[ad_1]

Sri Lanka’s debt default – introduced in April of final 12 months amid overseas forex shortages that had triggered rolling blackouts, gasoline queues, and avenue protests – has been topic to infinite debate by native and worldwide observers. The basis causes of the nation’s debt drawback have been attributed to varied components, together with corruption and nepotism, alleged predatory lending from China (the so-called “Chinese language debt lure”), and a structural steadiness of funds deficit. These debates apart, it’s more and more clear that the instant trigger for Sri Lanka’s collapse is the construction of the nation’s debt itself – particularly, its deep and rising publicity to worldwide sovereign bonds (ISBs) issued at excessive rates of interest.

Within the instant aftermath of Sri Lanka’s civil struggle in 2009, the nation launched into a primarily bilaterally-financed infrastructure funding program. Nonetheless, alongside these borrowings for investments in ports, power, and transport, the Sri Lankan authorities additionally binged on worldwide sovereign bonds, issuing $17 billion price of ISBs from 2007 to 2019, in face worth phrases. In keeping with a 2021 report by the Advocata Institute, Sri Lanka’s ISBs have been issued at excessive coupon charges (typically between 5-8 p.c), with some 36 p.c of those ISBs being topic to traditional collective motion clauses, which make restructuring a lot more durable for debtor governments. Because of this debt-fueled progress technique (or lack thereof), the nation’s ratio of public exterior debt inventory to GDP grew from 29 p.c in 2010 to 44 p.c in 2021.

The ISB Debt Lure

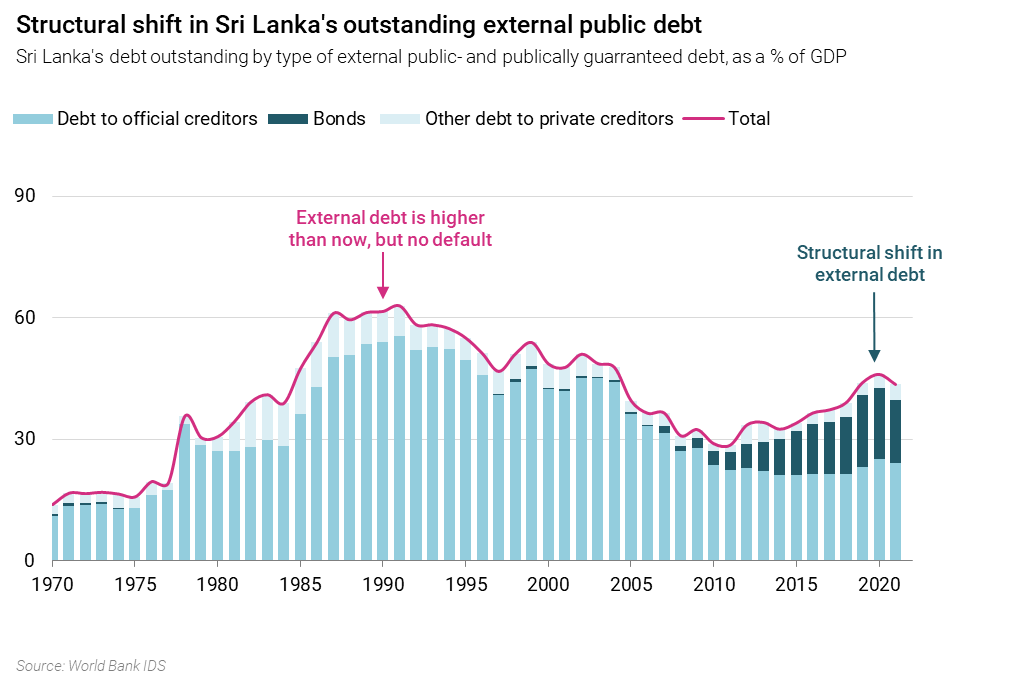

In historic phrases, Sri Lanka’s present exterior debt ratio is hardly a precedent. The nation endured increased exterior debt burdens, crossing 60 p.c of GDP, within the Nineties, however managed to keep away from a complete default. The distinction between at times is {that a} higher share of the nation’s exterior debt is borrowed from worldwide capital markets at excessive rates of interest.

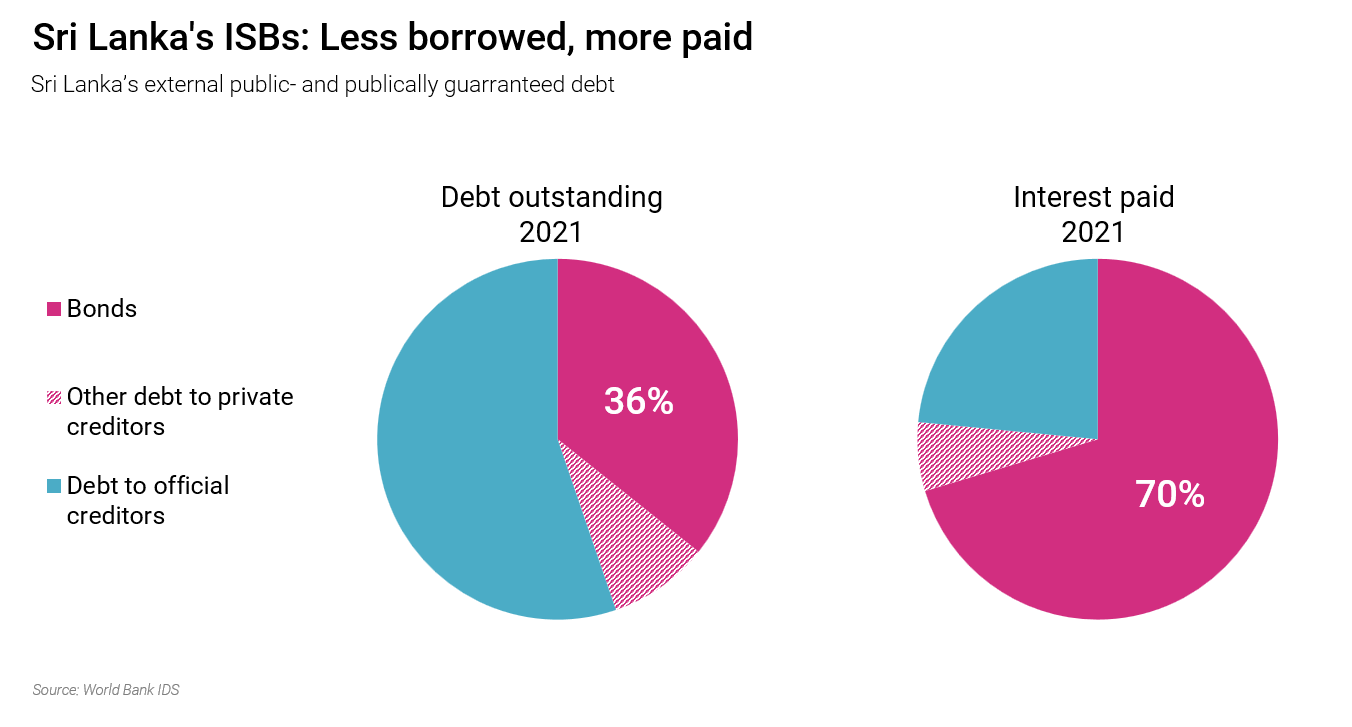

From 2010 to 2021, the ISB share of Sri Lanka’s exterior debt inventory tripled, going from 12 p.c to 36 p.c. But in 2021, ISBs accounted for a monster 70 p.c of the federal government’s annual curiosity funds. These figures spotlight the extent to which excessive curiosity borrowing from worldwide capital markets can eat into the overseas forex money flows of a rustic, particularly when it’s wracked by exterior shocks such because the COVID-19 pandemic and battle in Ukraine.

For underdeveloped international locations like Sri Lanka, borrowing from worldwide capital markets is exceptionally dangerous. Usually, ISBs should not linked to initiatives and due to this fact don’t produce a corresponding asset or financial progress, neither is there a lot transparency on how governments price range and spend funds accrued from these bonds. The bondholders themselves comprise a various set of pursuits who’re tough to coordinate with to barter a restructure. For instance, bondholders like Hamilton Reserve have held out and sued the Sri Lankan authorities.

Moreover, the bonds themselves are tradable and their costs topic to the choices of credit score rankings companies. When credit score rankings companies downgrade a rustic, the value of that nation’s bonds decreases and its yield rises. For the reason that yield acts because the benchmark for coupon charges on future bonds, this makes future borrowing costlier, and might result in a snowball impact the place a rustic takes on extra debt at increased rates of interest to pay again excellent obligations, which have been borrowed at decrease charges.

Sri Lanka’s expertise just isn’t distinctive amongst underdeveloped international locations, a lot of which have fallen for a similar ISB debt lure. The attract of low rates of interest within the wake of the 2008 monetary disaster was seized upon by underdeveloped international locations to cowl power steadiness of funds points linked to deteriorating phrases of commerce from an unindustrialized manufacturing base. On the similar time, low charges pushed Western institutional buyers to hunt earnings from different sources of revenue, together with the inventory market, CDOs, and rising market debt. The implications of this shift in debt construction amongst underdeveloped international locations has devastating penalties for residents who need to bear the brunt of the continuing debt disaster.

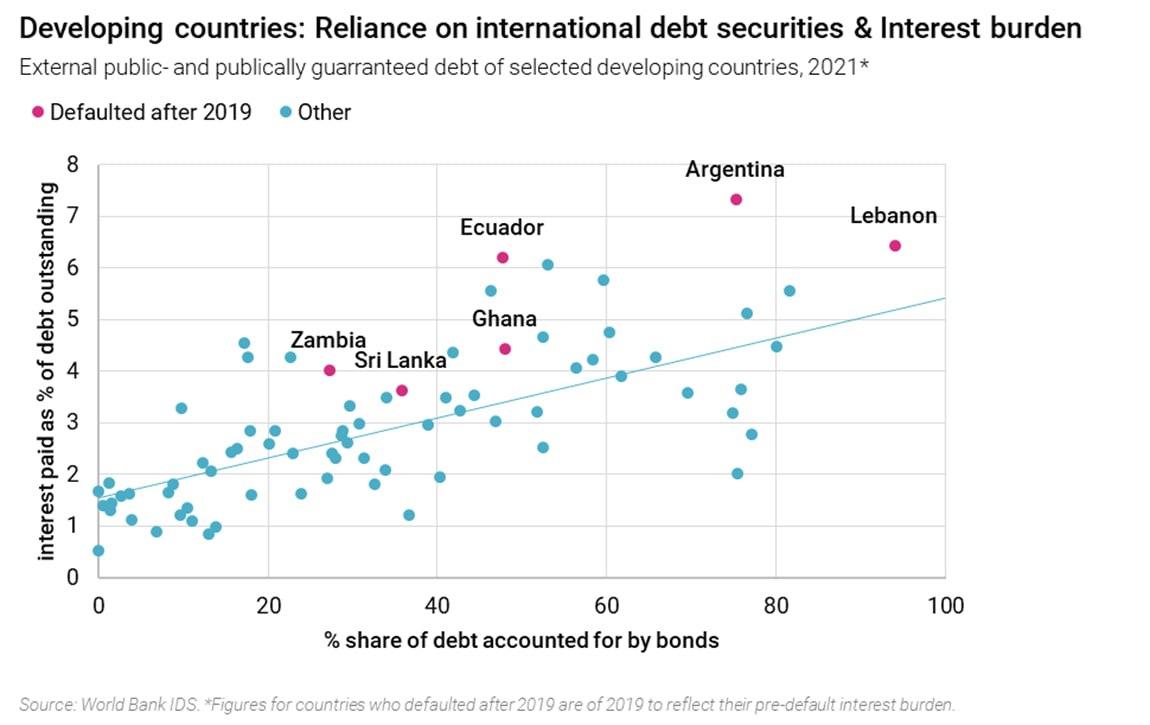

A look on the composition of whole debt inventory and debt servicing of underdeveloped international locations is telling – the upper the share of ISBs in excellent debt, the higher the annual curiosity paid. We discover that a few of the most debt distressed international locations on the earth, together with people who have defaulted after 2019 – corresponding to Argentina, Lebanon, Ecuador, and Ghana – all have in widespread a deep publicity to bond markets.

The excessive degree of ISB curiosity funds tends to exacerbate stresses from exterior and cyclical shocks, which underdeveloped international locations are susceptible to. For instance, the COVID-19 pandemic introduced world tourism to come back to a digital standstill in 2020 and 2021, inflicting Sri Lanka to lose round 24 p.c of its annual export income. Shortly thereafter, world oil and different commodity costs rose sharply as a result of struggle in Ukraine.

IMF Provides No Options

Sri Lanka desperately wants bridge financing to shore up its reserves and guarantee a gradual provide of necessities corresponding to gasoline and fertilizer in order that it might resume fundamental financial exercise and restore a way of normalcy for staff and companies. Because it stands, the nation expects to signal its seventeenth settlement with the IMF in March, practically a 12 months after negotiations first started. To name the IMF bundle a bailout could be a misnomer, because the $2.9 billion on provide (to be disbursed in tranches), is scarcely sufficient to cowl Sri Lanka’s annual gasoline invoice, not to mention the $4-5 billion it will usually require for annual debt servicing.

What an IMF settlement will do is restore worldwide creditor confidence and enhance the nation’s credit score rankings. Steps have already been taken to depreciate the forex, enhance taxation, implement cost-recovery based mostly pricing for utilities, and privatize state-owned enterprises. Some consultants body this as a constructive and an finish in itself, as it will assist Sri Lanka regain entry to worldwide capital markets.

Nonetheless, taking over extra debt from worldwide capital markets is the very last thing Sri Lanka wants whether it is to discover a manner out of its debt drawback, as this may merely contribute to a snowballing of ISB debt. A superb instance of that is the case of Egypt, which secured an IMF deal in December 2022 and now plans to challenge sukuk (Islamic bonds) at a yield of 11 p.c to repay an excellent Eurobond, which carries a set rate of interest of 5.557 p.c.

This sample of going to the IMF after which counting on ISBs for exterior financing was already tried by the Sri Lankan authorities from 2016 to 2019, throughout the nation’s sixteenth IMF program. On the time, Sri Lanka had entered right into a three-year prolonged association with the IMF for a paltry $1.5 billion. Utilizing the “credibility” gained from this association, Sri Lanka issued round $12 billion in sovereign bonds (round 70 p.c of the face worth of whole bonds issued within the nation’s historical past). This was accomplished on the justification that these funds have been wanted to refinance bilateral undertaking loans. As the info on construction of excellent debt and curiosity funds bears out, this refinancing technique has been disastrous for Sri Lanka, making its annual curiosity reimbursement invoice increased than it will have been had it caught with bilateral loans.

Sri Lanka’s long-term prospects for restoration would require a paradigm shift from what it has accomplished to this point. One of many nation’s instant targets ought to be to deleverage from ISBs publicity, and be extra strategic in regards to the sorts of money owed it takes on. Within the medium to quick time period, bilateral borrowing stays the nation’s most secure and most dependable technique for financing its exterior commitments. Curiously, latest revelations by native media counsel that Sri Lanka’s finance minister had secured bilateral financing from China to keep away from defaulting within the first place, however was blocked from pursuing this path for political (probably geopolitical) causes.

This isn’t to say that Sri Lanka ought to go to bilateral companions with a begging bowl or settle for unsolicited undertaking proposals with out due diligence. Fairly, the nation should take its destiny in its personal arms and formulate its personal industrial improvement technique, during which bilateral companions can play a constructive and supportive position. In a way, this may imply tackling the basis reason behind Sri Lanka’s debt itself – the large and protracted commerce deficit.

[ad_2]

Source link