[ad_1]

The federal government has acknowledged the potential that the diaspora and remittance maintain, and has tried to mobilize it by way of investments.

Reliance on Remittance

Remittance has develop into an more and more vital side of Nepal’s financial system, with thousands and thousands of Nepali residents working overseas and sending cash house to their households. In recent times, remittance has contributed considerably to the nation’s GDP, accounting for 20.76% in FY 2021/22. It has additionally performed a vital function in poverty discount and rising family earnings with one-in-three households in Nepal receiving remittance. Within the first eight months of FY 2022/23, remittance inflows elevated by 25.3% to NPR 794.32 billion.

Nonetheless, there are additionally considerations concerning the long-term sustainability of remittance inflows and their influence on the nation’s total financial improvement. An rising variety of Nepalis search approval for overseas employment, with 544,320 Nepalis leaving the nation for overseas jobs inside eight months of the present fiscal yr. A majority of the remittance despatched again is used for family consumption wants and to repay money owed.

The federal government has acknowledged the potential that the diaspora and remittance maintain, and has tried to mobilize it by way of investments. An instance is the International Employment Saving Bonds (FESB)—a long-term debt safety issued by the federal government to focus on the earnings of the Nepali diaspora for mobilizing capital for nation-building. Nonetheless, it’s but to interact a major quantity of the diaspora regardless of having been issued for over a decade.

Constant Below-subscription of FESBs

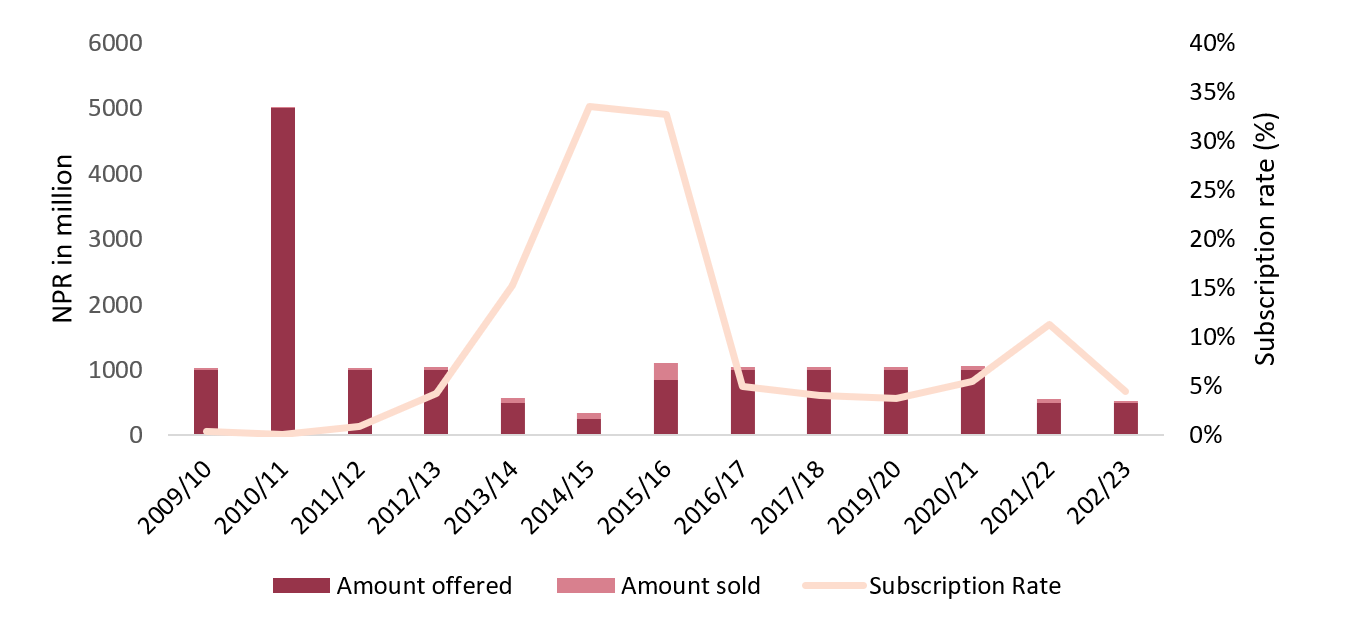

Within the Annual Funds of July 2009, the then-Finance Minister Surendra Pandey introduced a program to make the most of remittance and invite funding from the diaspora. It was adopted by the Nepal Rastra Financial institution (NRB) issuing the primary FESB in June 2010 by floating NPR 1 billion with an rate of interest of 9.75% for 5 years. Nonetheless, solely bonds price NPR 4 million had been offered. The development of heavy under-subscription has continued in each situation up to now, placing the common subscription fee of FESB at simply 5.22% in 2023. The newest situation was in 2023, whereby, the NRB floated NPR 500 million price of bonds at 12.5% for 5 years. Nonetheless, the subscription was price solely NPR 56.7 million (Determine 1: Subscription development of FESB).

Determine 1: Subscription development of FESB

Supply: Nepal Rastra Financial institution, Time Collection information of International Employment Saving Bonds Issued, March 2023

Problems with the FESB

Comparable diaspora bonds have been profitable in lots of different nations in financing varied improvement initiatives and funding the financial system in occasions of want. Nonetheless, Nepal has repeatedly been unable to interact its diaspora inhabitants. Regardless of this, no thorough research has been carried out to establish the explanation or doable avenues to extend the curiosity of the migrant employee inhabitants.

A motive for the disinterest within the bond might be the low confidence within the authorities. A majority of the individuals are migrating to overseas lands to seek for alternatives they may not entry in Nepal. Whereas FESBs are mentioned for use for the event of varied infrastructure initiatives, they don’t seem to be issued within the identify of a selected mission, which makes their anticipated use unclear. With a number of initiatives getting delayed for years resulting from poor preparatory work and having low capital expenditure, migrant employees have causes to consider sending cash on to their households could be a better option.

Nepal’s consistently depreciating foreign money might be one other deterrent for migrant employees as FESBs are issued in Nepali rupees. Not having points in a number of currencies, in contrast to different nations like Ethiopia and India, opens the investor to foreign exchange threat because the rupee depreciates in opposition to the foreign money the migrants use, and so they obtain their returns in Nepali rupees. Additional, the minimal quantity of buy has been set to NPR 10,000, and they don’t seem to be as liquid as different property contemplating Nepal’s underdeveloped secondary marketplace for bonds. Whereas the rate of interest on FESBs is greater than different bonds, folks can get comparable returns by way of long-term fastened deposit accounts. Moreover, the NRB doesn’t present bonds with varied maturities with all FESBs maturing in 5 years, which coupled with the illiquidity, might be serving as a deterrent.

The shortage of promotion that the bonds obtain has been most generally critiqued for the lukewarm response of the diaspora. Not having sufficient publicity interprets right into a majority of the diaspora not even being conscious of the bonds. Additional, the bonds even have a brief interval of sale with the primary situation in FY 2009/10 lasting from June 30 to July 12. It has elevated since then, having a subscription interval of virtually a month in 2016. The newest situation had a subscription interval of 20 days, opening on February 26, 2023, and shutting on March 17, 2023. Nonetheless, this has additionally didn’t make a major influence on the variety of patrons. The subscription interval should be too quick for migrant employees to acquire the wanted funds. FESBs additionally had a really restricted goal in its first situation in FY 2009/10, excluding migrants in India and Group for Financial Cooperation and Growth (OECD) nations. The NRB tried to have a extra inclusive target market by permitting households of migrant employees to buy the bonds from the remittance in 2011 and permitting Non-resident Nepalis (NRNs) in 2012. Whereas they’ve marginally raised subscription charges, the bonds are nonetheless undersubscribed by an enormous quantity.

Constructing a Higher Picture

Diaspora bonds have been profitable in lots of nations. Israel’s success on this space might be attributed to the essential elements of “belief and emotional ties” and “restricted foreign exchange dangers.” For Nepal to successfully interact its migrant employees from overseas, it’s important to ascertain a robust basis of belief with the diaspora neighborhood to make sure their investments are being utilized successfully. Moreover, addressing the foreign exchange dangers concerned is important and requires the implementation of a dependable hedging mechanism. Lastly, Nepal should conduct an official research to find out the explanations for the earlier failures of FESBs to permit the federal government to make the funding local weather extra favorable for NRNs. Specific focus needs to be given to the bureaucratic processes NRNs must undergo. These adjustments are required for the FESBs to have the ability to embrace and make the most of the diaspora within the nation’s improvement.

[ad_2]

Source link