[ad_1]

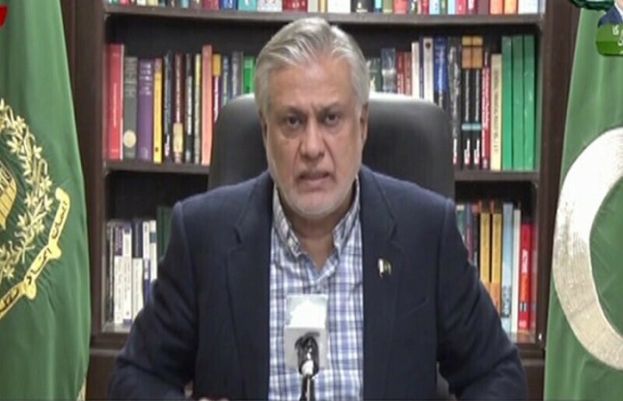

Finance Minister Ishaq Dar introduced on Tuesday that the Asian Infrastructure Funding Financial institution (AIIB) had transferred $500 million to the State Financial institution of Pakistan (SBP).

“AIIB has transferred immediately, as per their board’s approval, to State Financial institution of Pakistan/Authorities of Pakistan $500 million as programme financing,” the minister stated on Twitter

Earlier this month, the finance minister had stated Pakistan would obtain the funds as co-financing for a improvement programme.

The Constructing Resilience with Lively Countercyclical Expenditures Programme is an Asian Improvement Financial institution (ADB) financing programme to counter the social fallouts of financial disaster.

Final month, the ADB signed an settlement with Pakistan to offer a $1.5 billion mortgage for budgetary assist and assist flood-related rehabilitation and reconstruction actions.

The mortgage, supplied beneath the BRACE Programme, was supplied to fund the federal government’s $2.3bn countercyclical improvement expenditure programme designed to cushion the impacts of exterior shocks, together with the Russian invasion of Ukraine.

The $1.5bn mortgage was aimed to offer social safety, promote meals safety, and assist employment for individuals amid devastating floods and world provide chain disruptions.

The State Financial institution later introduced that it had acquired $1.5bn from the ADB “as disbursement of policy-based mortgage for the federal government of Pakistan”.

Early bond reimbursement

Right now’s influx from AIIB comes amid rising uncertainty about Pakistan’s capacity to fulfill exterior financing obligations with the nation within the midst of an financial disaster and recovering from devastating floods that killed over 1,700 individuals.

Pakistan’s reserves with the central financial institution stood at $7.8bn as of November 18, barely sufficient to cowl a month’s imports.

However on Friday, SBP Governor Jameel Ahmad stated he anticipated exterior financing necessities can be met on time due to inflows from worldwide lenders. He stated the nation will repay a $1 billion worldwide bond on December 2, three days earlier than its due date.

The bond reimbursement, which matures on Dec 5, totals $1.08bn, Ahmad informed a briefing, in accordance with two analysts who have been current.

For this goal, the governor stated funding was lined up from multilateral and bilateral sources, one in all which was the $500m from AIIB which Pakistan acquired immediately, to make sure the reimbursement wouldn’t have an effect on overseas alternate reserves.

[ad_2]

Source link