[ad_1]

ASTANA – The ultimate determination on the Digital Tenge undertaking has not but been made, however is anticipated to be introduced by the top of 2022, the undertaking’s head Ainur Kenzhayeva mentioned in an interview with The Astana Occasions.

Ainur Kenzhayeva leads the Digital Tenge undertaking.

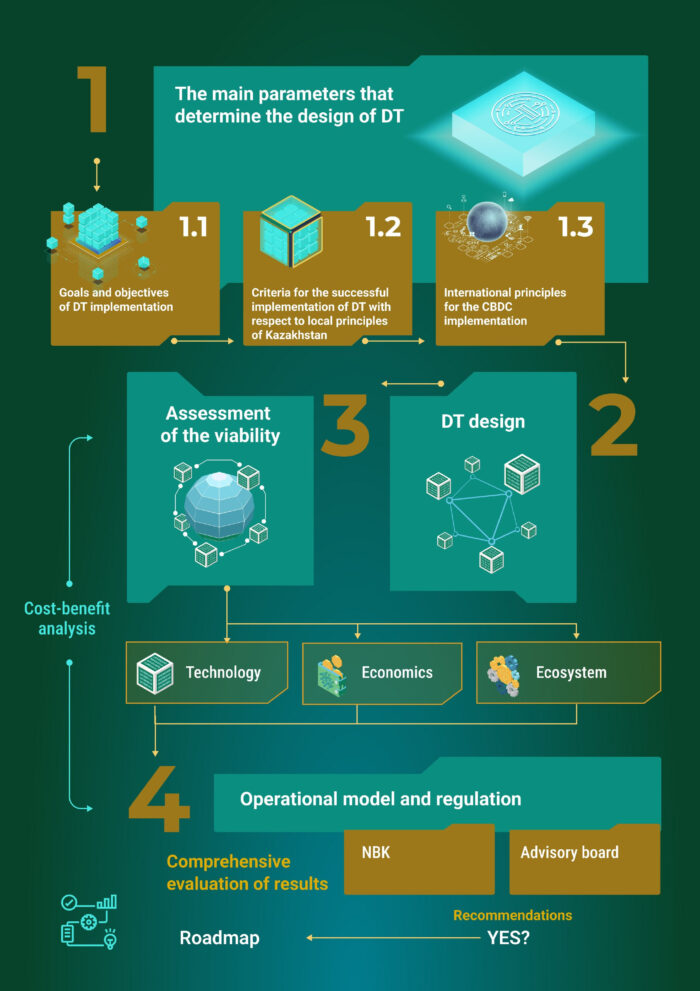

The undertaking, which the Nationwide Financial institution of Kazakhstan has been engaged on with monetary market individuals, the skilled neighborhood, and worldwide companions since 2021, requires a complete evaluation and examine of all potential advantages and dangers for enterprise individuals, in addition to by way of financial coverage and monetary stability.

“This 12 months, we’re working with the market individuals to broaden the technological prototype of the platform and conduct quantitative, financial analysis, and evaluation of regulatory features. All stakeholders are invited to take part on this work,” mentioned Kenzhayeva.

The workforce is working now to broaden the platform’s performance. A pilot undertaking with the participation of actual customers in a restricted loop can also be deliberate for this fall.

What’s the Digital Tenge?

Over the previous few years, Kazakhstan has seen an incredible improve in using digital applied sciences, largely pushed by the pandemic. Of their 2021 report, the Affiliation of Financiers of Kazakhstan point out that the amount of non-cash transactions in 2021 reached a staggering 72.3 trillion tenge (US$154.3 billion) and 19.1 trillion tenge (US$40.8 billion) within the first quarter of 2022.

In the course of a fast transformation from a money to a cashless society, Kenzhayeva famous the rising demand for the safety of the fee infrastructure.

“Central financial institution digital currencies can clear up present challenges by growing safety and neutrality in new digital funds, monetary inclusion, innovation, and system openness. Central banks exist to guard a rustic’s financial and monetary stability. They’re a device to realize these targets,” she mentioned.

Kazakhstan, in actual fact, is just not the primary nation to think about introducing a digital foreign money. In accordance with the Atlantic Council tracker, no less than 112 international locations around the globe are at various levels of exploring or launching a digital foreign money.

Kenzhayeva defined that digital foreign money is a “necessity of the time.”

“The digital tenge undertaking goals to develop and modernize Kazakhstan’s nationwide fee system to offer secure entry to cheap, quick, handy, and safe funds for each citizen. The introduction of digital tenge is a requirement of the occasions: throughout the pandemic, the event of non-banking platforms accelerated and the potential dangers of the affect of personal initiatives on the nation’s financial sovereignty elevated,” she mentioned.

She additionally famous that the digital tenge is designed to broaden monetary inclusion and to democratize entry to the digital fee ecosystem.

“Kazakhstan has a excessive proportion of the inhabitants which have both no or little entry to banking providers. As a substitute for money, the digital tenge will present a protected and handy approach to retailer and use cash, whereas offering entry to fashionable monetary providers,” she mentioned.

How does it work?

Technologically, the digital tenge pilot features on an open-source distributed registry platform.

“This strategy supplies a chance to difficulty digital tenge within the format of so-called tokens. Tokens can be saved within the digital wallets of shoppers, which they will entry by way of the channels of economic market individuals, like second-tier banks, and fee organizations,” mentioned Kenzhayeva.

Shoppers will be capable of pay with digital tokens by analogy with the present technique of fee by way of contactless playing cards or QR codes. They may even be capable of pay with out an web connection.

If launched, digital foreign money can be used together with money or non-cash cash. It is going to be issued solely by the Nationwide Financial institution of Kazakhstan, which supplies a assure that the cash is protected.

“By comparability, digital cash is issued and traded inside a selected e-money system and is the duty of the proprietor of the system, whereas stablecoins and cryptocurrencies, whereas related of their technological approaches, can not carry out all of the features of cash as a method of circulation, accumulation, and fee, in addition to a measure of worth. They lack a single issuer that might assure the safety of holders’ pursuits, and their worth is topic to fluctuations,” mentioned Kenzhayeva.

What are the dangers?

Talking of dangers, Kenzhayeva famous the so-called “digital escape,” implying the dangers of the outflow of funds from industrial banks because of the potential benefits of digital foreign money. “The benefits are the potential of curiosity accrual, a excessive stage of liquidity because of the feasibility of funds in offline mode, with out entry to the web, and the safety of belongings by the Nationwide Financial institution, not second-tier banks,” mentioned Kenzhayeva.

Potential dangers and benefits will change into extra evident, as soon as the macro and microeconomic research of the affect of the digital tenge on the nation’s economic system and monetary stability can be accomplished.

[ad_2]

Source link