[ad_1]

With the Article IV consultations focused for Nepal, it’s reassuring to be taught {that a} clear monitoring course of is in place that has resulted within the 5 key areas the place needed interventions and efficient implementations are required.

Background: Article IV Session

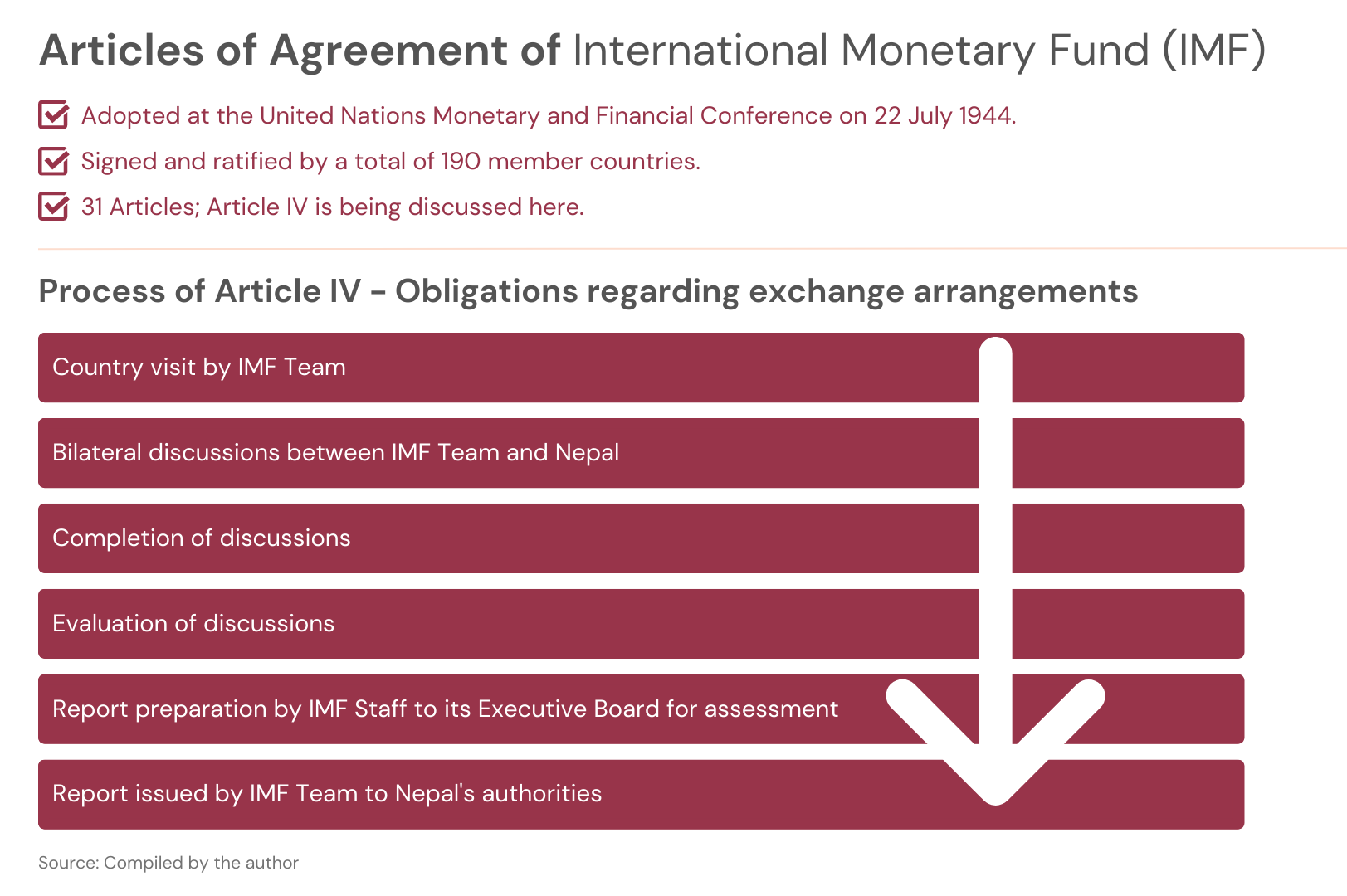

Normally yearly, the Worldwide Financial Fund (IMF) holds bilateral discussions with its member international locations with the central motive of reviewing the general financial developments within the nation underneath Article IV of the IMF’s Articles of Settlement. These discussions middle on points in regards to the trade charge, financial, fiscal, and regulatory insurance policies to take care of financial stability, and total macro-critical structural reforms wanted within the nation. Upon the completion of the discussions and analysis, the IMF’s employees current a report back to the chief board for evaluation, which is then issued to the precise nation’s authorities. This complete course of is called Article IV Session (consult with determine 1).

Determine 1 Articles of Settlement of IMF

Towards this background, the IMF concluded its 2023 Article IV Session with Nepal between 15 to twenty-eight February 2023 and launched its concluding assertion (preliminary findings). The IMF crew, led by Jarkko Turunen, met with the Proper Honorable Prime Minister – Pushpa Kamal Dahal, Honorable Deputy Prime Minister and Minister of Finance – Bishnu Prasad Paudel, Nepal Rastra Financial institution (NRB) Governor – Maha Prasad Adhikari, Nationwide Planning Fee Vice-Chairman – Min Bahadur Shrestha, different senior authorities and Nepal Rastra Financial institution (NRB) officers, growth companions and representatives of the enterprise neighborhood.

2023 Article IV Session: The place ought to Nepal’s focus be?

Following the conclusion of the 2023 Article IV Session, there are 5 key areas the place Nepal ought to place its elevated and speedy focus, that are:

- Efficient financial coverage, however fiscal reforms required: The Authorities of Nepal (GoN) adopted a contractionary financial coverage final yr, ensuing within the much-needed stabilization of the financial system. It contributed to reducing the inflation charge, which was hovering at round 8% on the time, to 7.26% in mid-January 2023. Nonetheless, fiscal reforms have made restricted progress. Consequently, the IMF recommends fiscal reforms specializing in debt sustainability, banking rules, and supervision, discount of the price of doing enterprise, and elimination of obstacles to FDI whereas enhancing good governance. This may end up in sustainable progress over the medium time period, which may then facilitate additional financial enlargement.

- Robust post-pandemic restoration, however actual GDP progress to be improved: As per the final 2020 Article IV Mission to Nepal held between 5 to 17th January 2020, the financial system of Nepal had been increasing at a charge, which was above the long-term common within the earlier years. The explanations attributed to this progress have been better political stability, improved electrical energy provide, and reconstruction actions after probably the most devastating earthquake of 2015 and the COVID-19 pandemic. The true GDP progress charge for FY 2020/21 as per the central financial institution of Nepal, NRB, stood at 3.8% which was a rise from the sooner -2.4%.

Following this robust post-pandemic restoration, it was anticipated that the actual GDP progress charge would speed up. As of 15 July 2022, the Asian Improvement Financial institution (ADB) reported that Nepal’s financial system had grown by 5.8% and would attain 5.0% in 2023. Likewise, the World Financial institution additionally said that Nepal’s financial progress charge will attain 5.8% in 2022 as per its ‘Nepal Improvement Replace (October 2022)’. This was moreover in alignment with the IMF’s projections of 4.2%, 5.0%, and 5.3% progress in 2022, 2023, and 2027, respectively of their ‘World Financial Outlook: Countering the cost-of-living disaster’. Additional, as per the annual report launched by the NRB, the preliminary estimate of the actual GDP progress charge for FY 2021/22 stood at 5.5%. Nonetheless, it’s envisaged that the sluggish restoration of the tourism and agriculture sector, and the liquidity crunch, together with rising political instability, will hurt Nepal’s progress profile. Consequently, the IMF forecasts that actual GDP progress will average to 4.4% in FY 2022/23. Henceforth, there’s a want for bettering the actual GDP progress for the upcoming FYs.

- Continued uncertainty and vulnerability, however precedence spending required: With optimistic financial progress however indicators of moderation at hand, the IMF crew initiatives that Nepal stays topic to an unusually excessive degree of uncertainty and vulnerability. The explanations are attributed to excessive and risky world commodity costs, pure disasters, elevated value of residing, deteriorating financial institution asset high quality, and poor tax collections. Consequently, there’s a must make room for precedence spendings equivalent to high-quality infrastructure spending, social spending, and extra.

- Dedication to insurance policies and reforms within the ECF-supported program required: The IMF accepted the Prolonged Credit score Facility (ECF) association for Nepal – an quantity of USD 395.9 million, with the primary disbursement of USD 110 million in January 2022. The aim of the primary installment was to mitigate the consequences of COVID-19 on well being and main financial actions geared toward weak teams, protect macroeconomic and monetary stability, and assist a reform agenda that may result in sustained progress and poverty discount. Among the key coverage actions for the GoN have been to extend revenues, public spending, monetary sector regulation, fiscal transparency, and improve governance whereas decreasing corruption.

Following this, the second installment of USD 52 million was scheduled to be disbursed in Might 2022, however it was delayed as a consequence of Nepal’s failure to satisfy its first tranche obligations in full. Consequently, a staff-level settlement was reached in February 2023 between the GoN and the IMF, leading to a number of insurance policies and reforms that must be accomplished for Nepal to obtain the second tranche of ECF. A few of them embody the formulation of a complete income mobilization technique, the development of public funding spending, the development of reforms on banking rules and belongings, and the strengthening of NRB governance.

- Bold structural reforms required: To safeguard macroeconomic and monetary stability within the nation, extra insurance policies which are formidable and centered on structural and sectoral reforms, resulting in inclusive progress are crucial. For this, a better and extra speedy emphasis might be positioned on decreasing the price of doing enterprise, eradicating obstacles to international direct investments, enhancing high-value agricultural manufacturing, info expertise, clear vitality, and tourism progress, monetary devices focusing on migrant employees, and bettering entry to finance amongst many others.

Conclusion

At a time when the nation’s macroeconomic scenario seems bleak, the surveillance of the economies or the vigilant monitoring of the financial state carried out by the IMF has posited nice significance. With the Article IV consultations focused for Nepal, it’s reassuring to be taught {that a} clear monitoring course of is in place that has resulted within the 5 key areas the place needed interventions and efficient implementations are required. This permits a large number of stakeholders in Nepal (together with authorities, personal, growth, civil society, and others) to supervise the problems and progress prospects, and deal with them promptly and in a concerted method, thereby stopping financial turmoil and the potential of world spillovers.

[ad_2]

Source link