[ad_1]

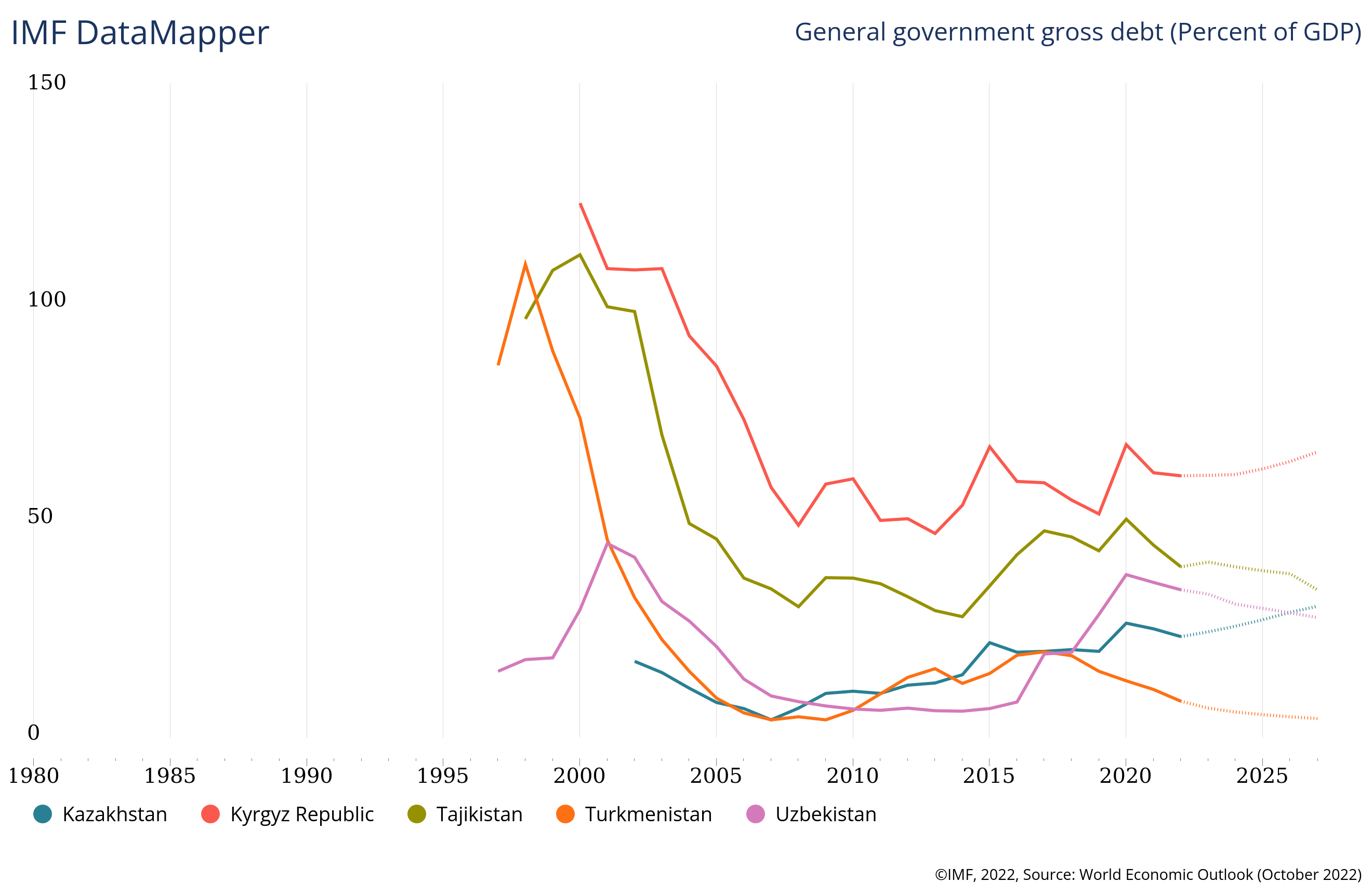

China maintains shut commerce and financial ties with the nations of the previous Soviet Union, together with the supply of concessional loans. To place this into context, it’s important to know the general scenario concerning the sovereign money owed of those nations, together with the outlook for the approaching years. Determine 1 reveals how sovereign debt as a ratio of GDP has developed for the reason that mid-Nineteen Nineties, together with a forecast till 2027, for the Central Asian republics.

Within the Nineteen Nineties, nearly all the previous Soviet republics have been compelled to take loans from worldwide improvement establishments such because the World Financial institution and the Worldwide Financial Fund (IMF). Some issued sovereign debt, akin to authorities bonds. In just a few nations, sovereign debt enormously exceeded sustainable ranges.

For instance, sovereign debt exceeded 125 % of GDP in Kyrgyzstan in 2000, and 110 % of GDP in Tajikistan in the identical yr. Merely put, within the Nineteen Nineties these nations couldn’t independently preserve the steadiness of funds and stability in socioeconomic improvement. On this regard, by making use of to the Paris Membership of creditor nations, Kyrgyzstan achieved a partial write-off and restructuring of its sovereign money owed in March 2005.

However much more surprisingly, within the late Nineteen Nineties sovereign debt exceeded 110 % of GDP in Turkmenistan and Russia, each of which have been heavy exporters of hydrocarbons. In August 1998, Russia needed to default on servicing its home public debt, which undermined its status within the capital markets for a very long time.

From the chart above, nevertheless, one can see that from the early 2000s, there was a wholesome and sharp drop in sovereign debt-to-GDP ratios throughout Central Asia, which was related to the speedy financial development and the competent administration of sovereign debt of those nations. Regardless of the non-sustainable stage of debt within the early 2000s, apart from Kyrgyzstan, not one of the Central Asian nations approached collectors with a request to restructure debt.

An try by the federal government of Kyrgyzstan to restructure debt but once more beneath the IMF and World Financial institution’s Extremely Indebted Poor International locations (HIPC) initiative even led to mass demonstrations in Bishkek in 2006, demanding the federal government withdraw from this system. Individuals didn’t need the nation to be on the checklist of hopeless jurisdictions that might not pay their money owed. Aware of this response, the Kyrgyz authorities launched a legislative norm beneath which the sovereign debt-to-GDP ratio shouldn’t exceed 60 %, which is consistent with IMF suggestions.

The construction of exterior loans in Central Asian nations varies significantly. The construction of sovereign debt of Kyrgyzstan and Tajikistan, each low-income nations, is dominated by obligations to worldwide monetary establishments as they provide concessional financing. They supplied 40 and 36 % of the overall mortgage portfolio for Kyrgyzstan and Tajikistan, respectively.

That mentioned, China stays the first supply of credit score within the area, offering loans with a preferential charge of round 2 %. Its share within the exterior debt of Kyrgyzstan and Tajikistan in 2020 was 45 and 52 %, respectively, the equal of greater than 20 % of their GDP. Nevertheless, Kyrgyzstan and Tajikistan’s debt to China has stabilized over the previous few years and even begun to say no.

Kyrgyzstan and Tajikistan are particularly reliant on exterior debt; such obligations which make up 77 and 86 % of their whole debt, respectively. The scenario is completely different in nations wealthy in pure assets. Loans from China account for 16-17 % of the GDP of Turkmenistan and Uzbekistan. Compared, Kazakhstan’s determine is the bottom at 6.5 %.

It’s nonetheless extra profitable to draw funds on worldwide markets. Lately, the federal government of Uzbekistan has additionally begun to draw exterior loans. Based on its Central Financial institution, the nation’s whole exterior debt as of July 1, 2020, reached $27.6 billion, and in comparison with the start of 2020, the amount elevated by 12.7 %. Turkmenistan at present refrains from attracting exterior loans, apart from Chinese language ones. Not like Kyrgyzstan and Tajikistan, Kazakhstan primarily attracts financing from personal buyers in international markets. Its main buyers are the USA, Russia, Switzerland, and China.

Apparently, in September 2017, Tajikistan raised $500 million from its first sovereign 10-year worldwide bonds for the primary time, at a coupon charge of seven.125 %. The deal was designed to finance the development of the Rogun HPP for the reason that nation was unable to draw loans from worldwide monetary establishments for these functions.

All post-Soviet nations count on accelerated financial development within the coming years. Appropriate or faulty administration of public funds can both speed up or decelerate such a course of. All of the recipients and their donors ought to pay particular consideration to this drawback.

[ad_2]

Source link