[ad_1]

Efficient regulation should strike a fragile steadiness between encouraging innovation whereas on the similar time discouraging extreme risk-taking. If regulation is simply too strict, it could stifle progress; if regulation is simply too lenient, it could fail to stop fraud that may threaten the steadiness of the financial and monetary system. In resolving this trade-off, China depends closely on versatile implicit rules that complement express guidelines. This reliance on implicit rules typically creates ambiguity, which the Chinese language enterprise tradition is kind of snug with. This ambiguity is just not equal to breaking the regulation, nevertheless. Quite the opposite, it helps the companies and the federal government navigate a fast-paced setting during which the issuance of formal guidelines can’t presumably meet up with the quickly altering panorama.

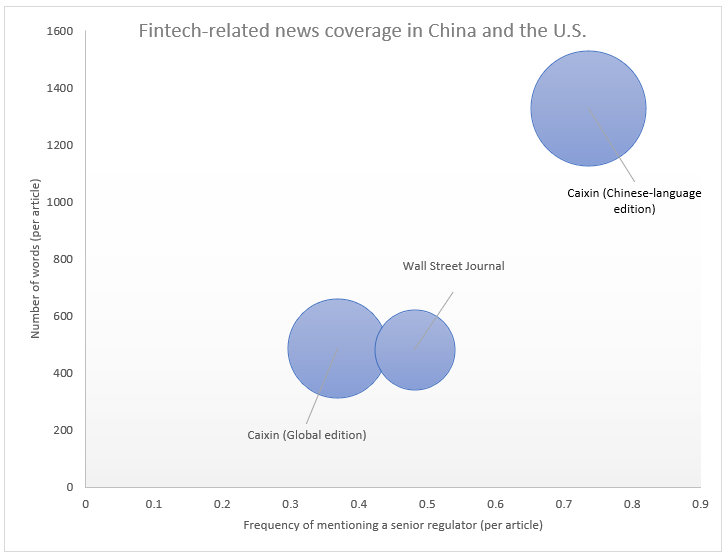

Implicit rules are norms that haven’t been codified into formal guidelines however that nonetheless present steerage for acceptable conduct. In China, such implicit rules are sometimes expressed as opinions of senior authorities officers. These opinions are featured far more closely in Chinese language information shops in comparison with their Western counterparts. For instance, a comparability of fintech-related information between main Chinese language and U.S. information shops exhibits that Chinese language-language media are much more prone to point out a senior authorities official than information items written for a Western viewers. Strikingly, these variations by way of protection exist even between media shops owned by the identical writer however concentrating on completely different audiences (reminiscent of Caixin’s Chinese language-language and English-language editions). These variations in enterprise information protection replicate the significance of implicit rules in China.

This determine compares the protection of fintech-related enterprise information in English-language and Chinese language-language media shops. The vertical axis exhibits the typical variety of phrases per article, whereas the horizontal axis exhibits the typical variety of instances {that a} senior regulator is talked about in an article. The dimensions of the circles signifies the variety of articles that point out the time period “fintech.”

Implicit rules have the benefit of being versatile, which allows the federal government to reply rapidly to quickly altering circumstances. Flexibility, nevertheless, could result in arbitrariness, which, in flip, can sabotage the very goal of regulation as a algorithm that everybody should comply with. There are no less than two elements that preserve the arbitrariness of China’s implicit rules in examine. First, the energy of the Chinese language authorities mixed with its overarching deal with financial prosperity retains the incentives of particular person regulatory entities in examine. Second, China’s lengthy authorized historical past has carved out a job for implicit rules whereas on the similar time sustaining the supremacy of written guidelines.

As a result of Chinese language regulators by and enormous try to advertise financial development, the interaction between China’s implicit and express rules follows a predictable sample. Initially, innovation (together with monetary innovation) is usually allowed to develop with few if any express guidelines. If and when indicators of misbehavior seem, regulators step in by offering implicit steerage relatively than issuing express guidelines. If implicit steerage is inadequate to rein within the excesses that authorities officers are involved about, express (and sometimes strict) rules comply with.

When express rules are enacted, they create a flurry of latest guidelines. Whereas these guidelines could appear arbitrary to an outdoor observer, they merely codify the implicit (and subsequently publicly unobserved) steerage that preceded them.

A current instance of this regulatory cycle is the evolution of Chinese language peer-to-peer (P2P) lending. P2P shops appeared in China in 2007, nevertheless it was not till 2014 that the very first express regulation concentrating on this trade was issued. Initially, senior Chinese language officers expressed optimistic views in regards to the trade. On November 9, 2015, for instance, China’s President Xi Jinping delivered a speech calling for the event of inclusive finance. As P2P’s development accelerated, indicators of fraud appeared and defaults proliferated. The federal government, nevertheless, didn’t outlaw P2P outright. As a substitute, it began sending robust indicators that monetary misbehavior and fraud ought to stop. In a marked shift within the authorities’s place, Xi referred to as out some particular P2P lenders by identify (E-zubao and Zhongjin) stating that they engaged in fraudulent actions that should cease. Ultimately, the federal government issued a spread of express guidelines in 2019, which successfully shut down the P2P trade in China.

The historical past of P2P lending holds classes in regards to the logic of Chinese language regulation extra typically. First, due to a considerable implicit element, China’s rules could shift fairly quickly. Second, formal express guidelines usually comply with authorities officers’ implicit steerage, however such express guidelines are exhausting to reverse as soon as instituted. Third, China’s skill to make use of implicit rules depends on state energy, which, if needed, can remodel or shut down complete industries (as was certainly the case with P2P lending). This logic is relevant not solely to P2P lending but additionally to different fast-paced sectors reminiscent of e-commerce, AI, and bio-medical industries.

How can Western enterprise leaders adapt to China’s distinctive regulatory setting? First, they should turn out to be snug with ambiguity, which in China creates house for innovation and permits companies to experiment. Second, enterprise leaders should pay shut consideration to the spirit of the regulation and never simply to its letter. One supply of details about the regulation’s spirit are official pronouncements by authorities leaders. Third, in no circumstance ought to companies disobey the written guidelines: Ambiguity in China is just not an invite to interrupt the regulation.

[ad_2]

Source link