[ad_1]

The telecommunications business is a key driver behind Vietnam’s digital transformation. Telecommunications and different sectors within the data and communications expertise (ICT) sector generated as much as 8.2 % of Vietnam’s GDP in 2021. Because the nation strikes to implement the fourth industrial revolution, the telecommunications business will play a significant position within the course of.

The Vietnam telecommunication market dimension was value US$6.3 billion in worth in 2021, with a CAGR forecast of roughly 1 % for the 2021-2027 interval. The business is about to scale additional up because the digital transformation of companies coupled with the pandemic has boosted hovering demand for web and telecommunication providers.

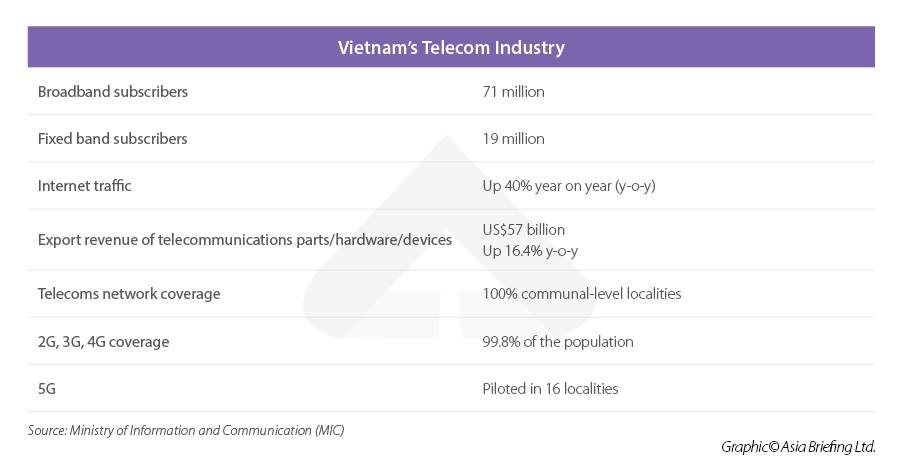

In 2021, 71 million cellular broadband subscribers and practically 19 million mounted band subscribers had been recorded, up by 4 % and 14.6 % respectively 12 months on 12 months. In the meantime, a rise of 20 % within the proportion of companies using the Web of Issues (IoT) was additionally reported in 2021, reaching 88.67 %.

The general efficiency of the telecommunications business in Vietnam in 2021 might be noticed within the following desk.

The authorized framework governing the telecommunications business has been up to date to advertise the digital transformation of Vietnam. In January 2022, the Ministry of Data and Communications (MIC) up to date Directive No.01/CT-BTTTT on the event technique of the ICT business, with particular targets for the telecom sector, for the 2022-2025 interval.

The 2022-2025 aim of the telecommunications business is as follows:

|

Annual aim |

2022 |

2023 |

2024 |

2025 |

|

Whole income of the telecoms business |

US$19.3 billion |

US$21 billion |

US$22.9 billion |

US$25 billion |

|

Contribution to GDP |

4.9% |

5% |

5.1% |

5.2% |

|

5G protection (% of the inhabitants) |

8% |

14% |

20% |

25% |

|

The speed of households with fiber optics |

75% |

84% |

93% |

100% |

|

Cellular broadband subscribers (on 100 individuals) |

85 |

90 |

95 |

100 |

|

Web customers (% of the inhabitants) |

74% |

76% |

78% |

80% |

|

IPv6 customers (% of the inhabitants) |

52% |

57% |

65% |

70-80% |

The Nationwide Meeting has additionally accepted the revised Regulation on Telecommunications and included it within the Regulation and Ordinance Growth Program in Decision No. 50/2022QH15.

The excellent news is, in keeping with the consultant of the Vietnam Web Middle, by June 2022, the speed of IPv6 had already reached 50%, attaining 96% of the aim as acknowledged within the desk. This has thus made Vietnam the nation with the second highest IPv6 consumer fee within the ASEAN area and tenth worldwide.

Present competitors within the telecommunications business

Viettel Group, MobiFone, FPT, and VNPT are the present giants in Vietnam’s telecoms business.

Since 2017 – the height 12 months in income for all telecoms gamers, solely Viettel Group confirmed regular income progress. In 2021, the group generated VND 21.4 trillion (US$913 million), in comparison with a low of VND 4.3 trillion in 2017 (US$183 million). In the meantime, MobiFone witnessed a fall from VND 940 billion (US$41 million) in 2017 to VND 710 billion (US$30 million) in 2021. The identical sample utilized to the income of FPT because the company’s consolidated income peaked in 2017 at VND 42 trillion (US$1.7 billion) earlier than dropping to VND 35 trillion (US$1.4 billion) in 2021.

This drop was attributed to the truth that conventional sectors within the telecommunications business in Vietnam are shrinking, making manner for brand new sectors. Viettel, alternatively, foresaw the transition within the telecoms business and was fast to regulate to the altering business, which defined its income progress.

Lately, in April 2022, Viettel put in an undersea cable known as the Asia Direct Cable (ADC) in Quy Nhon Metropolis, which can be in industrial use by 2023 to speed up web connection.

Different telecom giants are additionally getting ready to step up their operations within the period of digital transformation.

Alternatives and entry obstacles for international traders

As a consequence of excessive entry obstacles, the telecoms business in Vietnam is at the moment dominated by home gamers like FPT, NetNam, Viettel, and CMC, although CMC has 45 % of shares owned by a Malaysian agency.

The Vietnamese authorities solely permits international funding within the telecoms business within the type of:

- Joint ventures, partnerships, or shopping for shares for primary telecommunications providers;

- Buy of shares, partnerships, joint ventures with telecommunications enterprises in Vietnam which have been licensed to ascertain a community infrastructure for providers with community infrastructure

Any group or person that already owns greater than 20 % of the constitution capital of a telecoms enterprise will not be entitled to personal greater than 20 % of the constitution capital of one other enterprise in the identical section.

Nevertheless, international traders are allowed to come clean with 100% of the undersea fiber optic cable transmission capability ashore on the fiber optic cable station in Vietnam and might promote that capability to any licensed telecommunications community operator in Vietnam.

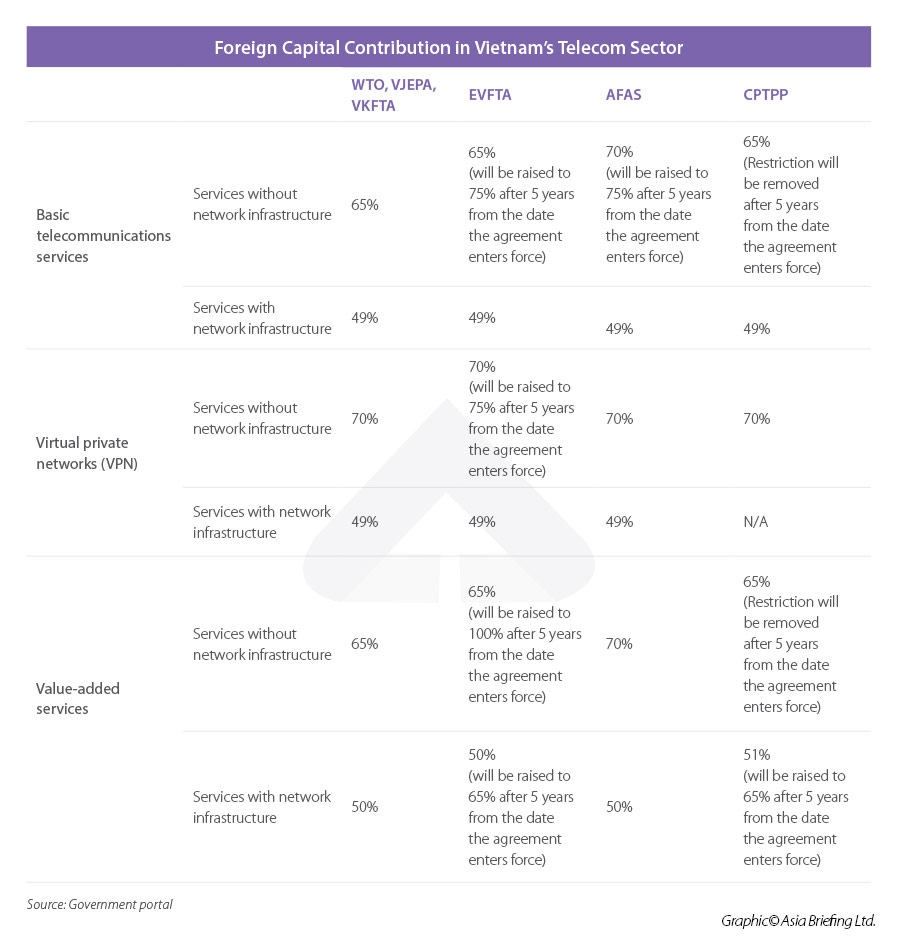

The desk offers the utmost share of international capital contribution allowed within the telecoms business:

Incentives for telecoms corporations

In December 2020, the federal government issued Determination No. 38/2020/QD-TTg, approving the listing of excessive applied sciences and merchandise eligible for incentive insurance policies. The telecom business enjoys incentives for the next segments:

- Superior community expertise together with 4G, 5G, 6G, NG-PON, SDN/NFV, SD-RAN, SD-WAN, LPWAN, IO-Hyperlink Wi-fi, Community slicing, next-generation optical community;

- The Web of Issues (IoT) expertise;

- Built-in programs of telecommunications;

- Tools, software program, modules, platforms, IoT integration options, and IoT platform providers;

- New-generation sign encoding and decoding tools; tools for encapsulating and transmitting indicators on the Web platform, by way of next-generation telecommunications networks (4G, 5G, 6G); hybrid tv tools and programs (HbbTV), interactive tv; and

- Working programs for specialised computer systems and a brand new technology of cellular units.

It must be famous that applied sciences which are at the moment not included within the listing however meet the necessities in clause 3 Article 5, clause 1 Article 6 of the Regulation on Excessive Applied sciences and are important to socio-economic improvement, can search a choice from the Prime Minister by way of the Ministry of Science and Know-how.

Segments included in Determination 38 which are eligible for the next incentives as acknowledged in Determination No. 13/2019/ND-CP:

- Land rental discount or exemption for as much as 15 years. In prioritized initiatives, the exemption might be for an indefinite time;

- Company Earnings Tax (CIT) exemption for as much as 4 years, adopted by 9 years of fifty % CIT discount;

- Preferential tax fee of 10 % inside 15 years, which might be prolonged for one more 15 years relying on the choice of the Prime Minister or the Administration Board of high-tech parks;

- Import obligation exemption for imported items, uncooked supplies, provides, and parts that haven’t been produced domestically inside 5 years;

- Can apply for monetary help from the Nationwide Hello-tech Growth Program’s funding and different governmental funding;

- Preferential credit score phrases for sure science and expertise enterprises; and

- Exemption from expenses to be used of machines and tools in nationwide laboratories for analysis and trial manufacturing.

Takeaways

Within the context of digital transformation, the telecommunications business in Vietnam is seeing main transitions and competitors. With the issuance of Determination 38 and the implementation of various commerce agreements, Vietnam’s telecoms business is wanting extra enticing for companies. Buyers ought to look to channel funding into this dynamic market to take pleasure in preferential insurance policies and a good enterprise surroundings.

For extra data on how greatest to faucet into the rising telecoms business in Vietnam, traders can contact our consultants to debate market entry and options for entry obstacles.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The agency assists international traders all through Asia from places of work internationally, together with in Hanoi, Ho Chi Minh Metropolis, and Da Nang. Readers could write to vietnam@dezshira.com for extra help on doing enterprise in Vietnam.

We additionally preserve places of work or have alliance companions helping international traders in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, along with practices in Bangladesh and Russia.

[ad_2]

Source link