[ad_1]

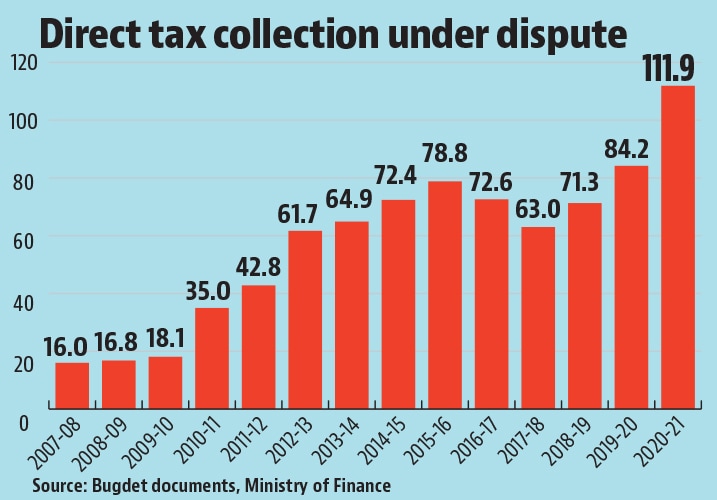

As finance minister Nirmala Sitharaman prepares the Union Finances for 2023-24, it’s price recalling her Finances speech from 2019, when she quoted Tamil poet Pisiranthaiyar’s allegory for government-taxpayer relations, “Just a few mounds of rice from paddy, that’s harvested from a small piece of land, would suffice for an elephant. However what if the elephant itself enters the sphere and begins consuming? What it eats could be far lower than what it will trample over.” An imaginative thoughts may see the form of an agitated elephant within the adjoining chart, which plots direct tax assortment beneath dispute on the finish of a 12 months, as a proportion of the gross direct tax assortment throughout that 12 months. The year-on-year change displays the web change throughout the 12 months, as some disputes get resolved, whereas others get instituted.

Firstly of the earlier decade, disputes rose quickly, moderating barely in 2016-17 and 2017-18, in all probability as a consequence of amnesty schemes. However in 2018-19 and 2019-20, the elephant raised its trunk in starvation. To make issues worse, in 2020-21, low income receipts, an increase in disputes, and the gradual decision of disputes pushed the inventory of direct tax assortment beneath dispute to a degree greater than the stream of direct tax revenues within the 12 months. The spike within the early 2010s was totally on account of disputes in private revenue tax, however the latest spike is seen in each company and private revenue tax.

What makes this rise in disputes troubling is that the administration appears unsuccessful in successful most of them. OECD’s biannual report on tax administration reviews the share of instances resolved in favour of the administration in main jurisdictions — that’s, instances by which the administration was profitable in additional than 50% of the problems contested. In 2020, the typical for the 47 jurisdictions included was 66%. In India, this was solely 7.9%. This disparity has persevered for a few years, and India has persistently ranked on the backside of the record of nations on this depend.

Whereas the poor success charge may very well be partly defined by a failure to combat these disputes correctly, the acute rarity of success suggests the administration could also be making some unreasonable calls for. It’s price contemplating why this can be occurring. First, the rise in disputes has corresponded with durations of financial slowdown. Early within the 2010s, direct tax disputes elevated whereas a fledgling, stimulus-driven restoration from the worldwide monetary disaster was underway. The latest rise additionally corresponds with a development slowdown. Financial issues might have translated into low tax assortment, and beneath strain to ship income targets, the tax authorities made some unreasonable calls for, triggering disputes that they misplaced.

Second, the rise in disputes additionally corresponds with diluting checks and balances within the regulation that constrains the actions of income authorities. In 2017, the revenue tax regulation was amended to weaken the checks on tax authorities. These embody not requiring the tax authorities to reveal the explanations for conducting or increasing searches and seizures, even to the appellate tribunal; empowering the officer conducting the search and seizure to connect property for as much as six months with the prior approval of senior officers; decreasing the seniority degree of the officer who can name for data for any inquiry or continuing, amongst others.

Third, the fiscal context may additionally create pressures to make extreme direct tax calls for. The federal government has massive, dedicated expenditures however has, in most years since 2008-09, registered weak efficiency in gathering oblique taxes, non-tax revenues (for instance, dividends and spectrum public sale), and non-debt capital receipts (primarily, disinvestment receipts). Since 2015, states’ share of the Union authorities’s tax pool has additionally elevated. There additionally appears to be an unwillingness to extend oblique taxes, besides by means of duties on petroleum merchandise, relying on crude oil costs. It appears administratively simpler to make further calls for for direct taxes than different income receipts.

Lastly, the rhetoric of political management in the previous few years suggests they think large-scale tax evasion. This might need translated into political strain on the tax administration, which then needed to seem to go after tax evasion. In 2020, further assessments raised from audits corresponded to 44.1% of tax collections, whereas the typical for the 51 nations that reported this data within the OECD report was simply 5.2%.

The Financial Survey of 2015-16 discovered India’s direct tax assortment is in line with different nations at this degree of revenue. India’s revenue tax assortment is way greater than the typical for nations with its per capita revenue. So, the expectation from direct taxes is perhaps constructed on false assumptions.

The allegory of the elephant and farmer should embody a mahout using the elephant. When and methods to train the elephant’s energy is a matter of the mahout’s sensible knowledge in understanding what’s within the elephant’s (and the mahout’s) long-term curiosity. If the State goes too straightforward, taxpayers might take benefit, but when it turns into too draconian, it might have a chilling impact. The powers of tax authorities are the Sword of Damocles dangling over all people and enterprises. They will disrupt companies and hurt private reputations, however they’ll ultimately damage the federal government’s skill to mobilise assets.

In recent times, the federal government has tried to scale back disputes, largely by means of dispute-settlement schemes. Nonetheless, it is usually essential to stop pointless disputes from arising within the first place. Whereas the price range is primarily about elevating and deploying assets, choices concerning income administration and expenditure administration techniques are additionally essential. The finance minister ought to take into account whether or not the federal government’s revenue-mobilisation technique and its strategy to the administration of direct tax are in line with India’s funding and development ambitions and the way the tax administration’s incentives could be structured in order that pointless disputes don’t come up.

Suyash Rai is deputy director, Carnegie India The views expressed are private

(A model of this essay was beforehand despatched in Carnegie India’s Concepts and Establishments e-newsletter)

[ad_2]

Source link