[ad_1]

yorkfoto

By Nicholas Mapa

Indonesia: At a look

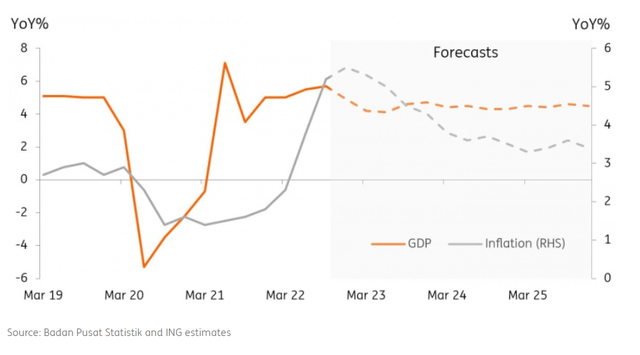

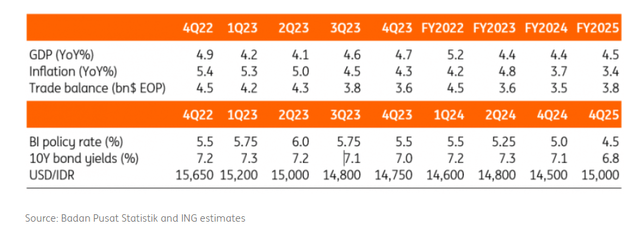

Progress in 2022 will doubtless common 5.3% year-on-year, however momentum is slowing because the commodity growth fades and inflation accelerates. Forecasts by Financial institution Indonesia (BI) point out GDP development ought to settle between 4.7-5.5% YoY subsequent yr.

Family spending was one stable issue behind the expansion engine due partly to comparatively well-behaved home inflation within the first half of the yr. Comparatively much less pronounced value pressures allowed BI the area to delay charge changes till the second half of 2022, which additionally supported development. By the second half of the yr, value pressures lastly caught up with Indonesia as headline inflation breached the central financial institution’s higher sure goal of 4%.

Indonesia’s commerce sector has additionally seen momentum fade as commodity costs have normalised after surging because of the warfare in Ukraine. This growth can even be value watching within the coming months.

Progress and inflation outlook

3 requires 2023

Slowing commerce momentum to maintain FX pressured

Indonesia was one of many few international locations that benefited from the commodity value growth in 2022, translating to document commerce surpluses. This resulted within the present account additionally reverting to optimistic territory, which in flip supplied strong help to the Indonesian rupiah (IDR). The relative stability of the IDR helped restrict value pressures early in 2022, which in flip allowed the central financial institution to postpone charge hikes to the latter half of 2022. With commodity costs moderating and anticipated to slip additional, we might see Indonesia’s commerce surplus diminish and even transfer into deficit territory in 2023. The lack of this earlier help means that the IDR will doubtless stay pressured for a lot of subsequent yr, particularly if monetary outflows proceed. A weaker IDR in 2023 might additionally translate to extra charge hikes by the central financial institution early subsequent yr.

Tinkering with central financial institution constitution a optimistic or a unfavourable?

The Covid-19 pandemic’s impression on fiscal balances led to some central banks resorting to quasi-budget financing along with quantitative easing. Financial institution Indonesia (BI) was one of many extra lively central banks by way of offering help to fiscal counterparts with BI buying authorities bonds within the main market. This momentary scheme was termed a “burden-sharing association” and was permitted through Presidential decree. BI Governor Perry Warjiyo promised to wind down such operations after the pandemic, however Indonesia’s lawmakers handed recent laws to make the quasi-central financial institution financing a everlasting fixture for BI.

Using “burden sharing” throughout Covid-19 raised eyebrows when first applied however was justified given the fallout from the pandemic. The passage into regulation might name into query central financial institution independence, which in flip might trigger some nervousness within the bond markets and the forex.

Jokowi’s final full yr in workplace forward of early 2024 election

President Joko Widodo enters his final full yr in workplace subsequent yr as he isn’t eligible to take up a 3rd time period as President. Indonesia holds presidential elections in February 2024. Jokowi seems to have made a veiled endorsement for his successor by suggesting that Indonesians vote for a candidate with “white hair” and “wrinkles”. Opinion polls at present have three entrance runners: Central Java Governor Ganjar Pranowo, former Jakarta governor Anies Baswedan and former defence minister Prabowo Subianto.

It is going to be fascinating to see how Jokowi spends the final 14 months of his time period as he might nonetheless move key laws given his management over the home of representatives. Key legislative payments embrace the New Capital Metropolis (NCC) regulation and a brand new penal code. Particularly, the NCC might positively impression development potential as amendments might usher in a recent spherical of funding given the capital-intensive necessities to maneuver the capital from Jakarta to East Kalimantan.

Jokowi, however, could develop into extra concerned within the marketing campaign by explicitly endorsing one of many three entrance runners – a transfer which might distract him from passing amendments to present legal guidelines or drafting recent laws.

Indonesia abstract forecast desk

Content material Disclaimer

This publication has been ready by ING solely for info functions no matter a specific consumer’s means, monetary state of affairs or funding targets. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a suggestion or solicitation to buy or promote any monetary instrument. Learn extra

Unique Put up

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Source link