[ad_1]

Overview

A yr in the past, the COVID-19 pandemic and the following lockdowns had severely impacted the Nepali economic system, with the remittance sector amongst these affected. The detrimental steadiness of funds, declining alternate reserves, hovering inflation price, and different miserable macroeconomic indicators had additionally pushed the central financial institution of Nepal, Nepal Rastra Financial institution (NRB), to direct all banks and monetary establishments (BFIs) of the economic system to not problem letters of credit score (particularly for the import of non-essential objects like non-public automobiles) on 4 April 2022. Following this, the federal government additionally banned the import of 10 items, that it deemed non-essential or luxurious items, in a bid to cease the nation’s international reserves from additional depleting. The ban was anticipated to be in place till mid-July 2022 and was met with criticisms from the non-public sector in addition to different key stakeholders concerned in export-import companies.

Throughout mid-April 2022, when these insurance policies have been adopted by the Authorities of Nepal, the international alternate reserves had amounted to NPR 1.17 trillion (USD 9.14 billion) (a 16.5% lower from NPR 1.4 trillion in mid-July 2021) and the remittances had reached NPR 724.7 billion (USD 5.66 billion) (a 0.6% lower from NPR 729.2 billion (USD 5.69 billion) in mid-July 2021).

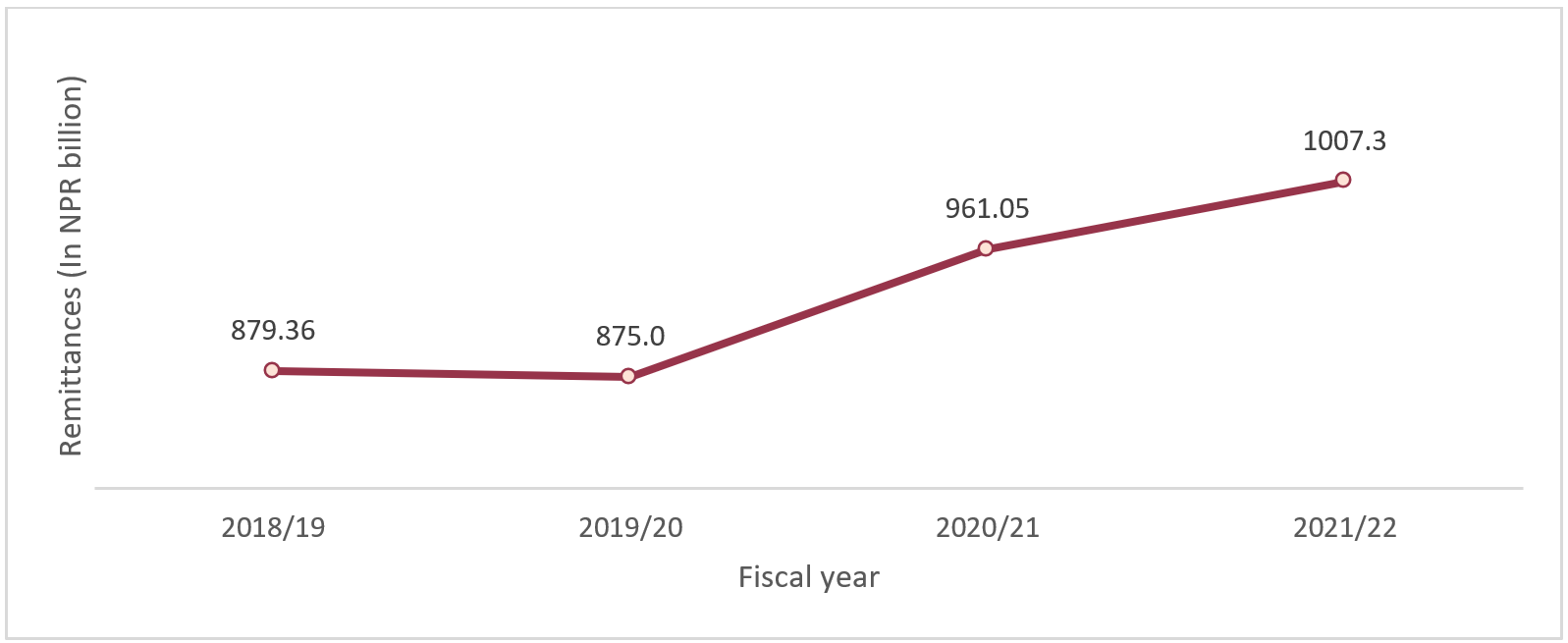

With the insurance policies carried out since April 2022, the international alternate reserves have been anticipated to deplete much more. The difficulty of depleting international alternate reserves may solely be eased if the influx of remittances would surge. Resulting from this purpose, the current 4.8% enhance in remittances to Nepal, which reached NPR 1.007 trillion (USD 8.33 billion) within the last months of the FY 2021/22 in comparison with NPR 961.05 billion (USD 7.51 billion) within the corresponding interval of the FY 2020/21, is encouraging and has supplied aid to the Nepali economic system.

Enhance within the influx of remittances to Nepal

The surge in remittances in FY 2021/22 is by a smaller share (4.8%), towards a 9.8% enhance in FY 2020/21. Regardless of this minimal enhance, the quantity reaching the vary of trillions is price notifying as it’s important and indicative of the gradual revival of the nation’s migration sector, which had seen a brief halt throughout the peak of COVID-19.

The remittance inflows to Nepal elevated from NPR 87.1 billion (USD 0.68 billion) to NPR 92.4 billion (USD 0.72 billion) from mid-Might to mid-June 2022 alone, which is a 6.12% enhance from the earlier month. A continued surge within the upcoming months can possible revive the nation’s revenue. Determine 1 depicts the annual development of remittance inflows to Nepal over the past 4 fiscal years.

Determine 1 Annual remittance inflows to Nepal in 4 consecutive FYs (in NPR billion)

Supply: Present Macroeconomic and Monetary Scenario of Nepal (ending mid-July 2022)

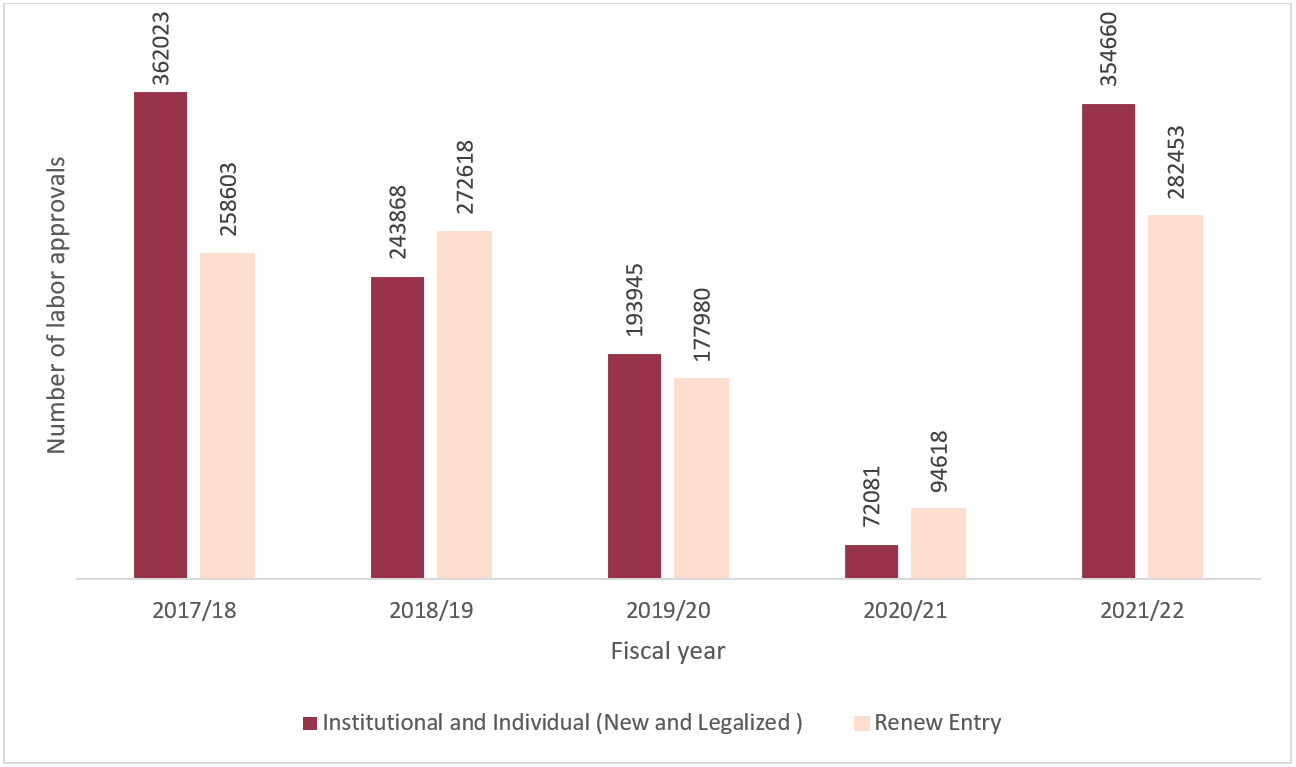

Encouragingly, the variety of Nepali staff, together with institutional and particular person (new and legalized) staff, taking approvals for international employment additionally elevated from 72,081 to 354,660 within the final month’s knowledge of the FY 2021/22 (ending mid-July 2022). The rise signifies a whopping 392% bounce from the earlier yr, majorly due to the comfort of lockdowns and COVID-19 restrictions. Moreover, growing employment alternatives with elevated salaries in locations similar to Malaysia, Qatar, India, and others additionally contributed to this constructive development. Likewise, the variety of Nepali staff in search of renewed entry approvals elevated by 198.5% to succeed in 282,453 in mid-July 2022, towards a lower of 46.8% within the earlier corresponding interval (Determine 2).

Determine 2 Annual variety of labor approvals within the final 5 FYs

Supply: Division of International Employment

As per the annual knowledge ending mid-July 2022, an growing variety of Nepali staff sought labor approvals for Saudi Arabia, Qatar, and United Arab Emirates (UAE) amongst many others. Desk 1 exhibits the highest 10 vacation spot international locations:

Desk 1 Prime 10 labor locations of Nepali migrant staff within the final three FYs (institutional and particular person – new and legalized)

| S.N. | Nation | 2019/20 | 2020/21 | 2021/22 |

| 1 | Saudi Arabia | 39279 | 23324 | 125374 |

| 2 | Qatar | 29835 | 22131 | 76822 |

| 3 | UAE | 52085 | 11611 | 53846 |

| 4 | Malaysia | 39167 | 106 | 25770 |

| 5 | Kuwait | 8974 | 2 | 22786 |

| 6 | Bahrain | 3305 | 3146 | 7592 |

| 7 | Romania | 1930 | 1954 | 6423 |

| 8 | South Korea* | 3542 | 16 | 4253 |

| 9 | Oman | 1996 | 1556 | 3627 |

| 10 | Cyprus | 1447 | 1003 | 3222 |

*Together with EPS

Supply: Division of International Employment

Nevertheless, India, which is unaccounted for within the official knowledge, stays one of many largest migration locations for Nepalis dwelling within the border areas of the neighboring nation.

Addressing limitations to remittance sector that stops financial growth

Regardless of these encouraging figures on the variety of remittances and migrants in search of employment overseas, the 2 elements proceed to be obstructed by limitations that stop remittances from aiding Nepal’s financial development.

One of the vital important limitations is the excessive value of sending remittances. As per an article revealed in 2018, the typical value of sending remittances to Nepal was 4.7% which was beneath the worldwide common of seven.1%. Likewise, the World Financial institution reported that the typical value stood at 4.54%, which was nonetheless effectively beneath the worldwide common.

Equally, the price of sending home remittances can be excessive in Nepal. Elaborating this, if an individual from Pokhara sends a remittance quantity of NPR 10,000 (USD 81.91) to an individual in one other a part of the nation, as an illustration – Butwal, the remit corporations cost at the least NPR 100 (USD 0.819). Contrastingly, the utmost cost in a financial institution switch quantities to solely NPR 8 (USD 0.065) by way of connectIPS, a cost platform.

Therefore, to handle this problem in home remittances, NRB has set a transaction restrict of as much as NPR 25,000 per day from earlier NPR 100,000 in home remittances, as of two March 2022. The objective of building this threshold was to discourage individuals from utilizing remittance intermediaries and to encourage them to ship cash through banking establishments or connectIPS, which can be formal and digital strategies. The aforementioned regulation, which narrows the size for home remittances, can be per the NRB’s coverage commitments to advertise higher monetary literacy and discourage the usage of remittance intermediaries on the nationwide degree, each of which have been talked about in its mid-term evaluate of Financial Coverage 2078/79.

Though, as of mid-July 2022, it has been reported that home remittances have elevated considerably because of the directive to set the brink restrict. Nevertheless, hundi/unlawful operators are nonetheless utilizing the F1 Gentle cost gateway to switch cash from international marketplaces, indicating the lingering presence and the grasp of casual channels that exist in Nepal, additional obstructing financial growth that’s achieved from remittances.

Means ahead

Even earlier than the pandemic, the remittance sector of the Nepali economic system was present process coverage hurdles. With the onset of the COVID-19 pandemic, the challenges have been exacerbated, indicating the necessity for a extra holistic method to addressing coverage challenges. Dialogues between the Embassy of Nepal in varied vacation spot international locations with the Chamber of Commerce and Industries of the respective vacation spot international locations in addition to with the commerce and funding boards must be inspired and instituted as a frequent occasion. By these applications, the formalization of the remittance channel will be promoted, a bigger inhabitants will be knowledgeable and made conscious, and alternatives for funding or employment will be explored.

When such avenues are recognized, ability growth applications geared toward supporting the skilling, re-skilling, and up-skilling of migrant staff will be focused and deliberate in collaboration with donor businesses, nationwide and worldwide organizations, the non-public sector, civil society teams, and different key stakeholder teams. The British Council-managed “Dakchyata: TVET Sensible Partnership” program of NPR 265.24 million, which is meant to be in operation for 10 months and serve at the least 1,500 returnee migrant staff, is among the most up-to-date examples of such ability growth applications. The Nepali economic system might profit, if the ability gaps are recognized and prioritized on this method.

Although the rise in remittance inflows, labor approvals, and wage will increase are commendable, they are going to solely give the Nepali economic system a brief respite. Except the limitations are eradicated, structural transformation can’t be achieved. Nepal’s exterior sector remains to be fragile and must be dealt with promptly. Given this, the Nepali economic system would undergo attributable to a shortsighted method to fixing a deep-rooted drawback. It’s vital to analyze and put into observe a extra sustainable coverage method with higher and extra environment friendly plans and insurance policies that may decrease the price of remittances, enhance the usage of formal channels, and strengthen productive investments within the nation.

[ad_2]

Source link