[ad_1]

FIEs and Ros are required to undergo China’s annual compliance procedures beginning after the tip of the fiscal yr and normally happen till the tip of June. Failing to hold out the procedures correctly will trigger a collection of undesirable penalties. Particularly with China’s social credit score system repeatedly creating, corporations ought to pay extra consideration to the annual compliance necessities.

With the scope and punishments of China’s social credit score system being additional clarified in 2021 and 2022, authorized and regulatory compliance has turn into extra necessary than ever. Extra consideration must be addressed to the annual compliance procedures as mandated by numerous governmental departments.

Overseas invested enterprises (FIEs) and consultant places of work (ROs) in China are required to supply an annual audit report, conduct annual tax reconciliation, and report back to related authorities bureaus in cost, although the detailed procedures and necessities are completely different. Failure to hold out these procedures correctly or on time could end in additional bills, penalties, downgrading of the credit score of the enterprise, and even revocation of enterprise licenses.

On this article, we’ll stroll you thru the annual compliance necessities for FIEs and ROs in China and spotlight the newest updates and tendencies.

Annual compliance procedures for FIE

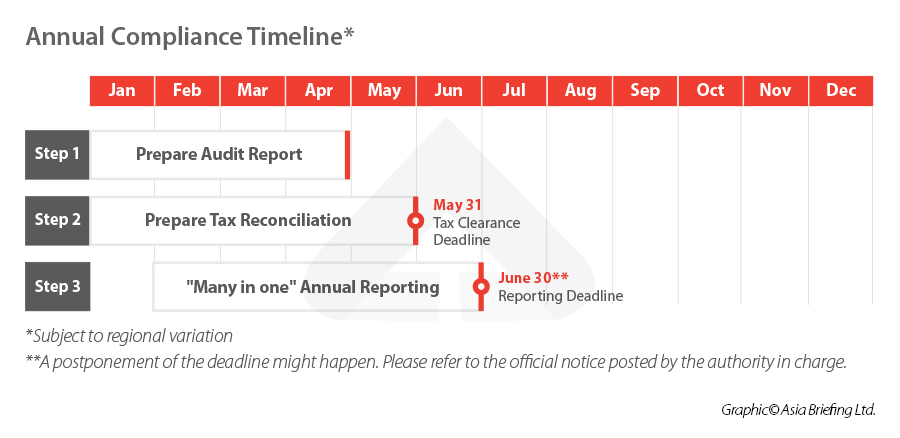

For FIEs, no matter wholly foreign-owned enterprises (WFOE) or joint ventures (JV), the annual compliance necessities begin after the tip of the fiscal yr (December 31 as China follows the calendar yr) and normally takes place till the tip of June.

Step 1: Put together an annual audit report

The annual compliance procedures begin with the annual audit of the enterprise. Although the preliminary audit can begin as early as November or December, the annual audit report have to be ready after the tip of the fiscal yr to incorporate knowledge from the previous complete yr. And to proceed with the annual tax submitting in Could, the audit report must be accomplished earlier than the tip of April.

The annual audit report for FIEs typically consists of a stability sheet, an revenue assertion, a money move assertion, a press release of change in fairness, and a supplementary assertion of economic indicators. To make sure that FIEs meet Chinese language monetary and accounting requirements, the annual audit report must be carried out by certified accounting companies and signed by two Licensed Public Accountants (CPAs) registered in China.

Regardless of a requirement by the Firm Regulation, in some cities, corporations is probably not required to submit the annual audit report back to the native tax bureau. Somewhat, they might solely must disclose whether or not they have achieved an annual audit throughout annual reporting. Even so, corporations are usually not recommended to take the possibility. They’re nonetheless suggested to conduct their audit on a yearly foundation for the explanations we defined within the first article.

Within the case the place an annual report is required, the necessities for the report could differ by area. For example, in Shanghai, corporations should embody a taxable revenue adjustment sheet within the audit report, which isn’t a vital complement in Hangzhou, Beijing, or Shenzhen. Corporations ought to keep on with the native formalities.

Step 2: Conduct CIT reconciliation

The following step following the audit report is to conduct annual CIT reconciliation, which can be known as annual CIT submitting, earlier than Could 31 yearly.

Though the State Taxation Administration (STA) oversees every kind of tax, solely CIT requires annual reconciliation to the tax bureau on the firm stage.

In China, CIT is paid on a month-to-month or quarterly foundation in accordance with the figures proven within the accounting books of the corporate – corporations are required to file CIT returns inside 15 days from the tip of the month or quarter. Nevertheless, attributable to discrepancies between China’s accounting requirements and tax legal guidelines, the precise CIT taxable revenue is normally completely different from the full earnings proven within the accounting books.

As such, the STA requires corporations to conduct annual CIT reconciliation inside 5 months from the earlier yr’s year-end to find out if all tax liabilities have been met and whether or not the corporate must pay supplementary tax or apply for a tax reimbursement.

Typically, the Annual CIT Reconciliation Report should embody adjustment sheets to bridge the discrepancies between tax legal guidelines and accounting requirements amongst different paperwork. FIEs that conduct transactions with associated events ought to put together an Annual Affiliated Transaction Report on switch pricing points as a supplementary doc to the Annual CIT Reconciliation Report.

Furthermore, FIEs in sure areas is perhaps required to organize one other separate CIT audit report by assembly sure situations, which additionally differ from metropolis to metropolis.

The CPA agency that prepares the monetary audit report normally additionally has Licensed Tax Brokers (CTAs) to organize an audit report for CIT. Within the case that the CPA agency doesn’t have CTA qualification, corporations should rent one other CTA agency to do the report. The CTA agency will request an annual (monetary) audit report as a reference for CIT reconciliation.

Within the present development of digitalization and enterprise reform, annual CIT reconciliation might be carried out via on-line channels, underneath which corporations can conveniently submit related info within the appointed system. That is particularly really helpful within the context of the COVID-19 pandemic. Nevertheless, if corporations can not make on-line CIT reconciliation attributable to sure circumstances, they’ll nonetheless go to the tax bureau in particular person to submit related supplies as required.

The deadline for conducting annual CIT reconciliation is Could 31 yearly, however the investigation of the tax compliance may final till the tip of the yr, and corporations must be ready to offer supporting paperwork upon demand from the tax bureau. Apart from, the place corporations are unable to conduct CIT reconciliation inside the stipulated deadline attributable to a drive majeure occasion, they might apply for an extension. However they have to submit a report back to the tax bureau instantly upon cessation of the drive majeure occasion. The tax bureaus shall examine the details and approve accordingly.

Yearly round March, relying on the placement, the native tax bureau will problem annual steerage on CIT reconciliation. FIEs are recommended to regulate the steerage for any potential adjustments concerning the necessities and procedures.

All corporations partaking in manufacturing and operation, together with pilot manufacturing and operation, are required to undergo annual CIT reconciliation, no matter whether or not or not the corporate is underneath a tax deduction interval, and whether or not or not the corporate makes a revenue. For corporations sustaining department places of work in a number of areas and required to pay tax on a consolidated foundation, there are particular guidelines and necessities concerning CIT reconciliation procedures. Corporations ought to pay particular consideration to the matter in the event that they fall into this scope.

Step 3: “Many-in-one” annual reporting

The third step of annual compliance is to conduct annual reporting to a number of authorities bureaus earlier than June 30 yearly, to make sure that corporations are compliant and that the knowledge associated to every division is up to date.

Ranging from 2020, the annual reporting to a number of governments might be achieved by submitting all related info without delay via the Nationwide Credit score Info Publicity system (www. gsxt.gov.cn). That is the so-called “many-in-one” reporting.

Corporations are now not required to individually report back to the native State Administration of Market Regulation (SAMR, which beforehand was known as the Administration of Trade and Commerce or AIC), the commerce bureau, the finance bureau, the tax bureau, the statistical bureau, and the overseas trade bureau. The annual report submitted ought to cowl at the very least the next info:

- Fundamental info of the enterprise, together with the contact info, the existence standing of the enterprise, the enterprise scope, the licensing state of affairs, the staffing and wage info, the social insurance coverage contributions, the IP state of affairs, and many others.

- Investor profile, together with info concerning the subscribed and paid in quantity, time, methods of contribution, the precise controller of the investor, and many others.

- The title and URL of the web site of the enterprise and of its on-line outlets.

- Fairness adjustments info of the fairness switch by the shareholders of a restricted legal responsibility firm.

- Info regarding any funding by the enterprise to determine corporations or buy fairness rights.

- The stability sheet info of the enterprises, together with complete belongings, complete liabilities, complete proprietor’s fairness, and many others.

- Warranties and ensures offered for different entities.

- Info concerning the operation of the enterprise, together with complete imports and exports, complete income, revenue from the principle enterprise, operational value and bills, R&D bills, complete tax cost, gross revenue, web revenue, revenue distribution, and many others.

- Info concerning the credit score and debt.

- Tax breaks info if the enterprise enjoys preferential remedy for importing gear.

- Customs related info if the enterprise is topic to the administration of the customs.

A part of the knowledge can be synced from the statistics maintained by different authorities bureaus, such because the social safety bureau and tax bureau, routinely. Enterprises are required to organize and submit different info on-line in the course of the interval between January 1 and June 30.

Penalties of failing to comply with annual compliance necessities for FIEs

If the enterprise fails to submit the annual reporting info on time, will probably be put into the Catalogue of Enterprises with Irregular Operations (Irregular Operations Catalogue), which is open to the general public.

Apart from, the enterprise may even be put into the Irregular Operations Catalogue if fraudulent info or critical concealment is found by authorities within the random examine following the annual reporting.

If the enterprise is listed on this Catalogue for 3 years in a row, there can be extra critical penalties – the enterprise can be put into the Catalogue of Enterprises with Unlawful and Dishonest Behaviors, which serves as a black listing for future operations and investments.

The authorized consultant and the final supervisor of the blacklisted enterprise can be banned from taking the authorized consultant or basic supervisor function in different enterprises for 3 years, and the blacklisted enterprise can be at a disadvantageous place in bidding, authorities procurement, licensing utility, acquiring land, in addition to making new funding sooner or later.

FIEs are recommended to concentrate to the deadlines and necessities, or make well timed correction the place compliance occur, to keep away from critical penalties.

Annual compliance necessities for ROs

RO’s annual compliance consists of getting ready an annual audit report, and a tax reconciliation report, after which reporting to the native SAMR in cost. Whereas the process seems to be like that relevant for FIEs, every step has completely different necessities and focus.

Step 1: Put together the annual audit report

Whereas FIEs are solely required to submit the audit report in restricted situations, it’s a obligatory requirement for an RO to take action. The annual audit report for ROs must be ready by exterior licensed accounting companies and signed by two CPAs registered in China.

When doing the annual audit for ROs, auditors ought to pay particular consideration to the next components.

- Financial institution statements, money, employees, and IIT: The stability on the financial institution ebook must be the identical as that acknowledged within the financial institution assertion. If not, a financial institution reconciliation must be ready to confirm the variations. The stability on the account must be the identical because the money contained within the money field. The auditors will carry out a money rely throughout their fieldwork. Employment of employees have to be registered in accordance with the related laws (native staff registered with certified dispatch businesses and legitimate work permits for expatriate employees), and IIT accurately assessed and filed.

- Bills report: Bills embody lease, transportation, phone, wage, workplace purchases, leisure, audit charges, utilities, and dispatching service charges, no matter whether or not these are paid from the RO or immediately from its head workplace. Any bills belonging to the fiscal yr must be correctly accrued with contracts or agreements as help. The entire wage of the chief consultant, whether or not paid offshore or domestically, have to be included within the bills. If staff are concerned in abroad social safety plans, these funds have to be included within the expense report.

- Taxable revenue: In accordance with related legal guidelines and laws, ROs of overseas enterprises in mainland China should pay CIT on their deemed taxable revenue, in addition to VAT and CT when it’s relevant. The CIT legal responsibility can be assessed by the deemed revenue technique, cost-plus technique, or precise income technique. Amongst these three strategies, the cost-plus technique is probably the most used, for the reason that different two strategies require ROs to submit quite a few supporting paperwork. Below the cost-plus technique, the taxable revenue, that’s, the deemed income is calculated on the idea of the bills: DEEMED REVENUE= RO EXPENSES / (1 – DEEMED PROFIT RATE). The deemed revenue fee is determined by the tax bureau, and shall be a minimum of 15 %.

Step 2: Annual tax reconciliation

Like FIEs, ROs additionally must submit the Annual Taxation Consolidation Report back to the tax bureau by the tip of Could annually, although regional variations could exist. If the audited taxes due are discovered to be completely different from the taxes paid by the RO, the RO shall focus on the variation with the tax bureau.

For overseas corporations that suspect this may happen, it’s clever to carry preemptive discussions with tax advisors previous to audit submission. The annual tax reconciliation might be carried out via the net submitting. Offline channels are additionally out there if on-line submitting is unsuccessful.

Step 3: Annual reporting to native branches of SAMR

ROs are required to submit an annual report between March 1 and June 30 yearly offering info on the authorized standing and standing info of the overseas enterprise, ongoing enterprise actions of the RO, and an audit report. As in comparison with FIEs, the reporting interval begins later, and the audit report is obligatory in all circumstances.

Through the annual reporting course of, the next paperwork must be offered in paper or on-line:

- Annual report (the template can be distributed by native authorities round March);

- Enterprise registration certificates;

- Audit report; and

- Proof of knowledge on the authorized standing and standing of the headquarters abroad.

Penalties of failing to comply with the annual compliance necessities for RO

Failing to submit the annual report on time could result in further penalties, starting from RMB 10,000 to RMB 30,000. An RMB 20,000 to RMB 200,000 penalty is perhaps given if the report consists of fraudulent info. Failing to make corrections as required or fraud may result in license revocation.

Recommendations on managing annual compliance necessities

Tip 1: Listening to the procedural adjustments and corresponding necessities

Whereas the important steps stay related, within the context of China’s enterprise reform and opening up, the detailed procedures have been topic to frequent adjustments in recent times:

Whereas the adjustments are designed to chop pink tape in the long term, it will increase compliance dangers for enterprises within the quick time period. Corporations are recommended to pay particular consideration to the annual compliance updates, research the brand new necessities, and make vital preparations to remain compliant.

Tip 2: Listening to the native variations

The detailed procedures and necessities of every step could differ from one place to a different. It isn’t at all times proper to imagine the corporate is compliant by solely referring to nationwide legal guidelines and laws. As talked about within the early components of the article, for instance, FIEs in sure areas is perhaps required to organize one other separate CIT audit report within the CIT reconciliation by assembly sure situations, and these situations additionally differ from metropolis to metropolis. Companies are recommended to seek the advice of with a professional service agency or contact the native authorities to keep away from pointless misconduct within the annual compliance.

Tip 3: Utilizing certified third-party providers

As there are numerous particular particulars to concentrate to within the annual compliance course of, it might be fairly difficult and onerous for some corporations to handle by themselves, particularly these which don’t have a robust inner monetary staff.

It isn’t unusual to see corporations getting penalized for pointless errors or negligence, with enterprise credit score being affected. Such corporations are recommended to make use of skilled third-party service companies slightly than managing the matter internally.

To pick certified providers, the under requirements might be used as references:

- A service agency that may handle the entire annual compliance course of is healthier than these which might solely deal with one or two steps of the procedures.

- A service agency that has branches in several cities and is conversant in native variances can be extra appropriate to offer providers to FIEs which have a number of subsidiaries or department places of work in China.

- A service agency that’s conversant in worldwide accounting requirements, corresponding to IFRS and GAAP, and might do mapping or conversion among the many requirements, is extra certified in offering providers to FIEs whose headquarters could have monetary consolidation necessities.

- A service agency that may work in fluent English can have higher communication with the senior administration of the FIEs to make the annual compliance course of smoother.

This text was tailored from our China Briefing Publication: A Fast Information to Accounting and Audit in China 2023 (1st Version). Dezan Shira & Associates’ skilled staff of tax accountants, attorneys, and auditors have a deep understanding of Asia’s advanced tax environments, in addition to in-depth trade data and expertise. We may also help on a large spectrum of tax service areas throughout all main industries, together with ongoing tax compliance and reporting, revenue repatriation, switch pricing, and many others. For extra info, please e mail us at Tax@dezshira.com or go to our web site at www.dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The apply assists overseas buyers into China and has achieved so since 1992 via places of work in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at china@dezshira.com.

Dezan Shira & Associates has places of work in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, along with our commerce analysis amenities alongside the Belt & Street Initiative. We even have companion companies aiding overseas buyers in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link