[ad_1]

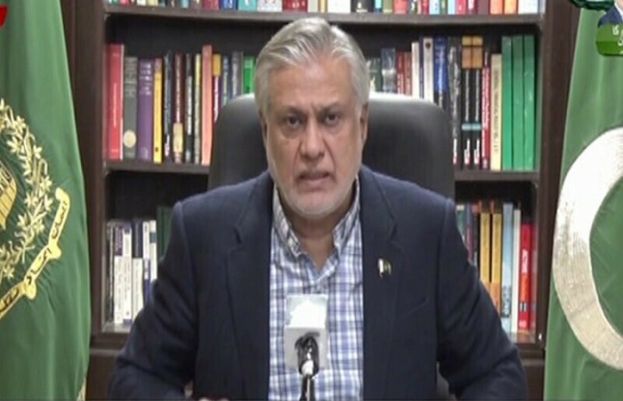

Finance Minister Ishaq Dar mentioned on Thursday that Pakistan’s negotiations with the Worldwide Financial Fund (IMF) associated to the completion of the ninth assessment of a $7 billion mortgage programme have been close to conclusion and the staff-level settlement with the worldwide lender will likely be signed by subsequent week.

The federal government is in a race towards time to implement measures to succeed in an settlement with the IMF because the nation has reserves barely sufficient for 3 weeks of important imports, whereas hotly contested elections are due by November.

In a sequence of tweets right now, the finance czar rubbished rumours concerning Pakistan defaulting.

“Anti-Pakistan components are spreading malicious rumours that Pakistan might default. This isn’t solely utterly false but additionally belies the info,” he mentioned.

Dar mentioned that the State Financial institution of Pakistan’s (SBP) foreign exchange reserves had been growing and have been nearly close to $1 billion, “greater than 4 weeks in the past regardless of making all exterior due funds on time”.

“Overseas business banks have began extending services to Pakistan. Our negotiations with IMF are about to conclude and we anticipate to signal Employees Degree Settlement with IMF by subsequent week. All financial indicators are slowly transferring in the precise course,” he added.

The finance minister’s remarks come because the Pakistani rupee sank sharply by Rs18.74 towards the greenback within the interbank market right now. Analysts attributed the file drop — which is 7.04pc — to the federal government’s deadlock with the worldwide lender.

The settlement with the IMF on the completion of the ninth assessment of a $7bn mortgage programme — which has been delayed since late final 12 months over a coverage framework — wouldn’t solely result in a disbursement of $1.2bn but additionally unlock inflows from pleasant international locations.

The conditions by the lender are geared toward making certain Pakistan shrinks its fiscal deficit forward of its annual finances round June.

Pakistan has already taken many of the different prior actions, which included hikes in gasoline and vitality tariffs, the withdrawal of subsidies in export and energy sectors, and producing extra revenues via new taxation in a supplementary finances.

[ad_2]

Source link