[ad_1]

China Q3 2022 knowledge reveals financial restoration was faster-than-anticipated however zero-COVID insurance policies and world recessionary developments are constraining efforts at a broader development rebound.

China’s financial system recovered at a faster-than-anticipated tempo within the third quarter. Beijing’s efforts, nonetheless, have been hampered by continued COVID-19 restrictions, a worsening actual property disaster, and the danger of a worldwide recession.

Nonetheless, some areas of the Chinese language financial system are significantly promising. Industrial manufacturing knowledge – a measure of exercise within the manufacturing, mining, and utility sectors – confirmed a steep enhance in September from a 12 months earlier. Different sectors haven’t been as excessive performing. China’s property market downturn has worsened, export development slowed some extra, and client spending declined once more after a short summer time bounce.

Under we have a look at China’s key financial and commerce knowledge for the July-September quarter and focus on what measures the federal government is implementing to get the nation out of its present financial droop.

Key financial indicators

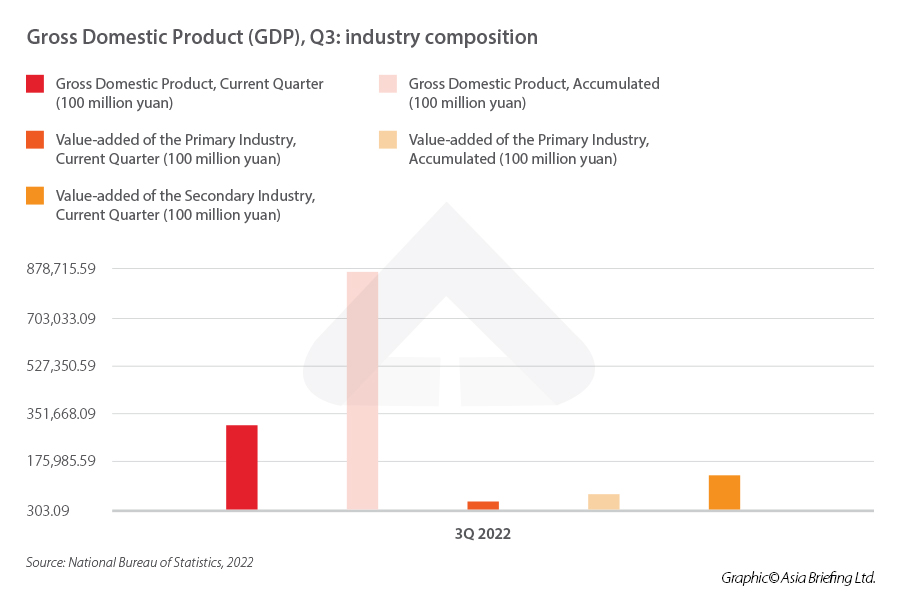

Based on official knowledge launched on October 24, 2022, by the Nationwide Bureau of Statistics (NBS), the world’s second-largest financial system’s gross home product (GDP) elevated by 3.9 p.c within the July-September quarter in comparison with the identical interval final 12 months, exceeding the three.4 p.c tempo predicted by some earlier analyses and choosing up velocity from the 0.4 p.c development recorded within the second quarter.

In comparison with the earlier 12 months, within the third quarter of 2022 – all three sectors of the financial system skilled development: – The worth added of the tertiary business was RMB 46,530.0 billion, up by 2.3 p.c.

- GDP elevated by 3.9 p.c year-on-year.

- Industrial manufacturing rose 6.3 p.c between January and September.

At a fast look, by the third quarter of 2022:

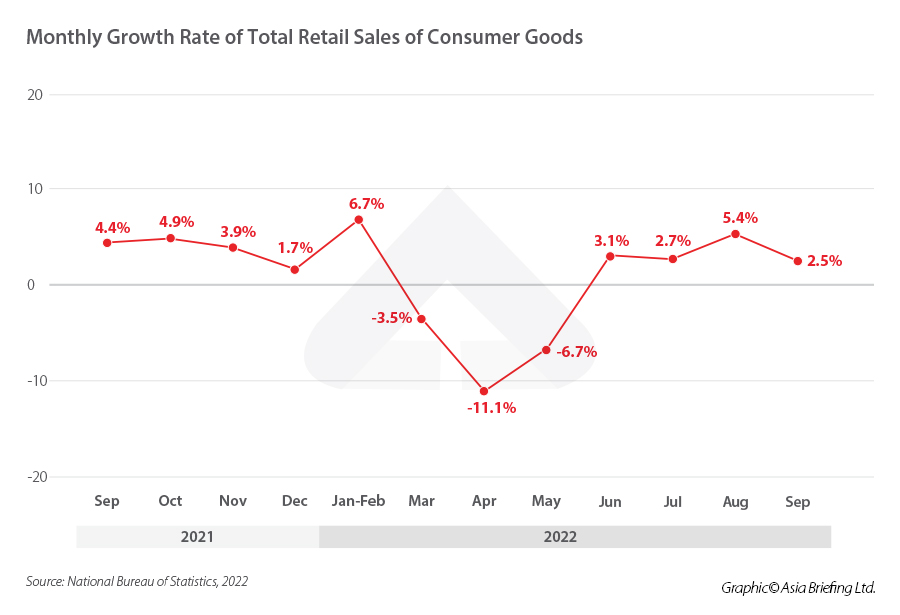

- Retail gross sales development slipped to 2.5 p.c (3 p.c under predictions).

- Within the first 9 months of the 12 months, fastened asset funding elevated by 5.9 p.c.

- Unemployment rose to five.5 p.c in September, from 5.3 p.c within the earlier month.

- Export development lowered from 7.1 p.c in August to five.7 p.c in September, displaying an general decline in Q3.

- The worth added of the secondary business was RMB 35,018.9 billion up by 3.9 p.c.

- The worth added of the first business was RMB 5,477.9 billion, up by 4.2 p.c.

Industrial manufacturing restoration led by high-tech manufacturing

Industrial manufacturing within the third quarter rebounded considerably from the second quarter, with the most effective restoration registered in September.

Worth-added output of commercial enterprises over a delegated measurement (these with an annual important enterprise revenue of RMB 20 million (US$2.9 million) and above grew by 3.9 p.c year-on-year, 0.5 share factors quicker in comparison with the primary half of the 12 months. The worth added to high-tech manufacturing and gear manufacturing elevated by 8.5 p.c and 6.3 p.c, respectively, in comparison with 2021.

All three important industries skilled an annual development enhance:

- Mining grew 8.5 p.c.

- Manufacturing grew by 3.2 p.c.

- Electrical energy, warmth, gasoline, and water manufacturing and provide grew 5.6 p.c.

Sure industries noticed important quarterly development, reminiscent of inexperienced power and sensible merchandise:

- New power autos have been up 112.5 p.c.

- Photo voltaic power batteries grew 33.7 p.c.

The manufacturing buying supervisor’s index (PMI) grew to 50.1 in September, from 49.4 in August. A PMI studying over 50 signifies development or growth of the manufacturing sector. That is additionally the primary time it recovered since July 2022.

Gradual consumption

Yr-on-year development in retail gross sales made a shaky comeback within the third quarter, declining barely to 2.7 p.c in July earlier than growing to five.4 p.c in August and declining as soon as extra to 2.5 p.c in September. analyses counsel that the development was partially a mirrored image of the fluctuation in numbers between June and September, influenced by the macroeconomic circumstances and the resurgence of COVID-19 circumstances. Total, all through the primary three quarters of 2022, retail gross sales grew by simply 0.7 p.c year-on-year.

Taking a look at consumption patterns, gross sales of merchandise reached RMB 28,905.5 billion (US$4,008.9 billion), a rise of 1.3 p.c from 2021. In the meantime, catering revenues got here in at RMB 3,124.9 billion (US$433.9 billion), a big lower of 4.6 p.c. This drastic drop in catering gross sales is principally because of the measures adopted by the ‘Zero-COVID’ and dynamic clearing coverage, which has significantly impacted this sector.

For a similar cause, on-line retail gross sales elevated by 4.0 p.c from January to September to achieve RMB 9,588.4 billion (US$1,329 billion). Amongst them:

- On-line retail gross sales of bodily items elevated by 6.1 p.c, accounting for 25.7 p.c of all retail gross sales of social client items.

- On-line retail gross sales of bodily items elevated by 15.6 p.c, 4.7 p.c, and 5.2 p.c, respectively, for meals, clothes, and client items.

Manufacturing indicators of the principle companies sectors nonetheless noticed reasonable development within the first three quarters of 2022:

- Data transmission, software program, and IT companies grew 10.3 p.c year-on-year.

- The monetary business grew 5.5 p.c year-on-year.

Mounted asset funding steady with a concentrate on manufacturing and infrastructure

Within the first three quarters of 2022, fastened asset funding (FAI) reached RMB 42,141.2 billion (US$5,844.6 billion), a rise of 5.7 p.c in comparison with 2021 (excluding rural households), and up 0.1 share factors from the January-through-August interval. Particularly, funding in manufacturing elevated by 10.1 p.c, and that in infrastructure elevated by 8.6 p.c.

Funding additionally elevated in every sector of the financial system individually, with the first, secondary, and tertiary sectors seeing a 1.6 p.c, 11.0 p.c, and three.9 p.c enhance year-on-year, respectively.

When it comes to high-tech manufacturing, investments elevated by 28.8 p.c within the manufacturing of digital and communication gear and 26.50 p.c within the manufacturing of medical gear, measuring devices, and meters. Within the high-tech companies sector, investments grew by 22.1 p.c in companies for remodeling scientific and technological developments and 18.7 p.c in analysis, growth, and design companies.

FAI development is a significant contributor to home demand and contains infrastructure spending. Spending on infrastructure tasks has elevated year-on-year at a faster fee since Might, with an 8.6 p.c enhance famous within the first 9 months. This important enhance in infrastructure spending coincided with an enormous central authorities stimulus: the State Council granted the nation’s coverage banks a further RMB 800 billion (US$120 billion) quota for lending to infrastructure tasks in early June, in an effort to help the financial system.

Alternatively, actual property growth, funding, and gross sales noticed the most important contraction, with business housing gross sales dropping 26.3 p.c from the earlier 12 months to RMB 9,938.0 billion (US$1,378.3 billion). Since a number of builders started defaulting loans within the second half of 2021, resulting in a widespread mortgage boycott, China’s housing market has been in experiencing a profound disaster. In October 2022, nonetheless, indicators have been pointing to a extra optimistic flip of occasions. Based on knowledge gathered by brokerage Cinda Securities Co. Ltd., China’s pre-owned housing market has proven indicators of stabilizing amid a loosening of property rules, with transactions in 15 surveyed cities growing 40 p.c year-over-year to 1.9 million sq. meters.

Overseas commerce on a gradual rise

With decreases in export volumes to China’s main markets just like the US, Germany, and France, export development slowed in September to five.7 p.c. Commerce was a dependable supply of financial growth for China in the course of the pandemic, however in current months, world demand has decreased and worries a few world recession have grown.

Nonetheless, cumulative commerce knowledge for the previous three quarters present indicators of steady development. Whole imports and exports of products in September reached RMB 3.81 trillion (US$560.77 billion), a year-on-year enhance of 8.3 p.c. Exports continued to see sturdy development, reaching RMB 2.19 trillion (US$322.76 billion), up 10.7 p.c from the earlier 12 months.

The expansion of imports remained gradual, reflecting weak home demand, growing 7.4 p.c year-on-year to achieve RMB 1.62 trillion (US$238.01 billion), only a slight enhance from August.

China’s largest commerce associate within the third quarter of 2022 remained the ASEAN area, which accounted for 15.1 p.c of all imports and exports between January and September. China’s commerce surplus with this area has additionally expanded by 93.4 p.c throughout this time, reaching RMB 753.6 billion (US$104.5 billion). The nation additionally imported the most important quantity from ASEAN, reaching RMB 1.97 trillion (US$218 billion).

The EU was China’s second-largest buying and selling associate with a complete of RMB 4.23 trillion (US$586.6 billion), accounting for 13.6 p.c of all imports and exports to this point in 2022.

The US is China’s largest export market and third-largest commerce associate. Exports grew 10.1 p.c to achieve RMB 2.93 trillion (US$331.5 billion), whereas imports grew simply 1.3 p.c. The commerce surplus expanded by 14.2 p.c to achieve RMB 2.07 trillion (US$287 billion).

South Korea is China’s fourth largest commerce associate, accounting for five.8 p.c of complete imports and exports. Exports to South Korea grew 16.5 p.c, whereas imports merely grew 0.6 p.c. China’s commerce surplus with South Korea shrank by 34.2 p.c, standing at RMB 206.66 billion (US$28.66 billion) as of September 2022. Based on current evaluation, the bilateral deficit was partly brought on by China’s COVID-19 rules, but additionally Seoul’s want for a long-term plan to regularly rework the way in which through which commerce between the 2 nations is structured. The South Korean authorities has highlighted the slowing commerce with China among the many high dangers for the nationwide financial system to be addressed promptly.

Mechanical and electrical merchandise accounted for 56.8 p.c of all exports within the interval from January to September 2022, growing 10.04 p.c from the identical interval in 2021. Amongst them, exports of computerized knowledge processing gear and parts elevated by 1.9 p.c to achieve RMB 1.18 trillion (US$163.65 billion), whereas exports of cellphones elevated 7.8 p.c to RMB 672.25 billion (US$93.23 billion) and exports of vehicles grew 67.1 p.c to RMB 259.84 billion (US$36.03 billion).

Methods to learn this knowledge?

Evaluating the third quarter of 2022 to the second, the true financial system has made some progress. The provision shock has subsided, and the demand stimulus remains to be in impact, that are the 2 important components contributing to this marginal development.

Financial exercise within the industrial and repair sectors has considerably elevated in comparison with the second quarter, and provide shocks like manufacturing and logistics introduced on by the pandemic within the earlier quarter have been mitigated. From the demand facet, infrastructure funding has began to exert stress, and commodity retail and repair consumption have each elevated.

Nevertheless, this 12 months noticed a continuation of the declining development in actual property funding. Additionally, in August, the export development fee dramatically decreased. China’s financial system remains to be underneath stress because of the rise in world rates of interest, the deepening battle between Russia and Ukraine, and the European power disaster.

Though the third quarter’s GDP development fee elevated by 3.4 share factors over the second quarter’s, the preliminary development goal of 5.5 p.c by the tip of the 12 months nonetheless appears too removed from the precise state of affairs.

Authorities plans to revive the financial system

The information was initially scheduled for launch on October 18, 2022, however was delayed amid the 20th Nationwide Congress of the Communist Occasion (CPC). On this event, President Xi Jinping outlined the significance of boosting financial development, praising the Chinese language financial system for having “nice resilience, potential, and scope of motion,” and promising that “ its sturdy basic will stay unchanged.”

To attain so, the federal government has carried out a number of coverage packages all year long. In Might 2022, Beijing launched 33 stimulus measures in an effort to revive the financial system within the wake of the COVID-19 lockdowns. The stimulus measures construct on the help applications for companies affected by the epidemic and work to stimulate funding and assure the provision of important sources.

These have been adopted by one other set of 19 measures unveiled in August within the wake of a worsening actual property disaster and extended electrical energy shortages introduced on by a extreme drought. The bundle included recent financing totaling greater than RMB 1 trillion (US$146 billion) to advertise funding and consumption in addition to better freedom for native governments to help the true property sector. In addition they comprised rules designed to take away administrative obstacles and facilitate enterprise individuals’s cross-border motion.

Furthermore, following the conclusion of the twentieth Nationwide Congress of the CPC, China’s high financial planner, the Nationwide Improvement and Reform Fee (NDRC), together with 5 different ministries, issued 15 new measures to ease the implementation of foreign-invested tasks. These insurance policies embody measures reminiscent of facilitating worldwide journey for key personnel and permitting international corporations to boost cash on China’s inventory markets, a transfer that analysts stated demonstrates China’s willpower to additional open up its market and strengthen its financial system.

Restoring enterprise confidence and attracting traders are high priorities

Most main central banks world wide have initiated a cycle of rate of interest will increase recently, and China’s client value index grew by 2.8 p.c year-on-year in September, indicating stronger inflation stress. But in August 2022 China’s central financial institution introduced a fee reduce, shocking most specialists. The market anticipated that the Individuals’s Financial institution of China (PBOC) would prioritize structural financial devices, reminiscent of elevated liquidity or fee reductions for particular industries, over a extra widespread rate of interest lower.

Based on official studies, China is anticipated to extend its attractiveness to traders by stepping up its efforts to handle its expectations. The 33 measures launched in Might have been additionally meant to hasten the completion of vital international funding tasks and extra actively entice international funding.

To direct international capital into industries like high-end manufacturing and scientific innovation in places like the center, western, and northeastern Chinese language areas, the modification of the commercial catalog for sectors that favor international funding can even be expedited.

Together with increasing cross-border financing choices for companies, enhancing communication between Chinese language authorities and international chambers and companies, and actively facilitating international commerce, the nation can even help international traders in organising analysis and growth facilities in high-end and rising applied sciences.

Different strikes embody accelerating market opening, reminiscent of by way of the growth of pilot areas for complete opening-up within the companies sector. Additional, authorities insurance policies additionally concentrate on guiding international funding into vital sectors like superior manufacturing, high-end expertise, power conservation, and fashionable companies. They goal to enhance working mechanisms at each the central and native authorities ranges for large-scale international funding tasks.

These resolutions present that the Chinese language authorities is conscious of the important thing function performed by international capital and companies in supporting general financial development.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The apply assists international traders into China and has finished so since 1992 by means of places of work in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at china@dezshira.com.

Dezan Shira & Associates has places of work in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, along with our commerce analysis amenities alongside the Belt & Street Initiative. We even have associate corporations helping international traders in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link