[ad_1]

Observe us on Telegram for the most recent updates: https://t.me/mothershipsg

A rise in Singapore’s Items and Companies Tax (GST) will kick in from January 2023, from 7 to eight per cent, and to 9 per cent in 2024.

Whereas the matter was not too long ago debated extensively in Parliament, Ho Ching has additionally chimed in together with her views on the reserves and GST in a Nov. 26 Fb submit.

GST would’ve climbed even increased with out reserves: Ho Ching

The previous CEO of Temasek defined that with out the nation’s present reserves, which have been “saved, invested and grown over generations,” the GST must climb to a good increased 12 per cent with a view to make up for the S$20 billion of spending capability given by the Web Funding Returns Contribution (NIRC) framework.

The NIRC contains:

- As much as 50 per cent of the Web Funding Returns (NIR) on the web property invested by GIC, Financial Authority of Singapore, and Temasek

- As much as 50 per cent of the Web Funding Earnings (NII) derived from previous reserves from the remaining property

The funding returns from the reserves are spent in areas like training, healthcare, and transport infrastructure.

Ho, the Chairperson of Temasek Belief, then went into element in regards to the impression of the investments returns from reserves.

Based mostly on a few conservative estimates, she calculated that the federal government dietary supplements its spending with round S$6 billion to S$8 billion of Temasek’s returns.

It’s because the NIRC framework permits for 50 per cent of the anticipated long run charge of actual return.

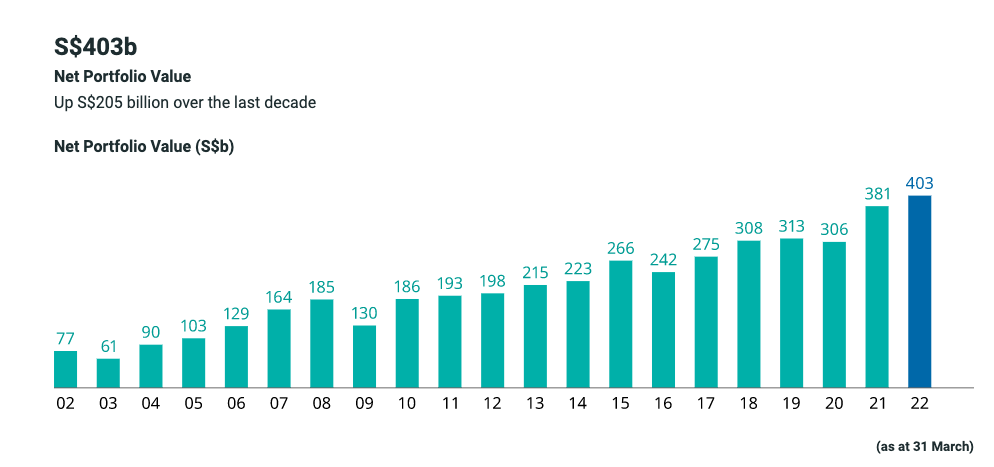

Taking Temasek’s long run actual charge of returns as 4 per cent, as much as two per cent of Temasek’s present internet portfolio worth (S$403 billion this 12 months) returns a determine of round S$8 billion.

Alternatively, a extra conservative valuation of Temasek based mostly on its retained earnings would return a determine of round S$6 million — specifically, two per cent of S$300 billion.

Supply: Temasek web site.

Supply: Temasek web site.

In accordance with Ho, our present GST of seven per cent added about S$12 billion to the nation’s coffers on 2021.

That may make one per cent equal to a further S$1.7 billion in income.

“So S$6-S$8 billion of NIRC contribution from Temasek would translate to 3 to 5 per cent extra in GST,” Ho reasoned.

Moreover, Ho stated, all three sources of tax income —GST, company earnings tax, and private earnings tax—are every lower than the NIRC contribution of about S$20 billion.

Let’s not kill the golden geese

Ho stated that by taking 50 per cent of NIRC for spending, Singapore already has “50 per cent much less for reinvestment for extra future earnings”.

This comment is prone to be in reference to calls from opposition Members of Parliament (MPs) to extend the proportion of NIRC for spending.

The Staff’ Get together (WP) had instructed through the price range debates earlier this 12 months to modify the NIRC framework, for NIRC to be raised to 60 per cent from the present 50 per cent.

This was additionally talked about in WP MP Jamus Lim’s newest discussion board letter in Zaobao, although he famous that altering the NIRC to 60 per cent was solely one of many levers WP had supplied as various methods for elevating income.

Ho concluded by saying,

“Let’s not be grasping for extra, and kill the golden geese that assist us preserve our tax burden decrease than most nations, apart from those that can profit from oil reserves or different pure assets”.

Prime photograph through Temasek, Mike Enerio on Unsplash

[ad_2]

Source link

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2Z2FJRA6HBNS5MVHDDL66VB46Q.jpg)