[ad_1]

In a current article, we mentioned the insurance policies and laws within the esports trade in China. An rising and comparatively area of interest market, esports has gained in recognition among the many youthful demographic, producing hundreds of thousands in revenues. On this article, we discover the alternatives and dangers within the trade.

Esports market in China at a look

Esports, brief for digital sports activities, is a type of competitors primarily based on video video games. It has gained in recognition the world over for the reason that 2000s as web entry has widened, turning a leisure interest into an trade that’s value billions. In 2022, world esports tournaments have been anticipated to rake in US$1.4 billion in income and the determine might develop to US$1.9 billion by 2025.

China is the most important single-country market on the planet, fueled by the expansion of Chinese language customers’ buying energy, in addition to Chinese language tech giants’ investments which have spurred gaming leisure. In 2021, China’s esports market measurement was about RMB 167.3 billion, based on iResearch. China additionally has the best variety of energetic esports gamers and match viewership because of new applied sciences with cellular units and dwell streaming.

In response to the Ministry of Human Assets and Social Safety, in 2019 there have been greater than 5,000 esports groups and golf equipment in China, with about 100,000 skilled esports gamers and a complete of 500,000 folks employed within the trade. China Audio-video and Digital Publishing Affiliation (CADPA) reported a complete of 62 esports competitions held within the first half of the 12 months, a slight improve from final 12 months.

Each PC video games, similar to League of Legends, and cellular video games, together with Wild Rift, Honor of Kings, and Peacekeeper Elite, are very talked-about in China.

Enterprise scope in China’s esports market

The esports market income in a number of methods, together with by promoting gaming equipment, working tournaments, streaming dwell occasions, promoting, merchandise gross sales, and media rights.

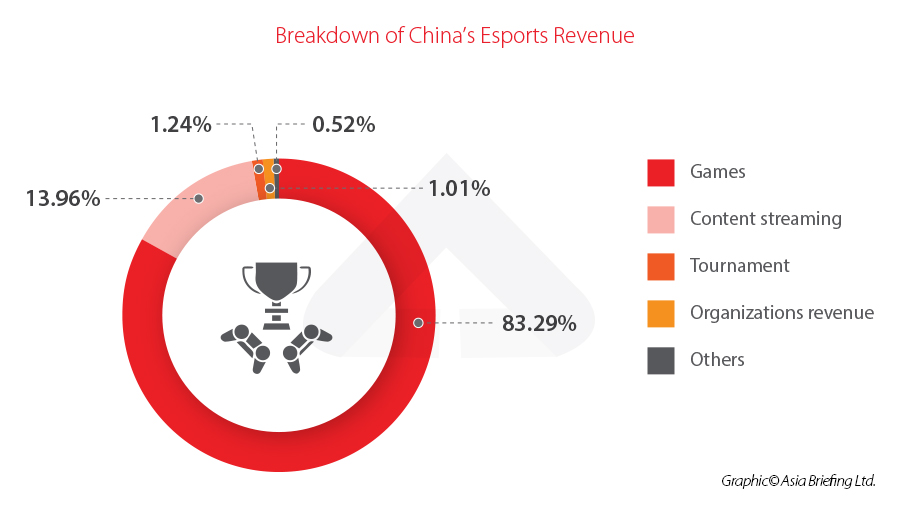

Lately, companies within the gaming trade have boosted their revenues by working tournaments and establishing skilled groups. Based mostly on a report from CADPA, China’s esports income streams break down as: video games (83.29%), content material streaming (13.96%), match (1.24%), organizations income (1.01%), and others (0.52%).

Esports tournaments have turned gaming right into a social occasion that includes skilled gamers and spectators. Throughout these occasions, the general public can watch multiplayer online game competitions with skilled gamers enjoying as people or as a crew. Some firms have additionally included observing options for additional broadcasting.

Whereas video video games are designed for all types of gamers, many esports video games are specifically designed to be performed professionally. The esports trade is just not solely profitable for large firms, but additionally for skilled gamers, because of some tournaments that supply a prize pool of over a dozen million U.S. {dollars}. A few of these gamers turn out to be celebrities within the trade, with 1000’s of followers. Their gaming observe set examples for the followers, who then look to emulate their esport idols by buying related tools and equipment.

Authorities recognition of esports

China is without doubt one of the earliest adopters of esports on an official, authorities degree. China’s Common Administration of Sports activities acknowledged esports as an official sport class in 2003.

The esports sector, nevertheless, has each a sporting and cultural dimension, linking sports activities, technological, social, and psychological issues. Recognizing their significance for China’s financial system, the Ministry of Schooling added the esports administration main in 2016, with greater than 50 universities providing associated packages. College students research programs on sport growth, esports occasions and providers, esports media, and esports coaching. The primary batch of esports administration college students graduated in 2021, eyeing future alternatives within the trade.

In early 2019, the Ministry of Human Assets and Social Safety additionally acknowledged esports operators and esports participant as two new official professions.

And in 2021, esports was included within the 14th 5-12 months Plan, and nationwide requirements for esports gamers had been launched.

Furthermore, esports will make its official debut as one of many official sports activities to be performed on the subsequent Asian Video games to be held in Hangzhou, China (postponed from 2022 to 2023). This newly emerged trade is now on its option to be a self-discipline on the Olympic Video games.

Enterprise alternatives for international gamers in China’s esports market

The demand for video games in China is gigantic as is the expansion potential of gaming firms. With the quickly increasing affect of esports occasions and content material, the commercialization of components similar to copyright, occasion sponsorship, and streaming manufacturing nonetheless maintains a excessive progress price. The esports trade offers alternatives for international manufacturers which might be able to enter China’s market.

Future progress drivers of the market will probably be a mixture of esports and rising codecs, together with back-end infrastructure, similar to cloud computing and IoT; front-end units, similar to augmented actuality (AR), digital actuality (VR), and blended actuality (MR); and underlying applied sciences, similar to blockchain and NFT. Present enterprise fashions within the esports trade are thus anticipated to alter in response to evolving applied sciences and technological functions.

China additionally wants extra skills within the sector. One government of Tencent Holdings estimated that not less than two million skills over the subsequent three to 4 years will probably be wanted to maintain China aggressive within the esports trade. Personnel will embrace occasion organizers, esports membership managers, livestreamers, broadcast presenters, media staff, and folks growing linked merchandise.

Additional, esports shouldn’t be thought-about as a ‘lone’ enterprise. Its recognition amongst younger folks has created a brand new kind of ‘fandom’ financial system that spurs consumption. New enterprise alternatives emerge consistently; under are some examples:

- In April 2022, Tencent and Beijing Common Resort introduced their partnership for the 2022 seasonal occasion. Tencent’s Honor of Kings, Peacekeeper Elite, QQ Velocity, card sport Doudizhu, in addition to a number of different video games, will probably be formally added to the Beijing Common Resort parade.

- In August 2022, Tencent and Ouyu Expertise launched the primary esports-themed lodge in Hangzhou, China. The lodge caters to the gaming group, that includes top-of-the-line {hardware}, comfy setups, bootcamps, entry to skilled live-streaming, and even incubation coaching areas.

Dangers and uncertainties

Regardless of the promising numbers, the trade additionally faces extreme challenges, because the Chinese language authorities tries to steadiness burgeoning enterprise alternatives and public issues, particularly for minors. Per guidelines launched in August 2021, these aged beneath 18 are restricted to solely three hours of gaming per week (Fridays, weekends, and holidays solely). All video games have additionally required actual identify verification to limit minor’s entry. Many analyze that this regulation might have a knock-on impact on the nation’s esports scene, proscribing the expertise pipeline and inflicting a drop in esports consumption by minors.

Moreover, the federal government has frozen approvals of recent video games. From June 2021 to April 2022, China didn’t subject a single new license for monetizable video games. On July 18, 2022, the Ministry of Commerce issued new tips to simplify and increase the approval course of for on-line video games, lifting earlier restrictions. Recreation license approvals have additionally begun to favor video games which might be academic in nature. Main gaming firms, similar to Tencent and NetEase, after receiving few approvals, want to increase abroad as a substitute of overleveraging on the Chinese language market.

Companies additionally want to contemplate the federal government’s ongoing squeeze on the “platform financial system” that has resulted in hefty fines for Tencent, Alibaba, and numerous different tech firms. These laws might cut back incentives for brand spanking new product growth and advertising efforts in gaming.

Issues additionally come up that the esports market may need begun reaching the trade ceiling, after years of speedy progress and growth. Within the first half of 2022, whole income of the gaming trade declined 1.8 p.c year-on-year. Regardless of the big market, the expansion of esports video games and esports livestreaming revenues has slowed down. Whereas the pandemic-induced provide chain disruption might have contributed to the lower, above-mentioned coverage restrictions additionally make the sector’s prospect murkier.

Trying forward

Companies eyeing alternatives in China’s esports trade ought to have versatile plans that may swimsuit each the short-term and long-term growth of esports within the nation. Quickly, with esports making its debut in worldwide video games in 2023, China will probably be anticipated to hasten its funding within the sector to retain competitiveness. The truth is, through the Asia Video games in Hangzhou subsequent 12 months, it may be anticipated that campaigns associated to esports will catch public consideration.

Lastly, the esports market is just not restricted to gaming alone however consists of different sectors, starting from livestreaming, occasion sponsorship, leisure, and life-style. It’s these extra industrial avenues that may open extra doorways to international funding. Subsequently, having enterprise capability that may be transferred to those linked sectors might improve advantages for esports corporations.

To be aggressive within the long-term, traders ought to carefully monitor China’s regulatory surroundings. State insurance policies might push the esports and gaming sector to provide extra content material that’s socially accountable and academic, notably when focused at minors. It will be significant that your small business technique plans for such contingencies in addition to catering to Chinese language client preferences.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The observe assists international traders into China and has completed so since 1992 via workplaces in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at china@dezshira.com.

Dezan Shira & Associates has workplaces in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, along with our commerce analysis services alongside the Belt & Highway Initiative. We even have accomplice corporations helping international traders in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link