[ad_1]

Like most individuals, I skilled many vital milestones in my first 12 months as a working grownup.

One of many memorable ones was monetary planning.

I keep in mind it as a quite severe affair, transacted over the course of three lengthy weekday night conferences with an agent at varied quick meals eating places in a purchasing centre in Serangoon.

Every assembly was extremely illuminating but in addition fairly annoying for me, a monetary beginner on the time.

Sure, I might have taken extra time to determine, however I used to be additionally eager to get it over and carried out with.

Now, 4 years later, I’m proud of the choices I made again then, however I do want issues might have been completely different.

A straightforward first-step insurance coverage

Enter SNACK by Revenue.

The monetary way of life supplier is known as for the way it doles out funding and insurance coverage merchandise in bite-sized parts by means of its cell app.

It provides “another strategy” to the excessive greenback worth purchases usually concerned in the case of shopping for insurance coverage protection, or investing.

As an alternative of hundreds, the attainable premiums for SNACK Insurance coverage begin from S$0.30, whereas one can decide up SNACK Funding merchandise for as little as S$1.

These premiums are paid each time the app detects that you’ve accomplished a pre-set “Way of life Exercise”, similar to while you take public transport, order meals supply, or train.

You then accumulate insurance coverage protection in incremental quantities of some hundred {dollars} every time.

After making an attempt out the app for per week, I used to be lined for S$46,333 (together with S$6,000 of free protection throughout three insurance policies — life, accident, and important sickness).

Components of your every day routine set off insurance coverage purchases

Step one in establishing the app was to determine which actions to hyperlink to insurance coverage purchases.

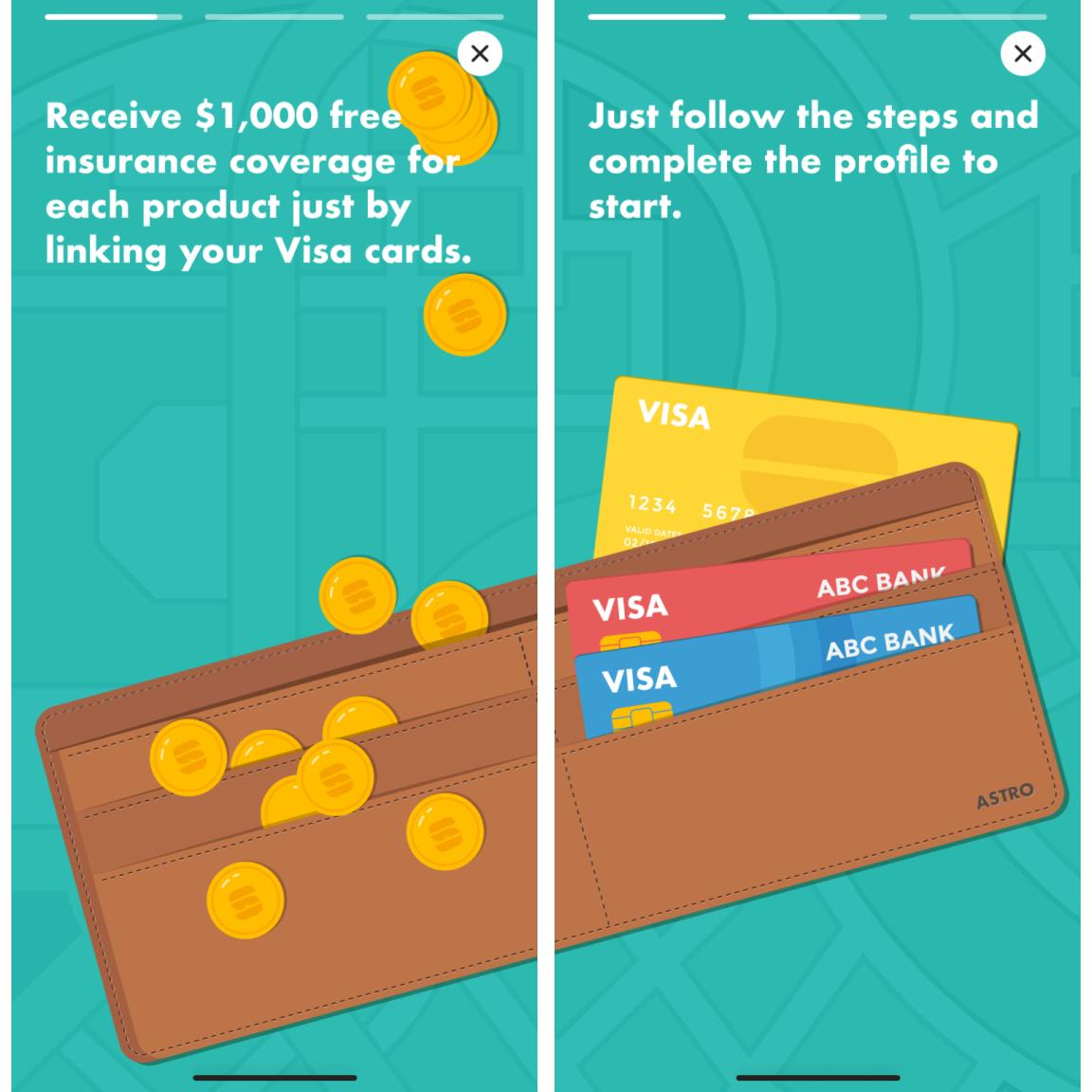

The revamped app interface consists of full-screen data panels, and you may faucet your means by means of at your individual tempo. Screenshot by way of SNACK app.

The revamped app interface consists of full-screen data panels, and you may faucet your means by means of at your individual tempo. Screenshot by way of SNACK app.

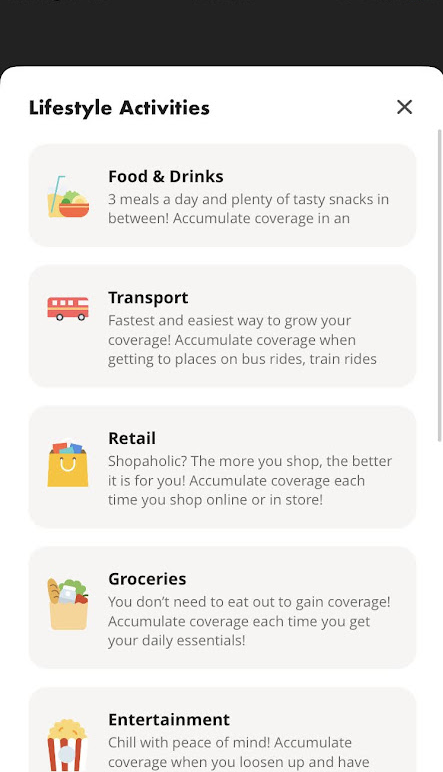

The record of actions you may select from consists of varied spending classes:

Screenshot by way of SNACK app.

Screenshot by way of SNACK app.

In addition to hitting the quite achievable goal of 5,000 steps per day.

I chosen all of the classes, understanding that I might at all times return to the app to disable some if wanted.

Going out, getting rewarded

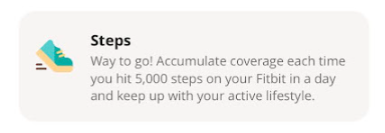

SNACK communicates with “Exercise Sources” similar to VISA, EZ-Hyperlink, and exercise monitoring apps (Garmin, Fitbit, or Apple Well being) so it is aware of when you might have carried out these actions.

I duly registered all my VISA playing cards to not miss out on any free protection. Screenshot by way of SNACK app.

I duly registered all my VISA playing cards to not miss out on any free protection. Screenshot by way of SNACK app.

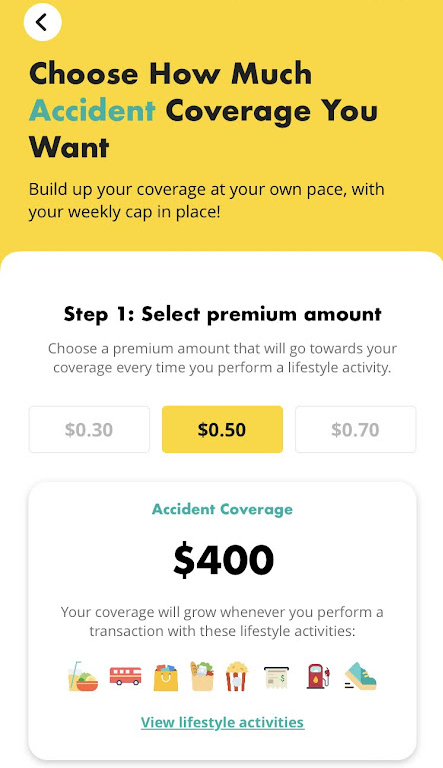

Selecting premium quantity

I used to be additionally requested to decide on the premium quantity: both S$0.30, S$0.50, or S$0.70.

Selecting the center choice. Screenshot by way of SNACK app.

Selecting the center choice. Screenshot by way of SNACK app.

With the knowledge of Goldilocks, I selected S$0.50. In any case, it didn’t actually matter since 1) it was a comparatively small quantity, and a pair of) I might at all times return to the app to boost or decrease the quantity.

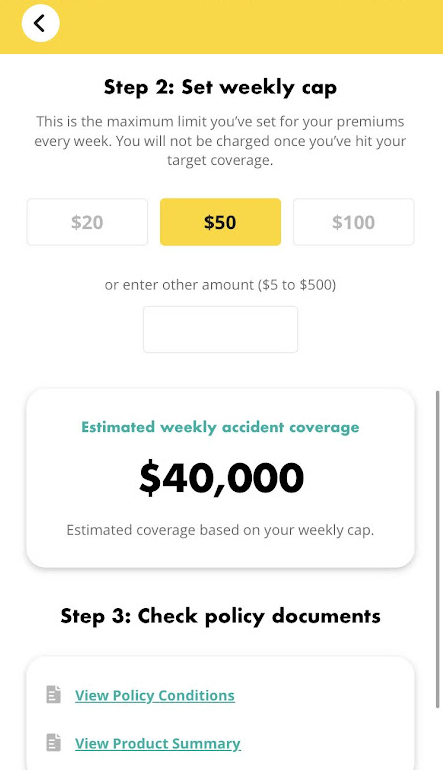

It additionally helped that I might arrange a weekly cap (I selected S$50).

Spoiler alert: I didn’t hit S$50 by the tip of the week. Screenshot by way of SNACK app.

Spoiler alert: I didn’t hit S$50 by the tip of the week. Screenshot by way of SNACK app.

So now at any time when I used one in every of my Visa bank cards to pay for a “Way of life Exercise” like going to the cinema, I’d robotically be charged S$0.50 till I hit the weekly cap of S$50 — all of the whereas accumulating accident protection.

It was an analogous set-up course of for the opposite two insurance policies (essential sickness and life).

And with that, I used to be able to exit into the world to earn my protection.

Screenshot by way of SNACK app.

Screenshot by way of SNACK app.

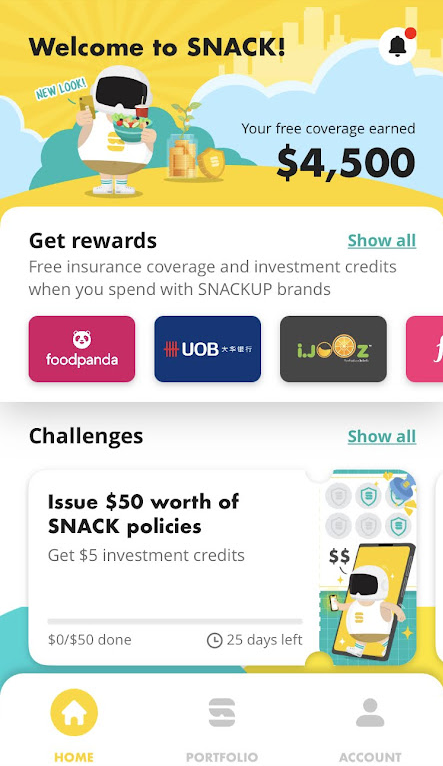

However not earlier than scoring S$4,500 of free protection — S$1,000 in every class as a beginning bonus from SNACK, and S$500 for finishing the set-up course of for every of the three.

Problem accepted. Screenshot by way of SNACK app.

Problem accepted. Screenshot by way of SNACK app.

On that day itself, I began to build up actions, and with that, protection.

My first transaction recorded by SNACK: a lunch of Nasi Lemak. Picture by Nigel Chua.

My first transaction recorded by SNACK: a lunch of Nasi Lemak. Picture by Nigel Chua.

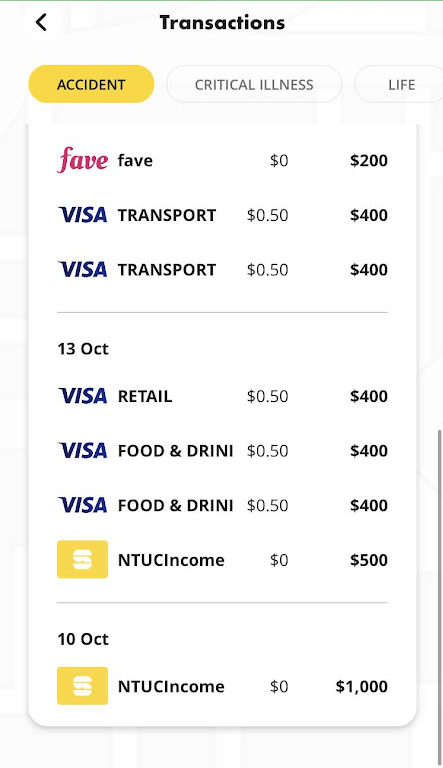

Oct. 13: Lunch, dinner, and selecting up some home goods on the best way residence. Three transactions, and S$1,200 protection for S$1.50. Screenshot by way of SNACK app.

Oct. 13: Lunch, dinner, and selecting up some home goods on the best way residence. Three transactions, and S$1,200 protection for S$1.50. Screenshot by way of SNACK app.

Every bite-sized chunk of insurance coverage protection is legitimate for 360 days — roughly a 12 months.

Which implies that as I proceed to dwell my life in the middle of the 12 months forward, I’ll proceed to build up protection and maintain the coverage working.

Organic age calculated every day

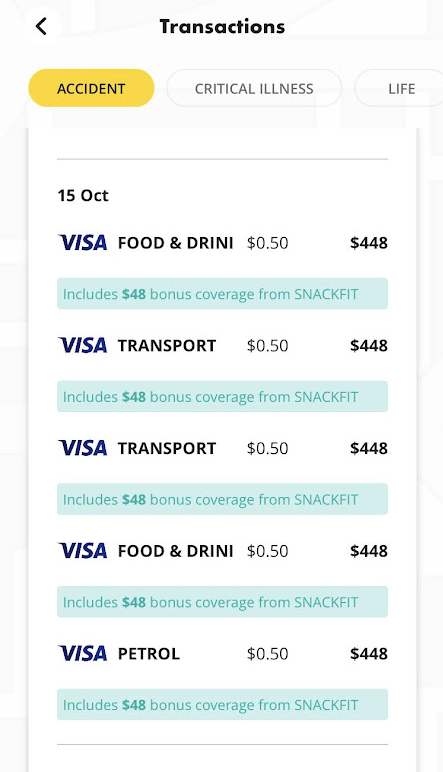

As somebody who usually tries to maintain wholesome and lively, I used to be more than happy to know that I get bonus protection for all my efforts, beneath a function known as SNACKFIT.

Screenshot by way of SNACK app.

Screenshot by way of SNACK app.

Every day, SNACKFIT tracks 5 key metrics: steps, energy burnt, BMI, resting coronary heart charge, and sleep.

The youthful your physique, the extra bonus protection you get, with a most of 20 per cent bonus protection for these whose organic age is 5 years youthful than their precise age.

Oct. 15: 12 per cent bonus protection for my accident coverage, because of my organic age being detected as 3 years youthful than my calendar age. Screenshot by way of SNACK.

Oct. 15: 12 per cent bonus protection for my accident coverage, because of my organic age being detected as 3 years youthful than my calendar age. Screenshot by way of SNACK.

It’s positively an incentive to get sufficient relaxation and train, and to remain according to these wholesome habits as a result of the information is pulled every day.

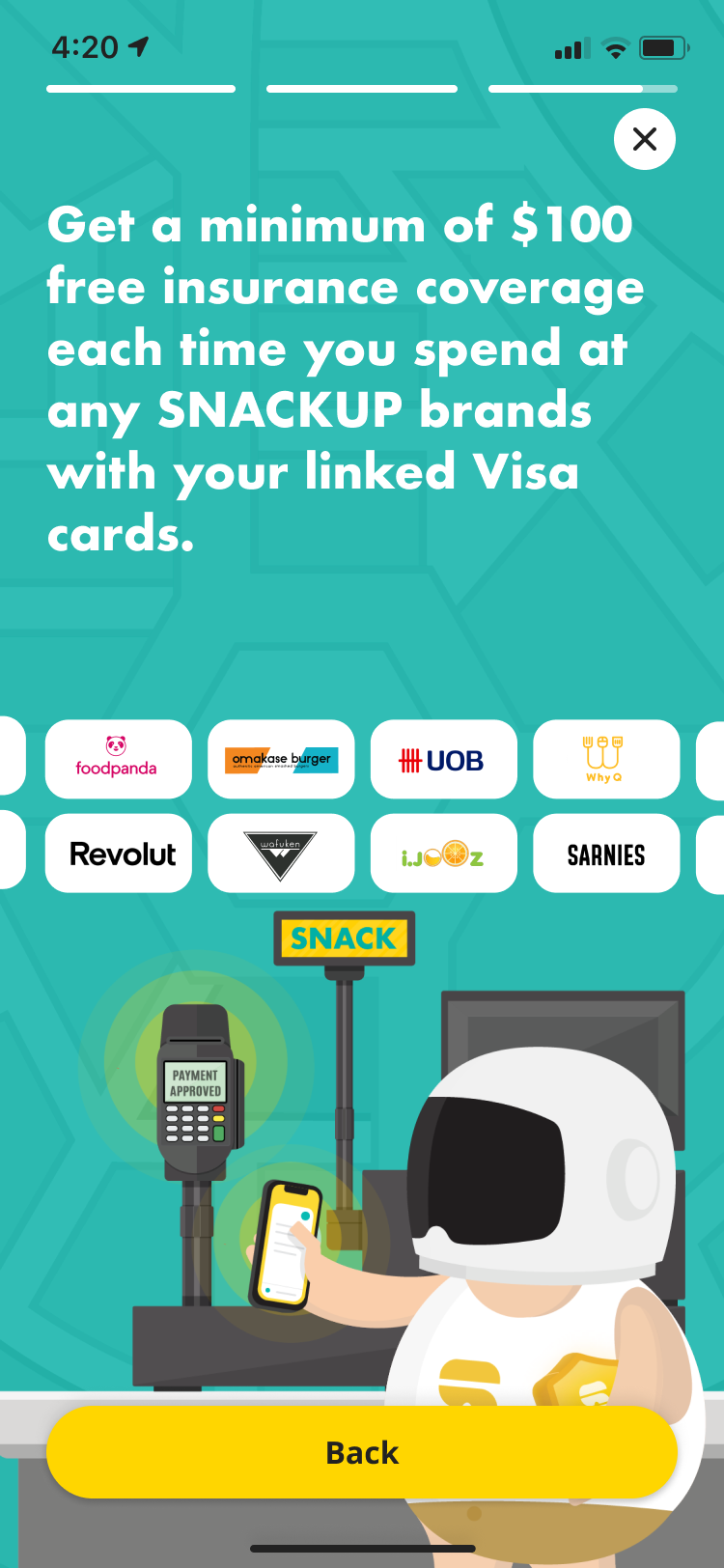

One other option to get bonus protection and funding credit is to make purchases with SNACK’s companion retailers — or, SNACKUP retailers — the place spending along with your linked VISA card will get you bonus protection and funding credit.

Certainly one of them being orange juice merchandising machine model IJOOZ.

Juiced-to-order. GIF by Nigel Chua.

Juiced-to-order. GIF by Nigel Chua.

S$2 for 4 oranges, juiced on the spot, S$100 free insurance coverage protection, and S$0.20 free insurance coverage credit? Cheers to that.

Cheers. Picture by Nigel Chua.

Cheers. Picture by Nigel Chua.

I additionally obtained bonus insurance coverage by paying with Fave, and ordering on foodpanda — each are SNACKUP retailers.

This meal at Wafuken additionally obtained me S$100 free insurance coverage protection and S$0.20 free funding credit.

Wholesome meal, free insurance coverage and free funding credit. Good.

Wholesome meal, free insurance coverage and free funding credit. Good.

Straightforward win

On the finish of 1 week, I collected S$46,333 protection, with S$40.5 of premiums in complete:

- Life: S$19,533, with S$13.50 in complete premiums paid

- Accident: S$13,400, with S$13.50 in complete premiums paid

- Important sickness: S$13,400, with S$13.50 in complete premiums paid

A very good chunk of the full — S$6,000 — was free protection that I scored, by staying wholesome and lively, and from SNACK’s varied giveaways and promotions with their companion retailers.

After all, I might have signed one massive coverage for equal and even higher protection in only a day, however which may have taken over a month to analysis and plan.

Total, SNACK by Revenue serves as a low-cost, low-effort option to get entangled on the planet of insurance coverage, with challenges, bonuses, and free protection to assist maintain you engaged within the course of.

It’s one thing I think about would have been endlessly useful for me, again after I was contemplating my first insurance coverage plan.

It could additionally function an add-on to present monetary merchandise. On the minimal, I’m going to maintain the accident coverage for certain, as I didn’t have one previous to this.

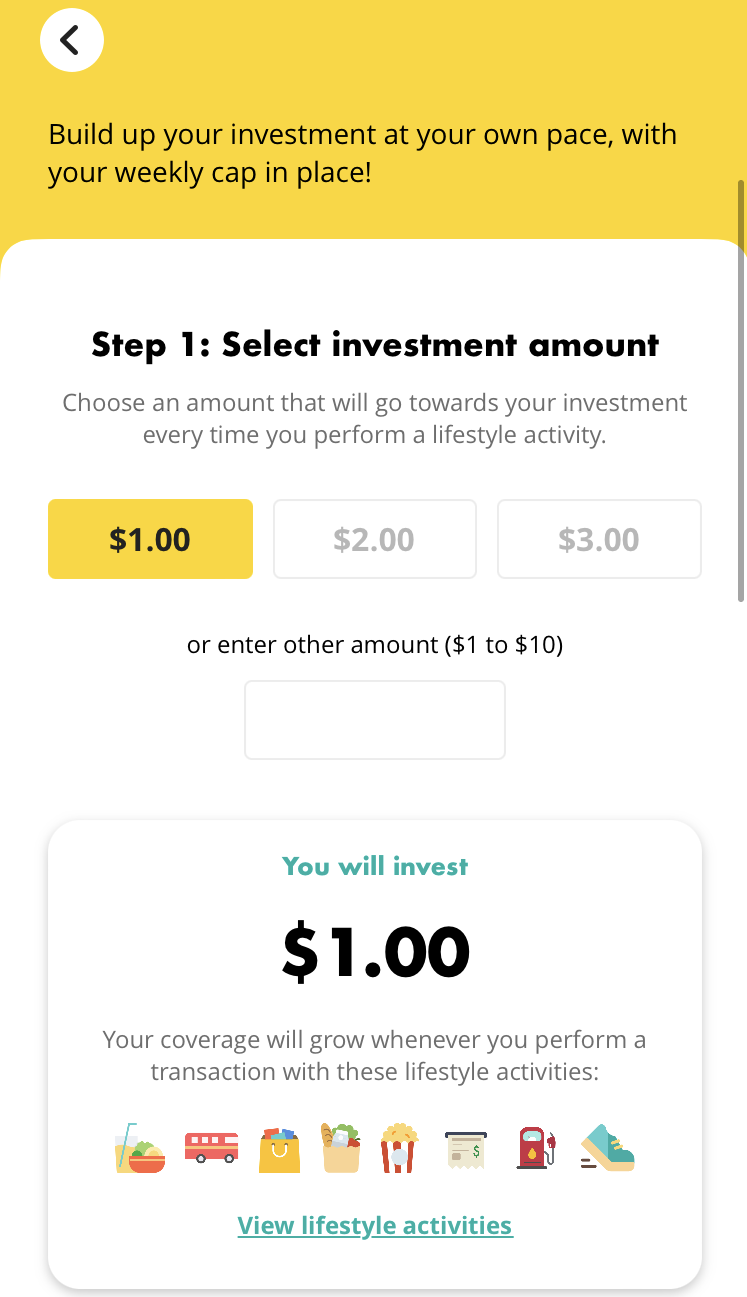

Get began on funding simply as simply

SNACK isn’t just an insurance coverage supplier.

It additionally permits you to get began on investments, with very comparable mechanics to how SNACK Insurance coverage protection is collected.

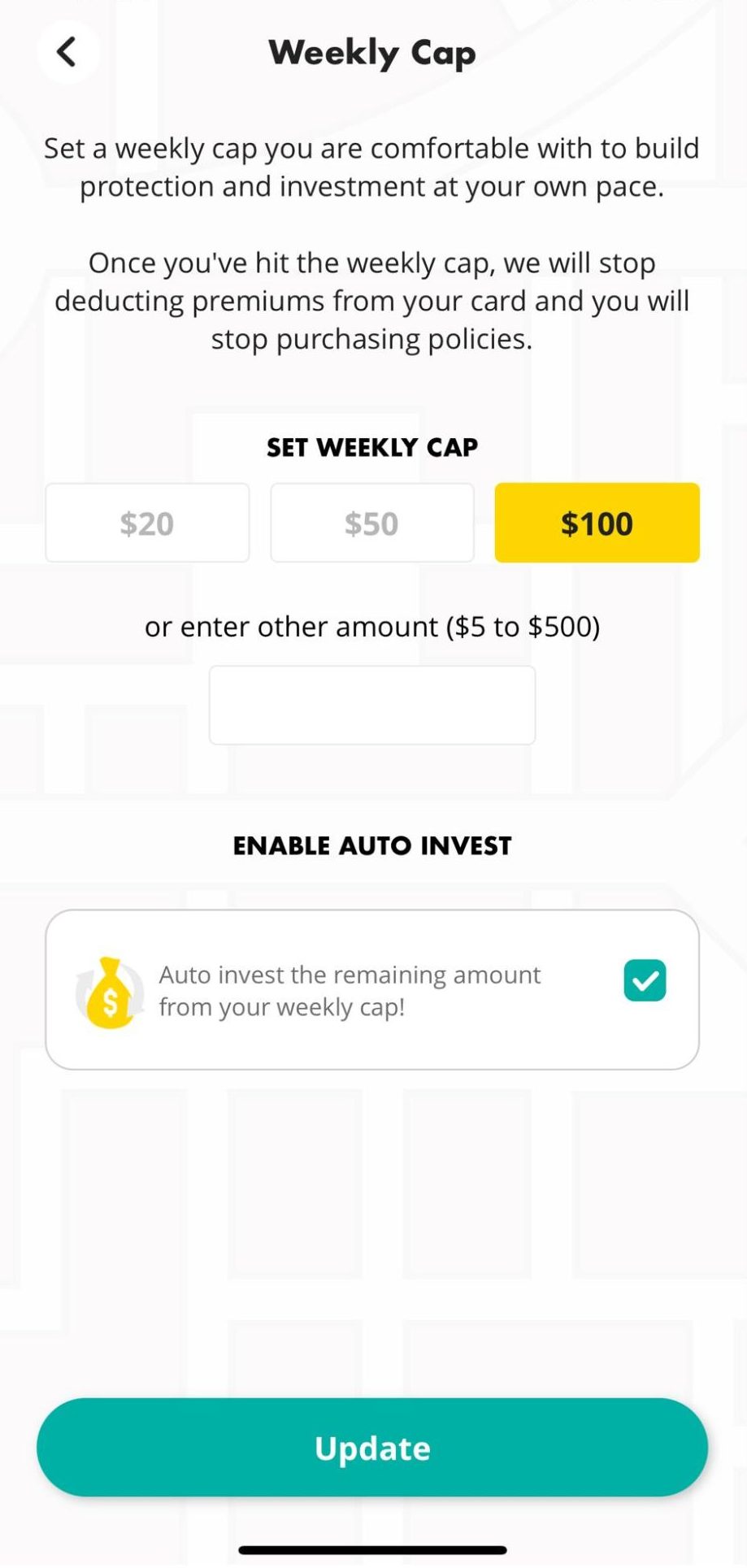

Day-to-day way of life actions (the identical ones that set off insurance coverage premiums) might be set as much as set off funding purchases in quantities of S$1, S$2, or S$3, with a weekly cap you may set relying in your funds for funding.

Screenshot by way of SNACK app.

Screenshot by way of SNACK app.

Identical to SNACK Insurance coverage, it’s a set-and-forget mechanism that permits you to construct your monetary portfolio with no need to consistently monitor it.

There’s additionally an auto-invest function which permits SNACK to robotically make investments the remaining quantity from the weekly cap that you’ve set.

You’ll be able to allow or disable this relying in your choice.

Screenshot by way of SNACK app.

Screenshot by way of SNACK app.

S$80 funding credit for brand new customers until Dec. 31

If you happen to’re a brand new SNACK person, you may get S$80 funding credit while you join a SNACK account with referral code <MS80> and begin your SNACK Funding.

You can too try different thrilling promotions and bonuses by means of the SNACK app itself.

Simply comply with these steps:

- Create a SNACK account with referral code <MS80>

- Go to “PORTFOLIO” and faucet “Begin now” on Funding

- Arrange your account and hyperlink your Visa card

- Full the Buyer Data Evaluation (CKA) and make sure you’ve boosted your Funding

If you happen to’re to strive it out, obtain the SNACK app and take a look at SNACK’s step-by-step information right here that will help you get began with SNACK Funding.

This sponsored article by SNACK by Revenue allowed this author to get fuss-free further insurance coverage.

High photos by Nigel Chua.

[ad_2]

Source link