[ad_1]

Snap CEO Evan Spiegel introduced this morning that the corporate behind Snapchat will scale back its employees by 20% as a part of bigger restructuring.

Snap has struggled financially for months. In Could, Spiegel wrote in an inner memo that the corporate would miss its income targets for the second quarter of the yr. Certain sufficient, though income for the quarter was $1.11 billion, up 13% yr over yr, the corporate badly missed its earlier steerage of 20% to 25% development.

“Our forward-looking income visibility stays restricted, and our present year-over-year QTD income development of 8% is properly beneath what we had been anticipating earlier this yr,” Spiegel wrote in an organization memo, which was additionally posted on Snap’s web site. “For planning functions we have now modeled a variety of outcomes, a few of which assume that low income development continues into subsequent yr, and we have now constructed our 2023 plan to generate free money move even in a low development state of affairs.”

Laid off workers within the U.S. will obtain 4 months of compensation substitute, plus monetary help to enroll in COBRA, Snap says. The corporate will “tailor compensation and advantages to mirror native norms” for worldwide staff.

“We acknowledge that these modifications might have a very severe affect on group members counting on work authorizations to stay exterior their residence nation, and we are going to present these impacted group members further assist and adaptability to reduce disruption to their immigration standing,” Spiegel wrote.

Along with slicing jobs, Snap will attempt to mitigate prices by slowing manufacturing on Snap-funded originals, minis and video games, {hardware} and standalone apps Zenly and Voisey. Although Snap says it’s dedicated to creating Spectacles, its augmented actuality glasses, the corporate will not develop the Pixy drone.

Snap additionally promoted senior vp of engineering Jerry Hunter to Chief Working Officer to deal with development and income.

“We’re restructuring our enterprise to extend deal with our three strategic priorities: group development, income development, and augmented actuality,” Spiegel wrote.

In the previous couple of months, Snap has examined Snapchat+, a subscription service, to extend its income. The product offers subscribers early entry to new options and unique app icons, just like the Twitter Blue product. Inside a number of weeks, Snapchat+ introduced in $5 million in income by promoting $3.99 month-to-month subscriptions. That’s a drop within the bucket in comparison with the positive factors that Snap should make to turn out to be cash-flow constructive, however it’s a noticeable bounce — earlier than the subscription product, Snapchat’s in-app buy income fell within the five-figures.

Picture Credit: Snap

Because it stands, almost all of Snap’s income comes from promoting merchandise like Snap Adverts and AR Adverts, however a troublesome macroeconomic atmosphere has negatively impacted the success of those companies. In an investor replace posted in the present day, Snap cited Snapchat+, Highlight and Snap Map as new income sources within the medium time period — in the long run, Snap’s plan is to turn out to be a frontrunner in augmented actuality.

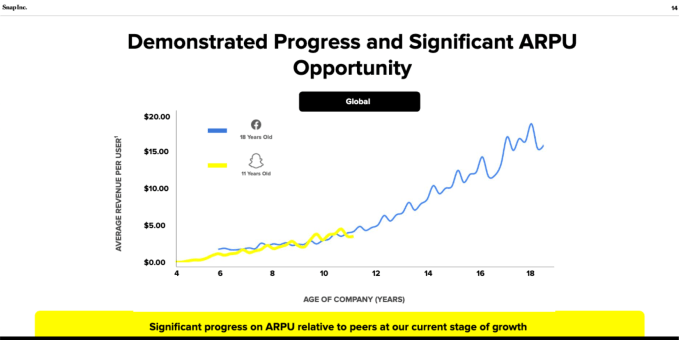

To reassure buyers, Snap in contrast its trajectory to Meta, a competitor that’s seven years older. Snap’s common income per consumer seems to observe an identical trajectory to Fb’s, however Fb’s consumer numbers grew far quicker. In 2015, eleven years after Fb’s founding, the corporate boasted over 1 billion each day energetic customers (DAUs). In the identical time-frame, Snapchat amassed 347 million DAUs.

A vivid spot for Snap, although, is that its merchandise are persevering with to develop. Even when its income is falling brief, its DAUs jumped 18% yr over yr, whereas Meta merchandise have largely stagnated in development.

[ad_2]

Source link