[ad_1]

We talk about the growth of e-invoicing in China because the digital e-fapiao program widens its pilot roll-out with distinctive options. For extra info, please contact Helen Bao and Ada Zhou.

UPDATES: Ranging from October 28, 2022, the pilot program of issuing absolutely digitalized e-fapiao was expanded to chose taxpayers in Sichuan province.

Absolutely digitalized e-fapiao, that are digital invoices (e-invoices), is a totally new sort of digital bill, which is totally different from the beforehand launched regular value-added tax (VAT) e-fapiao and the standard paper fapiao however has the identical authorized impact.

The pilot program of absolutely digitalized e-fapiao kicked off on December 1, 2021, when chosen taxpayers in in Shanghai, Guangdong (Guangzhou, Foshan, Guangdong-Macao Intensive Cooperation Zone), and Internal Mongolia (Hohhot) began to subject and settle for absolutely digitalized e-fapiao.

In 2022, the pilot program of absolutely digitalized e-fapiao was additional expanded, with a broader scope of taxpayers with the ability to subject and settle for absolutely digitalized e-fapiao.

Below the absolutely digitalized e-fapiao packages, a nationwide unified e-invoicing service platform will present pilot taxpayers 24-hour on-line providers to subject, ship, and confirm absolutely digitalized e-fapiao freed from cost. This implies the particular tax management tools, reminiscent of golden tax USB disk, tax management USB disk, and tax UKey, are not wanted.

Following the introduction of the conventional VAT e-fapiao and the development of the Golden Tax System Part IV, the absolutely digitalized e-fapiao marks the newest effort by the Chinese language authorities to advertise the digital upgradation and clever transformation of tax assortment and administration and cut back the price of tax administration.

On this article, we’ll introduce the important thing options of absolutely digitalized e-fapiao, stroll you thru the pilot absolutely digitalized e-fapiao packages in 2022, and clarify the potential impacts of absolutely digitalized e-fapiao in your companies.

What’s absolutely digitalized e-fapiao?

The absolutely digitalized e-fapiao is a totally new sort of digital bill. It has the identical authorized impact and utilization as the present paper fapiao however has no sheets. Like different VAT digital fapiao, it has no bill copies (regular paper fapiao consists of the stub copy, the deduction copy, and the account-keeping copy for the fapiao issuers and receivers to maintain and use).

The absolutely digitalized e-fapiao may also look neater, with solely 17 gadgets of content material: dynamic QR code, bill quantity, issuance date, purchaser info, vendor info, venture title, specification and mannequin, unit, amount, unit value, quantity, tax price/levy price, tax quantity, whole, advert valorem and tax whole (in phrases and figures), remarks, and bill.

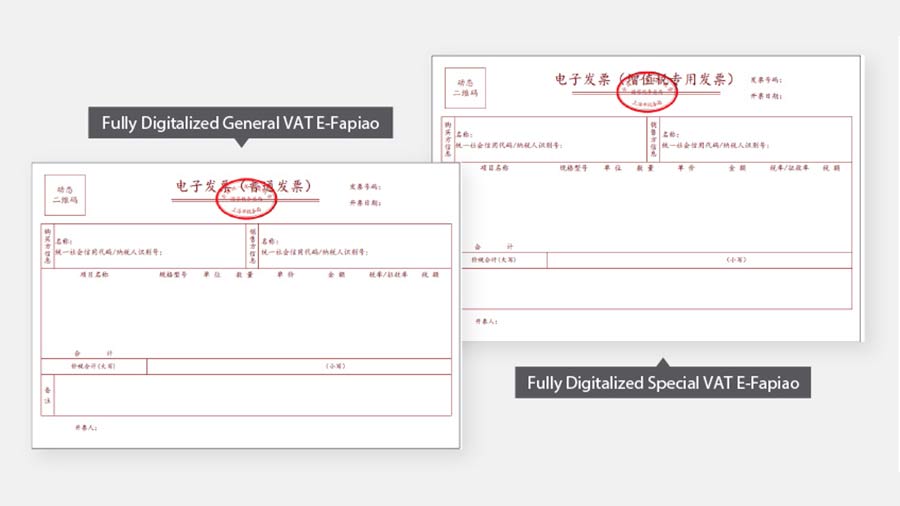

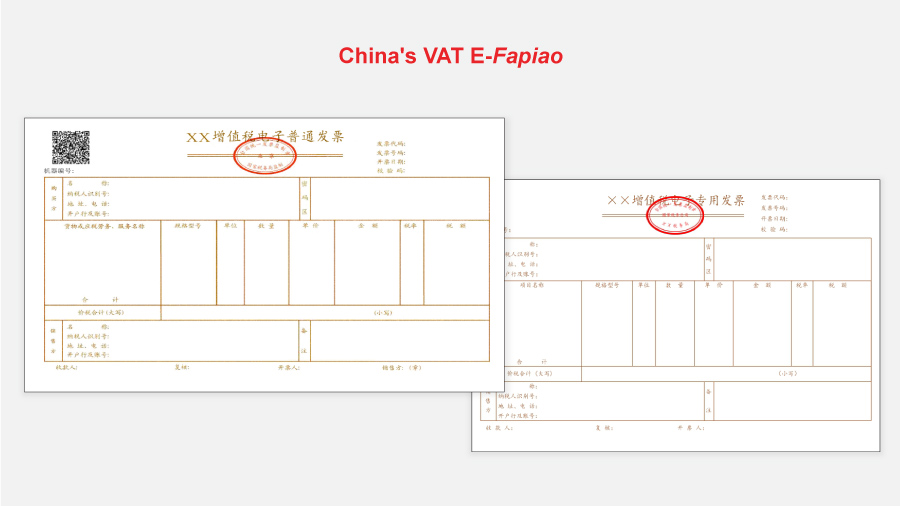

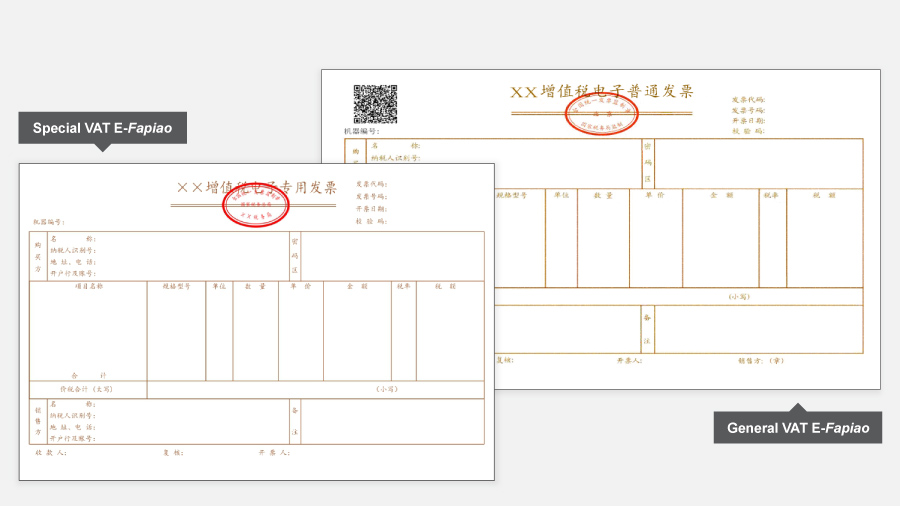

With their introduction, there might be a complete of six sorts of fapiao co-existing in China in the course of the nation’s ongoing fapiao system reforms. The six varieties are particular VAT fapiao, common VAT fapiao, particular VAT e-fapiao, common VAT e-fapiao, absolutely digitalized particular VAT e-fapiao, and absolutely digitalized common VAT e-fapiao.

The samples of the absolutely digitalized digital fapiao will be discovered beneath:

Compared, the conventional VAT digital fapiao and traditional fapiao appears to be like extra difficult as beneath:

What are the brand new options of absolutely digitalized e-fapiao?

As a brand new sort of digital bill, the absolutely digitalized e-fapiao can have distinctive options as defined beneath.

Simplified procedures to acquire and subject absolutely digitalized e-fapiao

- “No medium”: Taxpayers underneath the pilot program is not going to have to get the particular tax management tools (the medium) prematurely to subject fapiao; As a substitute, they will subject the absolutely digitalized e-fapiao via the nationwide e-invoicing service platform.

- “Fapiao quantity computerized task system”: Taxpayers underneath the pilot program is not going to have to get hold of the fapiao via utility to the tax bureaus; As a substitute, they will get hold of the absolutely digitalized e-fapiao via the e-invoicing service platform, which can routinely assign a singular fapiao quantity when the fapiao info is generated.

- “Managing the full quantity of fapiao primarily based on taxpayers’ credibility”: The tax authorities will decide the preliminary most quantity of invoices issued by the taxpayer in a calendar month and make dynamic changes thereto – primarily based on the chance stage, taxpaying credit standing, precise working circumstances, and different elements of a taxpayer. The utmost invoices quantity refers back to the higher restrict of the full bill quantity the pilot taxpayer’s bill issued inside a pure month, excluding VAT. Completely different from conventional paper fapiao, the absolutely digitalized e-fapiao isn’t restricted by the variety of fapiao items or the utmost amongst of a single fapiao.

Finally, newly established taxpayers can subject a totally digital e-fapiao as quickly as they begin the enterprise and there might be no typical ‘prepositive procedures.’

Extra handy methods to subject, ship, and confirm fapiao

- Diversified channels to subject fapiao: Pilot taxpayers can subject the absolutely digitalized e-fapiao via the unified e-invoicing service platform. In future, they can subject such e-fapiao via a terminal or the cell app. This fashion they’ll not require particular tax management tools.

- One-stop e-invoicing service platform: After logging onto the platform, pilot taxpayers can subject, ship, and confirm fapiao on the one one platform, as an alternative of finishing associated operations on a number of platforms as earlier than.

- Extra extensively relevant fapiao knowledge: Pilot taxpayers’ tax digital accounts on the e-invoicing service platform will routinely accumulate bill knowledge for inquiry, downloading, and printing by pilot taxpayers.

As soon as the absolutely digitalized e-fapiao is issued, the fapiao info will routinely be despatched to the tax digital accounts of each the issuer and the receiver for them to verify and obtain. The issuers can monitor the bill utilization of the receiver in actual time via the tax digital account ((reminiscent of whether or not the VAT has been deducted or not).

These digitalized fapiao knowledge may also lay a basis for taxpayers to pre-fill the ‘one built-in type’ for tax declaration. - No particular digital codecs required: In contrast to regular VAT e-fapiao, which must be in PDF or OFD codecs, absolutely digitalized e-fapiao isn’t required to be saved in a particular digital format. Pilot taxpayers can ship absolutely digitalized e-fapiao via their tax digital accounts on the e-invoicing service platform, or ship absolutely digitalized e-fapiao by e-mail, QR code, or different means. It will cut back fapiao supply prices and make it simpler for taxpayers to course of fapiao.

- Unblocked channel to entry tax providers: The e-invoicing service platform will incorporate extra interactive options, reminiscent of good consulting and objection submission features.

Along with the above, sooner or later, the e-invoicing service platform is anticipated to assist the direct reference to ERP and different monetary software program of the vast majority of enterprises to comprehend the built-in operation of bill reimbursement, entry, and submitting.

The pilot absolutely digitalized e-fapiao packages in 2022

After the primary spherical of trial in Shanghai and chosen cities of Guangdong and Internal Mongolia, the pilot absolutely digitalized e-fapiao program expanded the scope of issuers and recipients in 2022:

- Staring from April 1, 2022, the pilot program in Guangdong province was additional prolonged from the unique three cities and zones to cowl extra chosen taxpayers in the entire province (excluding Shenzhen).

- Ranging from April 25, 2022, the pilot program in Internal Mongolia was prolonged from Hohhot to chose taxpayers in the entire autonomous area.

- Ranging from Might 10, 2022, taxpayers in Sichuan province have been allowed to obtain invoices (together with absolutely digitalized e-fapiao) issued by chosen taxpayers in Internal Mongolia Autonomous Area, Shanghai municipality, and Guangdong province (excluding Shenzhen) through the digital bill service platform.

- Ranging from Might 23, 2022, the pilot program for fully-digitalized e-fapiao has been performed amongst chosen taxpayers in Shanghai following the up to date guidelines.

- Ranging from June 21, 2022, the scope of absolutely digitalized e-fapiao recipients has been additional expanded to Beijing, Shenzhen, Jiangsu province, Shandong province (excluding Qingdao), and Zhejiang Province. In the meantime, Shanghai, Guangdong (excluding Shenzhen), and Internal Mongolia have began to just accept absolutely digitalized e-fapiao issued by all three pilot cities/provinces, quite than solely accepting the absolutely digitalized e-fapiao issued inside their respective jurisdiction.

- Ranging from June 25, 2022, the pilot program in Shanghai was prolonged from Xuhui District to chose taxpayers in the entire metropolis.

- Ranging from July 18, 2022, the scope of absolutely digitalized e-fapiao recipients has been additional expanded to Chongqing, Hebei, Henan, Fujian, Anhui, Jiangxi, Shaanxi, Hunan, and Hubei.

- Ranging from July 31, 2022, the scope of absolutely digitalized e-fapiao recipients will additional be expanded to Qingdao, Ningbo, and Xiamen.

- Ranging from August 28, 2022, the scope of absolutely digitalized e-fapiao recipients will additional be expanded to Tianjin, Shanxi, Gansu, Ningxia, Qinghai, Xinjiang, Liaoning, Jilin, Heilongjiang, Yunnan, Guizhou, Guangxi, and Hainan.

- Ranging from October 27, 2022, Guangdong shall develop the pilot program for the issuance of fully-digitalized e-fapiao to cowl newly registered taxpayers in the entire province (excluding Shenzhen). It’ll additionally cowl different taxpayers in batches by industries and areas in order that they will subject fully-digitalized e-invoices through the digital bill service platform.

- Ranging from October 28, 2022, the pilot program of issuing absolutely digitalized e-fapiao was expanded to chose taxpayers in Sichuan province.

As of August 28, 2022, the acceptance scope of the absolutely digitalized e-fapiao issued by pilot taxpayers in Shanghai, Guangdong, and Internal Mongolia had been expanded nationwide, as acknowledged in respective bulletins issued by the provincial-level tax bureaus. For the absolutely digitalized e-fapiao issued by pilot taxpayers in Sichuan province, a number of native authorities have introduced particular dates for accepting such invoices. Going ahead, its acceptance scope shall be expanded nationwide as effectively.

| Scope of issuers | Chosen taxpayers in:

|

| Scope of recipients* | Taxpayers in:

|

| The Newest Scope of Issuers and Recipients of Absolutely Digitalized E-fapiao | |

*Taxpayers who don’t use or have the Web are briefly excluded from the pilot absolutely digitalized e-fapiao program. As of November 8, 2022, the acceptance scope f the absolutely digitalized e-fapiao issued by pilot taxpayers in Sichuan province has but to develop nationwide.

How will the pilot absolutely digitalized e-fapiao program have an effect on companies?

Absolutely digitalized e-fapiao is anticipated to significantly cut back the workload of enterprises’ monetary and accounting employees and enhance the effectivity of issuing a fapiao in the long term.

Nonetheless, companies might face short-term challenges relating to the processing and archive of absolutely digitalized e-fapiao, because the corresponding financing processes have to be adjusted primarily based on the brand new options of the absolutely digitalized e-fapiao.

Firms are advised to take this opportunity to contemplate adopting applied sciences to facilitate their e-fapiao administration, reimbursement administration, accounting, tax, and provide chain administration processes, step-by-step, because the added worth of e-fapiao, is deeply related to the automation stage of the related processes.

However, underneath the pilot program of the absolutely digitalized e-fapiao and the promotion of the Golden Tax System Part IV, companies is perhaps uncovered to larger tax dangers because the tax bureau’s capability in recognizing incompliance tax conduct might be enhanced by massive knowledge know-how.

Companies are advised to rearrange common tax well being checks and pay extra consideration to their inner controls. A daily tax well being verify, both performed internally or by knowledgeable third social gathering, will assist determine the weak factors within the enterprise’s every day operations and cut back the chance of triggering worse tax investigations from the tax bureau. Contemplating third-party service corporations are often extra skilled on related issues and extra confidential when reviewing monetary and operational paperwork, it’s extremely really useful if the corporate’s funds permits.

To conclude, it is crucial for companies to get ready and develop a radical technique for e–fapiao to alleviate operational dangers and get probably the most out of the e-invoicing system.

(The article was first printed on June 27, 2022, and was final up to date on November 8, 2022.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The follow assists international traders into China and has accomplished so since 1992 via workplaces in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at china@dezshira.com. Dezan Shira & Associates has workplaces in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, along with our commerce analysis services alongside the Belt & Highway Initiative. We even have accomplice corporations aiding international traders in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link