[ad_1]

It appears to be like like Saudi Arabian Oil Firm (TADAWUL:2222) is about to go ex-dividend within the subsequent 3 days. The ex-dividend date is one enterprise day earlier than an organization’s file date, which is the date on which the corporate determines which shareholders are entitled to obtain a dividend. The ex-dividend date is vital as a result of any transaction on a inventory must have been settled earlier than the file date so as to be eligible for a dividend. That means, you will have to buy Saudi Arabian Oil’s shares earlier than the ninth of November to obtain the dividend, which can be paid on the twenty eighth of November.

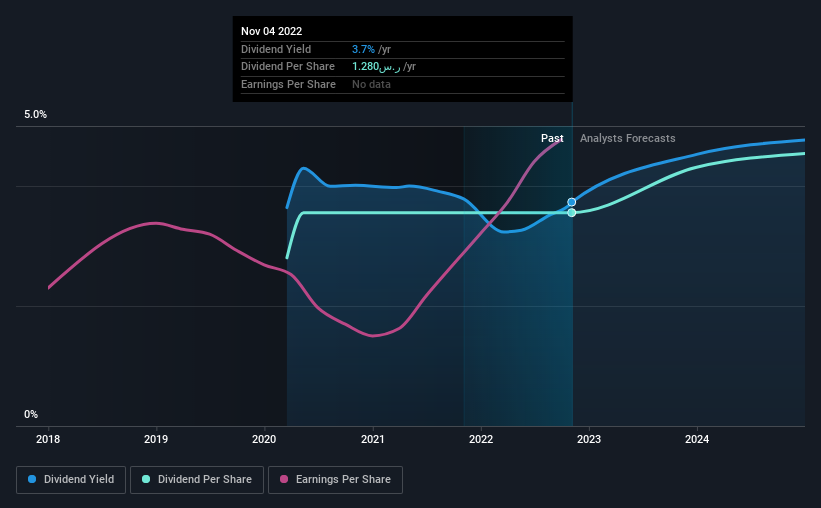

The corporate’s subsequent dividend fee can be ر.س0.32 per share. Final 12 months, in whole, the corporate distributed ر.س1.28 to shareholders. Calculating the final 12 months’s price of funds exhibits that Saudi Arabian Oil has a trailing yield of three.7% on the present share value of SAR34.3. Dividends are an vital supply of revenue to many shareholders, however the well being of the enterprise is essential to sustaining these dividends. Because of this, readers ought to at all times verify whether or not Saudi Arabian Oil has been capable of develop its dividends, or if the dividend may be minimize.

Take a look at our newest evaluation for Saudi Arabian Oil

Dividends are sometimes paid out of firm revenue, so if an organization pays out greater than it earned, its dividend is often at a better threat of being minimize. That is why it is good to see Saudi Arabian Oil paying out a modest 48% of its earnings. But money movement is often extra vital than revenue for assessing dividend sustainability, so we should always at all times verify if the corporate generated sufficient money to afford its dividend. Dividends consumed 51% of the corporate’s free money movement final 12 months, which is inside a standard vary for many dividend-paying organisations.

It is encouraging to see that the dividend is roofed by each revenue and money movement. This usually suggests the dividend is sustainable, so long as earnings do not drop precipitously.

Click on right here to see the corporate’s payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Rising?

Shares in corporations that generate sustainable earnings development usually make one of the best dividend prospects, as it’s simpler to raise the dividend when earnings are rising. If earnings fall far sufficient, the corporate could possibly be pressured to chop its dividend. For that reason, we’re glad to see Saudi Arabian Oil’s earnings per share have risen 12% every year over the past 5 years. Saudi Arabian Oil has a median payout ratio which suggests a steadiness between rising earnings and rewarding shareholders. Given the short fee of earnings per share development and present stage of payout, there could also be an opportunity of additional dividend will increase sooner or later.

Many buyers will assess an organization’s dividend efficiency by evaluating how a lot the dividend funds have modified over time. Within the final three years, Saudi Arabian Oil has lifted its dividend by roughly 8.2% a 12 months on common. We’re glad to see dividends rising alongside earnings over plenty of years, which can be an indication the corporate intends to share the expansion with shareholders.

The Backside Line

Ought to buyers purchase Saudi Arabian Oil for the upcoming dividend? From a dividend perspective, we’re inspired to see that earnings per share have been rising, the corporate is paying out lower than half of its earnings, and a bit over half its free money movement. It is a promising mixture that ought to mark this firm worthy of nearer consideration.

In gentle of that, whereas Saudi Arabian Oil has an interesting dividend, it is price figuring out the dangers concerned with this inventory. Our evaluation exhibits 2 warning indicators for Saudi Arabian Oil that we strongly suggest you take a look at earlier than investing within the firm.

In the event you’re out there for sturdy dividend payers, we suggest checking our choice of prime dividend shares.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Saudi Arabian Oil is doubtlessly over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to carry you long-term targeted evaluation pushed by basic information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZPS35VAU3BL5FGTPG2DKVPNIA4.jpg)