[ad_1]

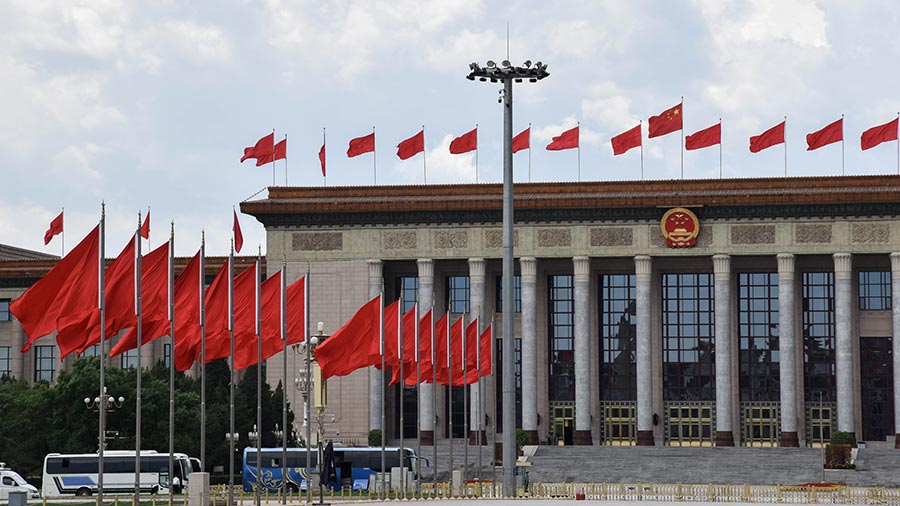

On the primary day of the 2023 Two Classes, the outgoing Chinese language Premier Li Keqiang delivered the annual Authorities Work Report, one of the crucial vital coverage paperwork of the 12 months. Along with setting China’s GDP goal for 2023, the report outlines varied insurance policies and targets for reinforcing financial and trade progress over the 12 months, together with insurance policies to spice up consumption, funding, inexperienced growth, lengthen tax incentives, and extra. We take a look at the main targets and proposals set out within the report.

On Saturday, March 4, 2022, the Nationwide Individuals’s Congress (NPC) convened for the opening assembly of China’s annual Two Classes conferences. Within the assembly, outgoing Premier Li Keqiang delivered the 2023 Authorities Work Report (GWR) on behalf of the State Council, which units an unlimited vary of financial and growth duties for the nation to pursue over the approaching 12 months. It consists of the primary 2023 GDP goal and descriptions how China plans to realize these targets.

On this article, we take a look at the important thing factors from China’s 2023 GWR, together with the 5 p.c GDP goal, preferential tax insurance policies, trade priorities, measures to spice up consumption, insurance policies to draw international funding, maneuvering China’s inexperienced transition, measures to mitigate monetary dangers, and the shifting of healthcare priorities.

EVENT – Is China “Actually” Coming Again? How Profitable Manufacturers are Navigating Uncertainty in China and Southeast Asia

Munich | Tuesday 7 March 2023| 17.30 – 19.30 CET

Milan | Thursday, March 9, 2023 | 17:30 – 19:30 CET

With China’s shock reopening, the Chinese language market is on the minds and within the information feeds of many international model executives. However as e-commerce progress slows and the nation’s path to financial restoration stays unsure, many are questioning… is China “actually” coming again?

As you put together for an unsure 12 months forward, it’s extra vital than ever to make well-informed enterprise choices to assist your progress methods for China and Southeast Asia. Be a part of us at considered one of our upcoming in-person occasions in Europe, the place we staff up with Kung Fu Knowledge to uncover e-commerce trade insights, discover methods to shield your mental property in Asia when promoting on-line, and talk about the most recent developments happening within the area to carry you the within scoop on model efficiency and client habits.

This occasion is FREE of cost. This occasion is a part of our Reforesting Asia 2022 Eco Initiative.

REGISTER TODAY

GDP goal set at “round 5 p.c”

Within the readout of the 2023 GWR, the federal government introduced a GDP progress goal of “round 5 p.c” for 2023, which is on the decrease finish of expectations.

Earlier this 12 months, numerous international establishments, together with the Worldwide Financial Fund (IMF), raised their 2023 progress forecast window for China to 4.8 to five.6 p.c, after China shifted away from its zero-COVID coverage and despatched sturdy alerts that it’s going to prioritize financial progress in 2023 as soon as once more.

Previous to the assembly, Reuters reported that China may set a GDP progress goal as excessive as 6 p.c for 2023, although three of their seven unnamed sources mentioned this quantity can be from 5 p.c to five.5 p.c.

Contemplating China’s sturdy financial restoration within the first two months (the official manufacturing PMI reached the best degree in almost 11 years in February and the providers PMI continued to rise as effectively), this modest GDP progress goal means that China will put extra emphasis on high-quality progress and sustainable growth and attempt for financial stability amid ongoing financial headwinds, slightly than aiming for the breakneck progress seen in previous years.

That mentioned, regardless of being one of many lowest progress targets launched within the historical past of the Two Classes, the 5 p.c progress fee implies that China will proceed to be one of many world’s fastest-growing main economies, whereas the US and EU face recession dangers.

However, on the native degree, the common of all of the regional progress targets is round 5.9 p.c, indicating that regional governments gained’t quit efforts for short-term progress. Companies can nonetheless count on appreciable assist from varied ranges of presidency, together with extra infrastructure funding, incentive insurance policies, and measures to spice up home consumption. Additionally it is most unlikely that China will miss its 2023 progress goal except another “black swan” occasions occur.

Preferential tax insurance policies

Not like in earlier years, the 2023 GWR didn’t announce any particular tax measures. Quite, it solely promised that “China will enhance preferential insurance policies on taxes and costs, lengthen present measures reminiscent of tax cuts, tax rebates, and tax deferments that must be prolonged, and optimize present measures that must be optimized”.

We count on that the Ministry of Finance (MOF) and the State Taxation Administration (STA) will shed extra mild on these extensions and optimizations within the coming months.

Which tax measures could also be prolonged?

Though no official data is on the market for the second, we are able to make some early predictions based mostly on our understanding of earlier authorities coverage priorities.

Within the post-COVID period, the complete social economic system of China remains to be within the technique of restoration, regardless of the sturdy financial rebound seen previously two months. Amongst others, small and micro enterprises, particular person companies, the life-style providers trade, supply providers, and another weak sectors are nonetheless dealing with challenges. The assist measures launched for these industries previously three years are very more likely to be prolonged in 2023.

For instance, a part of the company revenue tax (CIT) incentives for small and low-profit enterprises (SLPE) expired on December 31, 2022, as proven within the under desk:

| Company Earnings Tax Cuts for Small and Low-Revenue Enterprises | ||||

| Annual taxable revenue (ATI) | Tax base | CIT fee | Efficient CIT fee | Efficient interval |

| The portion under RMB 1 million | ATI*12.5% | 20% | 2.5% | January 1, 2021 to December 31, 2022 |

| The portion between RMB 1 million and RMB 3 million | ATI*25% | 5% | January 1, 2022 to December 31, 2024 | |

That’s to say, SLPEs can not benefit from the “20 p.c CIT fee on 12.5 p.c of the taxable revenue quantity for the portion of taxable revenue not exceeding RMB 1 million (approx. US$144,246)” after December 31, 2022.

Nonetheless, the preferential coverage that enables SLPEs to take pleasure in a 20 p.c CIT fee on 25 p.c of their taxable revenue quantity for the portion of taxable revenue between RMB 1 million and RMB 3 million (approx. US$432,738) can be in place till December 31, 2024. It due to this fact doesn’t make sense for the coverage for the decrease revenue threshold to not be prolonged, and this coverage is anticipated to be prolonged to not less than December 31, 2024, to match the at present efficient coverage.

Different potential extendable preferential tax insurance policies may embody (however usually are not restricted to):

- The tremendous deduction coverage for enterprises entitled to the present further pre-tax deduction ratio of 75 p.c for R&D bills. In the course of the interval from October 1 to December 31, 2022, the ratio was raised to 100%.

- The one-off pre-tax deduction coverage for top and new expertise enterprises (HNTEs) for gear and devices (mounted belongings aside from homes and buildings) that had been newly bought through the interval from October 1 to December 31, 2022. Throughout this era, deductions had been allowed to be 100% weighted.

- The worth-added tax (VAT) exemption coverage for public transportation through the interval from January 1 to December 31, 2022.

- The VAT exemption coverage for supply providers through the interval from Could 1 to December 31, 2022.

Nonetheless, right now, these expectations are suppositions that await authorized and regulatory affirmation.

Which tax measures could also be optimized?

In January 2023, the MOF and the SAT optimized some VAT incentives for a variety of market entities, together with small-scale taxpayers and taxpayers within the manufacturing and way of life service industries.

For instance, the small-scale taxpayer insurance policies make clear that through the interval between January 1 and December 31, 2023, small-scale taxpayers with month-to-month gross sales of underneath RMB 100,000 (approx. US14,424) shall be exempted from VAT. This threshold is a bit decrease than that in 2021 and 2022. In the course of the interval from April 1, 2021, to December 31, 2022, the VAT threshold for small-scale taxpayers was RMB 150,000 (approx. US$21,636) monthly (or RMB 450,000 per quarter, approx. US$64,910).

| VAT Legal responsibility Threshold for Small-Scale Taxpayers, 2021 to 2023 | ||

| Month-to-month gross sales | Quarterly gross sales | Efficient interval |

| RMB 100,000 | RMB 300,000 | January 1, 2021, to March 31, 2021 |

| RMB 150,000 | RMB 450,000 | April 1, 2021, to December 31, 2022 |

| RMB 100,000 | RMB 300,000 | January 1, 2023, to December 31, 2023 |

The VAT discount coverage for small-scale taxpayers and the extra VAT deduction coverage for way of life and production-oriented providers have additionally been adjusted in 2023. Extra particulars may be present in our article: China Clarifies 2023 VAT Incentives for Small-Scale Taxpayers and Way of life and Manufacturing Oriented Companies.

These modifications are consistent with the financial state of affairs and coverage growth in China. In 2022, companies in China had been combating strict COVID-19 management and prevention measures. Now, with China reopening its borders and lifting restrictions, the financial forecasts are a lot improved. In the meantime, the federal government may even be contemplating the stability of funds, after spending billions on pandemic management previously few years.

And what in regards to the 2022 large-scale VAT rebates coverage? There’s not a lot data on how this coverage can be carried out in 2023. However on condition that China has repeatedly expressed its assist for international commerce and export, this coverage is anticipated to be continued and even optimized. We pays shut consideration to any information or developments on this coverage.

Insurance policies to stimulate home demand and improve funding in society

In an effort to obtain full financial restoration, consumption should bounce again too. Home demand has been sluggish over the previous couple of years as a result of impression of the COVID-19 pandemic and determining methods to stimulate it has been a headache for policymakers.

In 2023, the federal government will search to stimulate home demand by rising funding in industries and society as an entire, slightly than implementing particular consumption-stimulating insurance policies. Up to now, the federal government has offered varied incentives to stimulate the consumption of particular items, reminiscent of vehicles and residential home equipment.

The GWR states that “authorities funding and coverage incentives should successfully drive funding in the entire society”. The GWR requires “rising the revenue of city and rural residents by way of a number of channels”, with the hope that extra disposable revenue will result in larger ranges of consumption. It’s at present not clear what the mechanisms for rising revenue can be.

In the meantime, the GWR has additionally set a brand new quota for the issuance of native authorities particular function bonds (SPBs). SPBs are one of many most important ways in which the central authorities supplies funds to native governments to bankroll main infrastructure tasks, which has been a key mechanism for reinforcing financial progress within the a long time since China’s reopening.

The 2023 quota has been set at RMB 3.8 trillion (approx. US$549.2 billion), a slight improve from the RMB 3.65 trillion (approx. US$527.5 billion) quota set in 2022. In accordance with the GWR, the SPBs can be allotted to “speed up the implementation of main tasks through the 14th 5-Yr Plan” interval [from 2021 to 2025] and implement city renewal exercise”.

Lastly, the GWR additionally seeks to encourage the participation of extra personal capital in main development tasks.

Increasing international commerce and funding

The GWR requires attracting and using extra international capital in 2023. China’s international direct funding (FDI) inflows slowed barely in 2022 however remained comparatively sturdy. Precise use of international capital in 2022 reached RMB 1.2 trillion, up 6.3 p.c from the earlier 12 months.

Since China lifted nearly all COVID-19 restrictions, its authorities officers have been espousing the significance of international capital to the nation’s post-COVID restoration.

One mechanism proposed within the GWR to draw extra international capital is to “broaden market entry and improve the opening-up of the fashionable service trade”.

China controls the industries wherein international traders can take part by implementing a Adverse Record for Market Entry, the Particular Administrative Measures (Adverse Record) for International Funding Entry, and a Catalogue of Inspired Industries for International Funding, amongst different paperwork. The detrimental listing outlines the industries that are prohibited or restricted from receiving personal funding by corporations in China (not solely international corporations), whereas the particular administrative measures listing the industries which can be prohibited from receiving funding from international corporations particularly. {The catalogue}, in the meantime, lists the industries wherein international funding is inspired.

Over the previous few years, the federal government has continued to shorten the previous two lists whereas lengthening {the catalogue} of inspired industries. It’s doable we are going to proceed to see extra market opening by way of the additional adjustment of those lists and catalogues, specifically for sectors associated to the fashionable providers trade (reminiscent of skilled providers, telecommunications, monetary providers, tourism and leisure, and extra).

The GWR additionally requires implementing the “nationwide remedy” of international corporations, which implies making certain that international corporations are handled equally to home corporations, and requires selling the development of “landmark foreign-funded tasks”.

With regard to international commerce, the GWR seeks to advertise China’s accession to financial and commerce agreements, such because the Complete and Progressive Settlement for Trans-Pacific Partnership (CPTPP).

Tackling monetary dangers

The GWR requires “successfully stopping and defusing main financial and monetary dangers” and descriptions just a few key areas of focus. These embody mitigating the dangers of the actual property trade and of rising native authorities debt.

The true property trade has been in turmoil since late 2021 when main actual property builders defaulted on money owed resulting from insurance policies geared toward curbing lending to builders. The GWR doesn’t present specifics on methods to resolve the present points, however requires “bettering the standing of belongings and liabilities, stopping disorderly enlargement, and selling the secure growth of the true property trade”.

In the meantime, rising native authorities debt – and particularly the so-called “hidden debt” held by native authorities financing autos (LGFVs) – has been a serious concern for the central authorities for a few years. An ongoing liquidity crunch amongst native governments may additionally stymie efforts to spice up the economic system by way of funding in infrastructure tasks. Over the previous few years, the federal government has taken purpose at decreasing native authorities debt by way of mechanisms reminiscent of enabling native governments to swap their debt for the SPB quotas.

Additional actions to be taken in 2023 embody optimizing debt maturity construction, decreasing curiosity burden, curbing the rise of debt, and dissolving reserves.

Selling China’s inexperienced transition

The GWR doesn’t present any new particular insurance policies for selling China’s inexperienced growth, however slightly gives basic targets and proposals. These embody:

- “Strengthening the development of city and rural environmental infrastructure, and persevering with to implement main tasks for the safety and restoration of vital ecosystems.” Main renewable power tasks lately have included constructing an enormous photo voltaic power base within the desert, enlargement of nuclear energy capability, and enlargement of hydropower capability, amongst others.

- “Selling the clear and environment friendly utilization of coal and expertise R&D, and accelerating the development of a brand new power system.” Regardless of its local weather commitments, China has elevated its manufacturing of coal over the previous few years resulting from power shortages however has continued to advertise the “cleaner” manufacturing and utilization of coal alongside build up its renewable power capability.

- “Bettering insurance policies to assist inexperienced growth.” Previous insurance policies have included offering fiscal assist for inexperienced growth and launching a carbon buying and selling market.

Shifting healthcare priorities

China has lifted nearly all of its COVID-19 prevention and management insurance policies and formally declassified the virus to “Class B Administration”, that means it’s topic to much less strict controls. As China emerges from the pandemic and the preliminary wave of circumstances subsides, native governments may have way more bandwidth to concentrate on different healthcare outcomes and handle some lingering points within the trade.

The GWR requires “specializing in healthcare safety and extreme illness prevention” in addition to focusing “on fundamental well being take care of the aged, youngsters and sufferers”. As well as, it requires additional work to be executed on vaccines and medicines, together with “selling the iterative upgrading of vaccines and the event of latest medication, successfully guaranteeing the wants of the plenty for medical remedy, and defending individuals’s security and well being.”

What extra to count on from the 2023 Two Classes?

The GWR is likely one of the most vital coverage paperwork of the 12 months because it units the general tone for financial and growth coverage. Nonetheless, many extra vital bulletins can be remodeled the following couple of weeks.

Initially, the NPC is anticipated to approve a authorities restructuring through the Two Classes, as is customary firstly of every five-year session of the NPC. As the federal government went by way of a serious restructuring firstly of the final session in 2018, we count on this 12 months’s modifications won’t be as thorough however could contain an overhaul of the monetary system and the resurrection of the Central Monetary Work Fee (CFWC), as reported by the Wall Avenue Journal.

As well as, we may even see new appointments to a number of high-level positions, together with vice premiers and the heads of presidency departments, such because the Nationwide Growth and Reform Fee (NDRC) and the Ministry of Finance (MOF).

Lastly, the NPC can also be anticipated to approve legislative amendments, together with a major modification to the Laws Legislation, which might see extra powers given to native governments to formulate native legal guidelines and laws.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The observe assists international traders into China and has executed so since 1992 by way of workplaces in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the agency for help in China at china@dezshira.com.

Dezan Shira & Associates has workplaces in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, along with our commerce analysis amenities alongside the Belt & Highway Initiative. We even have associate companies aiding international traders in The Philippines, Malaysia, Thailand, Bangladesh.

[ad_2]

Source link