemen

Multilateral treaties beneath the WTO embrace:

- The Settlement on Commerce-Associated Features of Mental Property Rights (TRIPS), which requires WTO members to increase mental property (IP) rights to the IP homeowners in any member state or area. It features a most-favored-nation (MFN) clause, guaranteeing equal remedy for IP rights safety for all member nations and areas, and presents dispute decision and compensation mechanisms.

- Settlement on Commerce-Associated Funding Measures (TRIMs), which prohibits members from implementing funding measures which have the impact of limiting commerce with different members, corresponding to native content material necessities (necessities for a corporation to make use of locally-produced items or native providers with the intention to function available in the market).

- Common Settlement on Commerce in Companies (GATS), which ensures MFN standing to service suppliers of any WTO member (besides governmental providers corresponding to social safety schemes, public well being, training, and providers associated to air transport).

Hong Kong financial and commerce workplace in Dubai

Hong Kong has lately taken steps to deepen commerce and funding cooperation with the UAE by establishing its first financial and commerce workplace (ETO) in Dubai in October 2021. The ETO will search to advertise commerce and funding cooperation between Hong Kong and the Center East, specifically the Gulf Cooperation Council (GCC) member nations (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and UAE).

In response to the ETO, key sectors for cooperation embrace new and conventional vitality, good cities, transportation, logistics, fintech, biotech, and jewellery, amongst others. The ETO has additionally invited governments and firms within the GCC to “make use of the logistical, architectural, monetary, authorized, accounting, administration, and different skilled providers obtainable by Hong Kong enterprises to reap the social and financial advantages from this distinctive regional cooperation initiative”.

Dezan Shira & Affiliate’s Dubai Workplace opens in September 2022. We’ll help buyers all through the Center East in understanding and investing in markets in China, ASEAN, and India. For data on funding alternatives for Center Japanese firms in Hong Kong and assist with market entry, you may contact us at dubai@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The follow assists overseas buyers into China and has achieved so since 1992 by way of places of work in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at china@dezshira.com.

Dezan Shira & Associates has places of work in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, along with our commerce analysis amenities alongside the Belt & Highway Initiative. We even have companion companies aiding overseas buyers in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link