[ad_1]

Lately, with the continual enchancment of China’s data know-how sector and rising emphasis on information safety, the home cybersecurity market has quickly matured. There are numerous enterprises offering community safety merchandise, with completely different fashions, fierce market competitors, and low focus.

The evolution of cybersecurity presents quite a few alternatives for companies and organizations. Lately, China has expanded its cybersecurity capabilities attributable to considerations concerning the safety of its nationwide information and the necessity for extra private data safety within the digital economic system. On this article, we analyze the most recent developments in China’s cybersecurity business and study the market alternatives for international buyers.

China’s cybersecurity market at a look

In 2021, the dimensions of China’s cybersecurity market reached RMB 62.7 billion (US$8.64 billion), a rise of RMB 9.5 billion (US$1.3 billion), or 17 p.c, in comparison with 2020. Certainly, the nation’s cybersecurity market has entered a interval of fast growth, primarily pushed by two elements: coverage compliance and industrial upgrading. Notably, community safety providers have change into the fastest-growing monitor available in the market with enterprises allocating a better price range of their safety spending on cybersecurity providers.

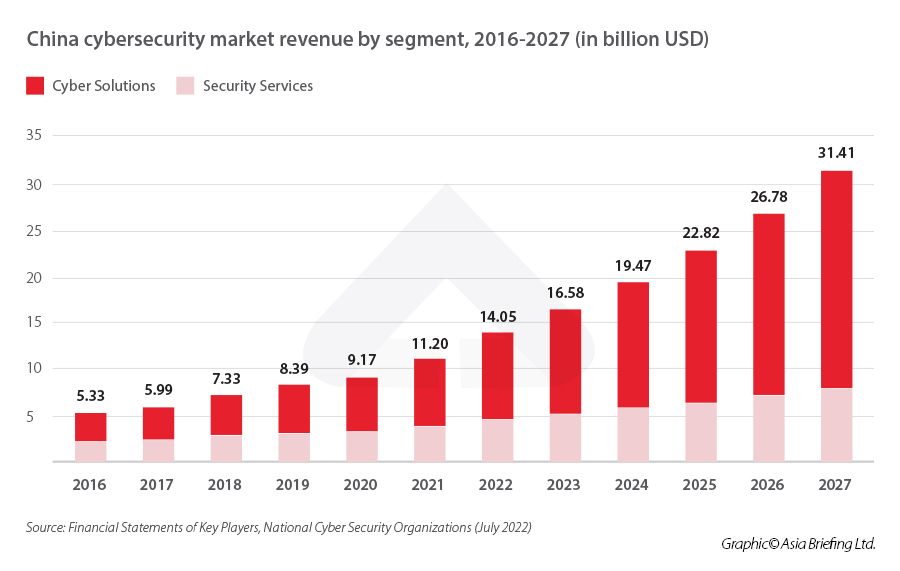

In 2022, China’s cybersecurity market income will attain US$14.05 billion, with cyber options representing the biggest market phase with a complete quantity of US$9.42 billion.

In a 2021 draft of its most complete coverage plan for the cybersecurity business in China, the Ministry of Business and Info Know-how (MIIT) mandated that important industries like telecommunications allocate 10 p.c of their IT improve price range to cybersecurity by 2023.

The Chinese language authorities anticipates the cybersecurity business to be valued at greater than RMB 250 billion (US$38.6 billion) by the identical 12 months. To realize this, Beijing is encouraging the event of accelerating demand for items and applied sciences resembling information safety monitoring and synthetic intelligence-powered (AI) menace detection.

Because of this, by 2027, the Chinese language cybersecurity market is anticipated to develop at a compound annual progress price (CAGR) of about 12.4 p.c.

Elements behind the rising demand for cybersecurity

Within the digital age, Chinese language corporations are liable for an ever-increasing variety of data and information transactions. These companies are presently the primary targets of cyberattacks, and due to organizational system weaknesses, crucial information ceaselessly leaks. Web customers in China have skilled monetary losses of as much as RMB 91.5 billion (US$12.62 billion) between 2016 and 2017 attributable to private data leakage, fraud, spam e-mail, and different related points.

One other issue is the speed of enlargement of Web protection and pace. The Broadband China Challenge, which goals to ship entry to managed high-speed broadband networks to 95 p.c of the city inhabitants, is an instance of this. Moreover, China’s State Council has plans to take a position US$22 billion in increasing broadband community infrastructure in rural areas of the nation. This funding focuses on offering improved web providers to roughly 30 million households and covers about 50,000 villages.

Lastly, China has a excessive variety of smartphone customers. These smartphones make the most of varied purposes that accumulate delicate private information: apps for processing on-line transactions and social networks make the Web a extremely weak place exposing customers’ information to cyberattacks.

Cybersecurity instruments are thus important in managing and safeguarding such particular person and enterprise publicity on-line, thereby propelling the demand for cybersecurity merchandise in China.

Cloud-based options improve the vulnerability of the system

Companies are conscious of the advantages of saving cash and assets by shifting their information to the cloud relatively than creating and sustaining new information storage, which is what’s driving the demand for cloud-based options and subsequent progress in using on-demand safety providers.

These advantages encourage massive firms and small and medium-sized enterprises (SMEs) in China to undertake cloud-based options extra ceaselessly. Within the upcoming years, it’s projected that cloud platforms and ecosystems will function the catalyst for a fast enhance within the quantity and scope of digital innovation.

In 2021, 143,319 data system vulnerabilities have been documented by the MIIT information-sharing portal for cybersecurity threats and vulnerabilities. 86,217 of those have been categorized as “medium danger” and 40,498 as “excessive danger”.

On the similar time, 753,018 distributed denial-of-service (DDoS) assaults have been reported by China Telecom, China Cellular, and China Unicom in 2021, a 43.9 p.c drop from 2020. The variety of cybersecurity threats and vulnerabilities reported to the MIIT portal as of 2021 was 88,799, down 60.9 p.c from the identical interval in 2020.

In December 2021, the MIIT discontinued its partnership with Alibaba’s cloud unit and a number of other different information-sharing platforms over cyber-security threats. Such measures display Beijing’s dedication to tighten management over important information and cyberinfrastructure for nationwide safety. China’s state-owned enterprises (SOEs) have been additionally required to switch their information from personal operators.

Enhance in cybersecurity incidents

Cybersecurity incidents have sharply elevated in China due to the rising organizational adoption of digitization and using associated know-how as a part of enterprise operations. Powered by 5G networks, Chinese language gadgets at the moment are extra interconnected than ever.

In accordance with the China Web Community Info Middle (CNNIC), as of December 2021, web customers reported not having skilled cybersecurity issues in 62 p.c of instances – a determine that remained in line with December 2020.

Moreover, the speed of non-public data leakage amongst Web customers was the best at 22.1 p.c; Web fraud affected 16.6 p.c of customers; 9.1 p.c of customers reported having their gadgets contaminated with viruses, and 6.6 p.c of them reported having their accounts or passwords stolen.

China’s regulation of cybersecurity

Cybersecurity in China is quick turning into synonymous with nationwide safety and state sovereignty. To shorten the hole with worldwide counterparts within the US and the EU and enhance the nation’s total safety and protection capabilities, the Chinese language authorities has launched a number of regulatory measures to emphasise community safety.

Beijing’s three-year cybersecurity plan doubles as a cyber protection technique that goals to fortify its digital belongings as a part of its drive for a resilient digital economic system.

The nationwide 14th 5-12 months Plan proposes to strengthen cyber safety assure methods and capability constructing, information assets, in addition to networks and knowledge methods in important sectors.

To concentrate on community and information safety in China, the federal government enacted the nation’s first Cybersecurity Legislation in 2016, which then turned efficient in 2017. To make the regulation in line with the varied laws launched in its aftermath, a number of amendments to the Cybersecurity Legislation have been launched in September 2022. The regulation now covers the next:

- Community operators should adjust to primary information safety and cybersecurity necessities, such because the Multi-Stage Safety Scheme (MLPS) requirements.

- It gives operators of crucial data infrastructure (CII) a framework for regulation.

- It gives pre-sale certification requirements for important community gear and community safety items. It creates a cybersecurity evaluation course of for community services and products that would endanger China’s nationwide safety.

- It specifies necessities to safeguard information gathered throughout community operations.

- It units a broad vary of penalties and fines for companies that don’t comply.

Since 2021, the federal government has applied different cybersecurity and information safety laws, together with the Information Safety Legislation, the Private Info Safety Legislation, the Community Safety Evaluation Measures, and the Key Info Infrastructure Safety Safety Laws.

Market composition

The cybersecurity market in China has a large margin of progress. As companies change into extra aware of the significance of cybersecurity, gamers available in the market are implementing a wide range of methods, resembling collaboration, investments, and new product introductions.

The Chinese language cybersecurity market may be segmented primarily based on the kind of merchandise provided, the best way of deployment (cloud and on-premises), and remaining customers – banking, monetary providers, insurance coverage, healthcare, manufacturing, authorities and protection, and IT and telecommunication.

Though China’s cybersecurity market continues to be comparatively decentralized, business focus retains enhancing. With the upgrading of community data know-how, in view of the more and more advanced community setting and precise wants, cyber safety know-how is turning into extra diversified, customized, and evolving clever capability, which places ahead increased necessities for product analysis and growth of community safety enterprises. Community safety suppliers at the moment are collaborating with producers with sure technical strengths and model consciousness, bringing a couple of increased market focus.

Though the Chinese language market composition could be very fragmented, a number of key gamers have steadily emerged. In November 2021, Palo Alto Networks launched its next-generation Cloud Entry Safety Dealer (CASB), which employs machine studying (ML) to extend the safety of collaboration and SaaS purposes. To supply capabilities like automated software discovery and improved information loss safety for delicate information, the corporate claims that its next-generation CASB platform makes use of ML and AI.

A brand new era community safety evaluation and administration platform have been launched in July 2021 by Chaitin Future Know-how Co Ltd, an Aliyun-affiliated supplier of community safety options, to fight community threats within the modern interval. The platform evaluations the companies’ safety scenario and helps them understand unified information evaluation, information processing, and safe operation standardization and automation.

ThreatBook, a Beijing-based supplier of safety menace intelligence, disclosed in March 2022 {that a} spherical of fundraising totaling over RMB 300 million (US$41.39 million) had been efficiently concluded. One other stakeholder, Star Street Ventures, assisted CDH Funding in finishing a transaction of over RMB 800 million (US$110 million). After this spherical of funding, ThreatBook plans to proceed rising its funding in product R&D, market enlargement, and aiding enterprise prospects in modernizing their safety operations in China.

Revolutionary gamers and merchandise

Under are among the hottest and cutting-edge cybersecurity corporations headquartered in China in accordance with Cybersecurity Ventures (2020):

- Antiy Labs: Beijing-based Antiy Labs is the creator of the next-generation antivirus engine. A prime vendor providing the best-in-class antivirus engine and cutting-edge antivirus providers to fight PC malware and cell malware, with six analysis facilities.

- Bangcle: High supplier of IoT and cell software safety providers and options

- Beijing Zhizhangyi Science & Know-how Co., Ltd: Market chief in enterprise cell safety options. Its shopper portfolio consists of hundreds of prime companies within the monetary, manufacturing, authorities, army, aviation, schooling, healthcare, and different high-tech sectors. This firm is now extending into its safety situational consciousness platform to attain large information visualization and show product advantages.

- Bluedon: A key participant within the Chinese language data safety market, it gives shoppers from a wide range of industries with one-stop data safety options due to its four-in-one enterprise mannequin of linkage growth, which incorporates safety merchandise, safety options, safety providers, and safety operations.

- BUGBANK: Is a proponent of open safety and a community safety model owned by Shanghai Muler Community Know-how Co., Ltd. Vulnerability So as to collect, study, deal with, and hold monitor of the newest Web vulnerabilities (together with zero-day exploits), BUGBANK works with worldwide community safety specialists.

- DBAPP Safety, Ltd: A pioneer within the fields of cloud computing, large information, sensible cities, cell web, internet software safety, and database safety.

- H3C: A market chief in digital options devoted to being our prospects’ most dependable accomplice for enterprise innovation and industrial modernization.

- i-Dash: Main supplier of id and transaction safety within the digital sphere that permits individuals, companies, and communities to develop id assurance and belief for reinforcing productiveness by means of digital identification and id of issues (IDoT).

- QIANXIN: An built-in firm that gives the general public sector and companies new-generation safety items and providers.

- Threatbook: Main supplier of safety menace intelligence in China. Since its founding in 2015, ThreatBook has protected hundreds of thousands of Chinese language computer systems with its intelligence and providers. Clients embody Fortune 500 corporations and Chinese language unicorns.

Growth prospects: China’s cybersecurity market potentials and challenges

The fast growth of the Web has led to modifications within the international economic system and know-how. On the similar time, cyber threats are rising one after one other, and cyber viruses are a critical menace to nationwide safety and the cyber safety of enterprises, establishments, and particular person customers. Nations world wide connect nice significance to our on-line world safety as it’s important to the event of the Web ecosystem and digital economic system.

China’s IT business is on the rise, and increasingly Chinese language corporations are coming into the worldwide market. Because of this, the nation’s cybersecurity business, which is a crucial assist for Chinese language nationwide technique by way of safety, can be coming into a crucial interval of introducing revolutionary merchandise, applied sciences, and abilities.

When it comes to key issues of the market panorama for international stakeholders – China presents a comparatively weak scenario by way of the upstream chip, working system, database, middleware, and different technical foundations. Furthermore, investing in data safety doesn’t produce direct financial advantages for corporations, so prospects presently are predominantly authorities departments and telecommunications, finance, vitality, and different extremely information-based and information-sensitive industries.

At current, China’s community safety business chain has steadily improved, and there are enterprises that present each services and products. Furthermore, cybersecurity in China is being steadily prioritized in rising software situations, resembling cloud computing, industrial Web, and the Web of Issues (IoT). International entities prepared to take a position on this sector can reap the benefits of such issues, offering providers and merchandise, significantly in these fields the place Chinese language capabilities lag.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The observe assists international buyers into China and has performed so since 1992 by means of workplaces in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at china@dezshira.com.

Dezan Shira & Associates has workplaces in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, along with our commerce analysis amenities alongside the Belt & Street Initiative. We even have accomplice companies helping international buyers in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link