[ad_1]

What are the early traits we should always search for to determine a inventory that would multiply in worth over the long run? Amongst different issues, we’ll wish to see two issues; firstly, a rising return on capital employed (ROCE) and secondly, an growth within the firm’s quantity of capital employed. Finally, this demonstrates that it is a enterprise that’s reinvesting earnings at rising charges of return. So after we checked out Qatar Navigation Q.P.S.C (DSM:QNNS) and its pattern of ROCE, we actually favored what we noticed.

What Is Return On Capital Employed (ROCE)?

If you have not labored with ROCE earlier than, it measures the ‘return’ (pre-tax revenue) an organization generates from capital employed in its enterprise. Analysts use this components to calculate it for Qatar Navigation Q.P.S.C:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Belongings – Present Liabilities)

0.028 = ر.ق485m ÷ (ر.ق18b – ر.ق1.1b) (Primarily based on the trailing twelve months to September 2022).

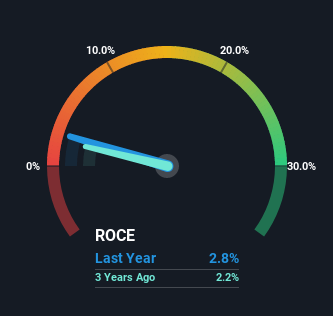

Subsequently, Qatar Navigation Q.P.S.C has an ROCE of two.8%. Finally, that is a low return and it under-performs the Transport business common of 11%.

See our newest evaluation for Qatar Navigation Q.P.S.C

Within the above chart now we have measured Qatar Navigation Q.P.S.C’s prior ROCE in opposition to its prior efficiency, however the future is arguably extra vital. When you’re , you may view the analysts predictions in our free report on analyst forecasts for the corporate.

What Does the ROCE Development For Qatar Navigation Q.P.S.C Inform Us?

Whereas there are corporations with greater returns on capital on the market, we nonetheless discover the pattern at Qatar Navigation Q.P.S.C promising. Extra particularly, whereas the corporate has saved capital employed comparatively flat over the past 5 years, the ROCE has climbed 98% in that very same time. Principally the enterprise is producing greater returns from the identical quantity of capital and that’s proof that there are enhancements within the firm’s efficiencies. On that entrance, issues are wanting good so it is value exploring what administration has mentioned about progress plans going ahead.

The Backside Line On Qatar Navigation Q.P.S.C’s ROCE

To convey all of it collectively, Qatar Navigation Q.P.S.C has accomplished effectively to extend the returns it is producing from its capital employed. Because the inventory has returned a staggering 124% to shareholders over the past 5 years, it appears like buyers are recognizing these modifications. With that being mentioned, we nonetheless assume the promising fundamentals imply the corporate deserves some additional due diligence.

On the opposite facet of ROCE, now we have to contemplate valuation. That is why now we have a FREE intrinsic worth estimation on our platform that’s undoubtedly value testing.

Whereas Qatar Navigation Q.P.S.C is not incomes the best return, try this free record of corporations which can be incomes excessive returns on fairness with strong stability sheets.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Qatar Navigation Q.P.S.C is probably over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to convey you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source link