[ad_1]

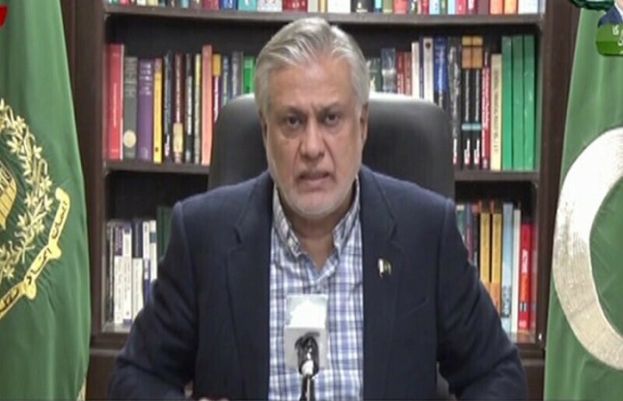

Finance Minister Ishaq Dar Wednesday mentioned the nation can change into interest-free in 5 years as stipulated by the Federal Shariat Courtroom (FSC) in its judgement earlier this 12 months.

“The banking system has change into a necessity of life and clear transactions may be ensured via it,” Dar mentioned talking at a seminar held in Karachi.

The seminar was organised below the auspices of the Federation of Pakistan Chambers of Commerce and Business (FPCCI) and the Centre for Islamic Economics in Karachi the place spiritual leaders from all faculties of thought, businessmen, bankers, and politicians spoke at size in regards to the “advantages” of an interest-free economic system.

The FSC judgement issued in April 2022 gave the federal government 5 years to implement an Islamic and interest-free banking system within the nation, because the financial system of an Islamic nation like Pakistan ought to be freed from curiosity.

In his verdict, Justice Dr Syed Muhammad Anwar said that the abolition of riba was elementary for an Islamic system, including that any transaction involving riba was flawed.

“The abolition of riba and its prevention is in accordance with Islam. The curiosity taken in any case, together with on debt, falls below riba. Riba is totally forbidden in Islam,” said the decision.

“In the event you make a honest resolution just for the pleasure of Allah, curiosity may be eradicated from the nation in 5 years.”

Since then, the spiritual events and clerics are demanding the federal government implement the decision and compelled it to withdraw the appeals towards it.

Right this moment, addressing the seminar, the finance minister mentioned that presently Islamic banking has reached 20 to 21% within the nation and the belongings of Islamic banking are Rs7 trillion.

Expressing settlement with the audio system, Dar mentioned an Islamic banking system was potential within the nation.

He mentioned that the SBP and different banks had filed appeals towards the choice of the FSC, which had been withdrawn.

Decision

A decision was additionally offered on the finish of the seminar, asking the federal government to take concrete steps in implementing the decision of the FSC and urging personal banks to withdraw appeals towards it.

“We welcome the choice of the FSC towards usury and specific concern that personal banks haven’t withdrawn appeals towards the decision,” the decision said.

It requested the federal government to take rapid steps to implement the courtroom verdict wherein significant progress may be seen.

The federal government ought to take sensible steps to finish the interest-based system inside the stipulated interval, the decision mentioned.

The gathering additionally requested for the Transgender Act to be amended in accordance with Sharia, whereas demanding to ban the movie Joyland.

The considerations had been additionally raised on the energy of the FSC which has diminished from 7 to 2 judges.

SBP governor vows joint efforts

Vowing joint efforts to fully remove curiosity, State Financial institution of Pakistan (SBP) Governor Jameel Ahmad mentioned the market share of Islamic banking had elevated to 21%.

“We’ve got withdrawn the enchantment towards the choice of the Federal Shariat Courtroom and the SBP is working to implement the choice of FSC,” the SBP governor mentioned.

“The central financial institution has activated a high-level working group on this regard.”

He mentioned Pakistanis needed to eliminate non-Islamic banking system.

Enterprise magnate Arif Habib, the founding father of the Arif Habib Group, acknowledged that Islamic banking was increasing quickly within the nation.

“Now Pakistanis need to eliminate the interest-based system,” he mentioned and urged the Ulema to information the citizenry who had change into a part of the prevailing system.

‘All faculties united on Islamic banking’

Famend spiritual scholar Mufti Taqi Usmani mentioned that “all of us have to lift our voices unanimously to finish the scourge of usury”.

Addressing the seminar, the eminent spiritual scholar mentioned there was no distinction within the stance of various faculties of considered Muslims on usury.

“Curiosity-free banking ought to be carried out, the curse of usury ought to be eradicated. There’s unanimity on this matter.”

Mufti Usmani mentioned it was good that students of all faculties of thought had been taking part within the seminar. “Implementation of Shariat is crucial challenge, however an armed wrestle for its implementation will not be permissible.”

He mentioned that the aim of this seminar was to demand from the federal government and associated establishments that sensible efforts be made to remove usury.

Earlier, in keeping with Appearing President FPCCI Sulaiman Chawla, the enterprise neighborhood considers curiosity as haram however Pakistan pays 40% curiosity.

“Islamic banking facility ought to be absolutely carried out in banks, Chawla added.

[ad_2]

Source link